- in Nigeria

- with readers working within the Advertising & Public Relations and Media & Information industries

- within Consumer Protection, International Law and Environment topic(s)

Executive Summary

Oil and Gas Sector

In the last quarter of 2024, Nigeria's oil and gas sector experienced a slight development from the previous quarter. In October 2024 the Nigerian Upstream Petroleum Regulatory Commission (NUPRC)recorded a decline in crude oil production from 1.54 million barrels per day to 1.53 million barrels per day. However, in November 2024, there was an increase in Nigeria's daily oil production which reached 1.8 million barrels per day. The Nigerian National Petroleum Company Limited (NNPC L) projected an increase to 2 million barrels per day by the end of 2024.

The decline and subsequent increase in Nigeria's oil production may have been driven by a combination of factors such as:

- Ongoing security challenges such as oil theft and vandalism, which disrupted production.

- Operational issues like ageing infrastructure and underinvestment also played a role in fluctuating output.

- Maintenance activities, as some companies may have conducted planned or unplanned maintenance on their facilities which would have temporarily reduced production. Etc.

Also, in the last quarter, the sector witnessed notable divestments and acquisitions of oil assets. Seplat Petroleum, for example, completed the acquisition of Mobil Nigeria, while the Federal Government of Nigeria (FGN) approved the Renaissance Group's purchase of $1.3 billion worth of Shell's Nigerian onshore assets.

Efforts to expand Compressed Natural Gas (CNG) infrastructure are also underway, with a focus on boosting the use of gas as an alternative energy source for both transportation and power generation. There have been, significant step taken towards the development of critical gas pipeline infrastructure, such as the Moroccan-Nigeria Gas Pipeline, which is set to improve regional energy access and strengthen Nigeria's position as a key gas supplier in Africa. In addition to this, the Nigeria Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) and Shell have collaborated on the development of key gas pipelines, which are aimed at enhancing Nigeria's gas infrastructure. This partnership is expected to drive greater gas supply, boost domestic consumption, and position Nigeria as a key regional energy supplier.

Executive Summary

Power Sector

The Nigerian power sector made incremental progress as the implementation of the Electricity Act, 2023, gained momentum. Several states, such as Lagos Benue, and Delta States passed their Electricity Bill into law aimed at decentralizing electricity regulation in the light of the provisions of the Electricity Act and for establishing their electricity markets. These states are taking steps to improve supply reliability and better control power generation, distribution, and regulation within their jurisdictions. In the last quarter of 2024, we see those challenges such as grid instability and high transmission losses persisted, with the national grid experiencing about four collapses. These issues highlight the urgent need for further investments in infrastructure and comprehensive reforms.

Renewable Energy

The renewable energy sector saw increased investments, particularly in solar mini-grids and decentralized energy systems targeting rural electrification. Public-private collaborations and international partnerships drove significant progress, with development agencies and local companies spearheading projects in underserved areas. Notably, WATT Renewables Corporation and Winnock Solar secured significant funding to expand renewable energy projects, further reflecting the growing interest in the sector. As Nigeria aligns with its energy transition goals, renewables are expected to play a central role in reducing energy poverty and advancing sustainability.

Market Overview

Power Sector

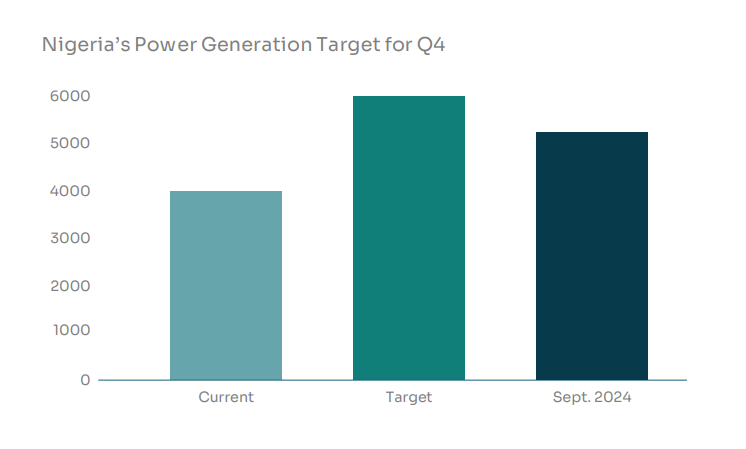

In the last quarter of 2024, Nigeria's power sector continued its efforts to enhance electricity access and reliability. The Federal Government set a target to increase power generation from 4,000MW to 6,000MW by December 2024, with a focus on hydro and solar plants to enhance electricity supply to households and businesses. However, this plan was hindered by N2.7 trillion in GenCos debts and frequent grid collapses. Despite these challenges, power generation reached 5,313MW in September 2024, marking the first time in three years this level was achieved. In Q4 2024, the Transmission Company of Nigeria (TCN) continued its efforts to enhance the stability of the national electricity grid. The federal government, in partnership with the World Bank, had initially planned to operationalize the Supervisory Control and Data Acquisition (SCADA) system by the end of the quarter. This system is designed to monitor and control field devices, thereby improving grid efficiency and reliability. A demonstration of the SCADA system was successfully carried out by TCN to showcase its capabilities. However, the timeline for the operationalization of the system has been moved to the first half of 2025. Despite these initiatives, the sector still faced challenges, including frequent grid collapses and the need for substantial investment to meet the growing energy demands of the population.

