- within Real Estate and Construction, Litigation and Mediation & Arbitration topic(s)

This article first appeared in newly released book from NERA Economic Consulting, 'The Line in the Sand: The Shifting Boundary Between Markets and Regulation in Network Industries'. With a foreword by Alfred E Kahn.

Continued from previous page

III. MAJOR GREENHOUSE GAS EMISSIONS TRADING PROGRAMS AND PROPOSALS

The increased national and international interest in emissions trading is largely based on concern about climate change and a consensus that GHGs are well suited to a cap-and-trade program.21 Once emitted, GHGs reside in the atmosphere for periods measured in decades and centuries. Atmospheric currents ensure that emissions are dispersed quickly in the atmosphere so that atmospheric concentrations of GHGs are relatively uniform over the globe. Uniform mixing means that a ton of a given GHG will have the same effect on atmospheric concentration—and thus on climate change—regardless of whether the ton is emitted in California, New York, or elsewhere on the globe. Thus, trading can—at least in theory—be national and international in scope, and the cost savings commensurately larger as the scope broadens.

The cumulative effect of greenhouse gases and their long duration in the atmosphere also mean that the timing of emissions reductions will not have a significant effect on atmospheric concentrations or climate.22 Thus, banking offers additional potential for cost savings by using credit-based approaches to bring in sources that would not otherwise be covered by a cap-andtrade program. Although the specific nature of domestic and global measures to address climate change will evolve over time, few environmental problems appear so well suited to emissions trading as GHG emission control.

The major programs and proposals are the Kyoto Protocol and the European Union Emissions Trading Scheme (EU ETS), which is the most significant program to date. Various proposals have also been developed for the United States.

C. Flexibility Mechanisms Under The Kyoto Protocol

In December 1997, representatives from the developed nations of the world met in Kyoto, Japan, and devised a plan for reducing GHG emissions. Signatories to the Kyoto Protocol committed themselves to specific GHG emissions reduction targets with an average emissions reduction of 5.2 percent. The treaty came into force in February 2005 and the first commitment period is 2008-2012.

The Kyoto Protocol includes three flexibility mechanisms that countries can use to achieve part of their emissions reductions:

- Trading of emission credits between governments;

- Participation in emissions reduction projects in developing countries (the Clean Development Mechanism, or CDM); and

- Participation in emissions reduction projects in transition economies (the Joint Implementation or JI).

CDM and JI projects are overseen and approved by the CDM Executive Board and the JI Supervisory Committee, which issue each project’s emissions reductions credits (CERs and ERUs). Countries have used both project-based mechanisms to meet the Kyoto requirements because they provide emissions reductions at a much lower cost than domestic emissions abatement measures. Governments and private companies from Europe and Japan have either developed CDM/JI projects on their own or have taken part in carbon funds—public and private institutions investing in CDM/JI projects in order to deliver emissions reduction credits to the fund participants. In aggregate, these funds manage more than $5 billion in capital.

D. European Union Emissions Trading Scheme

Under the Kyoto Protocol, the EU is committed to reducing its emissions of GHGs by 8 percent below 1990 levels over the period between 2008 and 2012. The European Union Emissions Trading Scheme for Greenhouse Gases (EU ETS) was established in 2003 as a costeffective mechanism to comply with this commitment.

1. Overview of the EU ETS

The EU ETS is a cap-and-trade program, and follows the general design outlined above. Its rules identify the installations that are covered by the program, determine how allowances to emit CO2 are to be distributed to these installations, and stipulate an obligation on each installation to surrender allowances equal to its total emissions in each calendar year. This amounts to establishing a cap on the carbon dioxide emissions from covered installations in the EU. 23 In addition, allowances can be bought and sold, and the resulting market in EU allowances helps lower the overall cost of achieving the cap on emissions.

