- within Antitrust/Competition Law, Food, Drugs, Healthcare, Life Sciences and Wealth Management topic(s)

On 16 January 2026, the Dutch Supreme Court ruled that the 8% tax interest rate applicable to corporate income tax assessments is disproportionate and violates the principle of equality. As a result, the applicable tax interest rate is reduced to 4%. As the State Secretary for Finance has included all similar objections in a mass objection procedure, the judgment has direct effect on all taxpayers that have filed objections against the amount of tax interest included in the CIT assessment.

The Supreme Court's ruling

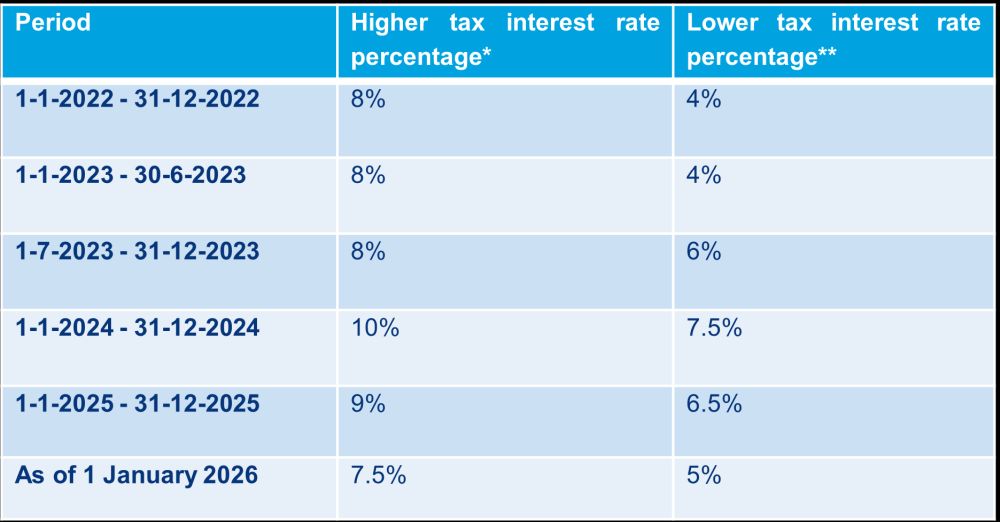

From 1 January 2022, the tax interest rate in corporate income tax (CIT) assessments is higher than in assessments for other taxes (as shown in the overview at the end of this post).

The Supreme Court has ruled that the higher tax interest rate for CIT assessments violates the principles of proportionality and equality. According to the Supreme Court, there is no justification for applying a higher tax interest rate to CIT assessments than to assessments for other types of taxes. Consequently, the tax interest for the CIT assessment in the case at hand must be determined based on a rate of 4%. This corresponds with the lower tax interest rate for other taxes. The Supreme Court further clarified that the lower tax interest rate applicable for other taxes is neither disproportionate nor discriminatory. As a result, the lower tax interest rate remains fully applicable.

Impact on taxpayers

As the State Secretary for Finance has included all similar objections in a mass objection procedure, the judgment has direct effect on all taxpayers that have filed objections against the amount of tax interest included in their CIT assessment. The Supreme Court's judgment requires the Dutch tax authorities to issue a single collective decision on all objections covered by this procedure within six weeks. In this decision:

- objections against the higher tax interest rate must be granted, and

- objections against the lower tax interest rate must be rejected.

Within six months, the Dutch tax authorities must make all required numerical adjustments to the interest included in CIT assessments for which an objection was filed in accordance with the Supreme Court's ruling.

For now, we advise taxpayers to continue filing objections against CIT assessments in which tax interest has been calculated at the higher interest rate, in order to safeguard their rights pending further guidance from the State Secretary of Finance.

Should you have any questions about the implications of this judgment for your situation, please contact your trusted adviser at Loyens & Loeff or one of the authors below.

Applicable tax interest rates

* This includes CIT (vennootschapsbelasting), conditional withholding tax (bronbelasting), minimum tax (minimumbelasting), solidarity contribution (solidariteitsbijdrage) and profit share (winstaandeel).

** This includes other taxes such as personal income tax, dividend withholding tax, wage tax and VAT.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]