- within Antitrust/Competition Law topic(s)

- with readers working within the Transport industries

- within Antitrust/Competition Law, Energy and Natural Resources, Food, Drugs, Healthcare and Life Sciences topic(s)

-

Introduction

The settlement mechanism has been introduced to the Turkish competition law practice by the Law No. 7246 Amending the Law No. 4054 on the Protection of Competition, which was entered into force on 24 June 2020. Upon the introduction of the settlement mechanism within the scope of the Law No. 4054 on the Protection of Competition ("Law No. 4054"), the secondary legislation of the settlement mechanism entitled "Regulation on the Settlement Procedure Applicable in Investigations on Agreements, Concerted Practices, and Decisions Restricting Competition and Abuses of Dominant Position" ("Settlement Regulation") was entered into force on July 15, 2021.

Settlement mechanism provides the undertakings with the possibility of receiving a discount at a rate between 10% - 25% over the administrative monetary fine to be imposed on the undertakings. However, as discussed further below, settling with the Turkish Competition Authority ("Authority") may also have certain disadvantages for the settling undertaking. As such, the undertakings need to weight the advantages against disadvantages case-by-case to decide whether it is in their benefit to settle.

This article aims to summarize the application of the settlement practice of the Authority so far, by providing a complete list of the precedents of the Board until the date of this article, along with brief summaries of some of the most notable ones. Further, this article statistically analyses the precedents by considering the frequency of settlement applications in the concluded investigations, discounts rates applied, types and lengths of violations and the corelation between discount rate and the timing of the submission of the settlement request. Lastly, this article will evaluate the advantages and disadvantages of the settlement mechanism for the undertakings.

-

Overview of the settlement mechanism.

According to Article 4(1) of the Settlement Regulation, the settlement mechanism can only be used during an on-going investigation. In other words, the parties to a preliminary investigation do not have the right to apply to the settlement mechanism. As such, the Turkish Competition Board ("Board") may initiate the settlement procedure during an on-going investigation until the official service of the investigation report, either ex officio or upon request of the investigation parties.

The undertakings wishing to settle with the Board are required to submit a written request, a letter of intent, to the Authority until the official service of the investigation report.1 The Board may accept (and invite the undertaking to the settlement negotiations) or refuse this request, or it may decide to invite ex officio the other undertakings to the settlement negotiations.

To decide whether or not to initiate the settlement procedure, the Board takes into account the potential procedural benefits arising from the rapid conclusion of the given investigation process and the scope of the alleged violation.

After submitting the letter of intent, Settlement Regulation does not envisage a fixed period for the Board to respond (i.e., accept or refuse) to the request under the Settlement Regulation and the response time of the Board varies from case to case.2

-

A brief summary of some of the notable settlement decisions.

After the introduction of the settlement procedure, starting with its first ever settlement decision Philips/Dünya/Melisa/Nit-Set/GİPA decision,3 the Board decided to end a total of 16 full-fledged investigation against a total of 33 undertakings/persons with a total of 17 decisions.4 The list of the full-fledged investigations the Board concluded with the settlement is as follow:

