Our report identifies investment themes and opportunities, explores the economic outlook for major countries, and outlines a long-term portfolio strategy.

2024 proved to be a year of exceptional returns for many financial assets. We saw major stock market indices, including the S&P 500, reach record highs and the Federal Reserve cut interest rates for the first time in nearly four years. Looking ahead to 2025, we expect many markets to build on this momentum. Our Global Investment Outlook 2025 report identifies investment themes and opportunities for 2025, explores the economic outlook for major countries including the U.S., Japan, Europe, Canada, Australia, and China, and outlines a strategy for adding portfolio value over the long term.

Outlook at a glance

When analyzing the macro-outlook and the balance of opportunity and risk in various financial markets, one approach we find useful is macro or micro-related investment themes. These themes help us identify the most important macro forces and understand what will likely drive markets over the next year. Where assets are not fully pricing in our expectations, this creates opportunity.

One of our major themes is for U.S. exceptionalism to continue in 2025 (Figure 1). In 2025, we forecast higher economic growth in the U.S., higher outperformance of consensus GDP growth expectations, and higher earnings growth than in other major advanced economies. This environment is typically supportive of positive performance for assets like equities and alternative corporate credit.

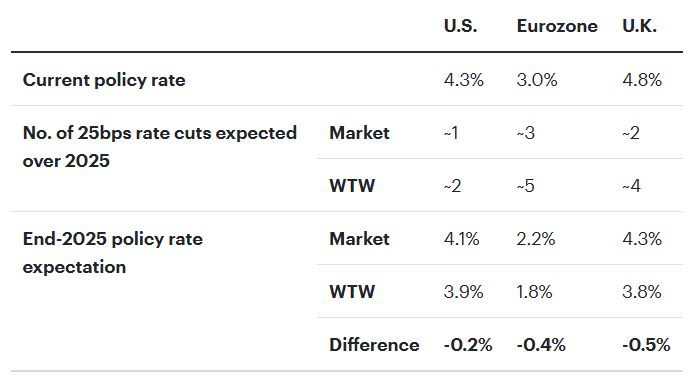

A second major theme is material divergences in economies in 2025 (Figure 2). The major advanced economies are now growing at vastly different speeds, face different inflationary pressures, and will have different government and industrial policies in 2025. This will lead to different responses by central banks in the pace at which they cut interest rates and creates opportunities in bonds and currencies.

Figure 2: Divergencies in economies and tactical opportunities in rates markets

Current and expected policy rates, %

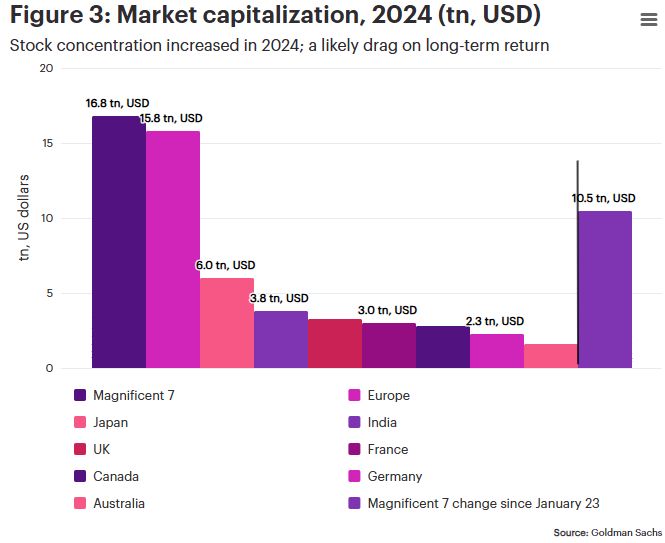

From a long term investment perspective, we face heightened chances of major policy, geopolitical, innovation, and financial market shifts, which suggests uncertain and more volatile prospects for simple portfolios. For example, the S&P 500 index is now highly concentrated (Figure 3). Typically, companies have been unable to sustain high rates of profit growth in the long run. This could lead to higher volatility and a return headwind for U.S. cap-weight equity over the next 10-years, with the potential value from skilled active management outsized.

When considering portfolio strategy over the long-term, we favor a competition for capital approach and a balanced, flexible portfolio. More specifically, we recommend looking for diversifying strategies, improved product design, dynamic asset allocation, and uncorrelated alphas.

Investment themes and opportunities

Theme 1: Continuation of the U.S. business cycle

We have a positive outlook for the U.S. economy in 2025. We expect annual real growth of c. 2.4%, core inflation ending the year at c. 2.5%, and the Federal Reserve to ease policy gradually. This macro environment is typically supportive for areas like equities and corporate credit, and we have a moderately pro-risk outlook through selective asset classes in the U.S. We expect good U.S. earnings growth to drive U.S. equity returns in 2025; in credit, we expect that greater part of the return-potential will be generated from the cash yields on assets.

Theme 2: Divergencies in economies

Advanced economy government bonds offer both outright and relative value opportunities. The major advanced economies are now growing at vastly different speeds, face different inflationary pressures, and will have different government and industrial policies in 2025. This will lead to different responses by central banks in the pace at which they cut interest rates and create opportunities in bonds and currencies.

