Measuring the value of your patent portfolio

Return on Investment (ROI) is a widely used measure of efficiency or profitability of an investment. Put simply, it identifies which parts of your portfolio are delivering value to your organisation and which are not.

$40 billion is spent on patent portfolios each year,

how can you measure the value derived from such a significant investment?

What is Return on Investment (ROI)?

ROI measures the return on a particular investment relative to its cost.

Why ROI?

ROI is used across the business for financial modelling of investments and assets.

So why treat patents differently?

Patents are a business asset and the ROI of a patent portfolio can be calculated and used as a way to communicate its value to the business and improve that value.

ROI of your patent portfolio promotes transparency and actionability

Transparency

ROI allows you to speak to the business using a language they understand, as it is already widely used amongst R&D, Marketing Finance teams.

Actionability

ROI allows you to compare the outcome of different strategies and make decisions about how you can maximise the gain from a scarce resource.

ROI Webinar

Joined by Head of Patents at Facebook, the webinar Pulling back the curtain: calculating ROI of patents covered the key components to calculating the value of an organisation's greatest asset and improving communication with the wider business.

Measuring patent portfolio ROI

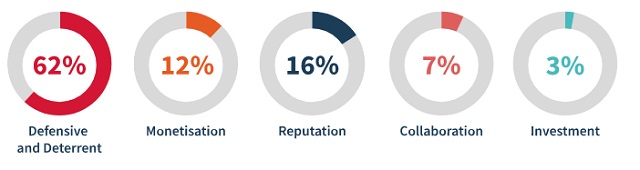

What is the primary purpose of your patent portfolio?

Defence against third parties

The assumption made is that the number one use of a patent portfolio is to defend your business against a potential aggressor. 62% of organisations report that this is their primary strategy for their portfolio.

What is the number one strategic objective that your patent portfolio serves?

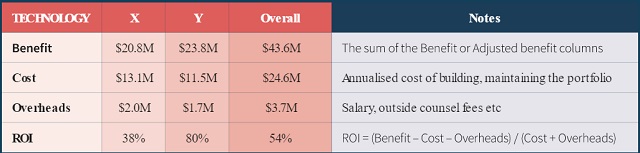

Building blocks of ROI

The Cost

What is the total cost of building your patent portfolio?

- Organic patent COST (patents you have filed) – what is the average yearly cost?

- Acquired Patent COST (excluding non-core patents, including core patents)

The Benefit

What is the deterrent value of your patent portfolio?

- looking backwards to understand what the portfolio has delivered and

- looking forwards to compare different strategies to enable the best choice to be made

Calculating portfolio ROI

Bringing this together, we have the final ROI calculation:

Want to calculate ROI of your patent portfolio?

Jeremiah Chan and Jonathan Liu from Facebook, and Nigel Swycher and Steve Harris from Cipher authored the full report on, Pulling Back the Curtain: Calculating Return on Investment of Patent Portfolios. The report goes into more detail on:

- Why is it important to measure ROI?

- Is Portfolio ROI too difficult to measure?

- The building blocks of ROI analysis

- Applying the ROI calculation to a hypothetical company

Get your copy of the report and see how you could apply this ROI calculation to your own portfolio using example calculation spreadsheets.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.