Issues affecting all schemes

Edinburgh Reforms – pensions implications

The government has announced a package of reforms, known as the Edinburgh Reforms, to drive growth and competitiveness in the financial services sector. Among the announcements that may impact pension schemes are the following:

- The regulations excluding certain performance fees from the scope of the DC default fund charge cap will be laid before Parliament in early 2023.

- The pace of consolidation in DC schemes will be increased. In 2023, the government, alongside the Financial Conduct Authority and the Pensions Regulator, will consult on a new value for money framework which will set required metrics and standards in key areas such as investment performance, cost and charges and quality of service.

- The ring-fencing regime for UK banks will be reformed to improve its functionality.

Action

Trustees and employers should keep the progress of the reforms under review.

Pensions dashboards – deferred connection

The government has published finalised guidance for schemes on deferring their dashboards connection staging deadline. Deferral is only possible in very limited circumstances. The government has also published a deferral application form.

Action

Trustees and administrators of schemes that wish to defer their staging date may find the guidance helpful.

Transfers – adequate due diligence checks and warnings

The Pensions Ombudsman has decided that a scheme failed to put in place proper processes to conduct adequate due diligence checks and to warn the member of the risks of transferring before processing a transfer to a suspected scam vehicle. The transfer was processed in February 2015 and the Ombudsman concluded that the scheme had had sufficient time to update its processes to reflect the Pensions Regulator's July 2014 Action Pack for Trustees and Administrators and had failed to do so.

The Ombudsman was satisfied that, but for the scheme's maladministration, the member would not have proceeded with the transfer. The Ombudsman therefore directed the scheme to reinstate the member's accrued benefits and to pay her £1,000 for the serious distress and inconvenience caused. However, to avoid double-counting, the Ombudsman directed that, if the new trustees of the receiving scheme retrieve some or all of the member's pension fund for her benefit, or she makes a successful application for compensation from the Financial Services Compensation Scheme, the scheme will be entitled to recover that amount from the member.

Action

No action required, but trustees and administrators should ensure that their transfer processes remain up to date with and follow industry good practice around identifying scams and warning members of the risks of scams

Issues affecting DB schemes

Pension Protection Fund – 2023/24 levy

The Pension Protection Fund (PPF) has published the finalised rules for the 2023/24 levy year. These are in the same form as the consultation version and confirm, among other things, that:

- The levy estimate will be £200 million, down from £390 million in 2022/23. 98% of schemes are expected to pay less levy in 2023/24, with the majority of schemes that pay a risk-based levy seeing it fall by more than half.

- The levy rates for levy bands 2 to 10 will be reduced, halving the band-to-band increase in the levy rate.

- Asset stresses will be updated to support the more detailed asset information that the Pensions Regulator will be collecting in the scheme return from 2023.

- The asset-backed contribution (ABC) rules will be changed to take account of payments made to a scheme in exchange for the trustee's interest in an ABC arrangement ceasing.

- Measures introduced in 2021/22 to support schemes through the pandemic with flexibility on payment terms will stay in place.

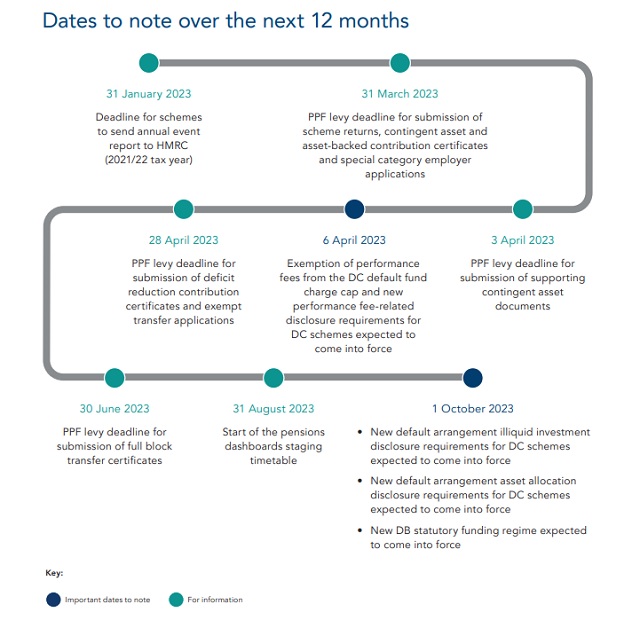

The key dates for the 2023/24 levy year are as follows:

- 31 March 2023 (midnight) – submission of scheme returns, contingent asset certificates, ABC certificates and special category employer applications.

- 3 April 2023 (5pm) – submission of supporting contingent asset documents.

- 28 April 2023 (5pm) – submission of deficit reduction contribution certificates and exempt transfer applications.

- 30 June 2023 (5pm) – submission of full block transfer certificates.

