- within Energy and Natural Resources topic(s)

- in United States

- with readers working within the Retail & Leisure industries

- within Consumer Protection, Government, Public Sector and Insurance topic(s)

Executive Summary

Q3 of 2024 for Nigeria's energy sector demonstrated significant advancements despite persistent challenges.

In the power sector, despite the infrastructural deficits and financial constraints, there has been notable efforts to improve efficiency in generation, transmission and distribution. The Electricity Act 2023 continues to set a positive trajectory by encouraging private sector involvement and enhancing regulatory frameworks.

In the oil and gas sector, Q3 saw an increase in oil production and significant strides such as the commencement of petrol production at the Dangote Refinery. This move is expected to reduce Nigeria's reliance on imported fuel and strengthen domestic supply chains. Additionally, natural gas exports continue to expand, particularly with new partnerships in Asian markets thus increasing the possibility of more affordable electricity at a closer timeline.

The renewable energy sector has continued to make headway, with increased investments and government initiatives supporting solar, wind, and other clean energy projects. Key developments, including new partnerships and technological advancements, contributes to the diversification of Nigeria's energy mix and improved access to electricity in underserved areas.

Overall, Q3 of 2024 saw strategic developments across the energy sector, from oil and gas production to renewable energy investments and power infrastructure improvements. While challenges remain, these advancements are critical for achieving energy security and supporting Nigeria's economic growth.

This review highlights the significant activities and notable advancements in Nigeria's energy sector, within Q3 of 2024, providing a thorough summary for individuals, stakeholders, and policymakers alike.

Market Overview

Power Sector

Q3 of 2024 continues to evidence a progressive trend in the Nigeria's power sector.

The implementation of the decentralisation of power generation, the multiple foreign investments attracted within the sector in Q3 and strategic partnerships by the federal government, regulatory bodies and agencies, aimed at ensuring easy and affordable access to electricity at a nearer date. With the government aiming to achieve a power generation capacity of 6000KW by December 2024, various partnerships and investments have gone into the development of the sector.

Notable developments in the Power industry

During Q3 of 2024, there were several notable developments in the power industry which include:

FG to Allocate $800 Million for Construction of New Substations, Distribution Networks across Nigeria

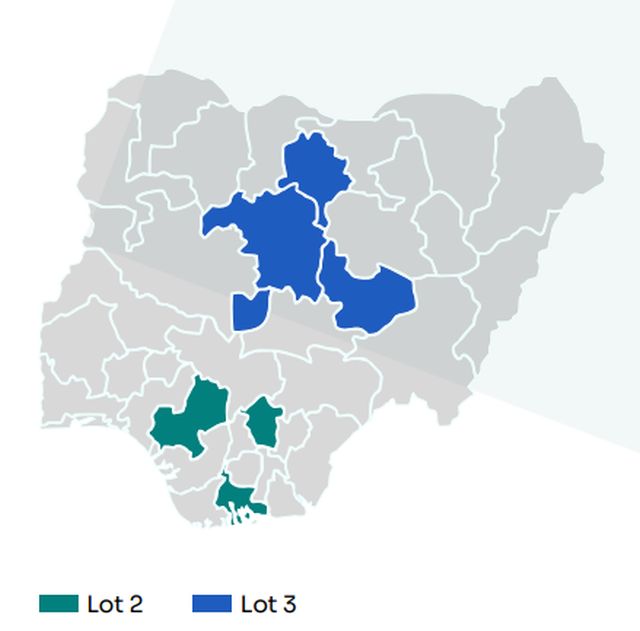

In a bid to addressing load rejection challenges faced by DISCOs, the Federal Government has announced plans to allocate $800 million for the construction of new power substations and distribution networks as part of the Presidential Power Initiative (PPI). The initiative will be executed in two phases: Lot 2 will focus on the franchise areas of Benin, Port Harcourt, and Enugu DISCOs, while Lot 3 will cover Abuja, Kaduna, Jos, and Kano DISCOs.

With Nigeria aiming to achieve a generation capacity of 6,000 megawatts by year-end, improving the distribution infrastructure is essential to effectively channel this increased output. The release of these funds is expected to address long-standing infrastructural bottlenecks in Nigeria's power sector, particularly in areas where the distribution networks are either outdated or underdeveloped. This investment will not only enhance operational efficiency but also help reduce the persistent issues of power outages and load rejection by DISCOs. Furthermore, by strengthening the power grid, the initiative aligns with broader national goals of achieving energy security and promoting industrial growth across key regions.

FG Signs Agreement With 3 Chinese Firms to Supply 1.4 Million Electricity Meters

The Federal Government, through the Bureau of Public Enterprises (BPE), signed an agreement with three Chinese companies; Ningbo Sanxing Medical & Electric Co. Ltd, Ningbo Sanxing Smart Electric Co. Ltd, and Messrs XJ Group Corporation to supply and install 1.43 million electricity meters across Nigeria. This project is part of the Distribution Sector Recovery Programme (DISREP), which is financed by the World Bank through a $500 million facility under the Investment Project Finance (IPF) arrangement. The initiative aims to address Nigeria's severe metering shortfall and close the gap between electricity supply and demand. It is a significant step toward resolving Nigeria's metering gap, which has hindered effective billing and service delivery in the power sector. By introducing more smart meters, the project will contribute to improving grid efficiency, reducing energy theft, and enhance consumer trust in the billing system.

