The Patent Trial and Appeal Board (PTAB) issued its first written opinions based on a trial of the relatively new Post-Grant Review (PGR) proceeeding and genetic factors.

American Simmental Association (ASA) brought the petitions for review of the Leachman patents in response to a lawsuit filed by Leachman. ASA is an organization formed in 1968 with the stated mission of making cattle production more profitable by improving livestock production through advances in science and technology. Leachman Cattle of Colorado has the same stated philosophy, and traces its roots back to 1935, when the founders were college roommates at Ohio State University.

In 2014, Leachman sued ASA, claiming that its Feeder Profit Calculator infringed Leachman's patents. Leachman had previously attempted to negotiate a license with ASA, but ASA refused. The filing of the suit gained little national attention, but was reported on by Progressive Cattlemen as causing a stir within the industry. http://www.progressivecattle.com/news/industry-news/6320-leachman-patent-lawsuit-stirs-debate-at-bif (July 12, 2014).

Although the original suit was dismissed on personal jurisdiction grounds, ASA continued to maintain that the patents were invalid and filed PGR petitions with the patent office. In its petitions, ASA argued that the patents were invalid because the patents claimed non-patentable subject matter (Section 101) or were obvious based on existing systems for valuing livestock (Section 103).

The ASA petitions are the first PGR petitions to make their way through trial and result in a final written opinion from the board. PGR was added as part of sweeping changes to the patent office rules to help improve patent quality. The America Invents Act (AIA) added three procedures to review patents after they have been issued: inter partes review (IPR), covered business method (CBM) review and PGR. As outlined below, PGR provides the first opportunity for a third party to challenge the validity of a patent.

| AIA Procedure | Time Available | Types of Patents Considered |

| Post-Grant Review | Grant of patent – 9 months after grant | First to File Patents |

| Inter Partes Review | 9 months after grant to the end of patent term | First to Invent and First to File Patents |

| Covered Business Method | After a PGR is available or after a PGR is completed | First to Invent and First to File Patents |

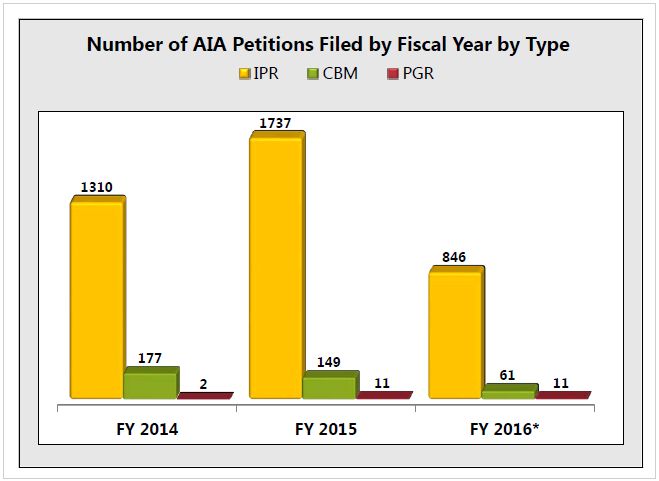

PGR allows a third party to challenge the validity of a patent based on any validity ground, except compliance with the best mode requirement, but it must be brought within nine months of the issue date of the patent. In contrast, an IPR is limited to questions of validity based on prior art (Sections 102 and 103 of the Patent Act), but may be brought at any time during the patent's term. PGR applies only to patents issued under the first-to-file system, which was enacted on March 16, 2013, and as a result, there have been fewer opportunities for use of PGR. U.S. Patent and Trademark Office (USPTO) statistics indicate that 24 PGR filings have been made in the past two and a half years, compared with over 4,400 IPR filings.2

While ASA asserted that both patents were obvious, the board agreed only with respect to claims 1-4, 8-12, and 14-19 of the '557 patent. The board, however, did find all claims of both patents invalid under section 101, for claiming non-patentable subject matter. The board's decision was guided by the Supreme Court's holding in Alice, reasoning that the claims (1) related to an abstract idea and (2) lacked any elements that would transform them into a patent-eligible application.

In particular, the board found the claims to be directed to applications of mathematical formulas and algorithms in the field of animal valuation. It also found that the claims covered a fundamental economic practice, pointing to characterizations of the prior art in the patent specification and testimony from ASA indicating that similar valuation techniques had been used for decades. With respect to Alice's second prong, the board again pointed to the specification. In particular, the board noted that the patents' references to a "commercially available terminal processor" demonstrated that generic computer hardware was used to implement the invention, leading to the conclusion that the claims do not offer significantly more to transform the claims to patent-eligible subject matter. The board distinguished DDR Holdings3 on the basis that the valuation of livestock based on genetic and physical traits did not involve a problem and solution unique to the realm of computers or necessarily computer-related. The board, likewise, rejected Leachman's request to amend the claims and went on to explain that the amendments would not cure the Section 101 defect.

These written opinions indicate that PGR, like IPR, can be a potent tool when questioning the validity of a patent. It also demonstrates that in appropriate circumstances, the USPTO will invalidate patents on non-prior art grounds, including whether the claims cover patent-eligible subject matter. From a patent drafting standpoint, the board's written opinions reinforce that care must be taken when there is a question of whether the patent covers patent-eligible subject matter. In particular, characterizations of prior art are not required as part of the application. While they are often used as background, this decision suggests that if such characterizations tend to demonstrate that a concept is a fundamental economic practice or building block of human ingenuity, it may be prudent to avoid such characterizations and simply provide the required prior art citations in an information disclosure statement.

Footnotes

1 For more background on PGR, see "Major 101 Decision – Enfish v. Microsoft"

2 http://www.uspto.gov/sites/default/files/documents/2016-4-30%20PTAB.pdf

3 "USPTO Releases Next Iteration of Examiner Guidance on Patent Subject Matter Eligibility"

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.