- Philips/Dünya/Melisa/Nit-Set/GİPA decision5

- Arnica decision6

- Singer decision7

- Kınık and Beypazarı decisions8

- Olka/Marlin decision9

- Numil Gıda decision10

- DyDo Drinco decision11

- Hayırlı El Kozmetik decision12

- Korkmaz/Gençler/Punto decision13

- Miele decision14

- Natura decision15

- Aslan Ticaret decision16

- Hiksan decision17

- Panek decision18

- NAOS decision19

- Electrical Engineers decision20

The first implementation of the settlement procedure is found in the Board's Philips/Dünya/Melisa/Nit-Set/GİPA decision.21 During the settlement negotiations, Türk Philips Ticaret A.Ş and Melisa Elektrikli ve Elektronik Ev Eşyaları Bilg. Don. İnş. San. Tic. A.Ş. being the first two undertakings that applied for settlement, argued that settlement application itself should be considered as a mitigating factor under Article 7(3) of the Regulation on Fines to Apply in Cases of Agreements, Concerted Practices and Decisions Limiting Competition, and Abuse of Dominant Position ("Regulation on Fines"). Accordingly, the Board decided that due to the already given 25% discount for the settlement, if the Board also applies a discount for active cooperation or admittance of the violation, it will result in two discounts applied for the same element. Therefore, the Board concluded that there was no mitigating factor to be applied to the administrative monetary fine within the framework of the Article 7(3) of the Regulation on Fines, where the undertakings already receive a discount stemming from the settlement.

However, the Board's Kınık and Beypazarı decisions22 demonstrate that dual discounts can be given to the undertakings under the Regulation on Active Cooperation for Detecting Cartels ("Leniency Regulation") and Settlement Regulation. Under Article 10 of the Settlement Regulation, an undertaking can benefit from Leniency Regulation, if the leniency application was submitted to the Authority before the settlement negotiations are finalized and the settlement text is also submitted. Accordingly, the Board applied a 35% discount for leniency and 25% discount for settlement to Kınık Maden Suları A.Ş and a 30% discount for leniency and 25% discount for settlement to Beypazarı İçecek Pazarlama Dağıtım Ambalaj Turizm Petrol İnşaat Sanayi ve Ticaret A.Ş.

In the Board's recent Hiksan decision, upon the Board's interim decision dated December 12, 2022, Hiksan Teknoloji Sanayi ve Ticaret Ltd. Şti. ("Hiksan") submitted two settlement texts to the Authority, first one on December 16, 2022, and the second one on December 20, 2022. Even though the reasoned decision is not published yet, it can be assumed that there was a missing matter in the first settlement text and the Board notified Hiksan to submit a second settlement text within 7 days in accordance with Article 8(3) of the Settlement Regulation.

In the recently published Olka/Marlin decision,23 three of the members of the Board disagreed with the remaining members of the Board, in terms of determining the amount of the fine to be imposed on the undertakings. According to the dissenting opinions, following the conclusion of the settlement negotiations and the report of the case handlers, the Board unanimously rendered its interim settlement decisions including the maximum and minimum rate of the administrative monetary fine to be imposed between 1.5% and 3% and the rate of the administrative monetary fines to be imposed on the undertakings. Following that, Olka Spor Malzemeleri Ticaret A.Ş. ("Olka") and Marlin Spor Malzemeleri Ticaret A.Ş. ("Marlin"), which were the investigated parties, submitted their settlement text accepting all the elements in the interim settlement decision including the maximum and minimum rates and amounts of the administrative fines that the Board was to impose, but also requesting the Board (i) to lower the rate of the administrative monetary fines to be imposed and (ii) to determine the rate as 0.5% which is the minimum rate that is possible for the violation concerned, on allegedly abstract grounds. Accordingly, the Board lowered the rate of the administrative monetary fines to be imposed for both Olka and Marlin in its settlement decision. Thus, the dissenting opinions put forward that since Article 7(4) of the Settlement Regulation clearly states that the matters included in the interim settlement decision cannot be made subject to further negotiations by the settlement parties, lowering the rate is against the relevant provisions of the Settlement Regulation and the purposes of the settlement mechanism.

There has been only one investigation, where the Board rejected the settlement application of an undertaking. The concerned full-fledged investigation was against 8 healthcare organisations. Among them, Medicana Samsun Özel Sağlık Hizmetleri A.Ş. ("Medicana Samsun") requested to initiate settlement mechanism on June 22, 2021. However, the Board rejected Medicana Samsun's request on two grounds:

- Settlement mechanism aims at procedural economy and since there

was only less than a month until finalization of the investigation

report by the case handlers, settlement application could not

reveal the procedural benefits envisaged by the settlement

mechanism; and

- Since there were seven other healthcare organizations that did

not apply for settlement.

