- within Real Estate and Construction topic(s)

The law on the amendments to the Tax Code of the Republic of Kazakhstan was published on 22 December 20221. Below you may find the most significant amendments introduced by this law. These amendments with few exceptions have come into effect on 1 January 2023.

1. Corporate income tax

In order to deduct the business trips expenses, employers are no longer required to have a document confirming that their employees have actually travelled (for instance, boarding passes).

2. Personal income tax

- The following income is excluded from the list of

individual's taxable income:

- capital gain from the sale of participation units in open-end and interval investment funds2;

- compensation/premium on KZT deposits3.

- An individual will be obliged to report the fact of owning digital assets issued by both Kazakh and foreign issuers.

- An individual who is legally restricted in owning accounts/deposits outside Kazakhstan is now obliged to report such accounts/deposits irrespective of the amount of money on them (earlier – only the amount exceeding 1 000 MCI4).

3. Duties and fees

- The following will be excluded from the list of

duties5:

- the fee for the state registration of the irrevocable de-registration authority on de-registration and export of an aircraft;

- the fee for the issue of the certificates of the authorised civil aviation organisation on compliance with the certification requirements;

- the fee for the state registration/re-registration of civil aircrafts as well as issue of a duplicate of the document confirming the state registration of civil aircrafts.

- The following will be included to the list of

duties6:

- the fee for the right to render services on disinfection, disinfestation and deratisation in the healthcare area in the amount of 10 MCI;

- the fee for the issue of a duplicate of the license on microfinancial activity in the amount of 3 MCI;

- the duty for filing of petitions to the Constitutional Court of the Republic of Kazakhstan in the amount of 1 MCI.

- The fee for the use of nature reserves will be differentiated

in the following order7:

- 0.1 MCI from a pedestrian;

- 0.2 MCI from a motorcycle, motorbike or quadbike;

- 0.3 MCI from a light motor vehicle;

- 1 MCI from a microbus with up to 16 seats or truck;

- 2 MCI for a bus with up to 32 seats;

- 3 MCI for a bus with more than 32 seats.

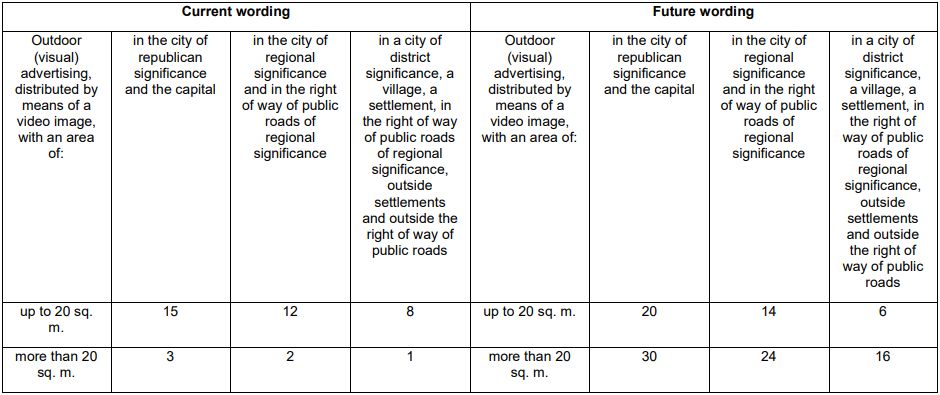

- Due to the changes in the advertisement legislation, the rates for outdoor/visual advertising in an open space will be changed in the following order8:

- For taxation purposes, digital miners definition will include persons rendering services on provision of complex computing infrastructure for computing operations and data processing in address of the persons engaged in the digital mining activities9.

- Digital mining fee shall now be reported no later than the 15th day of the second month following the reporting quarter and paid no later than the 25th day of the second month following the reporting quarter at the location of the taxpayer (previously March 31 and April 10, respectively).

- The fee for the state registration of truck tractors is nullified until 2028 (with the exception of the truck tractors manufactured 7 years ago or more).

4. Withholding taxes

- The following are added to the list of withholding tax objects:

- advance payment made under an agreement with a non-resident legal entity/non-resident individual which was not executed for more than 2 years, if there is no double tax treaty with the state of such non-resident;

- insurance payments made to a non-resident individual under a pension annuity agreement.

- In case a non-resident legal entity incurs capital gain in connection with the sale of property, securities, shares in Kazakhstan to a resident individual, such individual will be required to calculate, withhold, declare and transfer to the budget withholding tax in respect of the income of such legal entity10.

- In case of payment of dividends, interest or royalty to an

affiliate non-resident legal entity/non-resident individual, with

which state of residence the Multilateral Convention is applied,

the following conditions shall be additionally met in order to

apply the relevant double tax treaty:

- the abovementioned income is included in the taxable income of such non-resident in its/his state of residence without the right of adjustment, deduction, offset or refund;

- the nominal tax rate on the abovementioned income in the state of residence of such non-resident is at least 15%.

5. Special tax regimes

- The following are added to the list of activities prohibited

under the special tax regimes (the 'STRs') for small

businesses:

- rental and operation of a market;

- sublease of trade facilities related to the markets, stationary trade facilities of categories 1, 2 and 3 as well as trade places, facilities and public catering facilities located on their territory;

- joint activity of two or more taxpayers on rendering of hotel services on the territory of the same hotel/separate non-residential building.

- Individual entrepreneurs applying the STR on the basis of a simplified report are now entitled to use a special mobile application for issue of receipts as well as performance of individual income tax and social tax obligations.

- Digital mining and/or circulation of digital assets were added to the list of activities prohibited when applying a single cumulative payment.

- Micro- and small businesses applying the STR on the basis of a

simplified report or the STR for agricultural producers may now

apply a single payroll payment. This payment is paid in respect of

the employment income of employees instead of the personal income

tax withheld at the source of payment, obligatory pension

contributions, obligatory pension contributions of employer, social

contributions as well as obligatory social medical insurance

contributions of employer and employee in the following order:

- effective 1 January 2023 – 20%;

- effective 1 January 2024 – 21,5%;

- effective 1 January 2025 – 23,8%;

- effective 1 January 2026 – 24,8%;

- effective 1 January 2027 – 25,8%;

- effective 1 January 2028 – 26.3%.

6. Value added tax on digital services (Google tax)

- Now the value of digital services rendered by foreign companies to the Kazakh individuals shall be converted into KZT at the exchange rate of the last business day preceding the date of payment of Google tax in respect of such services (previously – the date of payment for the digital services).

- The turnover on digital services rendered by foreign companies to the Kazakh individuals shall be determined on the basis of the date of payment for such services.

- It was clarified that Google tax is non-refundable.

Footnotes

1. The Law No. 165-VII ЗРК dated 21 December 2022 'On introduction of amendments to the Code of the Republic of Kazakhstan 'On taxes and other obligatory payments to the budget' (Tax Code) and the Law of the Republic of Kazakhstan 'On enactment of the Code of the Republic of Kazakhstan 'On taxes and other obligatory payments to the budget' (Tax Code)'.

2. Came into effect on 1 January 2022.

3. In effect until 1 January 2025.

4. Monthly calculated indexes. In 2023 one monthly calculated index is KZT 3 450 or approximately USD 7.7.

5. Comes into effect on 1 July 2023.

6. Comes into effect on 1 January 2024.

7. Comes into effect on 1 January 2024.

8. Comes into effect on 1 January 2024.

9. Comes into effect on 1 January 2024.

10. Came into effect on 1 February 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.