Tax authorities could be

pushing the boundaries of legality as they seek to increase the

revenue they collect, say lawyers – meanwhile, the risk of

being held liable for facilitating tax evasion could mean some law

firms consider scrapping their tax practices

Tax authorities could be

pushing the boundaries of legality as they seek to increase the

revenue they collect, say lawyers – meanwhile, the risk of

being held liable for facilitating tax evasion could mean some law

firms consider scrapping their tax practices

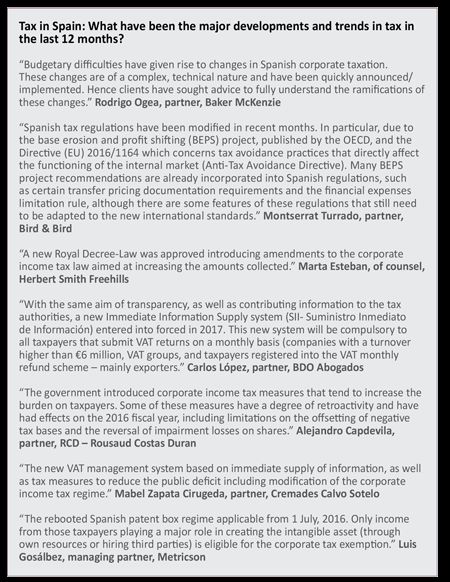

Given that the Spanish and Portuguese governments are looking to

raise more money for the public purse, the respective nations'

tax authorities are being set even higher targets in terms of the

amount of cash they need to collect. Consequently, lawyers claim,

corporate taxpayers are being increasingly squeezed by the taxman,

to the extent that, in the view of some, they may even be going

beyond what is legally permitted. As a result, tax demands are

increasingly being disputed with the result that litigation is on

the rise. While this means more instructions related to contentious

matters, there are other forces at work that mean there is also

considerable cause for concern among tax lawyers. There is a fear

that the tax advice provided by law firms to their clients could

potentially be viewed, in some quarters, as facilitating tax

evasion. If the relevant authorities were to take a dim view of

such practices, there is the chance that law firms could be held

liable, with the result that they could suffer severe financial and

reputational damage. In this context, some lawyers suggest that law

firms could cease investing in their tax departments because of the

potential liabilities or even go as far as to scrap them

altogether.

More aggressive

The Spanish tax authorities are adopting an increasingly aggressive

position, particularly in relation to their efforts to tax

businesses on profits obtained abroad, says Juan Alberto

Urrengoechea, partner at Roca Junyent. He adds that transfer

pricing issues and an increase in tax litigation are also

generating an increase in work for lawyers. Meanwhile, providing

tax-related advice on cross-border deals is becoming increasingly

challenging for lawyers, according to Latham & Watkins partner

Jordi Domínguez, as it is difficult to make an assessment on

the "practical implications of BEPS [base erosion and profit

sharing] and the extent of the changes that will derive from the

implementation of the multilateral instrument to modify bilateral

tax treaties".

The fact that some countries are taking measures to attract

investment by reducing tax rates is creating opportunities for

lawyers, according to Javier Gónzalez Carcedo, partner at

PwC Tax and Legal Services, who adds that tax transparency –

in relation to the Organisation for Economic Co-operation and

Development's BEPS initiative - is also providing considerable

work for law firms. The fact that it is difficult to predict the

outcome of inspections carried out by the tax authorities is a

significant challenge for lawyers when advising clients, according

to Ashurst partner Eduardo Gracia. He adds that the authorities are

becoming more aggressive because the "goals they are set are

more difficult to achieve in terms of collections". Gracia

also says that there is considerably more tax litigation taking

place, to the extent that the courts are overcrowded.

Andrés

Sánchez, partner at Cuatrecasas, Gonçalves Pereira,

says the outcome of recent cases means there is more certainty

about what to expect in terms of court rulings. "The courts

are becoming more pro-taxpayer, so there are some reasons for

hope," he adds. A key concern is "soft law" –

mainly derived from the BEPs recommendations – and its

application by the tax authorities and courts, according to

Víctor Viana, partner at Uría Menéndez.

"There is no clear picture in the current tax environment and

this shapes our relationship with the authorities and

clients," he says. "The changing, and more restrictive,

rules and criteria may result in growing tension regarding the

lawyer's role and relationship vis-à-vis clients and tax

authorities."