The first phase of the Scheme runs from 2005-2007, after which the Scheme will operate in five-year phases. The second phase, 2008-2012, thus coincides with the first commitment period under the Kyoto Protocol. The first phase covers large installations in certain industrial sectors (e.g., power generation, refining, iron and steel, cement, glass, lime, bricks, ceramics, pulp and paper) and in particular, all combustion installations with a rated thermal input exceeding 20 MW. Thus, the Directive covers almost the entire power generation sector. In total, the Scheme includes over 11,500 installations, accounting for around 45 percent of CO2 emissions in the EU, emitting around 2.2 billion tons of CO2 per year. The Scheme does not currently cover households, transport, or agriculture, other sectors with high emissions. For Phase II, the EU intends to bring aviation into the Scheme, and the European Commission also has proposed has including maritime shipping at a future date.

Emissions allowances are allocated by each national government, which is required to publish a National Allocation Plan (NAP) for each phase of the Scheme. In the first two phases, allowances are awarded largely free of charge,24 distributed either on the basis of grandfathering or using industry benchmarks. It remains unclear what allocation methodologies will be adopted for the subsequent phases of the Scheme, though some Member States have announced their intention to auction a larger share of allowances in future years. The Emissions Trading Directive requires that the total quantity of allowances allocated be consistent with the Member State’s obligations under the EU Burden-Sharing Agreement (Decision 2002/358/EC) and the Kyoto Protocol. These specify the emissions reductions incumbent on each individual Member State. Member States also have the option of reserving a portion of total allowances for new installations, and many Member States have plans to give allocations to such new entrants in Phase I and beyond.

2. Experience With The EU ETS Thus Far

It is too early to assess the potential economic and environmental gains from emissions trading of GHGs. The experience thus far illustrates the high price volatility that often occurs at the beginning of major emissions trading programs. In addition, the relatively brief history of the EU ETS has led to a major discussion of the effects the program has on competitiveness, largely as a result of linkages between carbon prices and electricity prices.

a. Allowance Prices And Volumes

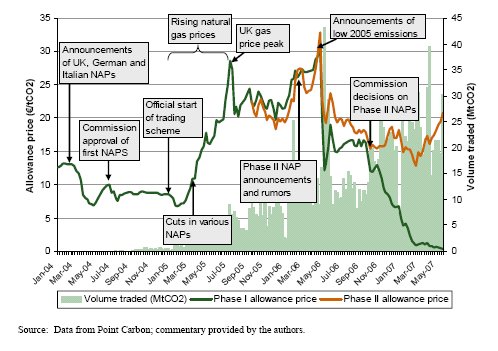

Figure 4shows the price of EU ETS allowances (EUAs) and volume traded each week. The wide fluctuations in price are driven by a variety of factors. The large decline in prices in late April 2006 reflected decreased demand for allowances due to announcements by a number of countries that 2005 actual emissions were considerably lower than expected. The subsequent decline in Phase I prices has been attributed variously to early abatement in the period with higher prices and to lower demand as covered entities had reportedly purchased nearly all of the allowances they need through 2007. Phase II prices have remained at higher levels, reflecting a more stringent cap level for this period, especially after the European Commission demanded less generous allocations from a number of Member States.

Figure 4. EU ETS Allowance Market

Table 3 presents the value, volume, and average price of CDM and JI transactions in 2005 and 2006. The total value of transactions of both types roughly doubled year-over-year, supporting the belief held by most observers that these "project-based" compliance mechanisms have successfully established a price signal to encourage GHG reductions in developing countries. As noted, carbon funds, which have been attracted by the relative price stability of CDM/JI credits, have played a special role in helping these markets to develop.

b. Electricity Price Effects

One contentious issue is that the EU ETS will lead to increases in electricity prices that benefit electricity companies and undermine the competitiveness of European industry. Early in the discussion of initial allocation, electricity users argued that some of the allowances should be allocated on the basis of electricity use rather than electricity production (commonly called indirect emissions). More recently, power-using sectors, consumer groups and government agencies have advanced various proposals that would limit electricity price increases in various ways.

Since the start of 2005, energy prices, including electricity prices, have increased sharply. While much of this is due to very high worldwide oil and other fuel prices, the impact of the EU ETS on energy price increases, industrial competitiveness, and the profits of electricity generators has become an issue. Higher electricity prices lead to increases in operating margins for some generators ("windfall profits"). Such changes in profits, however, are general features of competitive markets: Operators of nuclear plants may also see their operating margins improve if higher gas prices lead to electricity price increases. To the extent that the EU ETS also leads to higher electricity prices but has a differential impact on the costs of different generation units, it too may benefit some operators while reducing the margins of others.

