1. Introduction

During 2012, the UK Government announced a number of changes that impact on the purchase and ownership of UK residential properties. Some of these measures were introduced in the 2012 Budget with effect from 21 March 2012. Further measures were issued for consultation in 2012 and finalised in Finance Act 2013, with these measures being effective from 1 April, 6 April or 17 July 2013.

The Finance Act 2013 changes affect the purchasing and ownership of UK residential property worth over £2 million held by 'non-natural persons' in three respects:

- an annual tax on enveloped dwellings (ATED, but formerly known as the annual residential property tax) taking effect from 1 April 2013;

- an extension to the scope of capital gains tax (CGT) for ATED related gains, taking effect for gains accruing from 6 April 2013; and

- extensions to the relief from the higher rate of stamp duty land tax (SDLT - the 15% rate) which took effect for transactions occurring on or after 17 July 2013.

2 Annual tax on enveloped dwellings

An annual tax on enveloped dwellings (ATED) applies to interests in a UK residential property with a taxable value over £2 million where a company, or a partnership with a company as a member, is entitled to the interest. It also applies to such an interest held for the purpose of a collective investment scheme.

These categories of taxable person are similar to those that apply for the 15% rate of SDLT, except that the latter applies to a purchaser, whereas ATED applies to the entity entitled to the interest.

There are some two exclusions from ATED and some exemptions. The charge cannot apply to:

- an entity whose entitlement to the interest is purely in the capacity of a trustee or personal representative, and;

- an entity whose entitlement to the interest is as a beneficiary of a settlement. In addition there are exemptions from ATED for charities, public bodies (as defined by FA06 s33), bodies established for national purposes (certain museums and heritage or historic building bodies) and single dwelling interests which are conditionally exempt from inheritance tax.

In determining whether an entity is entitled to a high value residential interest, account will be taken of the interests held by connected parties, though in assessing the interests of connected parties, the interest of an individual will not be added to a connected company where the value of the company's interest is £500,000 or less.

The reliefs from ATED which need to be claimed are based around those uses of the dwelling which are for genuine business or commercial purposes and include those where the high value dwelling:

i) is exploited or to be exploited as a source of rents from third parties as part of a property rental business;

ii) previously satisfied the above relief and is being prepared for sale or demolition;

iii) is open to the public with access to a significant part of the interior for at least 28 days per year on a commercial basis, as a venue, location or to provide accommodation or other services;

iv) is held exclusively for development and resale in the course of such a trade carried on by the person entitled to the interest;

v) is acquired by a property developer where the vendor acquires another chargeable interest in exchange from the property developer;

vi) is acquired by a property trader and held as part of trading stock;

vii) is acquired by a financial institution in the course of a lending business and held for sale without undue delay;

viii) is held to provide an employee (or office holder) or partner with accommodation for the company's or partnership's commercial purposes in the course of a trade carried on (by the business or a relevant group member) with a view to profit, where the employee or partner has less than a 10% interest (income or capital) in the company or partnership, except that this does not apply to individuals who provide excluded domestic services;

ix) is a farmhouse on land occupied for a commercial farming trade where the farmhouse is occupied by a person carrying on that trade or occupied by a person connected with the trader, and the individual's occupation is as a farm worker for the purpose of the business, or a former long-serving (a three year test) farm worker or spouse or civil partner of such an individual;

x) is held by a profit making registered provider of social housing where the acquisition of the interest was funded with the assistance of public subsidy, subject to the acquisition or housing provider meeting certain conditions.

With respect to the reliefs listed at i, iv, v, vi, vii, there is a disqualification from relief for the preceding year and the following three years where a non-qualifying individual is permitted to occupy the property (a preceding year disqualification operates in respect of the relief at ii). In the case of relief i if there is a period of qualifying relief under the property rental condition after the non-qualifying use and before the end of the subsequent three year look forward period ends, then the three year look forward disqualification from relief ends. With respect to the preceding year disqualification look back, a period of actual letting qualifying for relief at i above can in some cases be regarded as not disqualified from relief.

The first annual charge will arise on UK residential properties owned at 1 April 2013 or acquired, built or converted from a non-residential property after that date and will be payable for the period 1 April 2013 to 31 March 2014.

The amount of the annual charge depends on the market value of the property. If the property was owned on 1 April 2012 the value at that date will be used to calculate the charge at 1 April 2013, for properties acquired after 1 April 2012 the value at the date of acquisition will be used. Properties will have to be revalued every 5 years so for properties held at 1 April 2012 the next valuation date will be 1 April 2017 which will form the basis of the April 2018 annual charge.

