The IP landscape is an assessment of the intellectual property rights in a particular area of technology.

It includes the activities of your competitors in terms of their pending and granted rights and can also reveal information about the direction of their R&D focus. Having a good understanding of the activities of your competitors is therefore valuable in terms of risk management because you are aware of which granted IP rights could impact your product line and you have sight of pending rights that have the potential to disrupt your future plans. The assessment of the IP landscape is also valuable for strategic reasons. For example, it can be possible to identify trends in the filings of your competitors or the market in general. The most prolific inventors can be identified which may inform your hiring decisions. The geographic distribution of IP rights may inform your decisions on where to place manufacturing functions, distribution facilities or research divisions.

In general, it is good practice to understand the IP landscape for risk management and strategic reasons as well as to give you an understanding of where your business stacks up against other IP rights holders.

To illustrate some of the information that can be gleaned from an IP landscape assessment, we take a look at the field of secondary cell recycling.

This article was first published in bestmag and can be found here.

PATENTS IN CONTEXT

Patent applications are categorised by the technology to which they relate when they are assessed by patent offices around the world. The classification system for patents is vast and can provide insight into patent filings in precise areas of technology. To provide an understanding of the information that can be obtained, we focus on classification "H01M 10/54" which is described as "Reclaiming serviceable parts of waste accumulators".

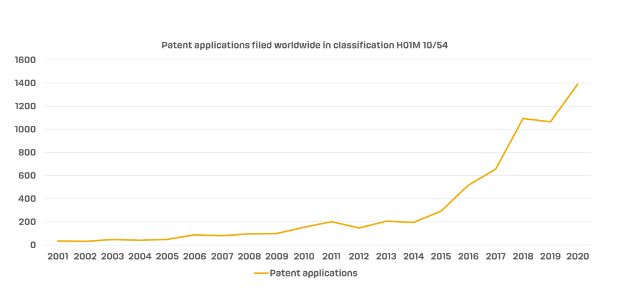

First, let us consider the number of applications filed worldwide over the last 20 years, which is shown in the graph of Figure 1.

This shows there was a moderate increase in filings around 2005 but it wasn't until 2014 and 2015 that there was significant interest in this area of technology. Since 2008 the number of patent filings made worldwide per year has increased ten-fold. With the EU battery directives and associated legislation along with increased environmental awareness, it can be expected that this increase in the number of filings will continue.

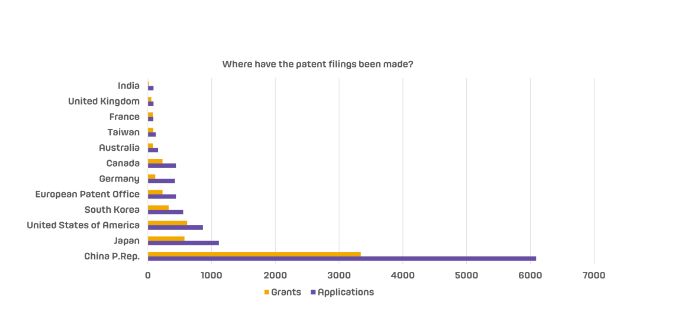

It is also important to understand what is driving this increase in patent filings. In Figure 2 we have broken down the number of patent filings in the same patent classification into the geographic areas in which the patents are filed.

We can now appreciate that a large proportion of the filings in this technological area originate from China. Thus, it may be that the significant patent filing activity occurring in China is skewing the results. Before we look more at growth in filings around the world in more detail, it is worth considering that Figure 2 shows both the number of patent applications and the number that have been approved for grant. The conditions for grant do vary slightly from patent office to patent office, but broadly the same assessment of novelty and inventive step is performed. We can see that roughly 50% of the patent filings in China are being granted, which is broadly similar to the other countries. The United States appears to have a greater grant percentage. Further investigation may be required to determine whether this is because of a lower threshold for allowance or because higher quality research and development is occurring in the USA.

