The economic slowdown and uncertainty in 2013 and 2014 had a negative effect on the global insurance sector. As a result, the total global premium volume increased at a rate of only 1.4% to USD 4,641 billion in 2013.1 Contrary to the general slowdown in the global insurance sector, the Turkish insurance sector is still in a steady growth and is offering opportunities to foreign investors.

According to the Undersecretariat of Treasury (the "Treasury"), the Turkish insurance and individual pension markets achieved a significant growth, with a TRY 24.2 billion (EUR 8.5 billion) gross premium volume through an increase of 21.8% in 2013.2 Life insurance premiums increased by 18.1%, while non-life insurance premiums increased by 14.5% in real terms. Insurance and pension companies issued in total 67,013,959 policies in 2013. The number of total valid policies issued in 2013 increased by 11.43%, thanks to a remarkable increase in the number of new policies issued in the life branch.

Three-quarters of Turkish insurance companies are now either foreign-owned or partnered. This shows that the Turkish insurance sector is a profitable target for investment by foreign companies. In 2013, German insurance company Allianz acquired Turkish insurance company Yapı Kredi Sigorta for TRY 1.6 billion (approximately USD 743 million). This was one of the most sizeable international transactions in Turkey's insurance sector in recent years. Also in 2013, the Malaysian sovereign wealth fund took over Acıbadem Sigorta for approximately USD 250 million.

I. Insurance Companies in Turkey

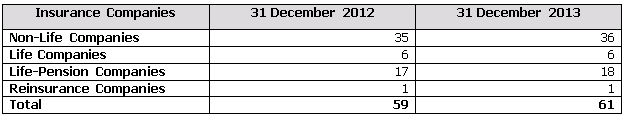

As of the end of 2013, there were 61 active insurance, pension and reinsurance companies operating in Turkey. Below is a breakdown of these companies3.

II. Competent Governing Authorities

The supervisory and regulatory authority for the insurance sector in Turkey is the Treasury. Certain transactions of insurance companies are subject to the Treasury's approval (e.g. mergers and acquisitions, portfolio transfers or share transfers).

All insurance and reinsurance companies must apply to the Treasury to obtain an operating license for each insurance product they would like to introduce, within one year following their establishment. Insurance companies can operate either in life insurance (and pension) or non-life insurance branches, while reinsurance companies are not subject to this restriction. Reinsurance companies can operate in both life and non-life insurance branches. A foreign insurer that does not hold a license as an insurance company cannot underwrite/sell insurance policies.

The Insurance Association of Turkey (Türkiye Sigorta, Reasürans ve Emeklilik Şirketleri Birliği) is a specialist, non-governmental institution established by law. All local and foreign insurance, reinsurance and pension companies operating in Turkey must be a member of this association. The main objective of the Insurance Association of Turkey is to conduct all research, training and all activities concerning the operating of insurance and pension activities and to coordinate insurers, as a neutral and reliable authority.4

III. Insurance Legislation

The primary piece of legislation governing the insurance sector is the Insurance Law.5 The Insurance Law entered into force in 2007 together with its secondary legislation and brought significant changes to the insurance sector. The Insurance Law governs, among others, the establishment, management, operations, supervision and audit of insurance/reinsurance companies, agencies and brokers operating in Turkey. In addition to the Insurance Law, the Turkish Commercial Code6 (the "TCC") also provides further insurance provisions.

A new legislation regarding a 25% state contribution as an incentive to encourage savings in private pensions, entered into force on 1 January 2013.7 This incentive generated a significant expansion in the pensions sector. This resulted in a major opportunity for insurers. In 2013, the number of participants in private pensions increased by 33% and reached approximately 4.2 million8.

The first half of 2014 was very productive for the insurance sector. Several new regulations were introduced and some important regulations were amended.

