- within Insurance topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Advertising & Public Relations, Media & Information and Oil & Gas industries

- within Insurance, Tax, Government and Public Sector topic(s)

Overview

Mergers and Acquisitions (M&A) transactions in Nigeria - much like in other jurisdictions - involve complex negotiations and significant financial stakes. At the heart of these transactions are representations and warranties made by sellers and target entities, which serve to allocate risk and define liability frameworks. Traditionally, these risks have been managed through contractual indemnities, holdbacks, escrow arrangements, or sponsor guarantees. However, an increasingly recognised alternative is Warranty and Indemnity (W&I) Insurance, which insures parties against losses arising from breaches of warranties or indemnities in transaction agreements.

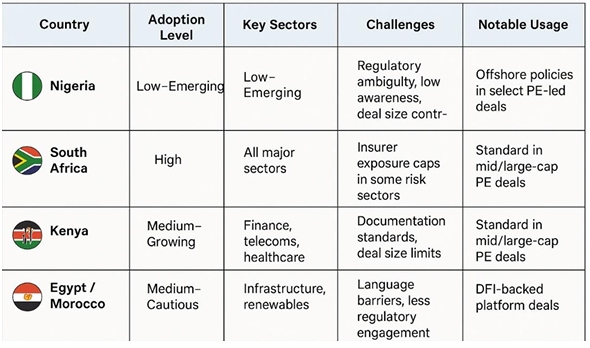

Globally, W&I insurance has become a standard feature in private equity exits and competitive M&A auction processes. According to AVCA1, adoption across Africa is growing, particularly in South Africa and Kenya. South Africa leads the continent, with W&I insurance routinely used in mid- to large-cap transactions. Kenya and parts of North Africa are also seeing moderate uptake, especially in private equity-led and DFI-backed transactions.

In Nigeria, market penetration remains relatively low due to several structural constraints, including regulatory uncertainty, limited underwriting capacity, low insurer appetite, and transaction sizes that often fall below the preferred USD 10 million threshold of international insurers. While effective risk allocation is critical in Nigeria's dynamic M&A environment, parties have historically relied on traditional mechanisms such as negotiated warranties, indemnities, and escrow structures. As such, familiarity with W&I insurance remains limited, and its use has not yet become market standard.

That said, the Nigerian M&A deal landscape is evolving exponentially. Transactions are becoming more complex and cross-border in nature, supported by deeper pools of international capital and increasingly sophisticated risk allocation structures. Against this backdrop, W&I insurance is being considered across a wider spectrum of transaction types. In our recent private equity and M&A transaction experience, we have seen W&I insurance adopted in transactions focused on sectors as diverse as fintech and digital payments, infrastructure development, and entertainment. In high-value exits, financial services consolidations, and infrastructure secondaries, W&I insurance is emerging as a viable strategic tool - enabling parties to shift financial risk to insurers, enhance certainty, and facilitate cleaner exits for both buyers and sellers in private equity and broader M&A contexts.

What Is Warranty and Indemnity Insurance?

W&I Insurance is a bespoke insurance product used in M&A deals to protect buyers or sellers from financial losses arising from breaches of warranties or indemnities in underlying transaction agreements -typically Share Purchase Agreements (SPAs) or Share Subscription Agreements (SSAs). Instead of relying on the counterparty for recovery, the insured party can claim under the policy, thereby reducing financial exposure and deal friction. It is therefore designed to supplement or replace traditional contractual protections, enhancing certainty and potentially accelerating deal execution.

Forms of W&I Insurance in an M&A Context - Buy-Side, Sell-Side, and Company-Issued

Buy-side W&I: This is the most common type of W&I insurance in Africa, particularly in cross-border transactions where sellers are assessed as financially weak, or where the enforcement of warranties is uncertain. The Buyer purchases the policy and claims directly against the insurer in the event of a breach of warranty or indemnity, avoiding direct recourse to the seller. This structure is particularly attractive in private equity exits - where sellers seek clean breaks with no post-closing liability - as well as in distressed sales involving financially constrained sellers, and in cross-border acquisitions where enforcement of post-closing claims may be challenging or impractical.

Sell-side W&I insurance, by contrast, involves the seller taking out the policy to cover its own liability to the buyer for breach of warranty or indemnity. While this form has become less common in international markets, it may be appropriate where the seller is subject to regulatory restrictions, has reputational concerns, or wishes to safeguard its balance sheet exposure.