Theme 3: Japan differentiation

Japan is in a very different economic place to other major economies. Our outlook for Japan in 2025 is for good growth, with wage and inflationary pressures building healthily, and the Bank of Japan tightening monetary policy gradually – a big shift from the last two decades. In our view, opportunities include long Japan equity, long yen, and short Japanese government bonds.

Theme 4: U.S. exceptionalism to continue in 2025

In 2025, we forecast higher economic growth in the U.S., higher outperformance of consensus GDP growth expectations, and higher earnings growth than in other major advanced economies. This environment is typically supportive of positive performance for assets like equities, although it is important to be selective — we favor U.S. small-cap equity as well as larger U.S. companies in 2025.

However, we also believe that U.S. cap-weight equity faces long-term headwinds. The S&P 500 is highly concentrated. Typically, companies have been unable to sustain high rates of profit growth in the long run. This could lead to higher volatility and a return headwind for U.S. cap-weight equity, with the potential value of skilled active management outsized in the long term.

Theme 5: Upside inflation risk and two-sided growth risks

Our baseline U.S. outlook is for good growth and stable inflation. However, this is based on uncertain government policy. Tariffs and fiscal stimulus could increase U.S. inflation. Growth could increase due to stimulus and deregulation or weaken due to tariffs. Tracking global policy outcomes against clear expectations will be key in 2025.

Global economic outlook

United States

2024 was a goldilocks year for the U.S. – rapid growth, productivity, and falling inflation. Labor markets rebalanced to a more normalized level, allowing for Federal Reserve rate cuts. We expect similar conditions in 2025. Household balance sheets are healthy, leaving scope for new borrowing and spending growth. Additionally, we expect supportive fiscal and monetary policy to help underpin annual growth of 2.4%. Inflation is likely to remain above, but sufficiently close to target, allowing the Federal Reserve to cut rates slowly. However, our positive outlook is not without risk. Inflation might be stickier than we expect, while uncertain domestic and trade policy under the new Trump administration could have important impacts on growth and inflation.

Japan

We expect good economic growth in Japan in 2025 and for inflation to remain close to target. Inflation has been above its 2% target over the past two years, underpinned by both wage and moderate economic growth. Corporate governance reforms have been supportive of the equity market and ongoing reforms should support business spending growth. Finally, healthy real growth should allow the Bank of Japan to continue its steady path of interest rate normalization, with interest rates increasing.

Europe

Growth in the Euro area was weak in 2024, which is likely to continue in 2025. Service-oriented economies have shown strength but manufacturing output, especially in Germany, is still below pre-pandemic levels. We anticipate four to five 25 basis point rate cuts from the European Central Bank (ECB) this year – more than other central banks. However, we still expect this to be insufficient to produce a high-growth outcome. For example, we expect government spending policy to become more of a drag on growth, while domestic political and external trade uncertainties are also a constraint on economic performance.

United Kingdom

We expect U.K. growth to accelerate to moderate levels in the first half of 2025, aided by monetary easing and higher government spending following the autumn budget. However, we predict that growth will then fade somewhat in the second half of the year as the positive impact from stimulative government policy begins to slow. As a result, we expect the Bank of England to cut its interest rate by 0.25% each quarter in 2025, both to normalize rates and to offset slowing growth in the second half of 2025.

Canada

Growth in Canada has been much weaker than in the U.S. recently due to slower consumer spending growth and lower productivity. However, growth should pick up in 2025 to around average, with lower interest rates likely to support consumption and investment. Risks to a rebound in growth are from U.S. trade policies and weaker than expected growth in China.

Australia

Australia is the last major economy to enter an interest rate easing cycle. Growth was weak in 2024 but should rebound in 2025, driven by consumption and easier monetary policy. The Reserve Bank of Australia is highly likely to begin cutting its policy interest rate in 2025. However, rate cuts are likely to be less than those in European economies as inflation remains a concern to policy setters.

China

2024 disappointed; in 2025 we expect growth, although uncertainty remains. Economic activity was a little below consensus expectations last year, while inflation remained flat, consistent with weak money supply growth. However, in the second half of the year, there were major policy announcements highlighting a rebalancing of priorities from structural reform towards growth in 2025. Overall, we believe that economic growth in China will remain solid in 2025, although there remains higher uncertainty around economic outcomes compared to the last 10 years.

Long-term portfolio strategy and summary

Understanding history may help us repeat successes, avoid failures, and analyze future trends. This is especially true when today's macro conditions are unusual and big structural changes in the global economy are occurring.

Today we face heightened chances of major policy, geopolitical, innovation, and financial market shifts, which suggests uncertain prospects for simple portfolios. For example, looking at similar historical periods to today, in the 5 to10 years from 1948 a simple portfolio return was very good, from 1968 it was very bad, and from 1994 it was good to average but volatile. In our view, more balanced, flexible portfolios stand a much better chance of meeting investors' goals.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]