Technological advancements, evolving workforce expectations and an increasingly competitive environment are driving transformative change in the biopharmaceutical and life sciences sector.

Rapid advancements in technology, evolving workforce expectations and an increasingly competitive environment are driving transformative change in the BioPharma and Life Sciences (BPLS) sector. Key trends include breakthroughs in drug discovery, shifts in employment dynamics and the evolution of compensation structures to attract and retain specialized talent.

Tech innovations driving drug development

AI-powered drug discovery

Researchers are revolutionizing drug development by leveraging artificial intelligence to predict molecular behaviors, optimize clinical trials and identify new drug targets. Along with accelerating timelines, AI-driven drug discovery also is reducing costs, making the process more efficient. Collaborations between major pharmaceutical companies and AI-focused firms are fueling this innovation, with significant investments aimed at leveraging machine learning and bioinformatics.

Gene and cell therapies

Advancements in gene editing and cell therapies are providing groundbreaking solutions for genetic diseases and cancers, and the field is set to expand rapidly with the U.S. Food and Drug Administration (FDA) poised to approve more of these therapies.

Personalized medicine

By tailoring treatments to patients' unique genetic profiles, personalized medicine is redefining healthcare. This approach enhances efficacy while minimizing side effects, particularly in cancer care. Tools like genomics and bioinformatics are pivotal in delivering these customized solutions.

Sustainability in drug production

The BPLS industry also is striving for greener practices, focusing on waste reduction and eco-friendly production methods. Sustainability is becoming a core priority as companies aim to align operations with environmental goals.

Workforce dynamics in a rapidly changing landscape

Talent shortages and upskilling needs

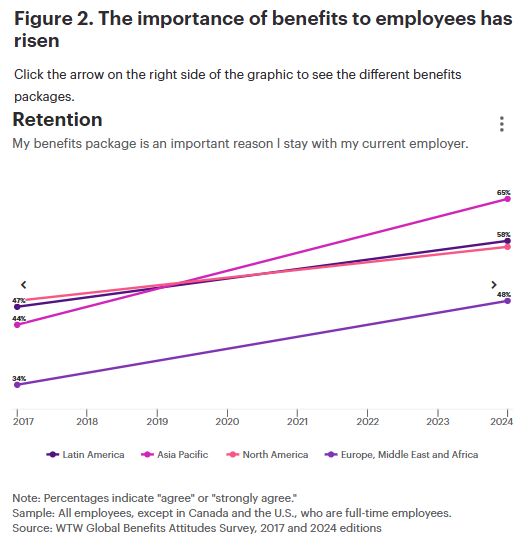

The increasing dependence on technologies like AI and machine learning has led to a talent shortage in the BPLS sector. Companies are finding it challenging to recruit and retain skilled professionals, especially for positions such as data scientists and software engineers. Additionally, industry-specific roles, including chemists, medical science liaisons (MSLs), and research scientists, are in high demand. To bridge these gaps, it has become crucial to upskill current employees through targeted training programs (Figure 1).

Figure 1. Top 20 jobs in demand in the BPLS sector, global

Source: WTW Talent Intelligence Report for the BioPharma and Life Sciences

Shifts in workplace preferences

Flexibility in work arrangements has become a top priority for employees. While leadership often pushes for in-office presence, workers increasingly value remote or hybrid setups. Organizations that align with these preferences are better positioned to attract and retain top talent.

