- within Media, Telecoms, IT and Entertainment topic(s)

- in European Union

- in European Union

The telecom sector continues to find shareholder value creation a major challenge, globally. Prohibitive spectrum prices; high levels of capital expenditure and monetization risks; shrinking sources of differentiation; and a lack of solid growth drivers are all making telco investors wary. Even the utilities sector—often referred to in the telecom industry as a "dump pipe" sector—has significantly outperformed telcos. Over a 5-year horizon, the global utilities sector has delivered an average share price increase of 18.4% vs. 4.2% for the telecom sector. Telcos are under pressure to keep up above average dividends—even as they borrow to fund infrastructure deployment.

Even here, in Asia Pacific (APAC), where the industry enjoyed tremendous growth from 2000-2020, telco performance is very mixed. Leveraging our Telco Compass platform, we analyzed the value creation at 25 telcos across both developing and mature markets. Only 10 of the 25 telcos had a higher ROIC (return on invested capital) than their WACC (weighted average cost of capital) over the last three years. Clearly, telcos are struggling to deliver more returns for shareholders than their borrowing costs.

In that context, a focus on data from the Malaysian telecoms market reveals more about these dynamics:

- Over the last two years, the total telecom consumer market size in Malaysia has been flat, but the market is expected to grow at a 2.4% compound annual growth rate (CAGR) through the 2029 financial year (Source: GlobalData)

- Mobile broadband stands at 50% of the consumer telecom market and is expected to grow at 4.1% CAGR over the next 5 years vs. 4.9% average for APAC

- Fixed broadband is currently 20% of the consumer telecom market and is expected to grow at 3.6% CAGR vs. 4.4% APAC average

- Mobile penetration is already higher in Malaysia, at 147% compared to the regional average of 120%. That means telcos have been winning customers from each other to drive their subscriber growth. Fixed penetration is at 44% and is heading towards saturation in the Tier 1 markets, where customers are starting to see parallel fiber infrastructure (FTTx)

- Mobile average revenue per unit (ARPU) has been flat over the last two years at $5.1 (despite 5G roll out to consumers) but the expectation is that it will grow at ~3.5% CAGR over the next 5 years. ARPU growth is expected to come from higher data usage and from porting pre-paid subscribers to post-paid plans. However, this ARPU increase is barely sufficient to cover rising costs. Wage inflation in Malaysia was at 2.9% in 2024 and the electricity tariff is expected to increase by 14.2% in July 2025

This data from Malaysia reveals the significant challenges facing the country's telecom sector as companies search for growth. The advent of eSIM is only expected to make subscriber churn higher.

Furthermore, as shown in the table below, Malaysia has more infrastructure-based telecom companies (infracos) vs. other markets relative to the size of market.

Source: Statista , Twimbit and GlobalData

With the dual 5G wholesale network being developed by UMobile, the infrastructure invested in the market is only going to increase and the returns on infrastructure at country level will be lower. The implications of a higher level of investment in infrastructure—even as 5G use cases haven't materialized—are manifold:

- Customers will ultimately pay the higher cost as investors seek market/risk adjusted returns for the infrastructure investments

- Duplicate builds/investments use precious forex

- With uncoordinated builds and excess capacity availability, there is a risk of a downward price spiral increasing the risk of bankruptcies and a fire sale of assets

- Short-term pull back will risk long-term investment in innovation and other infrastructure builds

