THE SINGLE PAYMENT SCHEME

The currency conversion rate for the single payment scheme has now been set at its lowest rate since 2008, however the claim validations are significantly ahead of last year's schedule.

Conversion rate for 2012

The rate for converting the 2012 payment is €1=£0.79805. This was the official European Central Bank rate on 30 September which fixes the value for 2012 payments. The rate is just under 8% less than last year's figure of £0.86665. It is the lowest conversion rate since the £0.7903 seen for the 2008 single payment scheme (SPS). A low figure indicates a weak euro and strong pound. Each euro buys fewer pounds and thus the SPS payment will be lower in sterling terms.

Modulation rates in the UK are unchanged in 2012 compared with 2011. The actual payments can now be calculated in Scotland and Wales for 2012 but in England the calculation of entitlement values is undertaken from scratch each year and the rate can vary depending on how many entitlements are claimed.

The adjacent table shows the actual payment farmers will receive in England based on the 2012 conversion rate. This is after modulation at 19% (ignoring the €5,000 threshold for EU modulation). This is compared to the payment for the last two years on a hectare of arable land (i.e. assuming a full history of arable area payment scheme claims in the reference period). England has now completed its transition to flat-rate regional payments and for 2012 onwards there is no historical element in English entitlements. Thus all entitlements within a region are now paid at the same rate.

Entitlement statements for 2012 have been available to view online since December. Those that made paper applications to the 2012 SPS will receive their statement in January 2013 through the post.

2012 payments

All the GB payment agencies have got a good proportion of 2012 single payments out to farmers. In England, the Rural Payments Agency (RPA) achieved its target for the whole of December on the first banking day (3 December). More than £1.38bn was paid (84.6% of the total) to 95,000 farmers (91.4% of customers). Those claimants who are unlikely to be paid in December should have been contacted by the RPA explaining the delay. In Scotland, around 14,200 claimants (approximately 70% of total) received their single farm payments on 3 January. This is an increase of around 4% on 2011. This was worth £303m.The Welsh Government had previously committed to pay 91% of claimants on the first day and appear to have achieved this target.

Dual use

The RPA is continuing its dual use information gathering exercise with a number of letters having been sent out to SPS claimants that the RPA has identified. Duel use is when a different business to the SPS claimant is claiming for the environmental scheme on a parcel of land. It is thought that the land occupant, the one who has the land within their holding should be responsible for both claims, but in (short-term) tenancy arrangements, this need not necessarily be the case as long as the occupant meets the environmental conditions on behalf of the claimant. The RPA will be looking for evidence that both parties can deliver their obligations under their respective agreements. The number of arrangements being surveyed is thought to be somewhat less than last year.

The spring Agricultural bulletin reported on the findings from the original exercise. This survey is part of Defra's ongoing campaign to allow dual use to continue. It has to have evidence to convince the EU auditors that it is satisfactory for one party to claim the SPS while someone else uses the land for agri-environmental schemes. If Defra loses the argument then dual use could be outlawed at any point. Although not officially confirmed, it seems fairly clear that it can continue for the 2013 scheme.

Soil protection reviews

It is a requirement for all SPS claimants in England to have completed a soil protection review (SPR). Lack of an up-to-date SPR is one of the main causes of cross-compliance penalties (in fact the SPR is often the first thing an inspector asks to see). Section 4 of the SPR requires any access to waterlogged land to be recorded. There had been no shortage of such land throughout last year, and we remind people to keep their records up to date. This must be updated by 31 December each year. Confusingly, the actual recording booklet is titled Soil Protection Review 2010 – but this continues to be the one to use. Defra is considering a revised version for the SPR. As the current booklet includes space to cover the 2013 year it seems likely that the revised version will apply for 2014.

FARM INCOMES ON THE UP

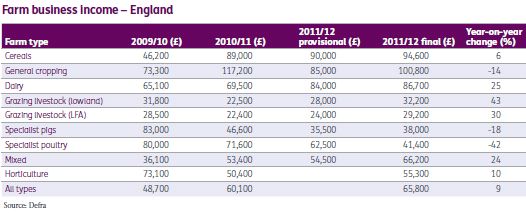

Defra has released updated farm business income figures for England, which show an increase in profitability for most sectors.

Defra has released updated farm business income figures for England. They show the profitability of different farm types for the 2011/12 year (February to February). These figures update those that were published in January. There are considerable changes from the provisional figures and major changes from last year's figures. With the exception of specialist poultry, the figures for all sectors have increased since the provisional numbers were released, some substantially, such as the general cropping, which is almost 20% higher.

