- with readers working within the Technology and Oil & Gas industries

- within Transport and Strategy topic(s)

The medtech sector is showing promising signs of recovery in both mergers and acquisitions (M&A) activity and venture capital (VC) investments.

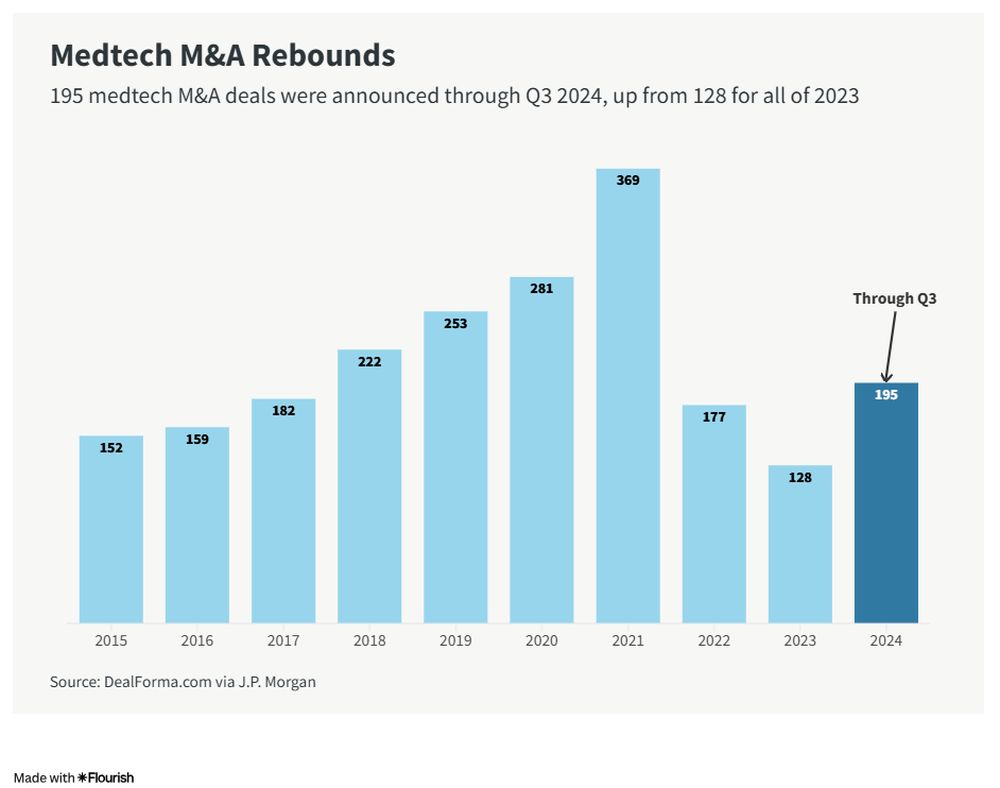

Medtech M&A Transactions Pick Up

M&A activity in 2024 has been robust, with 195 deals announced through the third quarter, already exceeding the 128 transactions for the entirety of 2023. Deal value totaled about $47 billion through the third quarter, on pace to surpass 2023's full-year total of $50.1 billion.

The Federal Reserve's expected interest rate cuts and anticipated deregulation from the incoming presidential administration could further boost M&A activity in 2025.

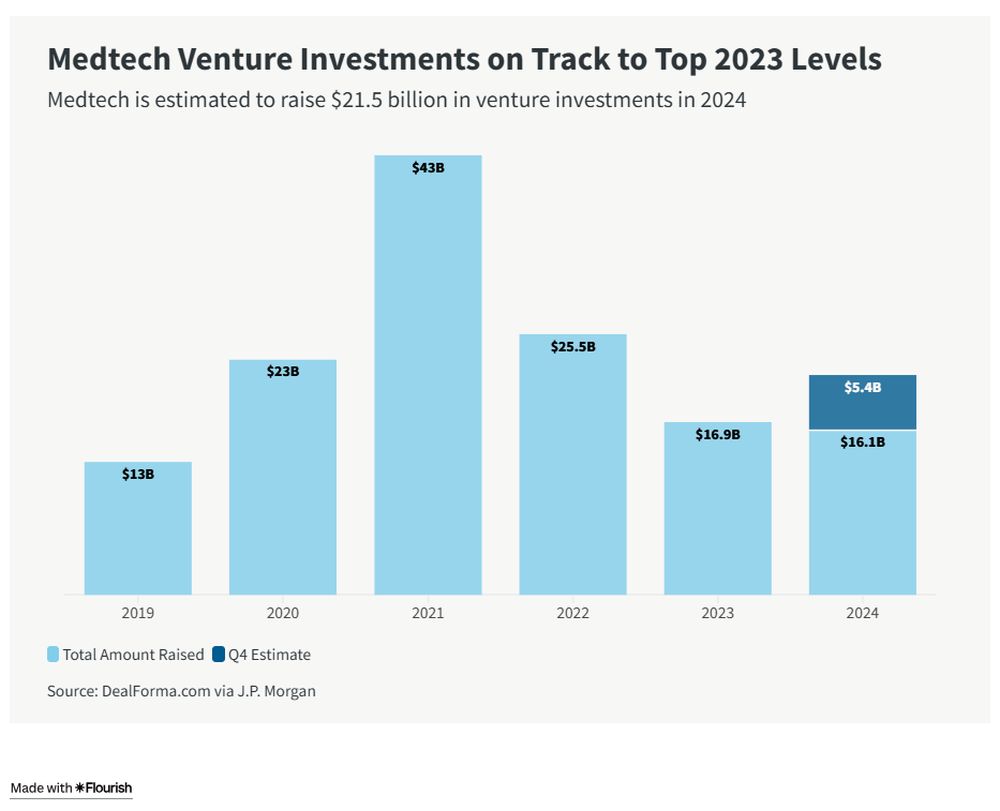

Medtech VC Investment Set to Strengthen

VC investments into medtech companies are projected to reach $21.5 billion by year-end, a 27% increase from the $16.9 billion recorded in 2023. This strong growth would follow a two-year slowdown in medical-device investment amid rising interest rates, economic uncertainty, and a more cautious funding environment following the pandemic-era boom.

VC funding into medtech will likely gain momentum in 2025 as interest rates decline and further advancements in AI-driven technologies continue to attract investor interest.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.