- Inconsistent Power Output: Despite an installed capacity of approximately 13,500 MW, Nigeria consistently generates and distributes only about a third of this capacity.

- Gas Supply Issues: Most of Nigeria's electricity is produced by gas-fired plants. However, challenges such as pipeline vandalism and inadequate infrastructure have led to insufficient gas supply, hindering consistent power generation.

- Underdeveloped Renewable Energy Projects: While there have been initiatives to develop solar farms and other renewable energy sources, progress has been slow due to a lack of essential guarantees and a challenging business environment.

Distribution

- Limited Access to Electricity:

A significant portion of the population lacks reliable access to electricity. Inadequate distribution networks and infrastructure have underserved many areas, especially rural regions. - Dependence on Generators:

Due to unreliable grid power, households and businesses rely heavily on gasoline-powered generators, which are costly and contribute to pollution. It's estimated that generators supply about 40,000 MW to consumers, far exceeding the grid's capacity. - Financial Challenges:

Distribution companies (DisCos) face financial constraints due to low tariffs, electricity theft, and poor revenue collection, hindering their ability to invest in infrastructure improvements and expand access.

Transmission

- Frequent Grid Collapses:

The national power grid has experienced multiple collapses, leading to widespread blackouts across major cities. For instance, there have been at least eleven collapses reported in 2024, causing significant disruptions. - Aging Infrastructure:

The transmission network suffers from outdated infrastructures making it susceptible to failures and unable to handle the full generation capacity. This has resulted in the grid being able to transmit only about 4,000 MW, despite a generation potential of 13,500 MW. - Vandalism and Security Concerns:

Instances of vandalism, particularly in the northern regions, have further compromised the integrity of the transmission infrastructure, leading to power outages and instability.

These challenges highlight the systemic issues within Nigeria's power sector, affecting the entire value chain from generation to distribution. Addressing these problems requires comprehensive reforms and substantial investments to ensure a stable and reliable electricity supply for the nation's growing population.

Notable Developments in the Power industry

During the last quarter of 2024, there were several notable developments in the power industry which include:

Lagos State Signs Electricity Bill to Law

Following the decentralization of regulatory oversight provided for under the Electricity Act 2023, the Lagos State House of Assembly enacted the Lagos State Electricity Law 2024 (the "Law") to address peculiar power challenges faced in the State. Against this backdrop, Lagos State created its electricity market joining many other states like Ekiti, Ondo, Edo, Kogi, Imo, and Oyo. One of the objectives of the Law is to create a regulatory framework and licensing regime for regulated activities in the Lagos Electricity Market and the delivery of services to electricity consumers in the State.

A key innovation of the Law is the provision for an Off-Grid Electrification Strategy and Action Plan aimed at providing electricity to residents within the State, particularly focusing on residents in unserved and underserved areas. A Power Enforcement Unit was also created under the Law to address issues of electricity theft, unauthorized electricity supply, illegal use of electricity, and damage to electricity infrastructure.

The enactment of the Law forms a roadmap toward the effective regulation of electricity activities in the State and promises a transformation of the State's electricity industry.

NERC transfers electricity oversight to Lagos

The Electricity Act 2023 mandates the Nigerian Electricity Regulatory Commission (NERC) to within 45 days of receiving a formal notification of the enactment of a law by a State, draw up and deliver to the State regulator, a draft order setting out a plan and timeline for the transition of regulatory responsibilities from the Commission to the State regulator. In light of the enactment of the Lagos State Electricity Law 2024, the NERC announced the transfer of regulatory oversight of the electricity market in Lagos to the Lagos State Electricity Regulatory Commission (LASERC) in December 2024. What this means is that LASERC now has full regulatory autonomy over the electricity market in Lagos.

The Transfer Order issued by the NERC outlined a series of steps to ensure a smooth transition of responsibilities to LASERC. Some of the key provisions of the Order include the incorporation of subsidiaries by Eko Electricity Distribution Plc and Ikeja Electricity Plc for the intrastate supply and distribution of electricity.

NERC transfers electricity oversight to OGERC in Ogun state.

In a significant move towards decentralization, the Nigerian Electricity Regulatory Commission (NERC) has shifted the regulatory responsibility for Ogun State's electricity market to the Ogun State Electricity Regulatory Commission (OGERC). The Ogun State Government, having complied with legal requirements, formally requested the transfer. As part of the transition, NERC has set a deadline for all processes to be completed by June 4, 2025.

Furthermore, the transfer order granted by NERC mandates Ibadan Electricity Distribution Company (IBEDC) to establish a subsidiary named "IBEDC SubCo" to manage the intrastate supply and distribution of electricity in Ogun State. This transfer aligns with the 2023 Electricity Act, aiming for more localized regulation and improved efficiency in state-level energy management. This shift could enhance responsiveness to regional energy challenges.

NERC tasks operators with compliance

The Nigerian Electricity Regulatory Commission (NERC) urged operators in the Nigerian Electricity Supply Industry (NESI) to set higher targets for improving regulatory compliance in 2025. This directive emphasizes adherence to relevant market rules established to ensure efficiency, reliability, and fairness. The renewed focus on compliance comes amid ongoing reforms and efforts to align with the Electricity Act of 2023, which has decentralized regulatory oversight for states like Lagos.

This development is particularly significant in light of recent state-level reforms, such as Lagos State's assumption of electricity market oversight. As states begin to manage their electricity markets.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.