The PPF's consultation on the draft levy rules also set out initial proposals in relation to future development of the levy. The policy statement notes that the majority of respondents were supportive of the proposed direction of travel and provided a range of comments that will inform the PPF's future approach. The policy statement emphasises that the PPF remains committed to ensuring the risk-based levy is risk-reflective, so that schemes with weaker sponsors continue to pay more per pound of underfunding.

Action

Trustees and employers should ensure that any required information and documentation is submitted by the relevant deadline.

DB funding – code of practice

The Pensions Regulator is consulting on its draft revised DB funding code of practice. The Regulator has also responded to its 2020 consultation on its initial proposals for the revised code and published a blog post on the need for trustees to adopt a long-term funding approach.

The draft code sets out the Regulator's expectations of how trustees can comply with the statutory scheme funding regime, in particular the new requirement to determine a funding and investment strategy and agree it with the employer. The draft code is based on the draft funding and investment strategy regulations on which the government consulted in July 2022. The Regulator acknowledges that the final form of the regulations may change, but is consulting before the regulations are finalised to help the industry reach a more complete view of how the regulations may be interpreted and implemented. Any changes made to the final regulations will need to be reflected in the final code and the Regulator will engage with the industry throughout this process.

The draft code contains three sections:

- The funding regime – this section explains the status of Regulator codes of practice and provides an outline of the statutory funding regime.

- Long-term planning – this section sets out the Regulator's expectations of trustees in relation to their funding and investment strategy, and written statement of strategy.

- Application – this section sets out the Regulator's expectations of how trustees should approach other aspects of their valuations and how the elements in the long-term planning section should be integrated into their funding solutions.

The Regulator emphasises in the draft code that trustees should approach compliance in a way that is appropriate for their scheme's circumstances.

The Regulator is also consulting on its twin track regulatory approach to DB funding. Under its proposals, the "Fast Track" route has been reframed as a filtering mechanism to determine which schemes the Regulator will engage with on funding, as opposed to the proposal in the 2020 consultation that it would act as a benchmark for schemes. The twin track approach, including the Fast Track parameters, has been removed from the code and is set out in a separate document to enable the Regulator to make changes where necessary without needing to go through the formal parliamentary route required to amend a code of practice.

The Regulator anticipates that the earliest that the revised code and the finalised regulations will come into force will be 1 October 2023, and that the code will therefore apply to valuations with an effective date on or after that date. The code would need to be laid before Parliament for approval by mid-June 2023 to meet this timing. However, the Regulator acknowledges that this timetable is subject to change.

Both consultations close on 24 March 2023.

Action

Trustees and employers should keep the progress of the consultation under review

Issues affecting DC schemes

Investment decision-making – improving trustee skills

The Pensions Regulator has published a blog post on the need for trustees of DC schemes to take advantage of available support and guidance to increase their investment decision-making skills and take action to enable members to access the investment opportuni

Action

No action required.

>Mayer Brown news

Upcoming events

For more information or to book a place, please contact Katherine Carter

- Trustee Foundation Course

8 March 2023

7 June 2023

6 September 2023

6 December 2023

- Trustee Building Blocks Classes

17 May 2023 – topic TBC

8 November 2023 – topic TBC - Quarterly webinars

29 March 2023 – topic TBC

28 June 2023 – topic TBC

27 September 2023 – topic TBC

13 December 2023 – topic TBC

Pro bono and CSR

- Giles Bywater, Beverly Cox and Esther Farley have been providing pro bono legal advice to an Afghan citizen who is applying to resettle in the UK under the Afghan Relocation and Assistance Policy (ARAP) scheme. The applicant worked at Camp Bastion in Helmand Province for 7 years, and is now at risk of action from the Taliban as someone who collaborated with foreign forces. The ARAP application was submitted in December 2022. Our advice is being provided as part of the Afghan Pro Bono Initiative, an ambitious collaborative project between Mayer Brown and 13 other law firms and the NGOs Safe Passage and Refugee Legal Support.

- In 2022, Mayer Brown sponsored, for the ninth consecutive year,

the Aspiring Solicitors Commercial Awareness Competition, which is

the leading initiative of its kind for diverse aspiring lawyers in

the UK. The competition is exclusively for participants from

underrepresented groups and aims to increase access to the

profession.

Jay Doraisamy sat on the panel to judge the Grand Final of the competition, observing a series of tasks demonstrating critical thinking, teamwork, effective speaking and commercial creativity. Mayer Brown's involvement has a proven track record for success in hiring top talent and, since 2016, the firm has offered a training contract to 12 individuals directly through this initiative – four of whom are now qualified associates. Across City firms, 90% of Grand Final participants go on to secure a training contract or vacation scheme

Originally Published by December 2022

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2022. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.