E. GHG Trading Programs and Proposals in the United States

Various proposals have also been developed in the United States, including a welldeveloped program for various northeastern states that is scheduled to enter into force in 2009.

1. Regional Greenhouse Gas Initiative

The Regional Greenhouse Gas Initiative (RGGI) is a proposal for a mandatory cap-andtrade program covering CO2 emissions from power plants in ten northeastern states. Beginning in 2009, emissions would be stabilized at current levels through 2014 and reduced by 10 percent by 2018.

At least 25 percent of allowances would be auctioned, and the proceeds would be used to support energy efficiency and renewable energy programs. Companies would be eligible to use project-based emissions offsets up to 3.3 percent of their reported emissions in any compliance period, which represents about 50 percent of the projected average emission reduction obligation. The program also incorporates "safety valve" mechanisms that would relax this limitation to 5 percent if the allowance price exceeds $7/ton and to 20 percent if it exceeds $10/ton; further, if the allowance price exceeds $10/ton for 12 months, the compliance period would be extended by one year.

2. Congressional Proposals

In addition to regional and state-level initiatives, interest in a federal cap-and-trade program for CO2 and other greenhouse gases has been growing in recent years. By 2006 11 Congressional proposals had been offered and the current (110th) Congress has seen eight separate proposals in its first several months. Proposals range from covering only electric generation to covering all sectors in the economy, and targets also vary substantially, with one proposal requiring emissions to be cut to 80% below 1990 levels by 2050 and others allowing emissions to grow (albeit at a reduced rate). Many commentators believe that the US Congress will pass a cap-and-trade program for greenhouse gas emissions in the next few years, though the specific provisions of any program are of course uncertain.

IV. KEY ISSUES FOR GHG EMISSIONS TRADING

The emissions trading approach seems destined to be the major policy approach used to deal with climate change. It is likely that the United States will develop a national cap-and-trade program for GHG emissions within the next several years and the European program is likely to evolve as well. Major issues are likely to arise both from a public policy perspective and from the perspective of private firms subject to the programs.

A. Public Policy Decisions

The public policy issues surrounding the use of an emissions trading program in dealing with climate change fall into three categories: program design elements, effects of a trading program on electricity and energy markets and competitiveness, and linkages among the global programs. The issues are somewhat different in Europe—which already has a program in force— and the United States.

1. Program Design Elements

While the EU ETS has a well-developed architecture that builds upon experience with prior emissions trading programs, modifications to specific elements of the program will likely be proposed, given the distinctive features of the Kyoto Protocol and the European setting. In the United States, where no program has been definitively determined, there is even greater leeway in designing the program. The following are the major issues likely to arise in program design.25

a. Upstream vs. Downstream System

A GHG trading program has to determine which emissions should be subject to the program and how the emissions should be accounted for. Prior emissions trading programs have involved regulating direct emitters (e.g., power plants), a system referred to as downstream because these facilities are downstream in the chain of energy production, distribution, and end use. Under an upstream approach, the point of regulation would be the energy producers and suppliers (e.g., coal mining companies, petroleum refiners). An upstream program has the advantage of reducing the number of entities that would be regulated and tends to capture a greater fraction of overall emissions. A downstream program has the advantage of familiarity and of being able to provide direct incentives to reduce emissions from the stack (e.g., carbon sequestration).

b. Cap Level And Trajectory

In large part, the cap level and trajectory will determine the stringency of the trading program; therefore the size of the cap and the trajectory for changes are inevitably critical decisions. Under the current EU ETS, the overall cap in each period is the sum of the caps that are set by the 25 Member States, subject to European Commission review and the requirements set by the Directive that established the program. In the US, presumably both would be set by Congress.

