- in United Kingdom

- within Antitrust/Competition Law, Real Estate and Construction and Intellectual Property topic(s)

Striving for best practice everywhere is the worst practice of all

How can a private equity (PE) firm stand out from the crowd? Deep pockets won't do it, because when the industry is sitting on more than $2.5 trillion in dry powder, money cannot be a differentiator.

To attract investors and be attractive to potential investments, a firm has to stand out by its performance—that is, by a proven record of superior value creation. In the second article of this series, we identified 57 practices across the PE deal lifecycle that industry leaders say produce superior results—things like building deep industry expertise and transforming portfolio company (portco) finance functions.

But here's the catch: Chasing every best practice might be the worst practice of all. Trying to be best in class everywhere can backfire by ending up costing more, diluting focus, and eroding what makes a firm distinct. The real question isn't how many best practices a firm can adopt. It's which ones align with the firm's strategy, culture, and value proposition.

Start with practices that create leverage across the lifecycle

How should PE firms sort through their options? In our experience, they should begin by looking at practices that make a difference in more than one stage of the deal and fund lifecycle.

We identified eight practices that punch above their weight by delivering impact across diligence, onboarding, transformation, and exit rather than being confined to a single phase. The practices are both operational and foundational. Three of them have to do with how rewards to PE firm partners are structured and communicated; five are directly related to improving firm and portco management and performance.

Strength of belief that leading practices that apply across all phases of the deal lifecycle contribute to superior PE Firm performance

Three themes emerged from these cross-lifecycle practices, and they point to areas in which firms can build real advantage:

- Talent: Our annual PE leadership survey has documented, repeatedly, the fact that leadership is the number one lever for value creation at portcos. Firms that use sophisticated talent search, that perform assessments, and that take advantage of coaching tools get better results. Firms should also apply the same rigor internally—to improve their own leadership and capabilities. Incentives matter, but so does introspection.

- Collaboration: Integrating diverse skill sets is more than a people challenge; it's a strategic one. The firms that win are the ones that connect dots across disciplines. Diligence is a telling example of the benefit of bringing experts in finance, operations, technology, and talent around the same table, but the same integrated approach applies across the cycle—from targeting and diligence to onboarding, operations, and exit.

- Technology: Artificial intelligence (AI) and advanced analytics aren't just buzzwords. They're tools that should be embedded across the value chain—wherever they drive insight and speed. For example, during the first 100 days of ownership, AI and machine learning can produce better and faster service delivery integration, organizational design, and vendor rationalization—the foundation stones of post-merger integration (PMI). And speed matters, too: as we showed in Harvard Business Review, the faster that PMI gets done—particularly in commercial functions—the faster a portco can get to work turning its investment thesis into a reality. That's why the most advanced PE firms are investing in firm-level AI capabilities and instilling them in their portcos.

Starting with those three—talent, collaboration, and technology—can put a PE firm on the path to building a value-creation tool kit in the form of an integrated set of capabilities that facilitate improved returns in portco after portco, fund after fund, time after time.

Identify those practices that establish differentiation and your identity, and then build your culture

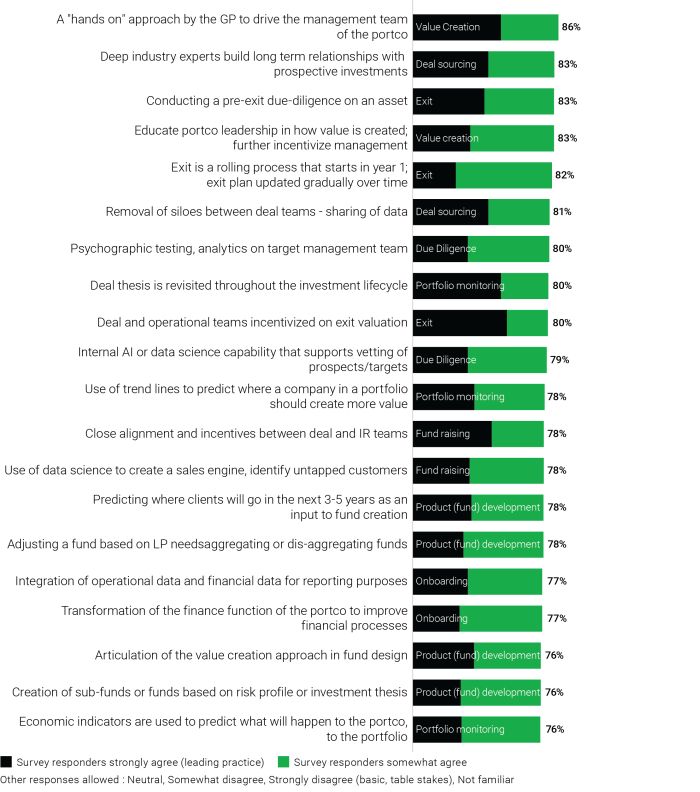

A PE firm's overall strategy and value proposition will determine which practices are most critical and how the practices should be implemented. Twenty of the leading practices we identified were cited by more than 75 of those in our survey sample. But different firms will—and should—choose among those practices according to each firm's value-creation strategy.

Take, for example, the number one leading practice—"a hands-on approach by the GP to drive the management team of the portfolio company," which was cited by 86% of our survey respondents; but it is not one that should be adopted regardless of firm strategy. In our work, we've seen firms at opposite ends of the spectrum. Some are deeply hands-on by being embedded in operations, shaping decisions, and driving outcomes. Others are intentionally hands-off, setting targets, installing leadership, and monitoring from a distance. Both approaches can work. But each requires a different set of practices, expectations, and internal capabilities. A hands-off firm can succeed if it is brilliant at discovering targets, performing due diligence, and finding great managers into whose hands to put the job of running a portco. A hands-on firm can fail if it meddles and micromanages.

Not surprisingly, AI came up within best practices at many stages of the life cycle for both value creation at a portco and internal use at the general partner (GP). All PE firms we work with are still trying to figure out the best way to deploy AI technologies for value creation at portcos and also within the GP itself. The AI technologies and the best practices around them are influencing differentiation, identity, and culture.

However, "implement all the AI best practices" cannot be a strategy alone. The deployment of AI is a good example—one we'll discuss more about in a future article. If a PE firm's identity and culture are hands-on, then the firm itself will play a key role in orchestrating where and how AI gets deployed across the firm's investments—but less so if it takes a hands-off approach. Similarly, an industry-focused firm will want to develop AI practices that add the most value, which will be different for, say, healthcare versus retail.

The goal isn't to adopt every practice; it's to zero in on the ones that actually move the needle for your firm. The top 20 offer a starting point, but the real work lies in figuring out where you have to raise your game to deliver real impact.

The top 20 leading practices from all phases of the deal lifecycle

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.