Introduction

In 2024, the Nigerian banking and finance sector experienced significant regulatory changes driven by the Central Bank of Nigeria ("CBN"). The changes were based on CBN's commitment to fostering monetary and exchange rate stability, encouraging innovation in the provision of financial services, strengthening the banks to be able to support a projected USD1 trillion economy by 2030, and aligning the sector with global best practices. Key reforms, such as updates to the regulatory capital requirements and prudential guidelines of banks in Nigeria, alongside heightened compliance obligations, were aimed at fortifying the resilience of financial institutions amidst prevailing macroeconomic challenges. In addition, measures to deepen the Nigerian Autonomous Foreign Exchange Market ("FX Market"), attract foreign direct and portfolio investments, and promote a robust financial system were central to the CBN's regulatory priorities.

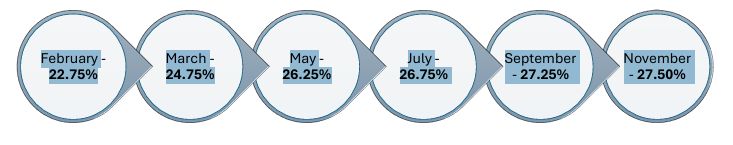

Macroeconomic pressures played a critical role in shaping the sector in 2024, notably the surge in inflation which reached 34.6% by November 2024 and a volatile exchange rate regime. In response to the surge in inflation, the CBN maintained its stance on tightening monetary policy to curb inflationary pressures and stabilise the economy, increasing the Monetary Policy Rate from 22.75% in February 2024 to 27.5% by November 2024. Looking ahead, the outlook for 2025 is expected to emphasise deepening financial system stability and fostering sustainable growth. The CBN is expected to introduce measures to enhance supervisory frameworks. We expect that progressive policies will likely dominate the agenda of the CBN to ensure Nigeria's banking and finance sector remains resilient and competitive in the global financial landscape.

This publication highlights the key regulatory trends that shaped the banking and finance sector in 2024 and provides an outlook for the sector in 2025.

BANKING SECTOR REFORMS

- Banking Recapitalisation Programme

The CBN implemented strategic measures to strengthen the financial position of Nigerian banks by increasing their minimum capital requirements to enable them to effectively support the economy. The capital requirements were introduced on 28th March, 2024 when the CBN issued a circular titled "Review of Minimum Capital Requirements for Commercial, Merchant, and Non-Interest Banks in Nigeria". This policy is designed to ensure that banks not only maintain sufficient capital to sustain their operations within the Nigerian economy but are also better equipped to withstand growing economic challenges. Depending on the type of licence that a bank holds, the new minimum capital requirements range from NGN10 billion to NGN500 billion. The options available to banks include (i) injecting fresh equity capital through 2 private placements, rights issue and/or offer for subscription; (ii) mergers and acquisitions; and (iii) upgrade or downgrade of licence authorisation. Many of the banks have or are in the process of rights issue, public offer or private placement while a few opted for or are considering mergers and acquisitions. Please refer to our earlier publication titled "Options for Nigerian Banks to Meet New Minimum Paid-Up Capital Requirements", using the link here for more details.

- Prohibition on the Use of Foreign Currency Denominated Collateral for Naira Loans (Back-to-Back structure).

The CBN has reaffirmed its commitment to easing pressure on the Naira by taking steps towards curbing the dollarisation of Nigeria's financial system and ensuring that there is liquidity in the FX Market. In this regard, the CBN has prohibited the use of foreign currency deposits in Nigerian banks as collateral for Naira loans. This was pursuant to a letter from the CBN to all banks titled "The Use of Foreign Currency Denominated Collateral for Naira Loans" issued on 8th April, 2024. The CBN specified in the letter that the only permissible forms of foreign currency collateral for Naira-denominated loans are (i) Eurobonds issued by the Federal Government of Nigeria; or (ii) guarantees of foreign banks, including letters of credit. The CBN mandated banks to wind down all such Naira loans collaterised with foreign currency deposits within 90 (ninety) days.

- Consistent increase in Monetary Policy Rate

Due to inflationary and exchange rate pressures in 2024, the CBN through the Monetary Policy Committee adopted an unprecedented approach of increasing in the monetary policy rate ("MPR") every two months resulting in a total of 850 basis points increase in the year. Specifically, the MPR progressed from 18.75 per cent in January to 27.50 per cent by the year-end. The MPR increment timeline is as follows:

The liquidity ratio remained steady at 30%, while the cash reserve ratio (CRR) underwent several adjustments from 32.5% to 50%. In March 2024, the CRR for Deposit Money Banks was maintained at 45%, while the CRR for merchant banks was increased from 10% to 14%. By September 2024, the CRR for DMBs was further raised to 50%, and the CRR for merchant banks climbed to 16%. These changes reflect a tightening of monetary policy aimed at controlling inflation and managing liquidity within the banking sector.