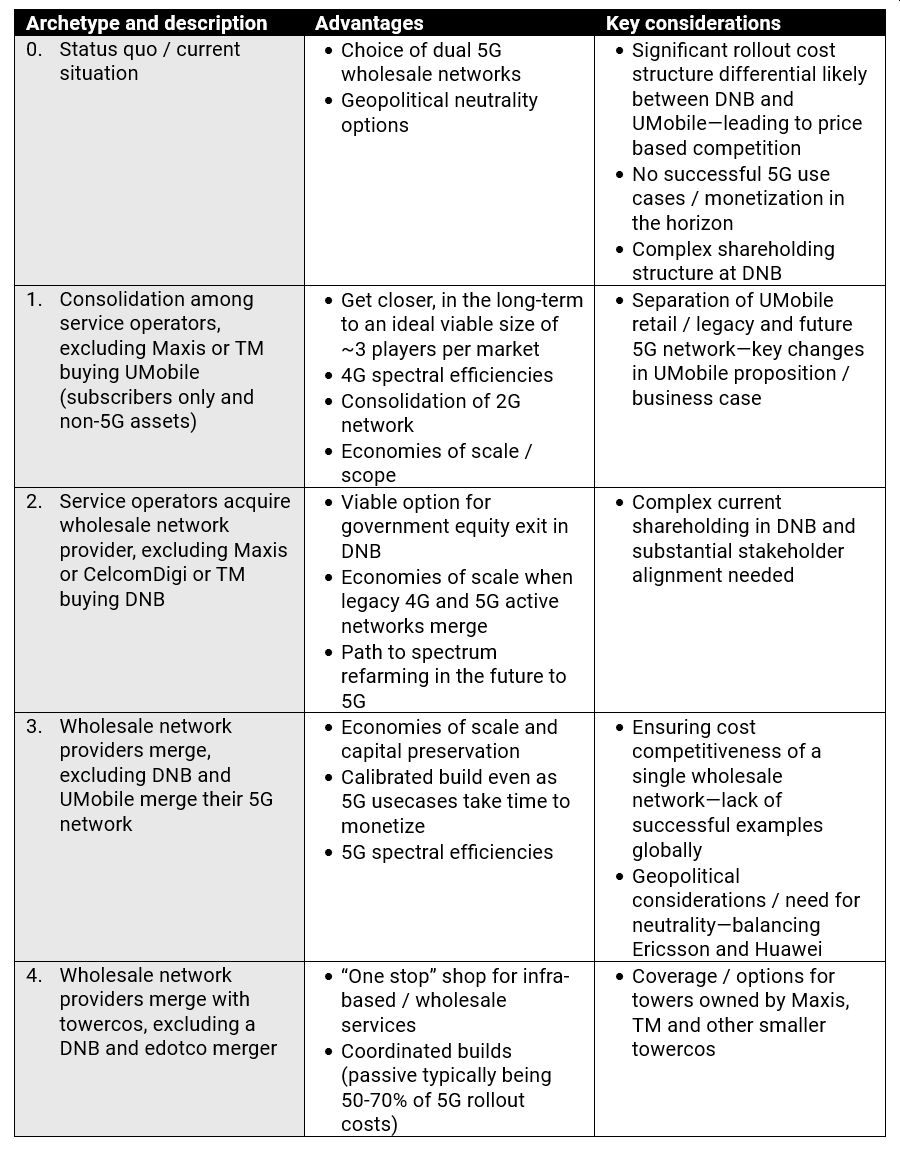

We see a clear case for further consolidation in the market among infrastructure providers. This consolidation could play out across a few archetypes:

- Further consolidation among service operators with infrastructure (beyond the the recent merger at Celcom Digi)

- Service operators acquire wholesale network providers

- Wholesale network providers merge

- Wholesale network providers merge with towercos

Below we've set out the advantages and key considerations for each of these possible archetypes from a market standpoint rather than an individual operator standpoint. This outline analysis also doesn't take into account any possible anti-trust or competitive intensity implications.

It is imperative that the economics and health of the Malaysian telecom industry are at the center of the debate about its future development. The current landscape is complex, unviable and creates uncertainty for future investment. This calls for broader consultations by the Malaysian Communications and Multimedia Commission (MCMC) exploring the future structure of the industry.

Telecommunication is a vital public utility which governments around the world should shield from destructive boom and bust cycles.

Unchecked capacity growth and cutthroat competition have recently left a trail of bankruptcies and market chaos in the airline and semiconductor manufacturing industries. The warning signs for telecoms are clear—with potentially greater impacts from similar market disorder. With the rapid pace of technology change, time is of the essence: the current infrastructure assets run the risk of impairment and need to be monetized urgently.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.