Andrés

Sánchez, partner at Cuatrecasas, Gonçalves Pereira,

says the outcome of recent cases means there is more certainty

about what to expect in terms of court rulings. "The courts

are becoming more pro-taxpayer, so there are some reasons for

hope," he adds. A key concern is "soft law" –

mainly derived from the BEPs recommendations – and its

application by the tax authorities and courts, according to

Víctor Viana, partner at Uría Menéndez.

"There is no clear picture in the current tax environment and

this shapes our relationship with the authorities and

clients," he says. "The changing, and more restrictive,

rules and criteria may result in growing tension regarding the

lawyer's role and relationship vis-à-vis clients and tax

authorities."

Many transactions involving companies need to be reported to the

board so in-house lawyers are "no longer willing to accept

vague advice", says Francisco Martín Barrios, partner

at Deloitte Abogados. "Multinationals are now reacting to

BEPS, there was more activity in this area in 2016 and it will

increase in 2017," he adds. Silvia Paternain, partner at

Freshfields, says there are reservations about the implementation

of BEPS. She adds: "It will be difficult to read between the

lines, the European Union is keen on multilateral tax treaties, but

who else is really committed?" Meanwhile, Paternain says there

are also doubts about the application of tax law. "The tax

authorities are aggressive, but are they properly applying the law?

Are they going beyond the law?"

Linklaters partner Javier García-Pita says that regardless

of how well a tax lawyer is prepared from a technical perspective

when dealing with the tax authorities, the authorities have strict

targets they have to meet in terms of collections. "The

authorities are increasingly pressured to comply with their cash

objectives and sometimes it seems they are more keen on getting to

the figure than they are on the technical support of the

assessment," he says. García-Pita adds that, due to the

uncertainty around tax, one strategy is for clients to ask the tax

authorities for an opinion on a proposed tax structure. However,

Domínguez says that timing can be an issue when seeking to

obtain a ruling from the tax authorities on M&A deals. He adds:

"Despite the excellent team within the General Directorate of

Taxation, on some occasions the timing of the transactions makes it

very difficult to seek an opinion."

'Robin Hood' mentality

Media coverage of tax issues is often negative, says Paternain,

highlighting "corporate tax issues being reported upon in a

way that implies those in question are guilty of tax avoidance or

paying little taxes, but without much further thought or

analysis". She adds: "This enables a ´Robin

Hood' attitude, but the press should take it seriously because

tax is law and there are many legal reasons why a company can pay

less taxes in Spain and not be publicly ashamed." Araoz &

Rueda partner Javier Prieto says a growing global trend is an

"increase in the level of managers' liability for

companies' tax matters". He adds that tax law is

constantly changing and this is a "big risk", but also a

great opportunity for law firms, though the challenge is to

"persuade clients of the added value provided and convert this

into good fees". Meanwhile, uncertainty regarding the

participation exemption regime is proving challenging for lawyers,

according to Clifford Chance counsel Roberto Grau. He adds that, as

some tax demands are retrospective, there have been situations

where clients have "asked for financing to pay the tax

authorities".

Clients are reluctant to sue the tax authorities, partly due to the

fact that it can take up to ten years before a case is resolved if

it goes to the higher courts, say some lawyers.  Meanwhile, Antonio Montero, counsel at CMS

Albiñana & Suárez de Lezo says: "In some

instances, especially in the most complex cases, it's very

difficult to give an opinion with certainty on what the decision of

the courts will be." He adds that, in the last 12 months,

political uncertainty in Spain "meant there has been no new

tax laws in development at a time when everybody (the tax

administration, taxpayers and tax lawyers) needs more precision in

relation to the tax rules".

Meanwhile, Antonio Montero, counsel at CMS

Albiñana & Suárez de Lezo says: "In some

instances, especially in the most complex cases, it's very

difficult to give an opinion with certainty on what the decision of

the courts will be." He adds that, in the last 12 months,

political uncertainty in Spain "meant there has been no new

tax laws in development at a time when everybody (the tax

administration, taxpayers and tax lawyers) needs more precision in

relation to the tax rules".

