- within Environment, Wealth Management and Consumer Protection topic(s)

- The Inflation Reduction Act was signed into law in the US in August 2022.

- It has the potential to significantly curb the country's greenhouse gas emissions.

- Its provisions pertaining to climate change mitigation, clean energy and energy innovation will help clean up the US environment and should positively impact the rest of the world.

On August 16, 2022, American President Joe Biden signed the Inflation Reduction Act (IRA) into law. The IRA is the most meaningful climate bill ever passed in the US It has the potential to significantly curb the country's greenhouse gas emissions (GHG) over the next few years.

The 755-page legislation touches on a plethora of issues, including healthcare, prescription drugs and stock buy-backs and it raises nearly $800 billion from multiple resources. Its provisions pertaining to climate change mitigation, clean energy and energy innovation, however, dominate the headlines.

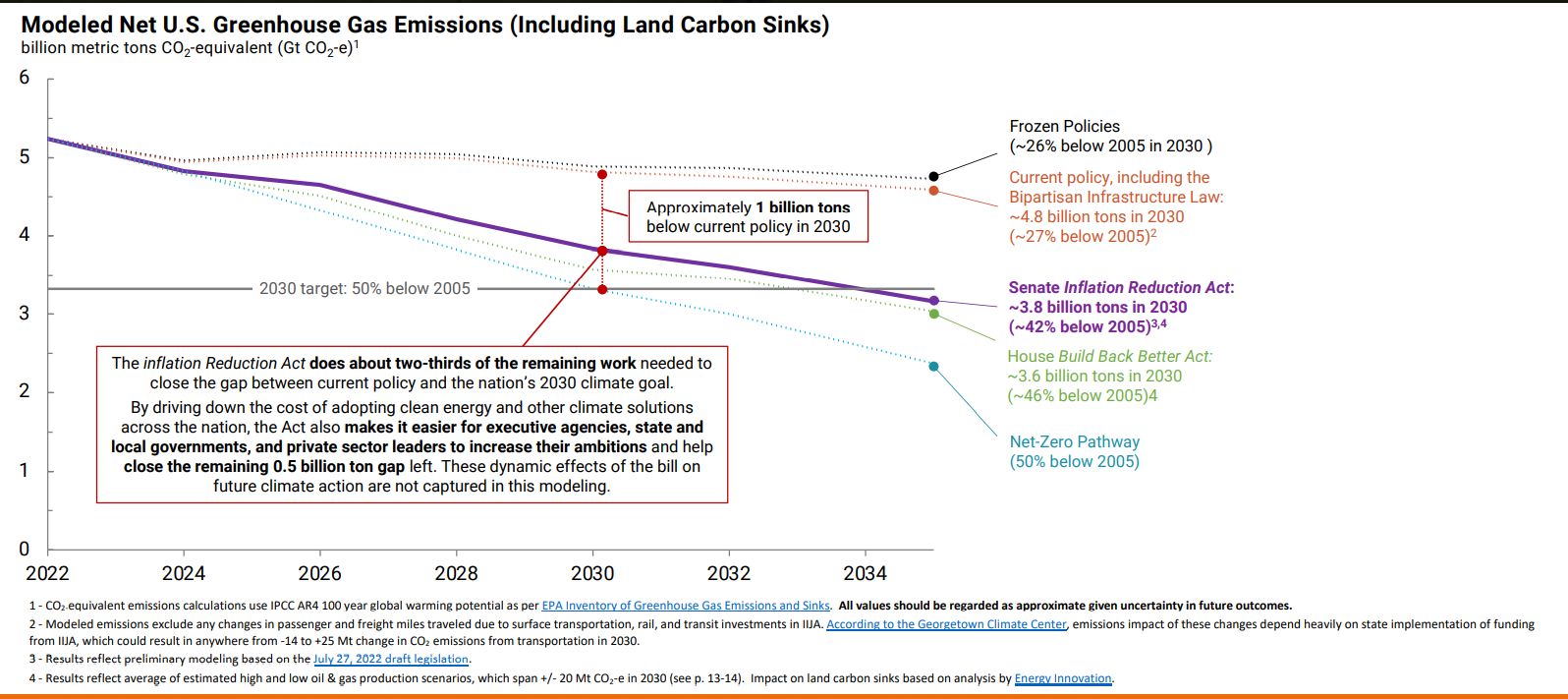

The $369 billion earmarked for clean energy and climate change mitigation initiatives as per the Inflation Reduction Act is an unprecedented level of support from the US Federal Government for the transition to sustainable energy. It is expected that the Act will reduce US GHG emissions to approximately 40%, compared to 2005-levels, by 2030. Without the enactment of the IRA, the US was on course to reduce its GHG emissions to only 26%, compared to 2005-levels, over this period.

