- in Europe

- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- in Europe

- in Europe

- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

For regular readers of this newsletter, you will probably notice a different face and name on this page – albeit still a recognisable one for many of you, I hope!

I am delighted to have assumed the role of U.K. leader for the firm's Turnaround and Restructuring practice, since the start of July. It has been three years since my relocation from the U.S., and my family and I are excited for the extended adventure ahead, now that I will be a permanent fixture in this part of the world. I also want to thank Simon for his leadership, support, and guidance prior to me beginning my new role – all of which I'm sure we will further benefit from with his continued focus on client engagements, his broader European remit, and an oversight role in Asia.

We remain highly attuned to the market we serve and have further evolved this year to offer a greater concentration of expertise that builds on the remarkable platform already in place at AlixPartners.

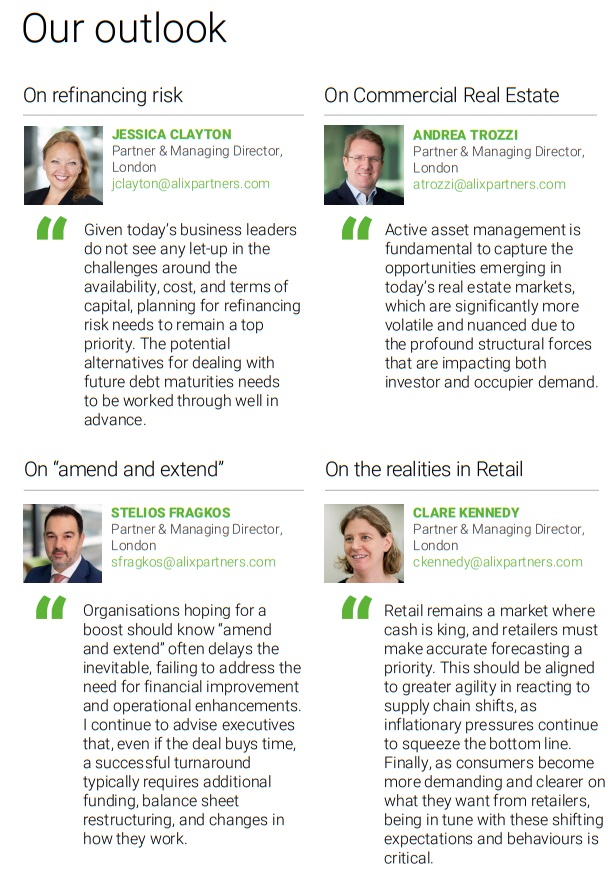

As the team has continued to grow, we are also taking this opportunity to refresh the coordination of our different routes to market. As such, Lee Watson and Jess Clayton will continue to oversee our Creditor Advisory work, Clare Kennedy and Ben Browne will oversee our Contingency Planning & Insolvency efforts, and Stelios Fragkos and Andrea Trozzi will oversee our Company Advisory and Interim Management offering. Joe O'Connor will lead U.K Risk and Compliance in Turnaround and Restructuring, while Dan Imison and Chris Davis will oversee our critically important People function, in addition to their client-facing leadership roles.

MARKET OUTLOOK

After a strong first half of 2024, we can see the market really picking up as we emerge from the summer period. We have been busy supporting a number of CRO requirements, which speaks volumes for the depth of experience we have within our team following last year's transformational acquisition of THM. More broadly from an industry perspective, we see increasing levels of activity in Real Estate – which you can read more about on the following pages – and a rising level of non-U.K. jurisdictional deal flow. I expect much more of the same in the final few months of this year; hedge funds and credit funds appear to be very active in a market that is demonstrating greater levels of liquidity needs, which points towards a growing number of pre-distressed situations and turnaround opportunities, if not necessarily insolvency activity.

We remain highly attuned to the market we serve and have further evolved this year to offer a greater concentration of expertise that builds on the remarkable platform already in place at AlixPartners.

PRIDE IN OUR RECOGNITION

Finally, I wanted to end my introduction with two specific congratulatory messages. Firstly, to Joe O'Connor and the team who contributed to the outstanding outcomes achieved with Four Seasons Health Care, for which AlixPartners was recognised in the 2024 Health Investor awards as Consultant of the Year.

And last, but by no means least, huge congratulations to Alastair Beveridge who has been appointed to the position of President of INSOL International – a fitting testament to his technical excellence and personal qualities, and another familiar face within our industry in a new role, in addition to his client leadership duties...

I hope you all enjoyed relaxing breaks at various points during the summer months. As we move towards the final quarter, and as with all previous editions of our newsletter, please reach out to myself or the wider team if you would like to discuss any of the themes raised in this issue.

SGS' recapitalisation offers lessons for those navigating the real estate funding gap

Global lending market data suggests that the commercial real estate sector will need to address an unprecedented volume of real estate debt maturities over the next few years. The sector has traditionally relied heavily on short- to medium-term debt financing to support transactions, investment and development activity, typically spanning five to 10 years in length. Yet this debt maturity wave comes at a time when uncertainty remains elevated across the market – and will undoubtedly create some hurdles to overcome. So, how will this likely play out, and how can those who are impacted respond?

