The new Corporate Transparency Act (CTA) went into effect on January 1, 2024. This new act will require almost all entities, such as LLCs and corporations, with fewer than 20 employees and less than $5 million of revenue to file reports to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of Treasury. The objective of this new reporting regime is "to help prevent and combat money laundering, terrorist financing, corruption, tax fraud, and other illicit activity." This new law may impact you, individually, if you have an ownership interest in or exercise control over a reporting company.

The good news is that for most existing companies, the filing deadline is not until December 31, 2024, and Lane Powell's Private Client Services Team is here to help. We encourage you to reach out to us to find out what your reporting requirements are under this new law. Additionally, our team can help you respond to inquiries from companies you are invested in who may request information from you in order to meet these new FinCEN filing requirements.

Read more about the new law:

Deadline:

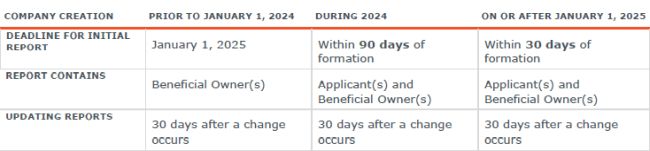

Depending on when the reporting company was created, different rules apply regarding the deadline for filing the initial report and the information required to be included in the report. Below is a summary of the current rules:

Who Must File:

With very few exceptions, all limited liability companies (LLCs), Corporations (both S-corporations and C-corporations), limited partnerships (LLPs), and other closely held entities that must register with a state government, and who have fewer than 20 employees and $5 million per year in revenue, must file a FinCEN report. These "reporting" companies must report the following about the company:

- Full legal name of reporting company

- Any trade name of "doing business as" (DBA) name

- Complete current U.S. address

- State, Tribal, or Foreign jurisdiction of formation

- Foreign companies also need to list the state or tribal jurisdiction of the first registration.

- IRS, TIN, or EIN

- If a foreign company does not have a TIN, use the tax identification number issued by the foreign jurisdiction and the name of such jurisdiction.

What Individuals Must Be Disclosed:

Each reporting company must report to FinCEN information about certain individuals involved with the entity as summarized below:

Beneficial Owner(s). This is any individual who, directly or indirectly, (i) exercises substantial control over a reporting company or (ii) owns or controls at least 25% of the ownership interests of a reporting company.

Applicant(s). Each reporting company created on or after January 1, 2024, is required to report at least one company applicant, and at the most two. All company applicants must be individuals that fall into two categories – individuals who directly filed the documents to register the entity, or individuals who are responsible for directing or controlling the filing of such registration documents.

Each Beneficial Owner and Applicant needs to disclose the following to the reporting company or provide the reporting company with the individual's unique FinCEN identifier:

- Full legal name

- Date of birth

- Complete current address

- Residential address for Beneficial Owner

- Company address permitted for Applicants

- Unique identifying number and issuing jurisdiction from, and

image of, one of the following non-expired documents:

- U.S. passport

- State driver's license

- Identification document issued by a state, local government, or tribe

- If an individual does not have any of the previous documents, a foreign passport

What to Know if Contacted by an Entity Who Wishes to Share Your Information With FinCEN:

Each Beneficial Owner and Applicant is required to provide certain personal information to the reporting company (as listed above) OR to provide a unique "FinCEN" identifier to the reporting company.

For privacy and security purposes we recommend that our clients obtain a FinCEN identifier and provide their FinCEN identifier to a reporting company instead of the information listed above. An individual can obtain a FinCEN identifier by providing the above-described personal information directly to FinCEN.

The CTA is a new and evolving law. The reporting requirements are fact-specific, so please contact us with questions about your obligations under the CTA and how to obtain your FinCEN identifier.

Although the CTA is currently being challenged in court, you should not ignore these new requirements in the hope that the law is invalidated. Violations may result in substantial fines and criminal penalties.

Additional information can be found here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.