The third, and less commonly used globally, form of W&I insurance is company-issued W&I insurance. This is typically applied in the context of share subscription agreements (SSAs). In transactions involving new share issuances - such as capital raises or private investment in public equity (PIPE) deals - the target company may obtain a policy to protect incoming investors. While this structure is potentially useful in the context of growth-stage private capital investments and equity-linked financing rounds in certain jurisdictions, it is not prevalent in Nigeria. Its viability in Nigeria would also be subject to navigating statutory financial assistance restrictions that restrict a company's ability to provide financial support for the acquisition of its own shares, such as under the Companies and Allied Matters Act 2020.

Mapping W&I Insurance Adoption Across Key African Jurisdictions: A Snapshot

While uptake of W&I insurance in Nigeria remains limited is gaining traction in high-value transactions across Africa. The findings suggest that buy-side policies continue to dominate the continent's deal landscape, particularly in jurisdictions with more developed legal and regulatory frameworks such as South Africa and Kenya. As at 2024 sectors such as financial services, FMCG, and infrastructure appeared generally more attractive to underwriters due to their perceived stability and clearer diligence processes.

However, access to W&I insurance remains largely confined to deals of $10 million (ten million dollars) or more, making it less accessible for mid-market transactions. Emerging trends include hybrid structures, in which sellers retain liability above the insurer's cover limit to balance and fortify cost and risk allocation. Nonetheless, insurers often exclude coverage in jurisdictions perceived as high-risk, and in transactions where due diligence is weak. Such factors continue to constrain broader adoption of W&I insurance in many African markets.

The Nigerian Legal and Regulatory Framework

Notably, there is not yet a discrete legal and regulatory framework prescribed specifically for W&I Insurance in Nigeria. All insurance activity in Nigeria is subject to the oversight of NAICOM under the Insurance Act 2003. Currently, no published NAICOM rules specifically address or provide clear guidance on W&I insurance products, which potentially creates uncertainty for Nigerian-registered policies. In Nigerian cross-border deals, policies are often issued offshore (e.g., London market) with local brokers acting as intermediaries.

Why W&I Insurance Uptake in Nigeria Is Nascent – Key Constraints

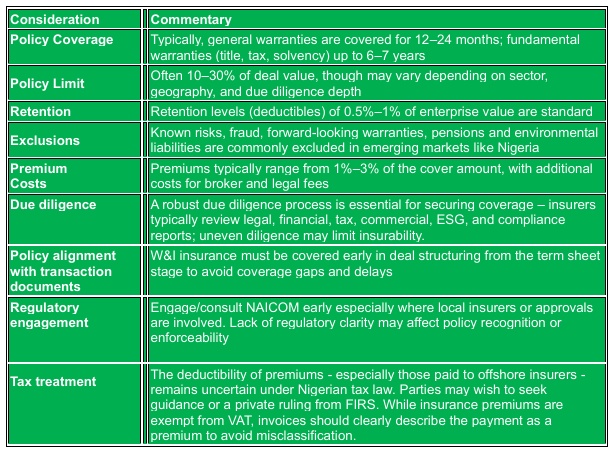

Despite its potential and practical appeal, the widespread use of W&I insurance in Nigeria has been constrained by several structural factors, including the absence of a discrete regulatory framework. Limited local underwriting capacity, with few insurers equipped or willing to underwrite transactional risk of this nature, also contributes to the under utilisation of W&I insurance, together with relatively high cost of premiums relative to deal size (typically 1% - 3% of the insured amount), which can be prohibitive for mid-sized deals.

Comprehensive and robust due diligence processes with a clear documentation trail are essential for securing coverage, with insurers typically reviewing legal, financial, tax, commercial, ESG, and compliance reports. This may not always be feasible in informal or thinly documented transactions.

Notably, W&I insurance policy exclusions also often leave key risks uninsured - particularly in transactions involving legacy or compliance-challenged businesses. Such insurance often excludes known risks identified in due diligence, fraud and willful misconduct, forward-looking warranties, environmental and pension liabilities (commonly excluded in emerging markets).

