- within Litigation and Mediation & Arbitration topic(s)

- in United Kingdom

- with readers working within the Insurance industries

- within Litigation, Mediation & Arbitration, Transport and Employment and HR topic(s)

- with Inhouse Counsel

The HSF Kramer Decision Analysis team brings together highly numerate disputes lawyers to build decision tree models and help clients quantify, visualise and better understand legal risks in their disputes. This service has brought new insights to resolving disputes strategically and favourably.

In this series, we discuss a number of different scenarios in which HSF Kramer has built Decision Analysis models to support clients in contentious situations.

First, we hear from Alexander Oddy, Disputes Partner in London, about using it to help with litigate-or-settle decisions:

A few years ago, we were instructed on one of the largest insurance coverage claims in the English courts. Our client was up against a number of different insurer groups, each advancing a wide range of policy construction, factual, causation and quantum arguments, some of which were mutually inconsistent. This made it very difficult to evaluate the litigation risk in the claim (for settlement purposes) by a traditional "finger in the air" or overall percentage approach.

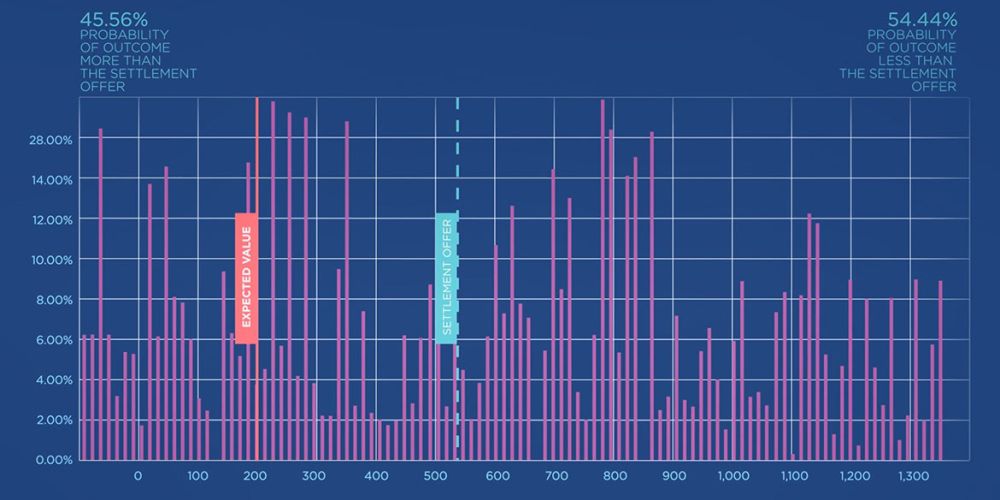

At the client's request we brought in our internal Decision Analysis team at an early stage. Although the team were not insurance specialists, they used their advanced numeracy skills as well as their disputes experience to put together a highly sophisticated decision tree model, taking each issue in the case in a logical order, and identifying that there were over 20,000 possible routes the judge could go down at trial.

For each issue in the case, we worked with the team to ascribe a probability of success, and worked this through to the value to our client of each outcome, taking into account future costs, costs orders and present-value discounting so that the modelled values were properly comparable to an immediate cash settlement.

We then presented the range of possible outcomes to the client's board in graphical forms, which gave them a clear idea of the risks and opportunities. We also ran sensitivity tests to see the impact of changing probability inputs to more optimistic or pessimistic numbers. The client could then consider their own risk appetite and decide what settlement range they would accept.

Read Part 2 of our Decision Analysis Series - Using Decision Analysis in settlement negotiations

Read Part 3 of our Decision Analysis Series - Using Decision Analysis for distressed debt valuations

Read Part 4 of our Decision Analysis Series - Using Decision Analysis for case management

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.