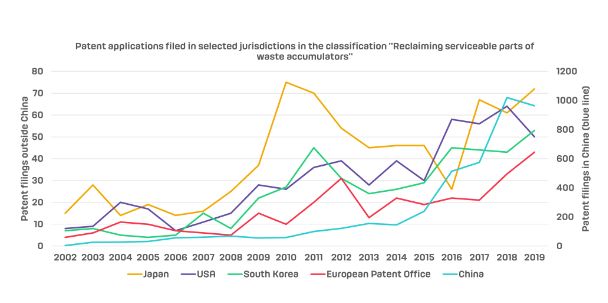

Figure 3 shows number of patent application filings per year in each of Japan, USA, South Korea and at the European Patent Office. The number of patent filings is also shown for China as a black line and is plotted against a different axis to the others given the great disparity in the number of filings in the different jurisdictions.

We now see a more nuanced picture of where innovation is occurring in this area. In Japan there was a rush of patent filings in 2010 and 2011. Looking into the figures we see that Sumitomo Metal Mining Co. was behind a good proportion of those filings and JX Nippon Mining and Metals Corp was on the rise at the same time. In the USA and South Korea there is a steady rise in interest since 2008. In Europe however, it wasn't until the battery Directive 2006/66/EC of 2006 that investment in patent filings increased. Nevertheless, since 2017 there appears to be a steady and continued increase in patent filings in Europe which looks to be catching up with the levels in USA and South Korea.

UNDERSTANDING THE COMPETITION

Let us now turn to who is filing the patent applications. Table 1 shows the Top 10 companies filing application worldwide in a first column. The next column shows the top 10 companies filing patent applications that are published in the USA and the final column shows the top 10 companies filing patent applications that are published in the Europe.

| Top 10 filers worldwide | Top 10 filers where the patent application was published in the USA | Top 10 filers where the patent application was published in Europe |

| Toyota Jidosha KK | Toyota Jidosha KK | Aqua Metals Inc. |

| JX Nippon Mining And Metals Corp. | Aqua Metals Inc. | JX Nippon Mining And Metals Corp. |

| Sumitomo Metal Mining Co. | Sumitomo Metal Mining Co. Ltd. | Sumitomo Metal Mining Co. Ltd. |

| Univ. Central South | JX Nippon Mining And Metals Corp. | Toyota Jidosha KK |

| Hefei Guoxuan High Tech Power Energy Co. Ltd. | NL IND Inc. | BASF SE |

| Inst Process ENG CAS | RSR Technologies Inc. | Umicore |

| Toyota Motor Corp. | BASF SE | RSR Technologies Inc. |

| Jingmen Green ECO Manufacture NEW Material Co. Ltd. | LG Chem Ltd. | Commissariat a l'Energie Atomique et aux Energies Alternatives |

| Dowa ECO System Co. Ltd. | Panasonic Corp. | Duesenfeld GmbH |

| Guangdong Brunp Recycling Technology Co. Ltd. | Robert Bosch GmbH | Kyushu Univ. National Univ. Corp. |

In terms of the filings made anywhere in the world, the top 10 is

filled with Japanese and Chinese companies with a Chinese

University, University of Central South, at number four. However,

when we consider the top filers at the US Patent and Trademark

Office, the picture looks very different with US, European and

Japanese companies filling the top 10. The list includes many of

the big names of the battery industry as well as Aqua Metals, Inc

which specialises in sustainable, closed-loop metal recycling

processes and RSR Technologies Inc. which provide chemical and

metallurgical research services to battery, mining, and smelting

companies. It therefore appears from this that the Chinese

companies perhaps have a more domestic patent filing strategy,

whereas the Japanese companies are concerned with having a patent

portfolio with wider geographic scope.

Looking at the filers in Europe we see similar names to those companies filing in the USA. However, Belgium-based Umicore make an appearance in the top 10 as well as specialist lithium-ion recycling company Duesenfeld GmbH. Filling the number 10 spot is Kyushu University of Japan which has a Department of Automotive Science and Advanced Materials and Chemistry specialism.

DIVING DEEPER

For each filer we can look more closely at the subject matter they are filing. For example, Duesenfeld GmbH have a granted patent (EP 3 529 841 B) for a method of treating used lithium batteries featuring the steps: (a) comminuting the batteries such that comminuted material is obtained, and (b) drying the comminuted material so that electrolyte of the battery evaporates, characterised in that (c) at least 50% of the evaporation heat is introduced into the communited material by means of mechanical energy. In the same patent family they have a patent (EP 3 312 922 B) for a method of treating used lithium batteries containing the steps: (a) comminuting the batteries such that comminuted material is obtained, and (b) drying at a maximum temperature of 80 °C, characterised by the fact that (c) the drying occurs at a maximum pressure of 300 hPa and the comminuted material is deactivated by the drying, thereby rendering an electrochemical reaction impossible, and (d) the deactivated comminuted material is not filled into a transport container after the drying process.