Other factors include the dearth of historical claims data in Nigeria, which may make pricing less predictable and risk appetite lower among global insurers for underwriting Nigerian and Nigeria-facing deals. The structuring of W&I policies can also add weeks to deal timelines, a potential source of friction in competitive or time-sensitive deals. Global/ offshore policies may also raise enforceability concerns and may exclude coverage in high-risk jurisdictions or where due diligence is perceived as weak.

Tax Considerations

There are several unresolved issues regarding the tax treatment of W&I insurance in Nigeria, particularly in relation to the deductibility of premiums, the classification of claims proceeds, and the treatment of cross-border payments. These uncertainties complicate tax planning and the cost-benefit analysis for transaction parties considering W&I cover, while also creating potential compliance and reporting challenges for both domestic and offshore insurers.

Deductibility of Premiums: There is currently no definitive guidance from the Federal Inland Revenue Service (FIRS) on whether W&I insurance premiums are deductible for corporate income tax purposes in Nigeria. For buyers, such premiums may be viewed as capital in nature—part of the acquisition cost - making them non-deductible. However, where the policy covers identifiable tax exposures or operational risks post-acquisition, an argument may be made for treatment as a revenue expense.

Sellers face similar uncertainty. Premiums are typically treated as part of the cost of disposal rather than as deductible expenses, particularly where they relate to the sale of a business interest. This lack of clarity complicates the commercial analysis of W&I insurance, and parties may need to seek formal clarification or a private ruling from FIRS.

Where premiums are paid to offshore insurers, deductibility may attract greater scrutiny, especially in the absence of a Nigerian tax identification number (TIN), NAICOM registration, or a demonstrable operational nexus with Nigeria. The absence of a local presence or registration under NAICOM may weaken the argument for deductibility, especially in light of anti-avoidance rules and scrutiny over base erosion and profit shifting (BEPS). Payments made outside Central Bank of Nigeria (CBN)-approved foreign exchange channels may further raise compliance and deductibility concerns under Nigerian tax law.

Treatment of Claims Proceeds: Where a claim is successfully made under a W&I policy, it is unclear whether the insurance proceeds received would be classified as taxable income, a capital gains adjustment, or non-taxable recovery. Such proceeds may be treated as taxable income, particularly where they compensate a buyer or target for financial loss - potentially qualifying as income under the Companies Income Tax Act (CITA).

Alternatively, where the claim relates to a breach affecting asset value (e.g., undisclosed liabilities or tax risks), the payout could arguably constitute a capital gains adjustment, reducing the tax base of the acquired assets. A third possibility is that the proceeds may be viewed as a non-taxable indemnity, especially where they simply restore the recipient to its pre-loss position and do not trigger income or gain.

This lack of clarity creates challenges in tax planning and financial reporting. Where proceeds are paid by offshore insurers, further complications may arise in relation to foreign exchange controls, capital importation requirements, and classification of inflows. The method of remittance - whether through domiciliary accounts or repatriated via official channels - may have tax and regulatory implications. In addition, where the insurer is not tax-registered in Nigeria, there is limited administrative precedent on how such proceeds should be treated, potentially exposing recipients to compliance risks.

Withholding Tax on Premiums Paid to Offshore Insurers: W&I policies are frequently underwritten by offshore insurers and facilitated through non-resident brokers. This raises the question of whether premium payments to such insurers attract withholding tax (WHT) under Nigerian law. Generally, payments to non-residents for services rendered are subject to WHT, which must be deducted at source and remitted to the Federal Inland Revenue Service (FIRS) by the Nigerian payer. However, there is currently no express statutory provision or administrative guidance that confirms whether insurance premiums fall within the scope of WHT.

The uncertainty stems from the difficulty in classifying such payments - whether they constitute "fees for services," which are subject to WHT, or payments for financial risk transfer, which may fall outside the WHT regime under current Nigerian law. Compounding this ambiguity is the absence of a Double Taxation Agreement (DTA) between Nigeria and many jurisdictions where offshore insurers are domiciled, potentially increasing WHT exposure. Where WHT is applicable but not withheld and remitted, the Nigerian payer may face penalties for non-compliance. Furthermore, if the offshore insurer engages a local broker or affiliate in Nigeria, the FIRS may contend that the service was at least partially rendered in Nigeria and seek to apply WHT on that basis.