Modelled Net US greenhouse gas emissions (including land carbon

sinks) Image: Inflation Reduction Act Preliminary Report

The Act incentivizes multiple sources of clean energy, including energy storage, nuclear power, clean energy vehicles, hydrogen and CCUS, so long as they are carbon neutral. Instead of opting for or preferring one solution for climate mitigation over others, this 'source agnostic' approach reduces the risks associated with picking technology winners. It focuses on reductions in GHG emissions linked to energy production.

Inflation Reduction Act extends and creates Investment Tax Credits (ITCs) and Production Tax Credits (PTCs) for clean energy generation and gives the producers the choice to opt for either ITC or PTC, according to what works best for them.

The enactment is also considered to be socially progressive. It awards higher incentives to projects implemented by workers paid increased wages. Most of the tax credits available provide for a base tax credit, which has the potential to be multiplied by five where the taxpayer complies with the prevailing wage and apprenticeship requirements provided under the Inflation Reduction Act.

It also removes the erstwhile uncertainty and unpredictability surrounding ITCs and PTCs for solar and wind respectively, by restoring them to their original value and extending them until 2033. From January 1, 2025, any carbon-free generation can opt for either an ITC or a PTC depending on their preference. And, in addition to the base ITCs or PTCs, the IRA allows additional tax incentives to be stacked on top, where the projects are based in existing energy communities or where they use certain percentages of iron, steel and manufactured components produced in the US

Furthermore, the Act gives taxpayers the option of direct pay (subject to certain conditions) and/or transferability of tax credits through cash sales. These options obviate the need to enter into complex tax equity financing arrangements, such as partnership flip agreements or inverted leases. These previously meant that project developers had to seek out a handful of banks or insurance companies that would have a corresponding federal tax liability to offset such tax credits.

Inflation reduction act gives clean hydrogen a significant boost

Inflation Reduction Act's impact on the production of clean hydrogen is perhaps the most important new area of investment incentivisation. The Act provides for a base credit of $0.60 per kilogramme of hydrogen produced, so long as the carbon intensity is within the range of 0-0.45 kilogram of CO2 equivalent (CO2e) per kilogram of hydrogen (H2). Where taxpayers comply with prevailing wages and apprenticeship requirements, they are eligible for a tax credit of $3/kg of hydrogen. The Act, however, does not incentivise hydrogen production with a carbon intensity exceeding 4kg of CO2e/kg of H2. It mandates a well-to-gate approach to measure the lifecycle emissions.

This means the taxpayer will likely need to account for downstream emissions after the point of sale. Alternatively, instead of a PTC, the taxpayer may opt for an ITC. The base ITC is 6%, subject to an increase to 30% if prevailing wages and apprenticeship requirements are met. And, whilst these hydrogen tax credits can be claimed in addition to credits for renewable production for green hydrogen and hydrogen storage infrastructure, they cannot be stacked with the tax credits available for carbon capture, utilisation and sequestration (CCUS).

These tax incentives will likely make the US one of the cheapest regions in the world for clean hydrogen production. A $3/kg payment, or credit, by the US government could drive the effective cost of producing green hydrogen to $0.73-$3.5/kg of H2, based on current Platts price estimates for unsubsidised production. For perspective, just last June, the US launched its initiative to reduce the price of hydrogen to $1/kg by 2030.

Incentivising multiple clean energy sources

The Inflation Reduction Act also creates a $5.8 billion programme, running until September 2026, to invest in projects in industries that are either energy-intensive or produce hard-to-abate emissions, such as iron, steel, cement and chemical production, and include retrofit facilities. Additionally, it disincentivises the closure of existing nuclear power plants by providing production tax credits for plants in service from the end of 2024 until 2032. It also promotes offshore wind generation by providing $100 million for the development, planning, analysis, modelling and optimisation of interregional transmission and integration of electricity produced by offshore wind. And, it lifts moratoriums in place on the development of offshore wind in various regions of the US

Plus, through the Methane Emissions Reduction Program, the IRA makes strides in curbing US methane emissions. It provides $1.5 billion to the Environmental Protection Agency (EPA) to support monitoring and methane reduction efforts in upstream oil and gas activities and imposes a penalty on methane emissions in excess of 25,000 metric tons of CO2e gas. The penalty kicks in in 2024 at $900/ton and incrementally increases to $1,200/ton in 2025 and $1,600/ton in 2026.

IRA has the potential to positively impact the whole world

The impact that the Inflation Reduction Act will have on the clean energy transition within the US and outside its borders is difficult to predict and remains to be seen, but it is, undoubtedly, one of the most significant pieces of US legislation in the last decade or more. Its second-order consequences will be fascinating to watch unfold - Germany's Energiewende is considered to have played a critical role in substantially reducing the costs of solar panels worldwide over the last decade. In the past, the ITCs and PTCs have played a crucial role in the growth of solar and wind power projects across the US It is expected that these new incentives will allow the US to make significant strides in curbing its GHG emissions and help it meet its targets under the Paris Agreement.

Originally published by World Economic Forum's Agenda.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.