c. Intensity Ttarget vs. Absolute Cap

Current cap-and-trade programs involve an absolute cap, a limit on the total level of emissions. Some recent commentators have suggested that the cap should be a relative cap that would vary with the level of economic activity. In the US, this approach is referred to as an intensity target; the Bush administration called for an 18 percent decline in emissions intensity (per unit output) over 10 years, 26 and the National Commission on Energy Policy has recommended a 2.4 percent annual decline.27 Unlike an absolute cap, an intensity target does not automatically become more onerous if economic growth is higher than initially had been expected; instead, a conscious choice would have to be made to lower the target.28 Thus, while an intensity target could achieve the same result as an absolute cap for a given growth trajectory, it also could mitigate (but not erase) fears that an initial lenient cap would evolve into an aggressive one because of unexpected increases in output.

d. Safety Valve

Some recent emissions trading proposals in the US include a "safety valve", typically a maximum price at which the government would agree to sell additional allowances. Arguments for such a mechanism reflect the view that such a price-based approach is more efficient for addressing the problem of climate change in the face of uncertainty,29 as well as a concern that a cap-and-trade program would be more politically acceptable if the overall cost were contained. The price can constitute either a penalty or a safety valve, depending on its level relative to the expected market price.

e. Banking

Experience provides convincing evidence that allowing banking increases cost savings from emissions trading. Banking can also reduce the volatility of allowance prices because banked allowances provide a buffer against short-term changes in demand conditions. Banking could lead to excessive emissions in the years in which banked allowances are used, and indeed, restrictions on the use of banked allowances are included in the NOx budget program to avoid high concentrations in emissions. In the case of climate change, however, such concerns are not likely to be relevant because of the long-term nature of the issue and the importance of cumulative emissions over decades, rather than the level of emissions in any given year.

f. Allocation Of Allowances

The area of greatest interest in policy design for the EU ETS has been the development of the Member State NAPs, and any US program also will have to determine an allocation approach. Specific issues that have proven important in prior programs are:

- What fraction of allowances should be allocated "for free" and what fraction should be auctioned?

- What use should be made of any revenue from auctions? Should the revenues be earmarked for specific purposes (e.g., energy efficiency, technology development)?

- If allowances are allocated first to sectors and then to facilities within each sector, what should be the basis for allocating to sectors?

- What should be the basis for allocating free allowances to individual facilities? Should the factors be based upon historical information (e.g., prior emissions, input, or output) or updated information (e.g., future output)?

- Should a fraction of allowances be set aside for early reduction credits? On what basis should credits be awarded?

- Should allowances be allocated to new facilities? If so, on what basis should the size of the allocation be determined? Should allowances be recovered from facilities that shut down? If so, what should be the criteria for shut-down?

- Should some allowances be allocated to non-participants affected by cost increases (e.g., industries and domestic users whose energy costs would increase)? If so, how should allocations be determined?

Experience suggests that decisions regarding allocation are likely to be contentious but also that it is feasible to develop an allocation plan that can achieve widespread political acceptance.30 Indeed, the success of Member States in developing the Phase I NAPs is evidence that acceptable allocation plans can be developed, even with the large amounts of money at stake—on the order of 15-60 billion euros in the case of the Phase I NAPs.31

2. Interactions With Markets And Competitiveness Concerns

Public policy is likely to be concerned not just with the design of an emissions trading program for GHGs but also with how the establishment of such a market affects other markets and, more broadly, what effects the program has on the international competitiveness of European or American businesses. Indeed, these issues have already figured prominently in the brief history of the EU ETS.

a. Impacts on electricity and fuel markets

The market for CO2 allowances created by the EU ETS has affected other markets, notably fuel (natural gas, coal) and electricity markets. All else being equal, putting a price on

carbon emissions increases the demand for low- and non-emitting fuels (natural gas, renewables) and decreases the demand for higher-emitting fuels (especially coal). Since carbon-emitting fuels are used in producing electricity, a cap-and-trade program for GHGs will inevitably affect electricity prices, although the extent of influence is a complicated conceptual and empirical issue. More complicated relationships may occur. For example, some commentators have suggested that the EU ETS has amplified the market power of natural gas suppliers, and thus increased the impact of higher gas prices on the price of electricity.32

b. Interactions with other environmental programs

The relationships between the market for CO2 allowances and electricity/fuel markets mean that the EU ETS will influence related programs and vice versa. Perhaps the most significant of these interactions concern efforts to provide incentives for greater use of renewable energy technologies and for greater energy efficiency. Particularly complex is the set of interactions among the EU ETS and green certificate renewable market programs and white certificate energy efficiency trading programs.33