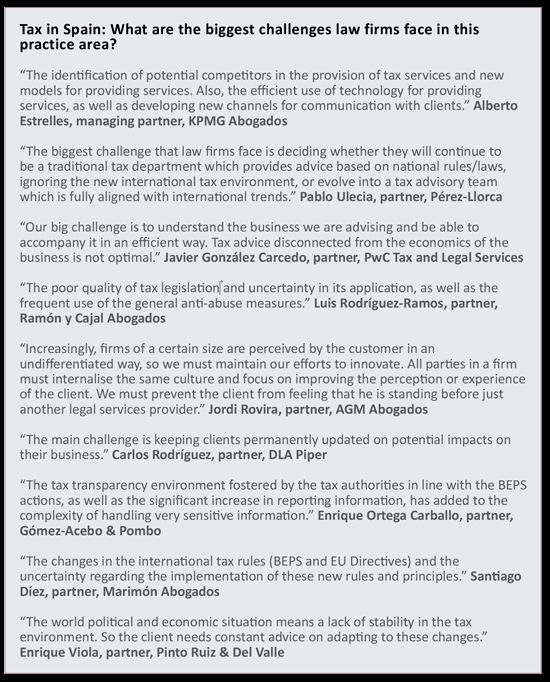

Generally speaking, tax is becoming a more important aspect of

every transaction, Gonzáles Carcedo says. "Because tax

is becoming more relevant and more complex, structures need to be

amended as there is a reputational risk," he adds.

Sánchez says one concern for law firms is that

companies' in-house legal departments are becoming larger and

therefore they are able to handle more tax-related legal matters

in-house.

Flight to

quality

Flight to

quality

There are currently many good opportunities for tax lawyers, says

Viana. "One client trend is a ´flight to quality' in

times of higher risk, while there are more opportunities due to an

increase in litigation, and there is a lot of transfer-pricing and

compliance-related work." A leading tax partner comments that

some firms may start to ask themselves whether, as a law firm,

"they are more exposed by having a tax department, they may

wonder whether they would we be better off without a tax

group". Other lawyers say there is a possibility that, due to

the potential liabilities associated with providing tax-related

legal advice, law firms will limit future investment in their tax

departments.

One partner comments that the large auditing firms have an

advantage in some fields of tax law, but law firms are better

placed to handle more sophisticated tax work. Meanwhile, in

reference to the competition between the legal arms of the 'Big

Four' auditors and more traditional law firms, one tax lawyer

in the Madrid office of an international law firm says: "I

think the principle of legal privilege will become more relevant,

there is privacy – companies can speak to a lawyer knowing

that the information is confidential."

While increasing legal activity may mean a higher volume of fees,

this does not necessarily mean an increase in profitability, says

Urrengoechea. He adds: "There has been a change in the

provision of tax services, previously clients generally wanted tax

planning schemes, now they want advice on how to avoid future tax

problems. García-Pita says uncertainty creates opportunities

for law firms and adds that tax governance, tax controversy, APAs

[advance pricing agreements] and audits will mean a greater volume

of work for lawyers in the coming year. He adds: "Deal flow

will increase [in the coming year] and tax advice will be more

relevant in deals." García-Pita adds that fees could go

up: "I see restrictions on fees being removed."

Martín Barrios agrees that there is currently an opportunity

for law firms to increase fees and profitability. He says:

"There is a higher demand for senior tax lawyers as there is a

scarcity of them, it is therefore critical to bring talent into

firms." Viana adds that there will be many opportunities for

tax lawyers in relation to real estate, distressed assets, M&A

and private equity deals in the coming months. Meanwhile, Grau says

that an increase in transactions, including private equity deals,

will generate significant work for tax lawyers in the next 12

months.

Portugal:

Maximising collections

Portugal:

Maximising collections

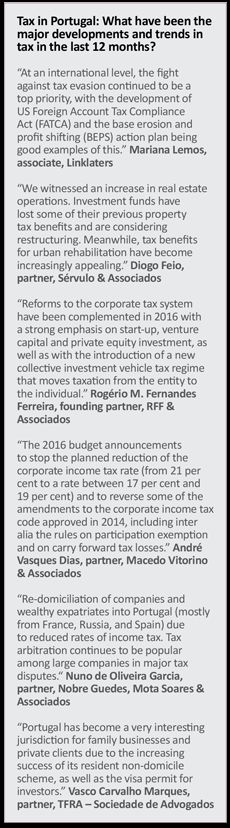

With regard to tax developments in Portugal, MLGTS partner

Francisco de Sousa da Câmara says that due to corporate and

personal income tax reforms, as well as the BEPS initiative, more

rules related to tax transparency and the exchange of information

have been introduced, with the effect that "greater tax

transparency, accountability and compliance" is now expected

from corporations and individuals. He adds that there has been an

increased level of vigilance on the part of the tax authorities as

they seek to tackle tax avoidance, and consequently, "on many

occasions tax assessments have been made to maximise collection,

which has led to significant levels of litigation".