Comparing 2011/12 with the previous year, there is a wide range of changes in performance. The figures shown in the table are in real terms (taking account of inflation). They show sector performances improving, led by lowland grazing livestock (43%), upland grazing livestock (30%) and dairy farming (25%), but a fall in performance of the general cropping (-14%), specialist pigs (-18%) and poultry a considerable -42%. Overall, profitability is seen to have been 9% higher last year than the previous year. The full release can be found on www.defra.gov.uk

BUSINESS BENCHMARKING

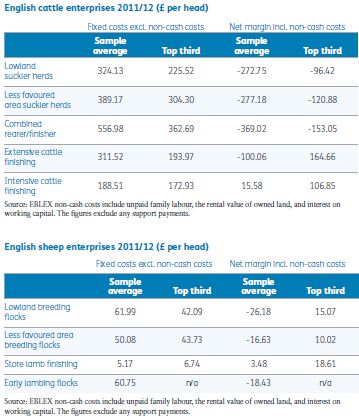

EBLEX has released its latest annual benchmarking report for the year ending 31 March 2012.

The main message which comes from the report is the need for beef and sheep producers to keep tight control of their fixed costs. The report reveals the top third of producers in all categories across the English beef and sheep enterprises spent significantly less on fixed costs (see tables). The only exception being store lamb finishers where the top third of producers actually spent more on this category of costs. Even so, these lamb finishers maintained positive net margins.

Output in both the beef and sheep sectors has increased due to strong prices. Sheep producers have also benefitted from an improvement in wool prices. It is estimated that all sheep flocks and cattle enterprise margins excluding non-cash costs (unpaid family labour, rental value of owned land and interest on working capital) will be better than year-earlier levels. All except the average and lower performing suckler herds are estimated to return positive net margins. Although, as the tables show, it is a different story when the non-cash costs are included. Unpaid family labour is high in most livestock enterprises. EBLEX has estimated this at £12.50/hour and also included the employer's liability insurance and national insurance.

The full Business Pointers 2012 report can be downloaded from the EBLEX website at www.eblex.org.uk

EBLEX will be launching a new in-house benchmarking system next year. Stocktake will use actual farm data from farms and enterprises.

SUPPLY AND DEMAND

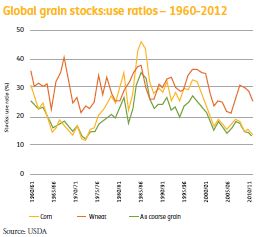

We examine the global stocks:use ratio of cereals and oilseeds at a time when the worldwide stock levels have fallen dramatically.

Cereals

The global maize stocks:use ratio has fallen dramatically since the mid-1980s from almost six months' supply (46% of the year) to just over seven weeks' supply at year end (14%). However, as the chart demonstrates, this is a situation that the world has been in before. Back in the early 1970s, the United States Department of Agriculture (USDA) data suggests global stocks fell to as low as six weeks' supply (12% of the year). This fall is more extreme for maize, the single crop that accounts for three-quarters of all coarse grain production and almost 80% of trade.

Only 1% of US maize is used for human consumption, the rest being processed for biofuels or fed to livestock for milk and meat production. Clearly, the percentage used for food will be higher in developing and poorer nations, but the point is that when prices are very high people still need to eat, but if the economics do not favour bioethanol manufacture, the biofuel plants will reduce production down to contractual or legal minima. Some flexibility is therefore created, enabling the world stocks to fall. Indeed, the USDA expects global cereal usage to fall this year. This will be the first time global grain consumption will have fallen since 1995, when prices were also very high. So does this imply a bull market? Not if the information is already built into the marketplace, but it does help explain why prices are high.

Looking more closely at the global stocks of maize, we notice that the proportion held in China has gradually risen to over half. Thus China now holds more maize than the rest of the world combined. For a country that trades only about 1% of its demand and production, this effectively means this tonnage can be discounted from the calculation as it is unlikely ever to see the light of the global marketplace. The last time China exported more than a million tonnes of maize was back in 2006. In fact, over the last two years, the USDA estimates that China will have imported 7.5 million tonnes of maize, not bad for a country that is effectively self-sufficient (its consumption is equal to its production, hence the rise of stocks). China has not previously imported such a quantity over a two-year period since the USDA's records began in 1960. So what is going on? China is protectionist, and recognises the importance of maize, especially to its pig industry. It now produces half of all global pig meat, from having produced very little 30 years ago. Pig meat is a major growth sector in China as the emerging wealth moves the country to a more sophisticated diet.

