- within Law Practice Management, Wealth Management and Insurance topic(s)

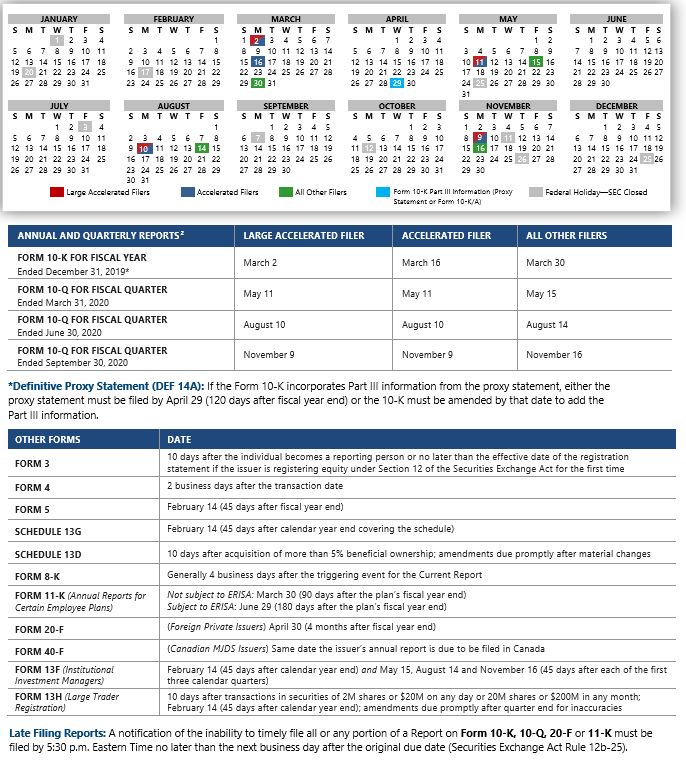

FILING DEADLINES FOR CALENDAR YEAR COMPANIES1

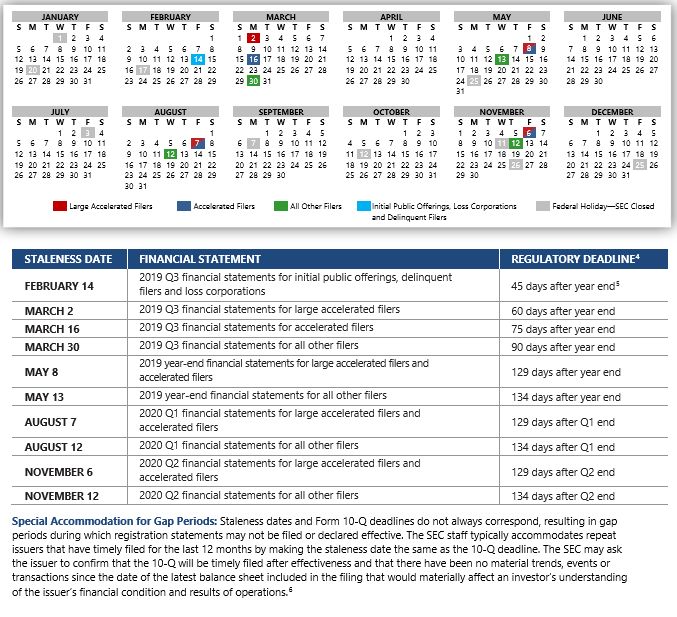

FINANCIAL STATEMENT STALENESS DATES FOR CALENDAR YEAR COMPANIES 3

Financial statements are considered stale under the rules of the US Securities and Exchange Commission (SEC) when they are too old to use in a prospectus or proxy statement. Accordingly, if financial statements have gone stale, an issuer must file the most recent required financial statements before using a prospectus or proxy statement. Deadlines vary based on the type of issuer.

FOREIGN PRIVATE ISSUERS ( FPIs)

Generally, FPIs' audited financial statements go stale after 15 months, and interim financial statements (covering at least 6 months) go stale after 9 months, subject to the exceptions noted below.7

EXCEPTIONS

- The 15-month and 9-month periods are extended to 18 months and 12 months, respectively, for the following offerings: (1) exercises of outstanding rights granted pro rata to all existing security holders; (2) dividends or interest reinvestment plans; and (3) conversions of outstanding convertible securities or exercises of outstanding transferable warrants.

- In an initial public offering of an FPI not public in any jurisdiction, audited financial statements go stale after 12 months unless the FPI sufficiently represents to the SEC: (1) compliance is not required in any other jurisdiction and (2) it is impracticable or involves undue hardship.

- If financial information for an annual or interim period more current than otherwise required is made available in any jurisdiction, such information should be included. The new financial information does not need to be reconciled to US GAAP, but narrative explanations of the differences in accounting principles should be provided and material new reconciling items should be quantified; however, such requirements do not apply to issuers filing audited financial statements prepared under IFRS.

EDGAR HOURS OF OPERATION

EDGAR filings may be made from 6:00 a.m. to 10:00 p.m. Eastern Time on weekdays (excluding federal holidays). Filings submitted after 5:30 p.m. Eastern Time receive the next business day's filing date (except Section 16 filings and filings pursuant to Rule 462(b), which receive the actual date of filing).

Footnotes

1 Dates reflect filing deadlines in light of weekends and federal holidays (Securities Exchange Act Rule 0-3(a)).

2 Form 10-K is due 60 days, 75 days and 90 days after the fiscal year end for large accelerated filers, accelerated filers and all other filers, respectively. Form 10-Q is due 40 days after the fiscal quarter end for large accelerated and accelerated filers and 45 days after the fiscal quarter end for all other filers.

3 Dates reflect staleness in light of weekends and federal holidays (Securities Act Rule 417).

4 Regulation S-X Rule 3-12.

5 Regulation S-X Rules 3-01(c) and 3-12(b).

6 SEC Division of Corporation Finance, Financial Reporting Manual (FRM) Section 1220.5, available at https://www.sec.gov/divisions/corpfin/cffinancialreportingm anual.pdf.

7 Regulation S-X Rule 3-12(f), Item 8 of Form 20-F and FRM Section 6220.

Downloads –

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.