- CRR Framework Implementation Guidelines

In February 2024, the CBN issued a letter titled "Cash Reserve Requirement Framework Implementation Guidelines" to all banks. The letter outlined a new policy framework aimed at strengthening banks' ability to plan, monitor, and align their records with the CBN, addressing the persisting liquidity challenges in the financial system. The policy was introduced in two phases.

Phase 1 applied the existing Cash Reserve Ratio ("CRR") of 32.5% for commercial banks and 10% for merchant banks to their weekly average adjusted deposits. Phase 2 imposed a CRR levy of 50% on the lending shortfall for banks failing to meet the minimum Loan to Deposit Ratio ("LDR"), in line with the CBN's previous directive issued in September 2019.

This policy was designed to enhance liquidity management across the banking sector, ensuring that banks maintain adequate reserves while discouraging risky lending practices. The phased implementation allowed banks time to adjust, with Phase 1 setting a baseline and Phase 2 serving as a corrective measure for banks not meeting the LDR requirements. The linkage between CRR adjustments and LDR performance encourages banks to strike a balance between maintaining liquidity and supporting sustainable lending, ultimately contributing to the stability of the financial system.

- Guidelines on Management of Dormant Accounts, Unclaimed Balances and Other Financial Assets

The CBN has reinforced its efforts to address issues relating to dormant and unclaimed funds in the financial system. In July 2024, the CBN issued a circular titled "Guidelines on Management of Dormant Accounts, Unclaimed Balances and Other Financial Assets in Banks and Other Financial Institutions in Nigeria". The guidelines, issued pursuant to the Banks and Other Financial Institutions Act 2020, supersede the previous 2015 guidelines and establish new measures to address dormant and unclaimed funds in Nigeria's financial system.

The guidelines require financial institutions to transfer dormant balances and unclaimed assets, which have been inactive for at least ten years, to a newly created Unclaimed Balances Trust Fund ("UBTF") Pool Account maintained by the CBN. These balances include local currency in savings, current and fixed deposit accounts, funds in domiciliary accounts, deposits towards the purchase of shares and mutual investments, and unclaimed wages amongst others. Financial Institutions must report and transfer unclaimed balances quarterly, accompanied by detailed records.

Additionally, the CBN introduced measures for the management of these funds, such as investing them in Nigerian Treasury Bills or other approved securities. Beneficial owners retain the indefinite right to reclaim their funds, with both the principal and applicable interest refunded within 10 (ten) working days upon verification. This regulation aims to protect unclaimed funds, promote transparency in the management of dormant assets, and ultimately enhance trust and confidence in Nigeria's financial system.

FOREIGN EXCHANGE REFORMS

- 2024 Market Performance Post-FX Market Segments' Unification of 2023

In 2023, the Nigerian foreign exchange landscape witnessed a significant shift. The CBN took key steps aimed at protecting the integrity of the FX Market, promoting transparency and mitigating FX volatility pressures. One of these steps was the abolition of the segmentation in Nigeria's FX Market and collapsing of all segments into the then Investors & Exporters (I&E) Window. The CBN also re-introduced the willing-buyer, willing-seller model as the market's guiding principle, consistent with the existing I&E Window framework established by the CBN as of April 2017. With this step, the CBN stopped the publication of benchmark rates and FMDQ Exchange Limited assumed the responsibility to publish prevailing official exchange rates. The unification curbed opportunities for round-tripping and arbitrage practices and enabled the CBN to clear the backlog of unrepatriated investment proceeds.

As a result, the FX Market in 2024 witnessed a remarkable boost in investor confidence, exemplified by a record foreign portfolio investment inflow of about US$14 billion. Remarkably, despite the positive developments, the Naira depreciated by more than 40% in 2024. This was despite the CBN's year-round efforts to stabilise the FX Market and prevent further depreciation of the Naira.

Looking ahead to 2025, the outlook for Nigeria's FX Market remains positive, with investor confidence likely to be sustained. The FX Market has witnessed a relative stability at the beginning of the year and the Naira has appreciated slightly against other convertible currencies. This optimistic start of the year could be sustained provided that the CBN continues to prioritise FX Market stability, enhance liquidity, support increased productivity, drive non-oil exports, and make decisive cut in interest rate to stimulate economic growth.

- Removal of the Spread on Foreign Exchange Transactions

On 8th February, 2024, the CBN removed the ±2.5% cap spread on interbank FX transactions, along with lifting the restrictions on the sale of interbank proceeds by Authorised Dealers. This policy shift expands the market for Authorised Dealers and allows FX transactions to be driven more directly by supply and demand dynamics. As a result, transactions are expected to become faster, more predictable, and transparent. The CBN stated that this change aligns 5 with its goal of promoting a "market-based price discovery system," which is anticipated to improve the efficiency of the FX Market and foster greater stability in the long run.

