- with readers working within the Property industries

- within Strategy topic(s)

Highlights

- The U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction suspending the government's enforcement of the Corporate Transparency Act and its Implementing Regulations (the Order).

- As anticipated, the U.S. Department of Justice appealed the Order.

- The U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) posted the following notice on its Beneficial Ownership Information (BOI) website on Dec. 6, 2024: "In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports."

- In view of the continuing uncertainty of outcome, reporting companies that have not yet filed should continue to gather and finalize the information necessary to complete their BOI Reports, and be prepared to timely file if the injunction is lifted.

The U.S. District Court for the Eastern District of Texas on Dec. 3, 2024, issued a nationwide preliminary injunction suspending the government's enforcement of the Corporate Transparency Act (CTA) and its Implementing Regulations (the Order). (See Holland & Knight's previous alert, "Corporate Transparency Act Reporting," Dec. 4, 2024.) Since then, there has been a flurry of developments, and more are anticipated in the coming weeks.

FinCEN's Response to the Texas Top Cop Shop Court Order

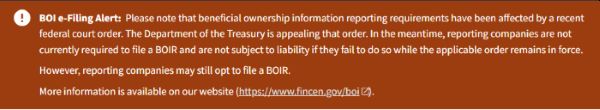

On Dec. 6, 2024, the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) added the following to its Beneficial Ownership Information (BOI) webpage:

FinCEN added the following header on its Welcome to the BOI E-Filing System webpage:

FinCEN has suspended access to the Application Programming Interface (API) to transmit Beneficial Ownership Information Reports (BOIR) to FinCEN through outside services providers. This means that BOIR, if they were to be made voluntarily, can be made only through the two filing methods of PDF BOIR or Online BOIR – the two methods available to the public on the FinCEN website.

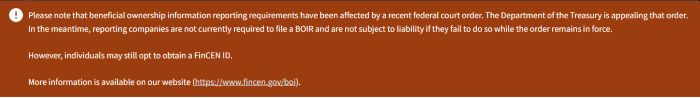

Finally, FinCEN added the following header on its Welcome to the FinCEN Application for Individuals:

Takeaways

- The Texas Top Cop Shop nationwide preliminary

injunction:

- enjoins the government from enforcing the CTA, as well as the regulations implementing BOI reporting

- stays all deadlines to comply with the CTA's reporting requirements

- Reporting companies are not currently required to file BOI with FinCEN and are not subject to liability if they fail to do so while the Texas Top Cop Shop court order remains in force.

- Since the FinCEN statement refers to "all" deadlines,

it should include the following:

- Jan. 1, 2025, deadline for pre-2024 reporting companies

- the 90-day deadline for companies formed or registered in 2024 and, assuming the injunction remains in effect, the 30-day deadline for companies formed or registered in 2025

- the 30-day deadline for updated and corrected reports

- The requirement to file is enjoined only while the Order remains in force, and filing requirements could once again apply if the U.S. Court of Appeals for the Fifth Circuit stays the district court's injunction. No information has been provided to indicate whether extensions will be allowed if the filing requirement is reinstated. Accordingly, reporting companies that discontinue preparations to file could be unable to timely comply if the injunction were stayed or vacated.

- Though two courts have questioned the constitutionality of the CTA, there are two courts – the U.S. District Court for the District of Oregon and U.S. District Court for the Eastern District of Virginia – that have denied preliminary injunctions based on their determination that the CTA is constitutional. Another court in Texas may be issuing a decision this week.

- Sources indicate that there also may be a legislative attempt to delay the Jan. 1, 2025, reporting deadline.

- In view of the continuing uncertainty of outcome, reporting companies should closely follow developments. Reporting companies that have not yet filed should continue to gather and finalize the information necessary to complete their BOIR and be prepared to timely file if the injunction is lifted.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]