c. Impacts on Competitiveness

The experience under the EU ETS has led to extensive discussion of its effects on the competitiveness of European businesses. These concerns are related both to the program’s direct effects on the costs of industrial participants and to its indirect effects through electricity price increases. Concerns about the impacts of climate policy on the competitiveness of US business came to the fore during consideration of ratification of the Kyoto Protocol. These concerns have perhaps been the most significant impediment to the development of a program in the US. The US Senate passed a resolution34 not to enter into any climate treaty that would adversely affect the US economy. Moreover, there is a concern that a modest initial effort would quickly be transformed into a more aggressive program in the future—the proverbial camel’s nose under the tent.35

A similar concern about the impact on competitiveness has led to proposals in various European countries36 to change the method of allocating allowances or to limit the translation of carbon allowance prices (and costs) into higher electricity prices. Indeed, some of these proposals would amount to re-regulation of the electricity markets at the same time as Europe is committed to liberalizing electricity markets to increase efficiency and competition. Concerns about competitiveness and other market impacts could also lead to modifications in the cap-and-trade program. Shifting to auctioned allowances would aggravate rather than mitigate competitiveness concerns and in some cases could also increase price impacts. But other program modifications (safety valves or intensity targets) could reduce the effects of the program on energy markets and on competitiveness of businesses in Europe and the United States.

3. Linkages Between Programs And Other International Considerations

Climate change is an international issue that ultimately will require international coordination. Moreover, there are potential efficiency gains from linking programs, both because of potential cost savings and because linkage tends to reduce leakage, i.e., the shifting of emissions from countries/regions that impose carbon controls to countries/regions that do not.

a. Program linkage

As various carbon cap-and-trade programs are developed and proposed, the question naturally arises whether—and how—different GHG emissions trading programs might be linked with one another. The gains from linkage are clear—since gains from trade depend upon differences in costs, linking trading programs with different GHG emissions sources (and thus different GHG abatement costs) promises to increase the overall cost savings from trading. Moreover, linkage can promote efficient emission reductions within and between companies with operations in multiple countries. Options include (1) allowing all market participants (e.g., facilities subject to the cap, brokers, etc.) to trade in all markets, (2) providing specific exchanges/mechanisms for inter-program transactions, and (3) limiting cross-program exchanges to the program administrators (e.g., governments).

Proposals to link different state, regional, national, or international programs must, however, deal with the design features that reduce the compatibility of the programs. One important design issue concerns the presence of a safety valve. If the emissions cap is broken in a program with a safety valve, linking to such a program could break through the cap of the linked programs as well.37 Other mechanisms designed to contain costs need not have this feature, although some other design elements (such as differences in monitoring and verification procedures) might also lead to difficulties.38

b. Involvement of developing countries and leakage

Virtually all commentators agree that involvement of developing countries in a global climate change regime will be critical, both because these countries will soon account for the bulk of GHG emissions and because these countries are likely to represent the least expensive means of reducing GHG emissions. But developing countries are reluctant to retard their economic growth by imposing stringent carbon restrictions. Various approaches have been proposed to encourage participation by developing countries, notably a growth target that would be equivalent to the intensity targets for a domestic program,39 but thus far no developing countries have expressed a serious interest in participating in a specific program.

Leakage would be the natural result of incomplete coverage of emissions control and international trade in goods. As the comparative advantage in producing carbon-intensive goods increases outside the countries/regions that impose controls, production of those goods and services will tend to increase in the non-participating countries, thereby increasing carbon emissions. Leakage also can occur because of changes to fuel markets and investment flows resulting from the differential introduction of emissions controls.

