- within Tax topic(s)

- in Asia

- within Tax topic(s)

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- with readers working within the Retail & Leisure industries

- within Tax, Immigration and Insurance topic(s)

Summary

The Hong Kong Inland Revenue Department (IRD) recently provided further guidance on the foreign-sourced income exemption (FSIE) regime by publishing four new frequently asked questions (FAQs) on its designated FSIE webpage. In this tax alert, we summarise the key points covered in the new FAQs and share our observations.

The new FAQs on the FSIE regime

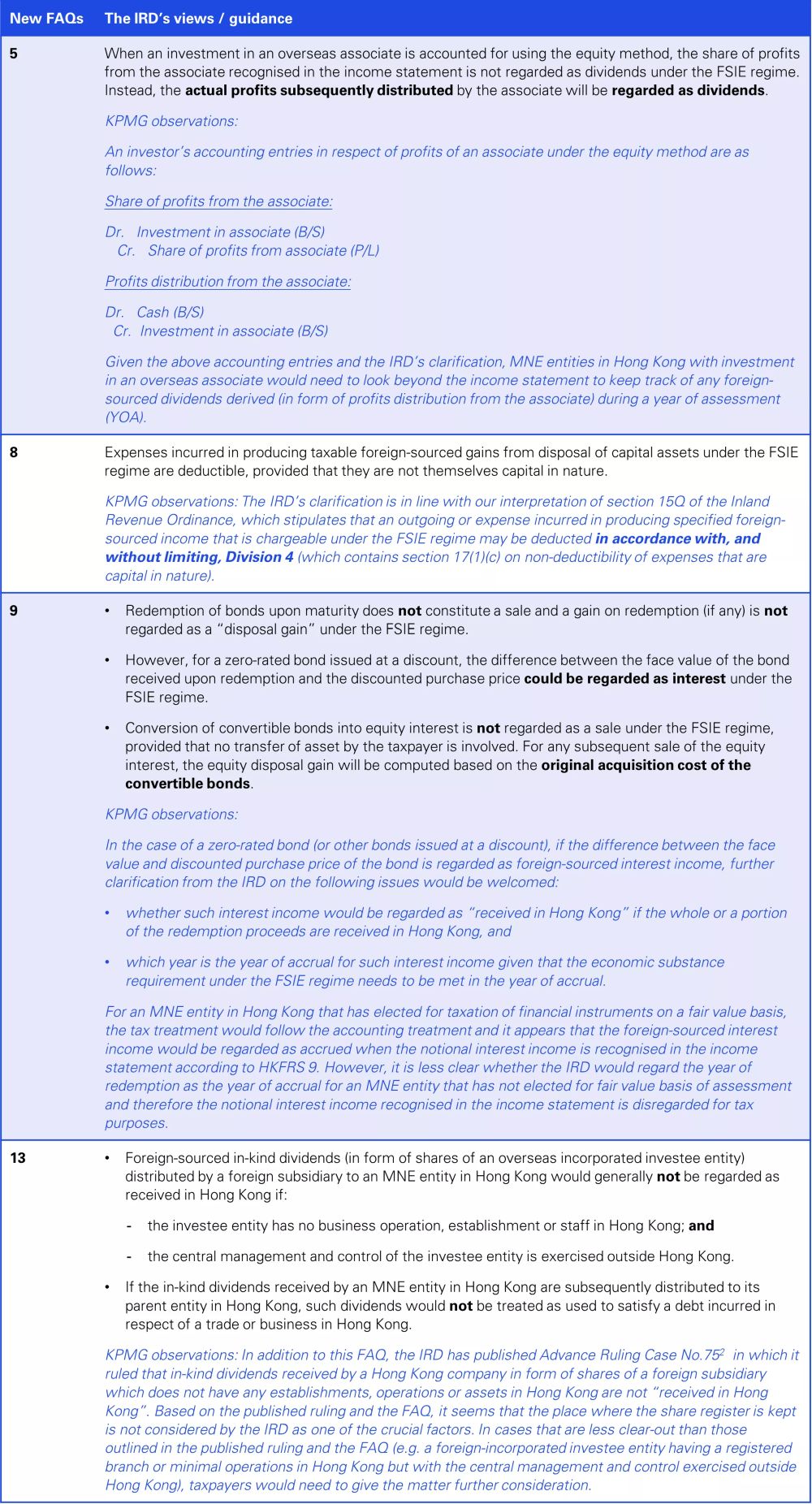

On 24 July 2025, the IRD posted four new FAQs1 onto its webpage on the FSIE regime. The newly added FAQs are all grouped under "Covered Income" and marked as NEW on the webpage. We summarise in the table below the key points covered in the new FAQs.

KPMG observations

We welcome the IRD's further clarification on its interpretation and administration of the FSIE regime. However, as pointed out above, uncertainty on the tax treatment under the FSIE regime may still exist for more complex business arrangements or issues.

Business groups in Hong Kong deriving specified foreign-source income should take note of the IRD's latest guidance, consider the implications of such guidance in light of their own facts and circumstances, and determine whether actions are required to ensure tax compliance and optimise the overall tax outcome.

Footnotes

1. The IRD's FAQs on the FSIE regime can be accessed via this link: https://www.ird.gov.hk/eng/faq/fsie.htm

2. For more details of the case, please refer to our previously issued Hong Kong (SAR) tax alert – Issue 15, November 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.