-

A numerical work on settlement decisions.

|

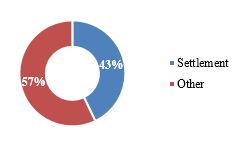

According to the Board's Decision Statistics, the Board concluded 28 investigations in total in 2022.24 Accordingly, the Board ended 12 of the investigations conducted in 2022 with settlement which is equal to the approx. 42.86% of all the concluded investigations. |

|

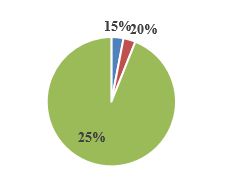

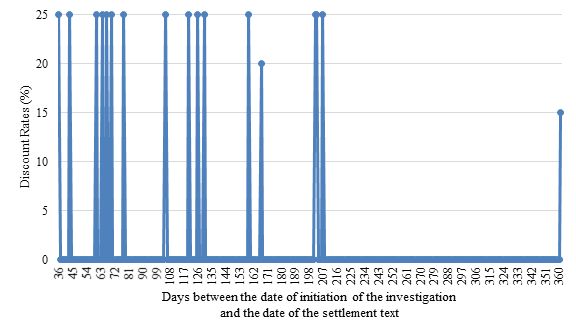

When the discount rates are analysed, the Board applied a discount rate to the undertakings between 25%, which is the possible maximum rate, and 15%.25 The Board applied a 25% discount to 31 undertakings/persons, %20 to one undertaking and 10% to one undertaking. |

|

|

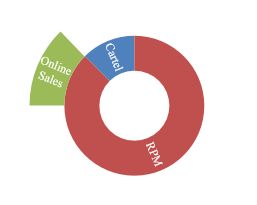

In a total of 16 full-fledged investigations, 12 of them concerned solely resale price maintenance ("RPM") violations, and two of them26 concerned both RPM and prohibition of sales through e-commerce platforms. The remaining investigations concerned cartel violations. 27 |

|

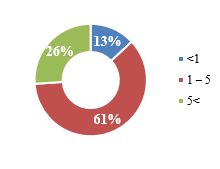

Out of 23 settled undertakings28, 3 undertakings' violations lasted less than 1 year; 14 undertakings' violations lasted between 1 – 5 years; and 6 undertakings' violations lasted longer than 5 years. |

|

When the discount rates imposed on the undertakings are analysed,

the Board applied a discount rate to the undertakings between 15%

and 25%. Further, the Board applied a 25% discount to 31

undertakings/persons, 20% to one undertaking and 15% to one

undertaking with an average of approx. 24.55% discount rate per

decision. The average rate of discount being so close to the

possible maximum amount could be caused by the Authority aiming to

encourage the undertakings to initiate settlement, which is still a

relatively new procedure under Turkish competition law. However,

since the last year (i.e., 2022) the Board ended 12 of the

investigations with settlement which is equal to approx. 43% of all

the concluded investigations in 2022, the Board may gradually lose

its incentive to apply higher rates in the upcoming years.

Regarding average timing for undertakings to submit their settlement texts, when 33 undertakings' timelines are assessed, the undertakings submitted their settlement texts to the Authority on an average of approx. 121 days from the initiation of the investigation.

As can be seen above, the Board applied the highest rate possible to almost all of the undertakings with two exceptions. Considering the benefits of the settlement for the Authority in terms of procedural economy, including a quicker conclusion of the investigation at a much less cost with less resources spent, from the limited number of decisions, the Board appears to give consideration to at what stage of the investigation the undertaking requested settle. In any case, even if the application is made in a very mature state of the investigation, the Board also appears to consider that the settlements would still result in procedural benefits envisaged by the settlement mechanism.