In the meantime, global wheat stocks are traditionally more consistent and have not varied from the 20% to 40% range. This is largely because of two reasons. Firstly, the demand for wheat varies less than that for maize as it is more of a staple foodstuff globally. Secondly, while it is only one crop, the range of types and specifications is greater than for other grains, meaning a range of stocks is required. Incidentally, China holds about 30% of global wheat stocks (meaning it holds about twice as much wheat per citizen as anywhere else) and like maize is virtually trade neutral.

There should be reasonable support for cereals prices as we head towards harvest 2013. This is reflected in current market sentiment with November 2013 LIFFE wheat futures values currently trading around £185 per tonne.

Oilseeds

While we are busy commenting on the tight supply and demand situation of the cereals, it is worth noting that the stocks:use ratio of rapeseed is at its lowest for 15 years, having fallen from a year-end stock level of 15% in 2009 to a meagre 4% this year. Indeed, sunflower stocks have not been this low since 1985, over a quarter of a century ago. Of the US soybean exports (the US normally accounts for over 40% of global exports), over half have apparently already been delivered and three-quarters committed. Yields as we know are down and supply is clearly tight. This year, more than for many previous years, the world will rely heavily on the southern hemisphere crop when it is gathered and counted. Again, this seems to suggest that there will be no great price collapse in oilseed prices for harvest 2013. Conversely, livestock farmers may be stuck with high protein prices for some time too.

BADGERS AND BOVINE TB UPDATE

The battle against bovine TB continues, with new surveillance and movement controls coming into force. Despite the controversial badger cull being postponed until summer 2013, the Government remains "absolutely committed" to its policy.

Badger cull postponed

The NFU took the difficult decision back in October to request that the pilot badger culls in West Somerset and West Gloucestershire should be postponed until summer 2013. Peter Kendal has written to all the NFU members explaining the decision. It appears the main issue was the difficulty of completing the six week continuous cull before the closed season took effect. The police had requested that the cull be delayed until after the Olympics and Paralympics, further delays were then imposed due to the legal challenges from the Badger Trust, and on top of this farmers were put under pressure during summer 2012 due to the extreme weather conditions.

In addition to these delays the latest surveys have revealed there are significantly more badgers within the pilot areas than originally thought. Since at least 70% of the badgers in an area must be removed in order to ensure the cull reduces TB in cattle, those responsible for the cull could not be confident that it would be possible to hit this target given the lateness of the season. Therefore, the directors of the companies co-ordinating the cull, along with the NFU, decided to postpone the cull until as early as possible next year and duly made this request to Defra.

There is some concern that this delay may eventually result in a cancellation as it provides more time for campaigners to exert pressure. However, in a statement to the House of Commons on 23 October 2012 the environment secretary, Owen Paterson, emphasised that there was no change in government policy and that it remained "absolutely committed" and would continue to work with the NFU to get the delivery of the policy right.

New surveillance and movement controls introduced

Although the badger cull has been postponed, new surveillance and movement rules continue to be introduced as part of the package to try and eradicate the disease. On 1 January 2013 new rules with the aim of reducing the spread of bovine TB between cattle came into force. The measures include changes to the TB surveillance testing regime and to the TB cattle movement controls.

Under the new rules, the surveillance testing has been altered so that England is divided into two cattle TB testing frequency areas – annual and four-yearly. There are no two and three-yearly testing intervals as from 1 January 2013 and TB testing intervals for cattle will be determined on a county basis rather than by parishes.

From 1 January, in addition to the counties currently on annual testing* the following counties were placed on annual TB testing:

- Cheshire

- Derbyshire

- Nottinghamshire

- Leicestershire

- Northamptonshire

- Oxfordshire

- Buckinghamshire

- Berkshire

- Hampshire

- East Sussex.

Defra's reasoning for extending the annual testing frequency is that evidence shows there has been a continued spread of the endemic TB areas from the South and South West towards the North and East of England and there is the requirement to keep ahead of the 'disease front'. The move to a county basis rather than by parish also makes the UK compliant with EU law and will help to ensure the much needed EU co-financing stays in place.

Furthermore, TB surveillance around breakdowns in four-yearly areas will be enhanced. Herds within 3km will require an immediate skin test, with a follow up six months later and, if negative, 12 months after that. However, these herds (if they remain negative) should see their routine TB testing intervals return to four-yearly testing more quickly than under the old parish-based system. Also, individual high-risk cattle herds, such as bull hire herds, heifer rearing herds, producer-retailers of raw drinking milk and those who regularly purchase cattle from high incidence countries or counties in England and Wales will remain on annual testing even where they are located in a four-yearly testing area (as currently). Cattle keepers were notified of their testing interval and herd testing interval via the usual statement in late November/ December.