- Introduction of the Nigeria Foreign Exchange Market ("NFEM") and the NFEM Rate

The CBN, in its continued efforts to deepen the Nigeria FX market published the Revised Guidelines for the Nigeria Foreign Exchange Market on 29th November 2024 (the "NFEM Guidelines"). The NFEM Guidelines cover critical regulatory and operational issues and changes to the regulatory regime. It also prescribed the roles of participants in the NFEM, FX transaction pricing mechanisms, and market participants' compliance and reporting standards. The NFEM Guidelines made far-reaching changes and supersede (i) the Operational Changes to the Foreign Exchange Markets, dated 14th June, 2023; (ii) Circular to All Authorized Dealers: Establishment of Investors' & Exporters' FX Window, with Ref: FMD/DIR/CIR/GEN/08/007, dated 21st April, 2017; and (ii) Revised Guidelines for the Operation of the Nigerian Inter-Bank Foreign Exchange Market.

The NFEM Guidelines provide that only trade-backed (visible and invisible) transactions as defined in the Revised CBN Foreign Exchange Manual 2018 (as amended) (the "FX Manual") are eligible for the purchase of FX in the NFEM. The NFEM Guidelines also permit Bureaux de Change (BDC) operators to access FX from Authorised Dealers to fulfill eligible customer needs, subject to an aggregate monthly cap of USD25,000.00. This development is aimed at enhancing BDCs' access to liquidity, broadening market access and promoting greater stability and efficiency in Nigeria's FX Market.

The CBN will publish daily transactional rates and market data to further enhance market efficiency and regulatory oversight. Please click here to access our analysis of the FX Guidelines.

- Introduction of the Electronic Foreign Exchange Matching System

On 2nd October, 2024, the CBN implemented a series of key reforms aimed at enhancing the efficiency and transparency of the NFEM. One of the changes was the introduction of the Electronic Foreign Exchange Matching System ("EFEMS"), which was officially launched on 1st December, 2024, following a two-week test run. The EFEMS is designed to streamline FX transactions by providing a platform for real-time buy/sell order matching and FX price transmission. It aims to reduce speculative activities and improve market transparency, while also minimising counterparty risk. The EFEMs platform is exclusively used for executing spot FX transactions between the Naira and the US Dollar, with the potential for other currencies to be included in the future.

The EFEMS operates with clear trading and operational requirements, such as daily transaction reporting to the CBN, mandatory trading hours from 9:00 am to 4:00 pm (WAT), and a minimum trade value of US$100,000. Furthermore, the system promotes governance and accountability, with the CBN overseeing all FX transactions and owning all trade data, ensuring informed policymaking. The introduction of the EFEMS is a pivotal step in strengthening Nigeria's FX market, fostering greater market efficiency, and providing the foundation for continued financial stability in 2025. This reform is expected to contribute to more predictable and transparent FX pricing, further boosting investor confidence and supporting Nigeria's broader economic goals. Please refer to our earlier publication titled "An Overview of the CBN FX Code and Circular on the Electronic Foreign Exchange Matching System", using the link here for more details.

- Introduction of the FX Code

As part of the CBN's policy drive to introduce mechanisms for effective governance, professionalism, and transparency and to bring some integrity within the FX Market, it published a draft of the Nigeria Foreign Exchange Code ("FX Code"). The CBN officially announced the approval of the FX Code on 22nd January, 2025. The FX Code establishes a comprehensive framework for ethical conduct, governance, and market discipline in FX transactions. It outlines six guiding principles: ethics, governance, execution, information sharing, risk management, and confirmation and settlement aimed at ensuring fair pricing, proper risk management, and accountability.

The CBN's adoption of the FX Code aligns with its broader goal to enhance market liquidity, reduce speculative activities, and improve the overall functioning of the FX Market. Looking ahead in 2025, these reforms are expected to transform the FX Market, contribute to efficient price discovery, increased liquidity, and a more stable exchange rate environment. The CBN's continued efforts to instill professionalism and global best practices in the FX Market will be pivotal in shaping the outlook for 2025 and beyond. Please refer to our earlier publication titled "An Overview of the CBN FX Code and Circular on the Electronic Foreign Exchange Matching System", using the link here for more details.

- Sale of FX by the CBN to BDCs to Meet Market Demand for Invisible Transactions

In a bid to address the expected demand for FX and ease pressure on the retail FX market, the CBN reintroduced the sale of USD to BDCs. Consequently, all existing BDCs are now temporary allowed to purchase FX from the CBN whenever the CBN makes same available for sale to BDCs and to access to the NFEM to purchase FX from Authorised Dealers, subject to a weekly cap of US$25,000. These measures aim to improve FX accessibility for eligible transactions while curbing the widening exchange rate premium in the parallel market. This is currently expected to continue into the second quarter of 2025.