The annual charge will be self-assessed so those persons liable to the charge will be responsible for obtaining the market value of their property at the respective dates. The due date for returns and payment of tax will normally be by 30 April of each year. However, for the first year the due date for the return will be 1 October 2013 (or 30 days after the date of first coming within the charge to ATED if later) with payment made by 31 October 2013 (or by the ATED return filing date if later).

There are different time limits for the first return when dwellings are first acquired after 1 April 2013. Where a relief applies, a nil-charge return to claim relief must be made. It is possible to include all properties qualifying for one relief on such a nil-charge return.

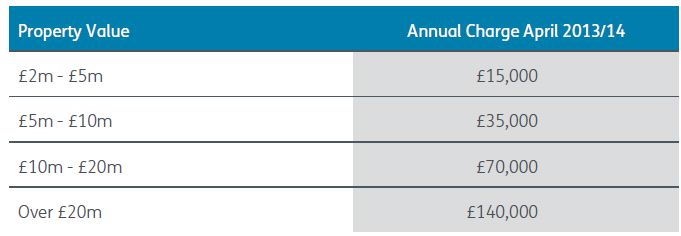

The bands and annual charge for 2013/14 are as follows:

The annual charge will be indexed to the Consumer Price Index (CPI) and updated each year. There are no proposals to uplift the rate bands with the CPI.

The amount of tax due will be the amount for the period from first coming within the charge to the end of the chargeable period unless interim relief is claimed in respect of days in that chargeable period which are not chargeable. Where the chargeable amount is reduced after a return is submitted and payment made (for example because of conversion to commercial property, a reduction in the level of interest, or newly coming within a relief (subject to a claim) or by disposal or demolition before the end of the chargeable period), it is possible to reclaim the amount paid that relates to the non- chargeable days, but the claim must be made by the end of the following chargeable period.

3 CGT charge on disposals of certain UK residential property

The scope of CGT has been extended to include a 28% charge on disposals or part disposals of UK residential property over £2 million by UK resident and non-resident persons who have 'ATED related' gains.

Under existing legislation CGT is only payable by UK residents. Anti-avoidance legislation treats gains on disposals by non-resident companies and trusts as accruing to UK resident individuals in certain circumstances. However, for ATED related gains accruing from 6 April 2013 CGT will apply to ATED-related gains on both resident and non- residents.

ATED related gains are gains made on disposals on or after 6 April 2013 and accruing from that date (necessitating a valuation at this date) in respect of the proportion of days for which ATED was payable. The size of the disposal has no influence on whether an ATED related gain accrues, it is the proportion of any gain that is ATED related that counts. A CGT charge on an ATED related gain will only arise where (in the case of a disposal of the whole interest) the consideration exceeds:

- £2m, or (in the case of a disposal of a portion of an interest); or

- the relevant fraction of £2m (in the case of a part disposal, where the relevant fraction is the proportion of the value disposed compared to the total market value at the date of disposal of the interest of the parts disposed of and retained.

Chargeable persons for the ATED can include the responsible partners of a partnership with a company member which has an entitlement to a single dwelling interest exceeding £2m. The CGT legislation excludes individuals, the trustees of a settlement and personal representatives of a deceased person from CGT on ATED related gains where the gain accrues on:

- the disposal of any partnership asset and the person is a member of that partnership; or

- a disposal of any property held for a collective investment scheme and the person is a participant in the scheme.

In addition there is an exemption for ATED related gains accruing to an EEA UCITS which is not an open-ended investment company or a unit trust scheme.

The gain will be calculated following normal CGT rules. The computation of gains will take into account those periods where reliefs from ATED were available. The period assessed will be from 6 April 2013 until the date of disposal for CGT purposes (note this may not coincide with the date on which an ATED charge ceases due to the disposal). However, by irrevocable election an alternative calculation can be made assessing the ATED related gain according to the whole period of ownership, with the proportion of the period for which the ATED related gain is treated as accruing calculated as if ATED had always been in force, and calculating the ATED related gain using actual base cost rather than the market value as at 6 April 2013. Making this irrevocable election will have merit if the original base cost was higher than the market value, or where much of the pre-6 April 2013 element of the gain would be exempt to a charge under ATED rules because of reliefs, or where there are ATED-related losses from other transactions.

There is a tapering relief for gains where the property is worth just over £2 million. The tax charge will only apply to disposals after 5 April 2013 and is calculated using the 6 April 2013 market value as the base cost. The nil gain/nil loss provisions for transfers of assets intragroup are disapplied for transfers of properties on which an ATED related gain accrues.