NERC Transfers Regulatory Oversight of Oyo and Kogi Electricity Market to State Regulator

The Nigerian Electricity Regulatory Commission (NERC), the apex regulator of Nigeria's electricity industry, has formally transferred the regulatory oversight of the electricity market in Oyo and Kogi State to the states' regulators. This development announced by NERC aligns with the provisions of the Electricity Act of 2023, as well as the recent amendments to the Nigerian Constitution. This action by NERC signifies the growing trend of decentralizing regulatory control of Nigeria's electricity sector, allowing states greater autonomy in overseeing electricity markets within their jurisdictions. The decision to allow states establish their own electricity regulatory commission is expected to encourage more efficient service delivery and investment in the region's electricity infrastructure. By decentralizing electricity regulation, the federal government aims to foster localized solutions to the country's power challenges, ensuring that states can independently address issues such as distribution bottlenecks and infrastructure deficits, thereby creating a more sustainable and efficient electricity market nationwide.

Abuja Disco Secures Deal with TransaFam Power to Deliver 50MW to Abuja Industrial Cluster

The Abuja Electricity Distribution Company (AEDC) signed a Memorandum of Understanding (MoU) with TransaFam Power to supply 50 megawatts (MW) of embedded power to the Abuja's Idu Industrial Cluster. The agreement between AEDC and TransaFam Power highlights the growing shift towards embedded power generation in Nigeria's electricity sector. Embedded power solutions, which involve the generation of electricity closer to the point of consumption, helps reduce transmission losses and provides a more stable and localized power supply.

With this partnership, AEDC is taking proactive steps to enhance power supply stability, particularly within industrial and commercial areas like the Idu hub. By leveraging embedded power generation, AEDC aims to mitigate the challenges associated with overreliance on the national grid, offering a more dependable energy solution for businesses operating in the Federal Capital Territory.

Notable developments in the Power industry

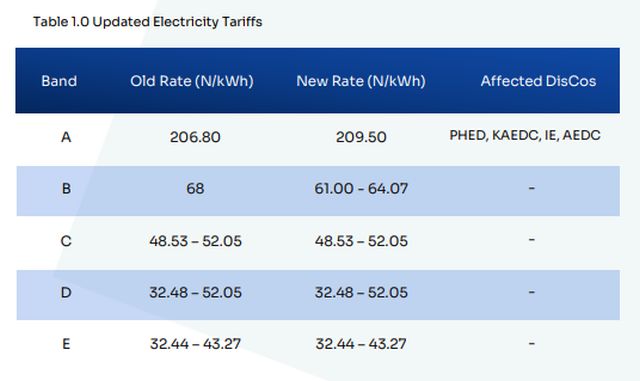

Nigeria's DisCos (PHED, KAEDC, IE, AEDC) raise tariffs for highconsumption users to ₦209.5/kWh.

The advanced system enables real-time monitoring, automated data collection, and remote control, modernizing Nigeria's electricity infrastructure for efficient power management.

DisCos Announce New Electricity Tariff Increase for Band A Customers

Several electricity distribution companies (DisCos) across Nigeria announced a new upward revision of tariffs effective from 1st July 2024, for Band A customers who are categorized as highconsumption users with relatively better access to electricity. According to the updated tariffs, Band A customers now pay ₦209.5/kWh, an increase from the previous rate of ₦206.80/kWh. The affected DisCos are the Port Harcourt Electricity Distribution Plc (PHED), the Kaduna Electricity Distribution Company (KAEDC), Ikeja Electric (IE) and the Abuja Electricity Distribution Company (AEDC).

The upward adjustment follows the revision of the 2024 Multi-Year Tariff Order (MYTO), which governs electricity pricing in the country. This tariff increase reflects ongoing adjustments within Nigeria's power sector aimed at addressing cost recovery and improving service delivery for consumers. It is a part of broader efforts by the government and regulatory agencies to ensure sustainable pricing in the electricity sector, aligning with cost-reflective tariffs to maintain efficient electricity distribution across the country.

FG Partners with World Bank to Improve National Grid Stability - Deploy $6bn Scada System

The Federal Government, in collaboration with the World Bank, has deployed an advanced Supervisory Control and Data Acquisition (SCADA) system. This is a significant step towards enhancing the stability and reliability of the national power grid. The initiative, unveiled by the Transmission Company of Nigeria (TCN), which involves an investment of $6 billion, aims to modernize the country's electricity infrastructure, addressing long-standing challenges in power supply management. This SCADA system will facilitate real-time monitoring and control of the grid, enabling operators to efficiently manage loads and swiftly respond to outages. With features like automated data collection, fault detection, and remote-controlled operations, we are laying the foundation for a more resilient and responsive power sector.

This initiative aligns with the government's broader vision of achieving energy security and expanding access to electricity for all Nigerians, which is the primary objective of the Nigerian Electricity Transmission Access Project (NETAP). The introduction of SCADA is part of the FGs strategic efforts to modernize power infrastructure and implement smart grid technologies.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]