- within Cannabis & Hemp topic(s)

- in United States

- with readers working within the Advertising & Public Relations, Banking & Credit and Healthcare industries

- within Criminal Law, Strategy and Real Estate and Construction topic(s)

Key Takeaways:

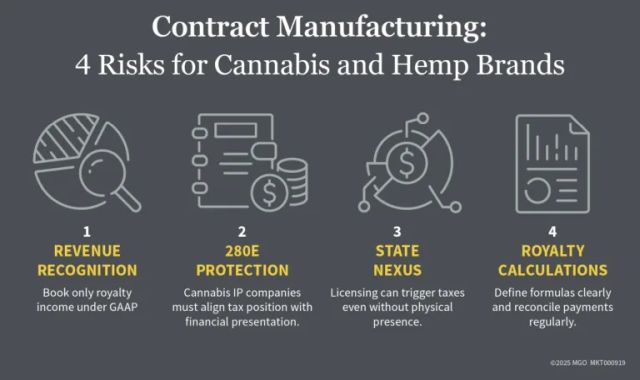

- Expanding through contract manufacturing opens opportunities for your cannabis or hemp brand — but also brings complex financial and regulatory challenges.

- Stay ahead of tax risks by aligning your operations with both federal and state compliance rules.

- Strengthen your contracts and tracking systems to keep royalty payments accurate and transparent.

—

Contract manufacturing arrangements can accelerate brand growth for cannabis and hemp companies, but they present complex tax, accounting, and compliance challenges. To protect financial integrity and valuation, companies must:

- Recognize and present revenue in a manner consistent with accounting standards and investor expectations.

- Structure operations to preserve favorable tax status — especially for cannabis intellectual property (IP) entities avoiding Internal Revenue Code (IRC) §280E.

- Monitor multi-jurisdictional tax nexus triggered by licensing activity.

- Implement clear, enforceable, and regularly reconciled royalty calculation methods.

1. Revenue Recognition and Financial Presentation

Accounting Considerations

In contract manufacturing models, brand owners typically license IP to local manufacturers, who produce and distribute products under the brand name in exchange for royalty payments. Under U.S. generally accepted accounting principles (GAAP), this licensing arrangement should be accounted for as royalty income — distinct from product sales revenue recorded by manufacturers.

- Licensed operators: Recognize product sales with corresponding inventory and cost of goods sold (COGS).

- IP companies: Recognize only royalty income, without inventory or COGS.

For both cannabis and hemp operators, proper classification ensures financial statements reflect contractual entitlements — not hypothetical retail values — which can withstand both audit and investor due diligence.

Investor and Valuation Impact

Royalty-based models often report lower top-line revenue than direct sales, potentially influencing valuation multiples in capital raises. Your company can mitigate this perception by:

- Presenting retail market performance data as supplemental (non-GAAP) information.

- Demonstrating brand market share, pricing strength, and geographic expansion.

- Maintaining accounting integrity by ensuring GAAP statements reconcile with contractual royalty terms.

Sophisticated investors prioritize accuracy and contractual consistency over inflated revenue optics.

2. Tax Positioning and Regulatory Compliance

Cannabis: Preserving Non-280E Status

Cannabis IP holding companies that do not sell THC products directly and operate as an independent trade or business are generally not subject to IRC §280E and enjoy a significantly lower federal tax burden than state-licensed cannabis operators. However, maintaining this advantage depends on operational alignment between a company's tax position and accounting presentation.

- Revenue must be recorded as royalty income, not product sales.

- General ledger (GL) accounts and financial statement categories must reflect licensing activity, not manufacturing operations.

Misalignment — such as recording product sales revenue while claiming 280E exemption — can trigger IRS scrutiny.

Hemp: Avoiding Misclassification

While hemp companies are generally outside §280E due to the 2018 Farm Bill, misclassification of revenue streams can still lead to incorrect tax filings, higher tax liabilities, or state compliance issues.

Proactive Compliance Measures

- Regular review of GL account descriptions and revenue categories.

- Documentation that ties reported revenue directly to licensing contracts.

- Periodic confirmation that financial presentation supports intended tax treatment.

For cannabis brands, this is critical to preserving 280E protection; for hemp, it safeguards proper business classification and tax outcomes.

3. State Tax Nexus and Multi-Jurisdictional Compliance

Income Tax Nexus

Licensing IP can create state income tax nexus without physical presence. States differ in sourcing rules — some focus on where products are consumed, others on where IP is exploited. Cannabis companies must navigate cannabis-specific rules layered over general sourcing provisions, while hemp companies contend with varied CBD/hemp regulations.

Sales Tax Considerations

Licensing arrangements may create sales tax obligations or require exemption certificate documentation. Hemp brands selling directly to consumers are typically subject to standard sales tax rules in each state.

Risk Mitigation

- Conduct nexus analysis regularly across all jurisdictions where products are sold.

- File returns in nexus states even if no tax is due.

- Document exemptions and monitor legislative changes.

Factor in marketing, contractor activity, and promotional events in nexus determinations.

4. Royalty Calculation and Documentation

Common Dispute Areas

Royalty disagreements often arise over:

- Gross versus net sales bases.

- Treatment of COGS, taxes, and regulatory fees.

- Allocation of shared costs (utilities, equipment, marketing).

- Returns, discounts, and promotional allowances.

Industry-Specific Nuances

- Cannabis: Must incorporate jurisdiction-specific excise taxes and licensing fees into formulas.

- Hemp: May face cost allocation issues related to compliance testing and certification.

Best Practices

- Include pro forma royalty calculations in contracts, tested with realistic production and pricing scenarios.

- Obtain written acknowledgment of the agreed methodology.

- Specify all potential chargebacks, shared costs, and allocation rules.

- Maintain separate royalty tracking systems.

- Perform periodic reconciliations between contractual formulas and actual payments to identify discrepancies early — an emerging industry best practice.

- Consider independent accounting reviews to validate partner-reported figures.

- If the manufacturer and the IP company are related parties, contracts should be reviewed in relation to tax transfer pricing rules that require arm's length and market rate terms.

Position Your Brand for Contract Manufacturing Success

Contract manufacturing can offer compelling growth opportunities for your cannabis or hemp brand. The key to sustainable success lies in disciplined revenue presentation, strong tax positioning, proactive compliance, and robust royalty oversight.

By aligning accounting standards with tax objectives, maintaining transparent investor communications, and reconciling royalties regularly, your company can position itself to expand with confidence while minimizing regulatory and financial risk.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.