On that front, in its DyDo Drinco decision,29 the Board applied a 20% discount to DyDo Drinco Turkey İçecek Satış ve Pazarlama A.Ş. that submitted its settlement text after 167 days from the initiation of the investigation. Even though the Board applied 25% discount in its Philips/Dünya/Melisa/Nit-Set/GİPA, Arnica and Singer decisions,30 where the undertakings submitted their settlement text 202 to 207 days after initiation of the investigation, these three decisions were the first three investigations that the Board ended with settlement. Therefore, the reason for applying the highest discount rate possible despite the relatively late application could be the fact that the settlement procedure was quite new at that time, and the Authority was may then still be encouraging the investigated undertakings to settle by applying higher discount rates.

In Hiksan decision,31 which was one of the most recent settlement decisions, Hiksan submitted its first settlement text to the Authority just in 36 days after the Board has initiated. This appears to be the fastest settlement application so far.32 Similarly, in Electrical Engineers decision,33 another recent decision, the undertakings/persons submitted their settlement texts after 64 and 67 days, respectively, which are almost half of the average timing (i.e., approx. 121 days).

-

Pros and cons of settlement

The most apparent advantage of a settlement is receiving a discount in the administrative monetary fine calculated based on the annual gross revenues generated by the undertaking, at a rate between 10% - 25%. Since settling with the Authority will conclude the investigation of the Board, the undertaking will have a legal certainty at an earlier stage. Lastly, from a pragmatic point of view, the longer the investigation lasts, the more costs would be incurred by the undertaking.

Opposed to the advantages given above, settlement also comes with a few disadvantages that should be also evaluated while deciding on whether to initiate settlement with the Authority. First of all, settlement mechanism requires the acceptance of the alleged infringements by the undertaking. As a result, if an undertaking settles its case with the Authority, that undertaking will not be able to seek judicial review of the final settlement decision of the Board. As such, even if there is another undertaking being investigated in the scope of the same investigation, and that other undertaking manages to successfully overturn the decision through judicial review of the decision, the settling party would not be able to benefit from that successful appeal.

Additionally, the third parties that suffered damages as a result of the established violation could initiate private enforcement actions against the settling undertaking for compensation and use the settlement decision as a decisive evidence in their private damages claim, which could be up to three times the amount of the actual damage suffered, according to the Law No. 4054. The precedents of the High Court of Appeals shows that, the courts must wait for the finalization of the Board's decision before rendering a decision on the merits of the case.34 Accordingly while the appeal process is on-going, any claim against the undertaking will not be taken up by the courts and an appeal all the way up to the High State Court may take up to 5 years. Conversely, once the undertaking settles, the decision will be final (i.e., no longer appealable) and therefore, the courts can immediately delve into the merits of a potential private action for damages claim before waiting for the judicial finalization of the Board's decision.

-

Conclusion

As discussed above, settling with the Authority may have certain advantages and also disadvantages for the settling undertaking. Therefore, the undertakings need to weight the advantages against disadvantages case-by-case to decide whether it is in their benefit to settle. It is not clear at this stage what the Board exactly takes into account in determining the rate of the discount. Nevertheless, it is likely that that the type of the violation, the stage of the investigation, the evidence that the Board has against the undertaking and therefore, the efficiency gains that may arise from settlement are taken into account.

Footnotes

1. The case handlers are required to finalize the investigation report within six months upon the initiation of the investigation, if not extended. This six-month period can be extended for up to six months for one time only.

2. See e.g. Singer (30.09.2021, 21-46/672-336), in 7 days, Philips/Dünya/Melisa/Nit-Set/GİPA (5.08.2021, 21-37/524-258) in 10 to 14 days, Arnica (30.09.2021, 21-46/672-335) 14 days in, Numil Gıda (30.06.2022, 22-29/483-192) in 17 days, Beypazarı (18.05.2022, 22-23/379-158) in 21 days.