VAT on Cross-Border W&I Insurance Transactions: Nigerian tax law expressly exempts the payment of insurance premiums from value-added tax (VAT). Accordingly, premiums paid to insurers - whether local or offshore - for insurance contracts, including W&I policies, are not subject to VAT, and neither output VAT nor reverse charge VAT should apply.

However, payments to offshore insurers may raise potential classification concerns under Nigeria's evolving VAT regime, particularly in light of new VAT rules applicable to non-resident digital and service providers. While there is currently no express provision extending reverse charge VAT to insurance premiums, Nigeria's continuing alignment with OECD and ATAF digital tax frameworks suggests that this area may merit ongoing attention.

W&I Insurance in Nigerian M&A - Illustrative Use Cases and Hypothetical Scenarios

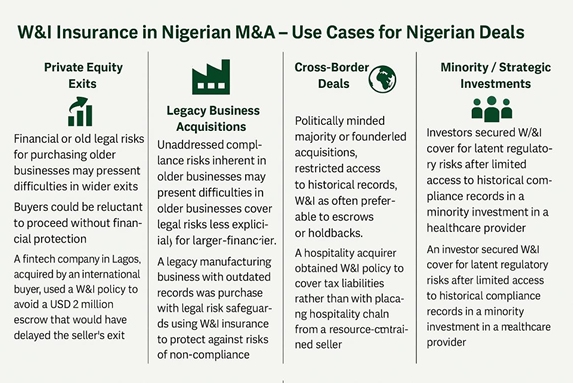

W&I insurance holds significant potential for Nigerian M&A, particularly in transactions where traditional risk allocation tools may be inadequate or commercially unappealing. It is especially useful in private equity exits requiring clean break structures, acquisitions of legacy businesses with limited documentation and compliance gaps, and cross-border deals where enforcement against local sellers is of concern.

The instrument can also be valuable in minority investments within regulated sectors - such as financial services and healthcare - where investors face heightened compliance risk but have limited post-closing control. Similarly, in strategic acquisitions involving founder-sellers, W&I insurance allows buyers to safeguard against legacy liabilities while preserving goodwill and avoiding adversarial post-closing claims.

Summary of Key Legal and Commercial Considerations for Structuring W&I Insurance In Nigerian M&A Transactions

Structuring W&I insurance effectively in Nigerian M&A transactions requires a clear grasp of deal mechanics, insurer requirements, and the local legal and regulatory environment. The considerations below reflect common variables that inform coverage terms, pricing, and insurability. Given persistent tax and regulatory uncertainty, early planning and alignment with transaction documentation are essential for optimising W&I policy outcomes in both domestic and cross-border deals.

Best W&I Practices for Nigerian Mergers and Acquisitions Transactions

The successful use of W&I insurance in Nigerian M&A depends on early planning, coordinated execution, and alignment with broader deal timelines. This section outlines key practical steps for integrating W&I cover into transactions - from early engagement with underwriters to managing interactions with seller indemnities and ensuring policy terms are enforceable under applicable law.

These and other best practices help support smoother execution, reduce friction, and enhance the effectiveness of W&I insurance as a risk allocation mechanism.

- engage insurance brokers and underwriters early - preferably at the term sheet stage

- coordinate legal, financial, and tax diligence with insurance expectations

- carefully structure the interaction between W&I cover and seller indemnities

- align dispute resolution clauses in the SPA with the policy framework

- where using offshore insurers, ensure enforceability of policy claims under Nigerian conflicts of laws rules

From Niche Tool to Strategic Lever

In concluding, W&I Insurance is not yet mainstream in Nigerian M&A. However, for deals involving international investors, high-value transactions, or complex risk allocation needs, it offers a potentially flexible tool to reduce friction, accelerate execution, and facilitate cleaner exits. As underwriting capacity grows and regulatory guidance improves, its relevance in Nigerian private capital, infrastructure, and cross-border investment transactions is set to increase.

The authors are grateful to Omotayo Ogunnaike for her editorial assistance.

Footnote

1. Data sources: https://www.linkedin.com/pulse/2023-private-capital-activity-africa-wttse/; https://www.avca.africa/data-intelligence/research-publications/2023-african-private-capital-industry-survey; https://avca-africa.medium.com/spotlight-on-w-i-insurance-recent-trends-in-african-m-a-transactions-0c255a90c2bf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.