B. Company Impacts And Decisions

The introduction (or indeed, the possibility) of a cap-and-trade program for carbon can have major effects on company decisions and other private considerations. Perhaps the most fundamental change in the shift from the traditional command-and-control approach to a capand- trade program is that environmental considerations change from compliance issues to business decisions. A cap-and-trade program means that firms consider the costs of alternatives to reduce their emissions compared to the likely market price of allowances. These considerations—along with the initial allocation of allowances—determine whether firms will be net sellers or net buyers of allowances.

a. Investment decisions under uncertainty

Since electricity companies and other trading participants make decisions on capital investments that can last for 30 years or more, uncertainty over the future nature of carbon regulation introduces another substantial source of uncertainty in the choice of the lowest cost generation technology. One technology (e.g., pulverized coal) can be the lowest-cost alternative assuming no cap-and-trade program for carbon emissions, while another technology might have lower cost under a cap-and-trade program with high allowance prices. Uncertainties exist not just around the issue of the CO2 price, but also the level of free allocation and the formula used to determine it—both of which can have significant implications for the value of new and existing assets.

Firms will need to consider more sophisticated analyses of alternatives that take into account uncertainties regarding future carbon controls. Forecasts of allowance prices will allow firms to develop more cost-effective compliance strategies and reduce the effects of uncertainty. Such forecasts can be developed within the firm or purchased from specialists in carbon markets. It will also be important for firms to know the costs of reducing their facility emissions so they can maximize the potential gains from trading under a cap-and-trade program. This information can be used in conjunction with forecasts of likely allowance prices to determine the appropriate strategy for reducing emissions and purchasing or selling allowances.

Participants in the European carbon market have developed futures markets and various derivative instruments to hedge against large price fluctuations. Financial instruments, such as put and call options or the use of forward contracts, are commonly used today to manage price risks in many financial and commodity markets. The potential impacts of higher CO2 costs could also be hedged through the development of various risk management strategies across related markets (fuels, electricity).

Firms also have opportunities to obtain emissions credits under the JI and CDM programs. Interest in these credit mechanisms has increased, particularly when EUA prices have been high. The use of CDM and JI credits reduce private costs and also influence the market price of EUAs.

b. Contractual Arrangements

The addition of carbon costs can alter contractual relationships and raise questions about how such additional costs should be incorporated. Most power purchase agreements in European electricity markets have clauses that anticipate the possibility of new taxes, but the carbon costs that arise from a cap-and-trade program are not considered taxes. Thus, the issue of who bears any additional costs and who is entitled to any benefits (e.g., of free allowances) is being determined based upon interpretations of contract terms that did not anticipate the development of the EU ETS. Anticipation of a cap-and-trade program in the United States provides an opportunity to provide clarity in these issues when the contracts are determined, even if there is substantial uncertainty whether (and when and how much) such a program might be developed.

c. Rate Case And Other Considerations For Regulated Entities

The introduction of a carbon cap-and-trade program will require firms in regulated electricity markets to modify their rate case materials. The specifics will depend upon whether allowances are auctioned (and thus included as costs) or provided for free. Companies subject to Integrated Resource Planning requirements in the United States will have to include carbon considerations in their analysis.

V. CONCLUDING REMARKS

Emissions trading has emerged as an important means of introducing cost-reducing flexibility into environmental control programs, reducing the costs and increasing the environmental integrity of regulatory programs. The last two decades have provided a great deal of experience with various forms of emissions trading. Indeed, emissions trading is a feature of virtually every proposal for new initiatives to control air emissions in the United States and, as highlighted by the European program, is the dominant approach in dealing with climate change. Greenhouse gas emissions trading programs can learn valuable lessons from prior programs relating to cost saving, environmental gains, and the design elements most likely to achieve them. Indeed, emissions trading is especially appropriate for dealing with GHGs.

Greenhouse gas emissions mix uniformly and remain in the atmosphere for a long time. Thus, it matters little where or when the emissions are reduced, as long as the required cumulative reduction is made. This characteristic of GHG emissions eliminates the concerns about emission location that have limited the scope of emissions trading in some other programs.

Understanding the lessons from the prior (and ongoing) experience with emissions trading will be important as the use of emissions trading for climate change expands. These lessons apply not only to the policy makers who will design and implement the programs but to private firms that will need to determine their strategy for taking advantage of the flexibility offered by emissions trading. Indeed, taking maximum advantage of this flexibility will enable firms to improve their profits—relative to less flexible regulatory approaches—and at the same time allow will allow the trading programs to achieve cost-saving and environmental objectives.