3. Philips/Dünya/Melisa/Nit-Set/GİPA (5.08.2021, 21-37/524-258).

4. Philips/Dünya/Melisa/Nit-Set/GİPA (5.08.2021, 21-37/524-258), Arnica (30.09.2021, 21-46/672-335), Singer (30.09.2021, 21-46/672-336), Kınık (14.04.2022, 22-17/283-128), Beypazarı (18.05.2022, 22-23/379-158), Olka/Marlin (30.06.2022, 22-29/488-197), Numil Gıda (30.06.2022, 22-29/483-192), DyDo Drinco (7.07.2022, 22-32/508-205), Hayırlı El (21.07.2022, 22-33/523-210), Korkmaz/Gençler/Punto (22-51/754-313, 30.06.2022), Miele (10.11.2022, 22-51/753-312), Natura (23.11.2022, 22-52/771-317), Aslan Ticaret (8.12.2022, 22-54/834-344), Hiksan (22.12.2022, 22-56/882-365), Panek (29.12.2022, 22-57/899-369), NAOS (12.01.2023, 23-03/29-12), Electrical Engineers (5.01.2023, 23-01/25-11).

5. Philips/Dünya/Melisa/Nit-Set/GİPA (5.08.2021, 21-37/524-258).

6. Arnica (30.09.2021, 21-46/672-335).

7. Singer (30.09.2021, 21-46/672-336).

8. Kınık (14.04.2022, 22-17/283-128), Beypazarı (18.05.2022, 22-23/379-158).

9. Olka/Marlin (30.06.2022, 22-29/488-197).

10. Numil Gıda (30.06.2022, 22-29/483-192).

11. DyDo Drinco (7.07.2022, 22-32/508-205).

12. Hayırlı El Kozmetik (21.07.2022, 22-33/523-210).

13. Korkmaz/Gençler/Punto (22-51/754-313, 30.06.2022).

14. Miele (10.11.2022, 22-51/753-312).

15. Natura (23.11.2022, 22-52/771-317).

16. Aslan Ticaret (8.12.2022, 22-54/834-344).

17. Hiksan (22.12.2022, 22-56/882-365).

18. Panek (29.12.2022, 22-57/899-369).

19. NAOS (12.01.2023 23-03/29-12).

20. Electrical Engineers (5.01.2023, 23-01/25-11).

21. Philips/Dünya/Melisa/Nit-Set/GİPA (5.08.2021, 21-37/524-258).

22. Kınık (14.04.2022, 22-17/283-128), Beypazarı (18.05.2022, 22-23/379-158).

23. Olka/Marlin (30.06.2022, 22-29/488-197).

24. Excluding the investigation against Fatih Römorkörcülük ve Denizcilik Hizmetleri A.Ş. and Atlantik Gemi İşletmeciliği A.Ş, as the investigation is still on-going for these undertakings.

25. This discount rate cannot be less than 10% and the upper limit is 25%.

26. Olka/Marlin (30.06.2022, 22-29/488-197), Aslan Ticaret (8.12.2022, 22-54/834-344).

27. Kınık (14.04.2022, 22-17/283-128), Beypazarı (18.05.2022, 22-23/379-158), Electrical Engineers (5.01.2023, 23-01/25-11).

28. The Board's Electrical Engineers decision (5.01.2023, 23-01/25-11) is not included in scope of this statistic since the duration of the violation was not stated in the related announcement.

29. DyDo Drinco (7.07.2022, 22-32/508-205)

30. Philips/Dünya/Melisa/Nit-Set/GİPA (5.08.2021, 21-37/524-258), Arnica (30.09.2021, 21-46/672-335), Singer (30.09.2021, 21-46/672-336).

31. Hiksan (22.12.2022, 22-56/882-365)

32. Hiksan submitted two settlement texts to the Authority, first one on December 16, 2022, and second one on December 20, 2022.

33. Electrical Engineers (5.01.2023, 23-01/25-11)

34. 11th Civil Chamber of the High Court of Appeals (5 October 2009, E. 2008/5575, K. 2009/10045); 11th Civil Chamber of the High Court of Appeals (23 June 2006, E. 2005/3755, K. 2006/7408).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.