The shift of the Portuguese government to the left of the political

spectrum brought a change in tax policy, PLMJ partner Nuno Cunha

Barnabé says. "The planned reduction of the corporate

tax rate to 17 per cent by 2019 was abandoned and the rate frozen

at 21 per cent, while some measures perceived as having a

regressive effect on personal taxation were revoked." He adds:

"A new tax on residential property (known as "AIMI")

was introduced on 1 January 2017. It appears that the new

government will pursue the objective to increase tax revenues

through indirect taxation and the property taxes, rather than by

continuing to increase income taxes."

The biggest tax-related opportunities for law firms relate to the

structuring of real estate investments and the re-domiciliation of

companies and businesses to Portugal, says Vieira de Almeida

partner Tiago Marreiros Moreira. He adds that with the

restructuring of the financial sector, clients' need for tax

compliance advice, as well as tax-related litigation and

arbitration, will also generate significant amounts of work. Marta

Pontes, partner at Uría Menéndez-Proença de

Carvalho, says the Portuguese tax authorities are now more

aggressive, and consequently, tax litigation and arbitration will

be an important area of opportunity. She adds: "Wealth

management is expected to be an important area of development,

especially considering the success of the Portuguese non-domiciled

resident regime and golden visa programme."

Planning problems

It is getting increasingly difficult for companies to plan their

tax affairs, according to Telles De Abreu Advogados managing

partner Miguel Torres. "This is a significant opportunity to

conduct new business since clients, corporate and private, will

increasingly need assistance to ensure that they are conducting

their tax affairs legally and as efficiently as possible," he

adds. "As compliance costs rise and the risks of conducting

business without obtaining proper tax advice become greater,

clients will increasingly feel the need to seek out high quality

tax consultancy services."

Tourism and real

estate-related matters are on the increase in Portugal and this is

generating more work for tax lawyers, says Cuatrecasas,

Gonçalves Pereira partner Diogo Ortigão Ramos.

"In parallel, financing transactions and the restructuring of

both portfolio and banking sector entities were also a market trend

in 2016," he adds. "The favourable, and highly-praised,

non-habitual tax resident regime continued to attract

high-net-worth individuals, and with them, a demand for estate

planning and inheritance and family law advice." Meanwhile,

António Moura Portugal, partner at ABBC, says contentious

matters provide a steady flow of work for tax lawyers in Portugal,

though he adds that the constantly evolving nature of tax law

provides a challenge given that clients are looking for

stability.

Tourism and real

estate-related matters are on the increase in Portugal and this is

generating more work for tax lawyers, says Cuatrecasas,

Gonçalves Pereira partner Diogo Ortigão Ramos.

"In parallel, financing transactions and the restructuring of

both portfolio and banking sector entities were also a market trend

in 2016," he adds. "The favourable, and highly-praised,

non-habitual tax resident regime continued to attract

high-net-worth individuals, and with them, a demand for estate

planning and inheritance and family law advice." Meanwhile,

António Moura Portugal, partner at ABBC, says contentious

matters provide a steady flow of work for tax lawyers in Portugal,

though he adds that the constantly evolving nature of tax law

provides a challenge given that clients are looking for

stability.

The digitalization of the economy means that lawyers need to

"speed up" their services to clients and provide a more

"pragmatic international overview" when responding to

enquiries, according to Tiago Caiado Guerreiro, partner at Caiado

Guerreiro. He adds that, due to Portugal's "stagnating

economy", fees for legal services are decreasing. pbbr of

counsel João Marques Pinto says competition from auditors is

one of the biggest challenges law firms currently face. According

to CCA Ontier partner Carla Matos, corporate income tax rate

– which stands at 21 per cent – has had an

"adverse impact" on corporate investment in Portugal. She

adds: "Our biggest challenge is to convince investors to move

to Portugal in spite of this."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.