Footnotes (continued)21 Many economists contend that in theory an emissions tax would be more appropriate for dealing with greenhouse gases, although there is agreement that a tax is not likely to be politically feasible (see, e.g., William Pizer, "The Optimal Choice of Climate Change Policy in the Presence of Uncertainty." Resource and Energy Economics, XXI, 3-4 (1999), 255-287; Michael Hoel and Larry Karp, "Taxes and Quotas for a Stock Pollutant with Multiplicative Uncertainty." Journal of Public Economics, LXXXII, 1 (2001), 91-114; and Willam D. Nordhaus, Life after Kyoto: Alternative Approaches to Global Warming Policies, National Bureau of Economic Research, Working Paper 11889 (Cambridge, MA: NBER, December 2005)).

22 This point about the indifference to the timing of emissions reductions within some control program does not imply that the initiation of some program to control GHG emissions is also a matter of indifference.

23 In addition to allowances allocated by each Member State, allowances may also enter the Scheme through the "Linking Directive" (COM 2003/403). This allows emissions credits generated through the Flexible Mechanisms of the Kyoto Protocol—Joint Implementation (JI) and the Clean Development Mechanism (CDM)—to be valid for compliance within the EU ETS.

24 Auctioning was limited to a maximum of 5 percent for Phase I and 10 percent for Phase II.

25 Program design issues are presented in Pete V. Domenici and Jeff Bingaman, Design Elements of a Mandatory Market-Based Greenhouse Gas Regulatory System. White Paper of the Senate Committee on Energy and Natural Resources (February 2006).

26 George W. Bush, Speech at the National Oceanic and Atmospheric Administration (February 14, 2002).

27 National Commission on Energy Policy, Ending the Energy Stalemate (Washington, DC: NCEP, December 2004).

28 See William Pizer, The Case for Intensity Targets, Resources for the Future, Discussion Paper No. 05-02 (Washington, DC: RFF, January 2005).

29 See, for example, Martin L. Weitzman, "Prices vs. Quantities," Review of Economic Studies, XLI, 4 (1974) 477- 491 and William Pizer, Optimal Choice of Policy Instrument and Stringency under Uncertainty: The Case of Climate Change (Washington, DC: Resources for the Future, March 3, 1997).

30 See Ellerman, Joskow, and Harrison, op. cit.

31 See Barbara Buchner, Carlo Carraro, and A. Denny Ellerman (editors), Allocation in the European Emissions Trading Scheme: Rights, Rents, and Fairness (Cambridge, UK: Cambridge University Press, forthcoming).

32 David Newbery, Climate Change Policy and its Effect on Market Power in the Gas Market, University of Cambridge Electricity Policy Research Group Working Paper No. 05/10 (Cambridge, UK: EPRG, November 10, 2005).

33 Harrison, Sorrell, Radov, and Klevnas. Op. cit.

34 Expressing the sense of the Senate regarding the conditions for the United States becoming a signatory to any international agreement on greenhouse gas emissions under the United Nations Framework Convention on Climate Change. Senate Resolution 98, 105th Congress, First Session (Washington, DC: July 25, 1997).

35 William Pizer, Climate Policy Design under Uncertainty, Resources for the Future Discussion Paper No. 05-44 (Washington, DC: RFF, October 2005).

36 See David Harrison, Jr., Daniel Radov, Per Klevnas, and Andrew Foss, Effects of the European Union Emissions Trading Scheme on Electricity Prices, Report prepared for the Electric Power Research Institute, Inc. (Boston: NERA Economic Consulting, November 29, 2005).

37 Henry D. Jacoby and A. Denny Ellerman, The Safety Valve and Climate Policy, MIT Joint Program on the Science and Policy of Climate Change Report No. 83. (Cambridge, MA: MIT, July 2002).

38 See David Harrison, Jr., Per Klevnas, Daniel Radov and Andrew Foss, Interactions of Cost-Containment Measures and Linking of Greenhouse Gas Emissions Cap-and-Trade Programs, Report prepared for the Electric Power Research Institute, Inc. (Boston: NERA Economic Consulting, December 2006).

39 See, for example, Robert N. Stavins, "Forging a More Effective Global Climate Treaty," Environment (December 2004), 23-30.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.