What this means for keepers is that those within the annual testing areas will need to have a pre-movement test before moving cattle. This includes those higher risk herds in the four-yearly testing areas. Cattle tracing system links will only be allowed between holdings within the same testing frequency (either annual or four-yearly). This is probably less of a problem now with the move to county intervals unless the holding is near a county border.

In addition to the new surveillance testing rules, from 1 January 2013, the following changes were made to the cattle movement controls.

- Re-stocking of 'officially TB free status suspended' herds will only be allowed after the herd has completed its first post-breakdown test and subject to a satisfactory veterinary risk assessment (this is in-line with 'officially TB free status withdrawn' herds).

- The movement window for cattle from TB restricted herds will be reduced from 60 to 30 days from their last clear test unless moving direct to slaughter or to an approved finishing unit in which case it will remain at 60 days.

- No new approved quarantine units (AQU) will be allowed and existing ones will be phased out. From 1 January 2013 existing AQUs are not allowed to restock.

- Approved finishing units found breaching their operating conditions could see their licences removed.

WINTER ROUND-UP

Susan Shaw highlights a number of current tax issues relevant to the farming community.

31 January tax payments

Farmers who have suffered from the poor 2012 harvest may find themselves short of cash to pay their 31 January 2013 tax bill. This will comprise a balancing payment for 2011/12 and a 50% payment on account for 2012/13 (with a further 50% payment due on 31 July 2013) - both based on the higher than average profits from the 2011 harvest. The problem will be exacerbated if they used cash generated in 2011 to invest in new equipment. You can claim to reduce your 2012/13 payments on account if you expect your income to have fallen, so it makes sense to prepare your 2012 accounts as soon as possible to quantify the claim. If it turns out that you have reduced your payments too far you will be charged non-deductible interest at 3%, but this may be a price worth paying for the cash flow relief. In cases of hardship it may be possible to agree a delayed payment pattern with HMRC. The important thing is to talk to your accountant early in the New Year.

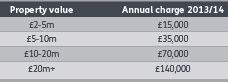

High value residential property

Further to my article in the last bulletin, draft legislation for the annual property tax on residential property, for example farmhouses, worth more than £2m has now been published. Subject to any final tweaks it will come into effect on 1 April 2013 and will apply to companies, collective investment schemes and partnerships that include a company.

The rate of tax is confirmed as follows.

The Government has announced a number of significant reliefs for genuine businesses carrying out genuine commercial activity, including farmhouses, certain employee accommodation and let properties. All these categories are subject to strict conditions which will need to be looked at in detail, but there is at least a measure of comfort for the many genuine UK businesses which own properties in companies and corporate partnerships.

Annual investment allowance

The Chancellor's Autumn Statement brought good news for farmers who are looking to invest in new equipment. Having slashed the annual investment allowance (AIA) – which provides 100% upfront relief on qualifying plant and machinery – from £100,000 to just £25,000 in April 2012, he has temporarily increased it to £250,000 for qualifying expenditure incurred between 1 January 2013 and 31 December 2014. The AIA is available to most businesses, regardless of size, but the maximum qualifying for relief at any particular time could be affected by the accounting year end and so the best advice is to ask your tax adviser to calculate the precise limit before you invest.

Cap on income tax reliefs

Farmers who incur significant losses may be affected by the new restriction on 'sideways loss relief' which comes into effect on 6 April 2013. Briefly, there will be a cap of £50,000 or 25% of income – whichever is greater – on the offset of trading losses, capital allowances on property and qualifying loan interest. The ability to carry forward losses against future profits of the same trade is unaffected, but without careful planning the cap may lead to cash flow problems in the short term.

Capital allowances on polytunnels

Following discussions with the NFU, NFU Scotland and British Summer Fruits, HMRC has softened its stance on some types of polytunnels. Any farmers who have been denied capital allowances in the past should review the position with their advisers. Likewise, if you are planning to invest in new polytunnels it makes sense to check that they will fall within the new qualifying spectrum.

Footnote

* The following counties were already subject to annual TB testing: Avon, Cornwall, Devon, Dorset, Gloucestershire, Herefordshire, Shropshire, Somerset, Staffordshire, Warwickshire, Wiltshire and Worcestershire.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.