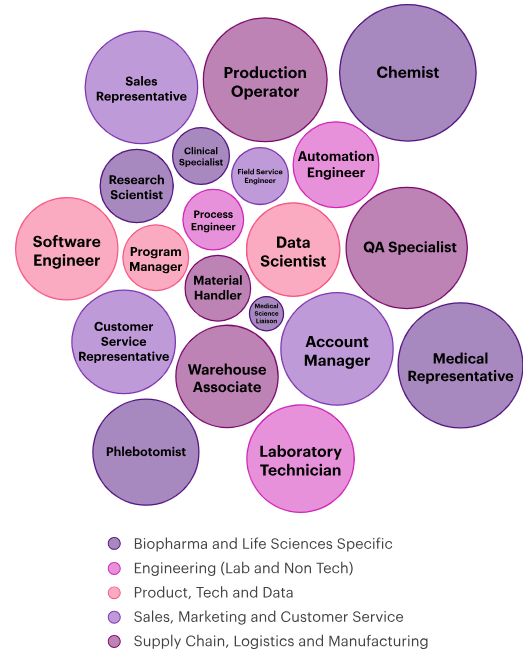

Employee benefits and retention

Comprehensive benefits packages, including health coverage, mental health support and professional development opportunities, are critical for retaining employees. In Asia Pacific, benefits emphasizing work-life balance and career growth are especially valued. Globally, career development opportunities and a sense of purpose are key motivators for younger professionals (Figure 2).

Compensation trends in BPLS

Rising salaries amid economic pressure

Inflation and tight labor markets have driven salary increases across the life sciences sector. Notably, countries like the U.S., Canada, Switzerland and the UK report higher average salaries, reflecting competitive labor markets. Conversely, nations with weaker currencies and higher inflation show lower salary levels.

Specialized roles and premium pay

Life sciences companies often use higher pay, additional stock options and bonuses, known as new-hire premiums, to attract top talent and compensate for the benefits that candidates might leave behind. These premiums are most common in high-demand roles such as research, regulatory affairs, clinical trials and corporate development. These incentives are especially prevalent in the UK and U.S., reflecting regional differences in recruitment strategies within the industry.

Incentive structures

Life sciences companies tend to offer higher long-term incentives (LTIs) compared to other industries. These LTIs emphasize innovation and retention, aligning with the sector's high growth potential and volatility. However, recent short-term incentives (STIs) often fall slightly short of targets.

Economic outlook and future projections

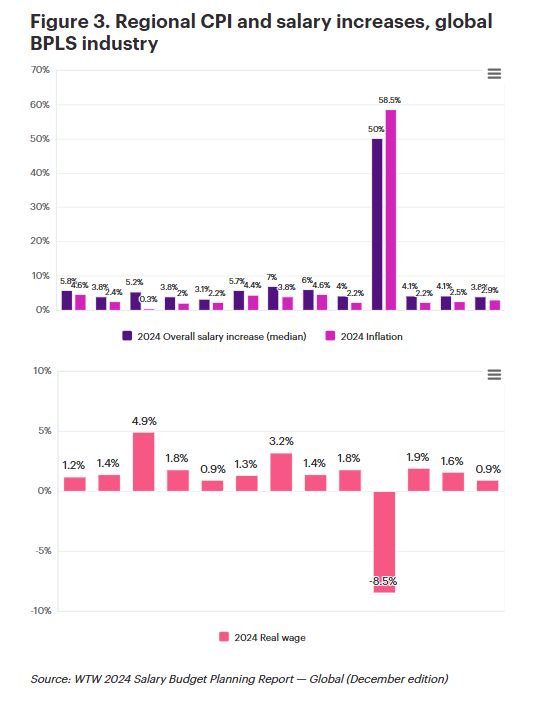

Inflation and wage growth

Globally, there is an encouraging trend toward positive wage growth in 2024 as inflation rates continue to stabilize. Most regions around the world are experience real wage growth, according to the December 2024 edition of WTW's Salary Budget Planning Report. However, Turkey remains an exception, where persistently high inflation is causing significant wage erosion.

Overall, the broader trend indicates that inflation is coming under control, allowing wages to keep pace in many areas. This shift offers some relief for both employers and employees, as wage growth, even if not always fully matching inflation rates, remains positive and promising for the coming year. This dynamic is a hopeful sign, particularly in countries where high inflation has previously hindered real wage growth (Figure 3).

Economic indicators and industry growth

The life sciences sector has continued to prosper since the pandemic, experiencing consistent growth and a decline in unemployment rates across various regions. Nevertheless, external factors (e.g., geopolitical factors, economic downturns) may affect future performance.

This industry is at a crossroads of innovation, workforce evolution and economic challenges. Companies can navigate these changes successfully by embracing cutting-edge technologies, prioritizing employee wellbeing and offering competitive compensation. The sector's ability to adapt to these dynamics will define its growth and resilience in the years to come.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.