- within Accounting and Audit topic(s)

- within Criminal Law, Strategy and Family and Matrimonial topic(s)

- with Finance and Tax Executives

- in United Kingdom

Key Takeaways:

- AI, talent shortages, and real-time auditing are transforming how financial audits are conducted in 2025.

- Clean, accessible data and early collaboration are key to smoother, more insightful audits.

- Audits are evolving from compliance checks into strategic tools for managing risk and driving better decisions.

—

In today's fast-changing environment, financial audits are more than just a year-end requirement — they're an opportunity to assess risk, strengthen financial processes, and uncover insights that can drive smarter decisions. But the audit landscape is changing rapidly. Emerging technologies, shifting workforce dynamics, and evolving stakeholder expectations are redefining what a successful audit looks like.

Top 5 Audit Considerations for 2025

Here are five key financial audit trends to keep in mind as the year progresses:

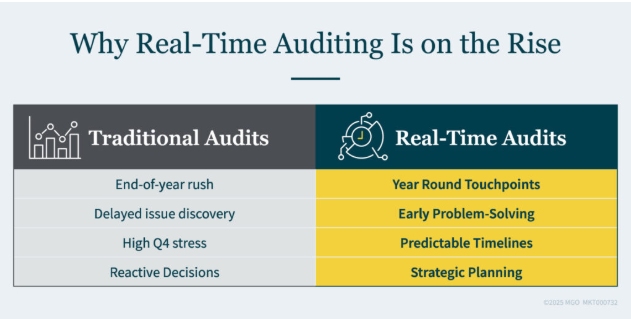

1. Real-Time and Continuous Auditing Are Gaining Traction

Why wait until the end of the year to catch an issue? In 2025, more businesses are moving toward real-time or continuous auditing — and you should consider whether it's right for you.

By working with your audit team throughout the year, you can test controls earlier, address valuation challenges in Q4, and resolve issues before they snowball into major delays. This approach reduces the year-end scramble and leads to a smoother, more predictable audit process.

Auditors can perform interim work, test new transactions, and review draft financial statements well before the final books close. This shift helps everyone: your team stays ahead of deadlines, and auditors gain more time to focus on high-risk areas.

What you can do: Collaborate with your auditors. Share early drafts of key reports, hold strategy calls, and front-load documentation to ease the pressure in January. A deliverables calendar and clear role assignments can help your team stay on track.

2. AI Is Reshaping the Audit Process — But Clean Data Is Key

Artificial intelligence (AI) and automation are transforming how audits get done. If your auditor isn't using AI to analyze entire datasets, detect anomalies, or streamline documentation, they're already behind. AI tools help reduce manual testing, speed up reviews, and allow audit teams to focus on big-picture risks and strategic value.

But the benefits of AI depend on how well you've prepared your systems. Poor data quality or disconnected platforms will limit the effectiveness of even the most advanced tools. In 2025, expect your auditors to ask questions about your tech stack, cloud platforms, and internal data governance processes. You'll need to demonstrate that your financial data is structured, accessible, and secure — or risk delays and incomplete assessments.

What you can do: Start by reviewing your financial systems, organizing your data, and working with your IT and compliance teams to make sure your internal controls align with how AI-driven audits are conducted.

3. The Audit Talent Crunch Could Impact Your Engagement

The audit profession is facing a serious talent shortage — and that could affect your experience as a client. Audit teams are leaner than ever, with firms struggling to recruit and retain professionals who have the right combination of financial reporting, analytics, and tech skills.

The result? Tighter timelines, increased workloads, and in some cases, fewer people available to answer your questions or dive into complex areas of your business.

This isn't just a staffing issue. It's about the changing nature of the audit profession. In 2025, auditors are expected to bring expertise beyond accounting — including data analytics and even industry-specific regulations.

What you can do: When evaluating or re-engaging an audit firm, ask about staffing depth and technical capabilities. Make sure your team has a primary point of contact who understands your business and can provide continuity throughout the audit cycle.

4. Firms Are Reassessing Auditor Relationships for Better Alignment

If you're exploring new audit firms this year, you're not alone. Many organizations are re-evaluating their audit relationships to find teams that offer deeper industry knowledge, better communication, or more advanced technology.

Making the switch doesn't have to be overwhelming. With a little planning, you can set the stage for a smooth transition that strengthens your financial reporting and aligns with your long-term goals.

From onboarding timelines to regulatory requirements and data access, there are a few key areas to keep in mind. But the most important step is finding a team that understands your business and can provide a smooth handoff without disrupting your reporting cycle.

What you can do: Work with your new audit firm to create a clear onboarding plan. Set expectations early, discuss timing, and collaborate on gathering documentation so your first engagement starts off strong.

5. Audits Are Becoming Strategic — Not Just a Compliance Exercise

Gone are the days when an audit was just a formality. Today, audits can offer powerful insights into operational risks, data security, and financial performance. Your board, investors, and regulators increasingly expect your audit function to go beyond the basics.

As reporting expectations grow and risk environments evolve, treat your audit like a strategic asset. Work with auditors who not only meet compliance standards, but who also understand your goals and can offer value-added insights along the way.

What you can do: Engage your auditors as advisors. Share your business strategy, new ventures, or expansion plans. The more context they have, the more relevant and insightful their findings will be — and the better your business will be prepared for what's next.

Turn Your Audit Into an Advantage

Now is the time to align your internal processes with the evolving audit landscape — and choose audit partners who can grow with you. Just as the audit process is evolving, so should your mindset: approach your next audit not as a task to complete, but as a tool to strengthen your business for what's ahead.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.