- within Antitrust/Competition Law, Media, Telecoms, IT, Entertainment and Accounting and Audit topic(s)

- in United States

- with readers working within the Banking & Credit and Law Firm industries

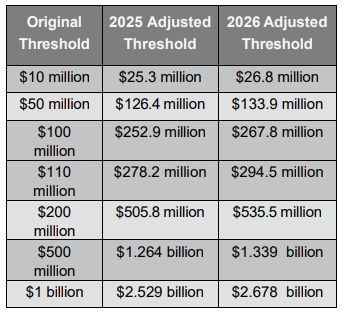

The U.S. Federal Trade Commission (FTC) has announced annual adjustments to the jurisdictional thresholds for the HartScott-Rodino Antitrust Improvements Act of 1976 (HSR Act), which were published in the Federal Register today. The new thresholds apply to all transactions closing on or after February 17, 2026. The HSR Act requires the FTC to adjust the thresholds annually based on the change in the gross national product (GNP) in the prior fiscal year.

Under the adjustments, the size of transaction threshold will increase from $126.4 million to $133.9 million. Consequently, the HSR Act notification and waiting period requirements will apply to acquisitions resulting in holdings valued in excess of $133.9 million of voting securities or certain assets, and in the case of partnership or LLC interests also conferring the right to 50% or more of the profits or assets upon dissolution of the acquired entity.

Acquisitions that do not exceed $535.5 million in value (previously $505.8 million) also must meet the size of person threshold to trigger the HSR Act requirements. Under the adjustments, the size of person threshold generally will be met if one of the parties has total assets or annual net sales of $267.8 million or more (previously $252.9 million) and the other party has total assets or annual net sales of $26.8 million or more (previously $25.3 million).

Acquisitions resulting in holdings of less than 50% of a corporation's voting securities may require HSR notifications for subsequent acquisitions resulting in holdings exceeding any of the following likewise adjusted dollar thresholds: (a) $133.9 million, (b) $267.8 million, (c) $1.339 billion, and (d) 25% of an issuer's outstanding voting securities if valued over $2.678 billion.

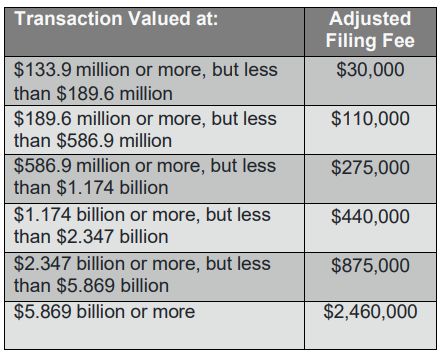

Adjustments to HSR Filing Fee Schedule

The FTC also announced adjustments to the HSR filing fee schedule as required by the 2022 Merger Filing Fee Modernization Act. The FTC is required to adjust the filing fees annually based on changes in the Consumer Price Index (CPI) for the prior fiscal year. Like the new filing thresholds, the new filing fees also will come into effect on February 17, 2026, and will apply to transactions filed on or after the effective date (regardless of when the transaction might close).

New Filing Fee Structure:

Adjustments in Thresholds for Section 8 of the Clayton Act

Finally, the FTC announced adjusted thresholds for interlocking directorates prohibited by Section 8 of the Clayton Act, which became effective January 16, 2026. Like the HSR Act filing thresholds, the FTC is required to adjust the Section 8 thresholds annually based on changes in the GNP. Section 8 of the Clayton Act prohibits, with certain exceptions, a person serving as a director or officer of two competing corporations that meet certain thresholds. As adjusted, Section 8 now applies where each corporation has capital, surplus, and undivided profits aggregating $54,402,000 or more, unless either corporation has competitive sales of less than $5,440,200. Although Section 8 of the Clayton Act on its face applies only to interlocks among "corporations," the agencies take the position that the statute applies equally to all modern corporate forms.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.