Andrea Trozzi

Partner & Managing Director

This is not the first time the sector has faced circumstances like this. The maturity wall of the Global Financial Crisis in 2008 was similar, but the zero-interestrate policy prevailing at the time facilitated widespread 'extend and pretend' and 'wait and see' strategies, rather than a deeper resetting of capital structures.

These strategies are still commonplace amid the current dislocation – analysis from Cohen & Steers in March 2024 estimates that 40 per cent of 2023 loan maturities were extended or otherwise modified. However, investors and lenders cannot continue to defer the need to address problematic refinancing positions indefinitely, as this might lead to missed opportunities and value destruction.

In the UK, the latest Real Estate Lending Report from the Bayes Business School published in May 2024 indicates that 42 per cent of the £170 billion of outstanding commercial real estate borrowing in the market requires refinancing over the next 12 months. The wave is even more pronounced in the US where Trepp estimates c.$550bn of real estate debt will mature every year until 2028.

By any estimate, the size of the debt maturity wave is significant, and is happening at a time when the sector is already struggling with severe cyclical and structural dislocation. Reduced credit availability in many sectors, elevated debt pricing, and tighter lending and underwriting criteria expose the vulnerability of heavily leveraged business models as sharply higher interest rates tighten liquidity. The resulting mismatch between the quantum of debt available and affordable at refinance is resulting in material debt funding gaps.

Case study: SGS Retail shows versatility is key

The retail sector – and shopping centre assets in particular – offer a good case study here. Their physical footprints, the investment required to reshape them, the costs associated with maintenance, as well as the climate in which they currently operate, means that ensuring a well-funded and sustainable capital structure is in place is key. The impacts of the maturity wave and funding gap are acutely felt.

SGS Group, which owns former intu assets Lakeside, atria Watford, Victoria Centre and Braehead Centre, is a recent example to point to. Here, AlixPartners acted as restructuring adviser, undertaking an executive management role from 2020 to 2024.

Earlier this year, the Group received wide backing for its landmark recapitalisation. This process saw SGS secure £445 million of new debt from Lloyds Bank – a strong endorsement and one which marks the biggest deal of this type since 2019. The success of this debt restructuring process was underpinned by the asset's performance in the face of challenging market conditions.

Over the past decade, the retail sector has undergone a profound transformation, driven by a confluence of factors, including the rise of online shopping, changing consumer behaviour, and COVID-19.

Together these changes mean that the nature of retail has fundamentally changed. E-commerce means physical assets now need to offer something more, something that cannot be replicated at home.

Creating an 'experience' is now key and we've thereby seen a flight to prime, with both tenants and consumers flocking to assets that supplement retail with a strong leisure and hospitality offer to create a 'day out', and also occupy the very best locations, with the best brands, enhancing the overall customer journey.

The tenant line-up has been significantly enhanced across SGS Group's assets following intu's fall into administration, with a focus on household names and a gear shift towards leisure and hospitality. This, alongside investment in data analytics and other asset management initiatives, has driven up footfall, occupancy, and rental income. Those able to navigate the current landscape and secure the financing they need have shown versatility and an ability to respond rapidly in a dynamic and fastevolving landscape.

Proactive, collaborative communication with tenants and lenders combined with granular, property-specific business plans and asset management strategies are increasingly critical. Ensuring that plans incorporate holistic and honest awareness of asset performance as well as fully costed capex programmes to deliver any repositioning and ESG upgrades required will facilitate discussions. Sustainability is also fundamental

in securing finance and minimising the cost of capital, whether in terms of operational asset performance (rent income security, resilience, and growth) or energy performance.

Crucially, we have seen strong asset performances translate into investor and lender support. Therefore, stakeholders must consider the landscape in which they operate and adopt the agility required to ensure they are strongly positioned when maturities arrive.

What lies ahead?

In the near-term, real estate financing costs will remain elevated and, whilst 'amend and extend' remains the preferred strategy in the hope of deferring action until a more stable macro environment and investment market prevails, this feels like it is only a temporary solution this time around. Lessons can – and should – be taken from those successfully navigating this complex landscape already.

Overall, while it may feel like the challenges facing the sector are yet to abate, there are reasons to be optimistic about the longer term. The potential dislocation that emerges as a result of these capital structure refinancing processes should help to catalyse transaction markets and spark investor interest in the sector.

OUR THINKING...

ALIXPARTNERS' 2024 TURNAROUND AND TRANSFORMATION SURVEY

In our 19th Annual Turnaround and Transformation Survey, more than 700 of the world's restructuring experts and executives tell us that the cost of capital is still the biggest factor driving company distress. However, that is just one part of the emerging story. If the forces of disruption are finding focus, how can leadership teams caught in the eye of the storm activate a reality check and reconfigure a company for success?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.