The existing CGT anti-avoidance legislation continues to apply to the pre-6 April 2013 element of the actual gain and to that part of the post-5 April 2013 gain which is not an ATED related gain.

If losses arise on the sale of properties within the charge, these will only be available to set against ATED related gains in the same or future years. The amount of allowable loss is restricted where the proceeds are less than £2 million and costs exceed the threshold.

4 Stamp duty land tax (SDLT)

4.1 7% rate of SDLT on consideration of more than £2 million

A 7% rate of SDLT applies to residential property transactions valued at more than £2 million with an effective date (normally completion) on or after 22 March 2012.

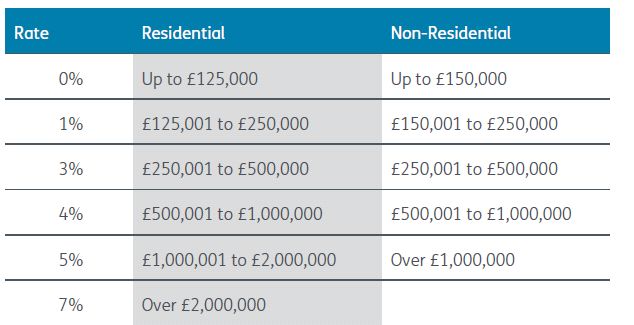

The standard rates of SDLT payable on land purchases are now as follows:

4.2 15% rate of SDLT on consideration of more than £2 million where UK residential property acquired by 'non-natural persons'

Where the acquisition of a UK residential property in excess of £2 million is by a 'non- natural person' the rate of SDLT payable on the purchase will be 15% rather than the 7% rate outlined above. This affects all purchases entered into on or after 22 March 2012.

'Non-natural persons' for this purpose has the same definition as for the ATED and include companies, partnerships with one or more company members and collective investment schemes.

For the period from 22 March 2013 to the date of Royal Assent of Finance Bill 2013 the companies and partnerships excluded from the 15% charge are as follows:

- companies acting in their capacity as a trustee of the settlement;

- bona fide property development businesses provided that:

- the property is acquired in the course of a bona fide property development business; and

- the business has been operating for a minimum of two years; and

- the property was purchased with the intention of re-development and re-sale (note that development and letting is not excluded from the charge).

- charities are excluded from the charge provided the charities exemption is met. Other exemptions from SDLT charges may apply depending on whether the conditions for exemption are met.

From 17 July 2013 the relief for property developers was widened and a range of other reliefs now apply so that the reliefs are similar to those applying for ATED. The reliefs are where the property is acquired:

i) Exclusively for the purpose of business letting, trading in or redeveloping properties. If it is intended that a non-qualifying individual (one connected with the purchaser) will be permitted to occupy the building, this will disqualify the availability of this relief. This will remove the two year trading history requirement of the property developer relief operating before Royal Assent;

ii) With the intention it will be exploited as a source of income from a trade of making a significant part of the interior available on a commercial basis to the public for at least 28 days per year. This requires reasonable commercial plans for this activity to have been formulated;

iii) By a financial institution in the course of lending activities for the purpose of resale in the course of that business;

iv) For the purpose of making the dwelling available to an employee or partner of a business carrying on (or with a relevant member carrying on) a trade with a view to profit on a commercial basis, who is entitled to less than 10% of the profits of the business or less than 10% of the interest in the dwelling and is not employed to provide excluded domestic services;

v) Which is or is to be a farmhouse (forming part of land occupied or to continue to be occupied for the purpose of a qualifying farming trade), occupied by a farm worker who is involved in the day to day work of the trade or in the direction and control of that trade.

Relief may be withdrawn if within three years of acquisition, the dwelling ceases to be used for a relievable purpose or the dwelling is occupied by any person connected with the owner (except for farmhouses and houses exploited for public access).

5 Existing Structures - What should be done now

There will be no generic right answer for all types of structure; each one will need to be considered taking account of the individual facts of the situation.

In each case it will be necessary to undertake cost analysis of maintaining or dismantling an existing structure, as well as the tax consequences of each alternative.

In some circumstances it would be preferable to keep existing structures and pay the new taxes so as to keep the current UK inheritance tax protection. Property owners may also have concerns about property tax charges in other jurisdictions.

Others will need to consider the SDLT and CGT consequences of dismantling a structure and their future IHT exposure. The position will depend to a large degree on the residence and domicile status of the individual concerned.

The new General Anti-Abuse Rule (GAAR) became effective for arrangements and transactions occurring on or after 17 July 2013 and that will be another factor to be borne in mind.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.