(i) Insurance Agencies Regulation9

The new Insurance Agencies Regulation replaced the former regulation in April 2014. The aim of the new Regulation is to clarify insurance agency activities and to provide protective provisions for both parties of insurance agency relations, by way of institutionalising agency systems based on essential principles. Following the enactment of the new Regulation, Circular No. 2014/8 on Implementation of the Insurance Agencies Regulation dated 22 May 2014 was also issued by the Treasury, to regulate the implementation rules. The main novelties brought by the new Regulation and the Circular are as follows:

- Before the enactment of the Regulation leasing, factoring and financing companies were allowed to operate as insurance agencies. Following the enactment, these companies are now required to incorporate a separate company to provide insurance agency services. Active leasing, factoring and financing companies providing insurance agency services must comply with this requirement until 30 April 2015.

- The minimum paid-in capital requirement for the incorporation of an insurance agency was increased to TRY 50,000 (this criteria is not applicable to active insurance companies). If an insurance agent will provide its agency services through branch offices, the minimum capital requirement is TRY 300,000, together with a minimum capital requirement of TRY 25,000 for each branch office. Furthermore, at least 50% of the paid-in capital must consist of cash or cash convertible investment instruments.

- Similar with the former regulation, "technical personnel" must fulfil certain criteria, as a novelty. The technical personnel must attend training programs organized by the Insurance Education Center (SEGEM) and obtain a license, following the courses.

- Agency agreements must include certain mandatory provisions (e.g. identification of parties, term, renewal and termination clauses).

The Regulation sets forth an adaptation period of six months for active insurance agencies. However, this period was then found insufficient and for this reason, criticised by market players. This period was extended to 30 April 2015 for certain provisions (e.g. provisions regarding financial lease and financing companies, agency agreements, technical personnel, branch offices).

(ii) Regulation on Activities to be Considered as Insurance Activities, Insurance Policies Concluded in Favour of Customers and Distance Sale of Insurance Policies (the "Regulation on Insurance Activities")10

>

The Regulation on Insurance Activities entered into force to clarify the definitions and rules for (i) the scope of insurance activities; (ii) insurance policies concluded in favour of a customer; and (iii) distance sale of insurance policies. The main novelties brought by the Regulation on Insurance Agencies are as follows:

- Insurance companies are not allowed to conduct any activities other than insurance or insurance related activities. Service agreements and subscription agreements cannot be considered as insurance agreements.

- If a policy is concluded in favour of a customer (as beneficiary), the insurer must provide a copy of the insurance policy to the customer.

- In addition to the Turkish Consumer Protection Law, which was recently enacted11, the Regulation on Insurance Activities also regulates insurance companies' obligations with respect to the organisation and technical infrastructure required for distance sale of insurance policies. It requires online notification and delivery of the insurance policy (submission of a policy in an electronic manner is permissible) in compliance with the respective provisions of the TCC.

IV. Conclusion

As an emerging market, the Turkish insurance sector is offering many opportunities to foreign investors. Particularly in recent years under the influence of new market players, the number of insurance companies and total gross premium volume have rapidly increased. We expect to see more foreign investors attracted by the Turkish insurance market with the implementation of the secondary legislation.

Footnotes

1 Sigma Report No.3/2014, World Insurance in 2013: steering towards recovery.

2 Annual Report on Insurance and Individual Pension Activities – 2013, issued by Undersecretariat of Treasury, Insurance Supervision Board.

3 Market Analysis Report – 2013, issued by Undersecretariat of Treasury, Insurance Supervision Board.

4. http://www.tsb.org.tr/about-us.aspx?pageID=919.

5 Law No. 5684, Published in the Official Gazette dated 14 June 2007, and numbered 26552.

6 Law No. 6102, Published in the Official Gazette dated 14 February 2011, and numbered 27846.

7 Law Amending on the Law on Individual Pension Savings and Investment Systems, Published in the Official Gazette dated 29 June 2012, and numbered 28338.

8 Annual Report on Insurance and Individual Pension Activities – 2013, issued by Undersecretariat of Treasury, Insurance Supervision Board.

9 Published in the Official Gazette dated 22 April 2014, and numbered 28980.

10 Published in the Official Gazette dated 25 April 2014, and numbered 28982.

11 Law No. 6502, Published in the Official Gazette dated 28 November 2013, and numbered 28835.

© Kolcuoğlu Demirkan Koçaklı Attorneys at Law 2015

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.