Incorporating the findings of the "How Many Patents are Enough?" survey conducted in collaboration with IAM

Most patent experts believe a well-balanced patent portfolio reduces the risk of patent litigation, but what is the right size and fit of portfolio? Cipher enables you to get the data you need efficiently, quickly and accurately to inform the modelling of your portfolio and get closer to answering this crucial question. Read the full report:

Cipher Report on Portfolio Optimisation

The Cipher Report on Portfolio Optimisation is the first global study specifically focussed on analysing the approaches taken to balancing patent portfolios in an economy where the impact of disruptive technologies has never been more important.

Key findings

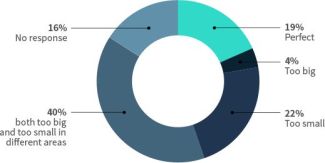

| Over $40 billion is spent on patents each year, but less than 20% of companies report that their portfolio is the right size |  |

| Hear all four Key Findings from the Cipher Report on Portfolio Optimisation |

Portfolio optimisation is a challenge faced by all organisations which choose to protect their investment in technologies with patents. This is true irrespective of sector, geography or portfolio size.

Patents are one of the primary ways that companies protect their investment in technology. The challenge is to optimise patent protection for the technologies delivering the most value and to protect the organisation from competitive threats. What is valuable and who is a competitor changes all the time. It is hard for the teams tasked with policing the company's intangible assets, and specifically intellectual property, to keep up with the drivers of corporate strategies. The result is typically the overstocking of patents in some areas and understocking in others. This imbalance means that patents are failing to deliver full value for the money spent.

Does a well-balanced patent portfolio mitigate the risk of litigation?

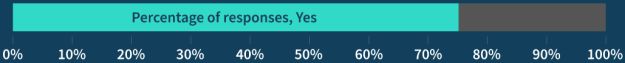

Over 75% of patent owners surveyed agree that a well-balanced patent portfolio reduces the risk of patent litigation. For the vast majority of companies, this is the most important strategic objective.

While patents confer the legal right to exclude others, the majority of patent owners regard the primary function of their patent portfolio to be defensive - namely, to neutralise the threat of litigation. With 76% of companies surveyed believing that a well-balanced portfolio reduces that risk, there is considerable focus on how best to achieve that balance.

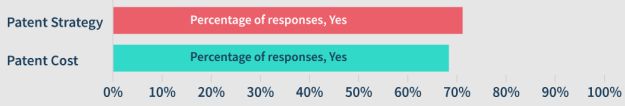

Is Patent Portfolio Cost / Strategy presented at your CTO, CFO and/or Board level?

Companies across all sectors including industrials, automotive, technology and healthcare are being disrupted by new technologies, and increased attention is being given to both the strategic benefits and cost of building large patent portfolios, with around 70% of organisations reporting scrutiny at CTO, CFO or board level.

It has long been the case that the CTO, CFO and others have accepted patent costs as necessary without understanding the strategic rationale for this investment. This has changed, with the vast majority of companies now presenting patent strategy outside the IP and legal teams.

Organisations spend an average of 9% of their patent budgets on strategic patent intelligence

While over 70% of patent budgets continue to be spent on new patents and maintenance of existing portfolios, on average 9% is being invested on analysis and modelling to communicate the strategic benefit of patent portfolios. This investment is entirely justifiable in an environment where, on average, 4.5% of revenues can be exposed to third-party patent claims.

Strategic patent intelligence includes being able to evidence how your patent portfolio meets its strategic objectives. For those companies which use their patents to neutralise threats posed by others, this means having the ability to understand not only the relevance of the patent portfolio to the company's own technologies and products, but also how their portfolio maps to the products and technologies of those who pose patent risk. While this requires sophisticated modelling, this is justified by the significant risk to revenue posed by the proliferation of patents.

Cipher Report on Portfolio Optimisation

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.