Understanding the claim scope of the patent rights held by your competitors is important so that you can either design solutions that circumvent the granted patents or, if that is not possible, begin a negotiation to gain appropriate licences to use the patented method or device.

It is also possible to look at the inventors named in each of the patents. Table 2 lists the 10 most prolific inventors alongside the number of patent families with which they are listed as an inventor.

|

Inventors

|

Number of patent families in which the inventor is named |

|

Asano Satoshi |

10 |

|

Sloop Steven E |

9 |

|

Arakawa Junichi |

7 |

|

Mitsui Masahiko |

7 |

|

Izumi Junta |

7 |

|

Ito Junichi |

6 |

|

Kurashima Yoshihiko |

6 |

|

Olper Marco |

6 |

|

Smith W Novis |

6 |

|

Iwata Katsuichi |

5 |

It can be seen that Satoshi Asano is an inventor for Sumitomo Metal

Mining Co. and that Junichi Arakawa is an inventor for JX Nippon

Mining And Metals Corp. Steven E Sloop is president of OnTo

Technology LLC. According to their website OnTo Technology perform

contract R&D to pioneer comprehensive methods to improve safety

and efficiency in recycling lithium-ion batteries and

materials.

Finally, we can look at the patent applications that are classified as relating to reclaiming serviceable parts of waste accumulators and are most cited against other patent applications. Thus, when a new patent application is filed, the patent office performs a search to identify other, older, patent publications that are relevant for assessing the patentability of the new patent application. If a relevant, older, patent publication is found then it is cited against the new patent application. A patent landscape assessment can look at which patent published are cited against other patent applications most frequently.

| Patent publication number | Title | Excerpt from abstract |

| US2005057888A | ELECTRODE IMPREGNATION AND BONDING | A method for making an electrode including a particle based film is disclosed in which the film is coated and/or impregnated with veins of conductive material. |

| US5651821A | BATTERY DISPOSAL AND COLLECTION APPARATUS | The battery disposal and collection apparatus includes a terminal connection having a terminal electrode pressed by a pressing structure on an upper cover, a battery guide case having a battery container to which the terminal electrode is inserted when the upper cover is closed, and which contains batteries, a rotary plate having an electrode terminal and a battery dropping hole on the plane of a rotary plate under the battery guide case. |

| US2016030856 | DISTILLATION REACTOR MODULE | The distillation reactor consists of a reactor apparatus with corresponding method of upstream distilling and purification of carbon based liquid or liquidized streams for use as fuels, lubricating oils and or gaseous energy and electricity production. |

| US2007108946 | BATTERY INFORMATION MANAGEMENT DEVICE | A secondary battery module includes a battery information storage unit for storing electric characteristic information and usage history information of the secondary battery module. |

| US2008003490 |

LITHIUM RESERVOIR SYSTEM AND METHOD FOR RECHARGEABLE LITHIUM ION BATTERIES |

A lithium-ion battery cell includes at least two working electrodes, each including an active material, an inert material, an electrolyte and a current collector, a first separator region arranged between the at least two working electrodes to separate the at least two working electrodes so that none of the working electrodes are electronically connected within the cell, an auxiliary electrode including a lithium reservoir, and a second separator region arranged between the auxiliary electrode and the at least two working electrodes to separate the auxiliary electrode from the working electrodes so that none of the working electrodes is electronically connected to the auxiliary electrode within the cell. |

DELIVERING ACTIONABLE INSIGHTS

In summary, an IP or Patent Landscape report provides insights into the market, your competitors and the technology. The data that can be obtained is useful for identifying trends in an area of a field of technology to inform your overall R&D and IP strategy. Once competitors and key inventors have been identified, the patents associated with them can be assessed and analysed for risk management purposes or for reasons of making a strategic acquisition. It is therefore highly advantageous for players across the energy storage market to understand the IP landscape and in doing so, become more IP aware.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.