- New IMTO Guidelines and its Impact

The CBN issued the Reviewed Guidelines of International Money Transfer Services in Nigeria (the "IMTO Guidelines") on 31st January 2024 which provide a new framework for the licensing and operations of International Money Transfer Operators ("IMTOs") in Nigeria. The introduction of the IMTO Guidelines marks a significant shift in the remittance industry in Nigeria in terms of improving liquidity in the Nigerian FX market and expanding the permissible activities of IMTOs. IMTOs are now permitted to process individual to individual, business to individual and business-to-business inbound transfers and access Naira's Nigerian foreign exchange market to settle diaspora remittances. These are commendable changes which aim to encourage the remittance of funds to beneficiaries in Nigeria through official channels. Please refer to our earlier publication titled "An Overview of the CBN's New Measures to Enhance Local Currency Liquidity for Settlement of Diaspora Remittances by IMTOs", using the link here for more details.

- Bureaux De Change Operations in Nigeria

The CBN issued the Guidelines for Bureaux de Change Operations in Nigeria 2024 (the "BDC Guidelines") on 22nd May, 2024. The guidelines introduced significant changes to the operation of BDCs in Nigeria. Some of these changes include licensing, capital requirements, permissible and non-permissible activities, sources of foreign exchange by BDCs, mode of disbursement of funds for transactions, issuance of cards, and operation of bank accounts by BDCs. Please refer to our earlier publication titled "An Overview of the New Regime for Bureaux De Change Operations in Nigeria", using the link here for more details."

- Payment Service Providers' Connectivity to Payment Terminal Service Aggregators for the Processing of Electronic Transactions

The CBN, pursuant to its powers to promote and facilitate the development of efficient and effective systems for the settlement of transactions (including electronic transactions) in Nigeria, issued a circular to all Payment Service Providers ("PSPs") on 11th September 2024 regarding their connectivity to Payment Terminal Service Aggregates ("PTSAs") (the "Circular").

The Circular introduced new routing guidelines for Point of Sale ("PoS") transactions to improve oversight and monitoring of electronic transactions within the Nigerian payments system. The Circular mirrors the broader strategy of the CBN to decentralise PoS transaction routing and address various concerns of stakeholders associated with the centralisation of all PoS transactions under a single aggregator, the Nigeria Interbank Settlement System Plc ("NIBSS"). The Circular reflects the concerted efforts of the CBN to enhance transparency and efficiency in electronic payments processing within Nigeria's electronic payments ecosystem.

Please refer to our earlier publication titled "Payment Service Providers' Connectivity to Payment Terminal Service Aggregators for the Processing of Electronic Transactions", using the link here for more details."

OUTLOOK FOR 2025

Looking ahead to 2025, Nigeria's banking and finance landscape is poised for significant transformation, driven by technological advancements, regulatory reforms, and evolving market demands. The sector's growth will be anchored on the CBN's continued commitment 8 to maintaining macroeconomic stability and implementing key reforms and the Federal Government's drive for Nigeria to be a USD1 trillion GDP economy by 2030. The CBN's efforts were articulated by the CBN Governor, Mr. Olayemi Cardoso, in his keynote address at the 59th Annual Bankers Dinner of the Chartered Institute of Bankers of Nigeria held in November 2024, where he outlined strategic initiatives aimed at advancing the banking sector in 2025 and beyond.

Among the key priorities outlined by the CBN Governor in his address was the implementation of an open banking framework expected to facilitate greater competition and innovation within the financial services industry by allowing third-party providers access to bank data. The introduction of open banking will provide consumers with a broader range of financial products and services, enhancing accessibility and inclusion, especially for underserved populations. As financial institutions leverage this framework, we anticipate a surge in the development of new products that cater to diverse customer needs, further enhancing financial inclusion.

Another critical initiative highlighted by the CBN Governor was the expansion of contactless payment systems. Contactless payments, which have already gained popularity in many global markets, will become more prevalent in Nigeria's banking sector in 2025. By supporting the infrastructure and regulatory environment needed to enable this transition, the CBN will encourage banks and merchants to adopt these solutions, promoting the benefits of digital payment systems to a larger segment of the population. The CBN Governor also emphasised the need for the expansion of the regulatory sandbox, a key mechanism to encourage innovation in financial services. The sandbox allows fintech companies, banks, and other financial institutions to test new products in a controlled environment before scaling them. By fostering innovation while ensuring that consumer protection and financial stability are not compromised, the sandbox initiative has the potential to drive the growth of Nigeria's fintech ecosystem. Startups, especially those in the digital payments and lending sectors, are expected to benefit from the flexibility and support provided by the sandbox. This initiative will continue to encourage competition, attract foreign investments, and position Nigeria as a leading fintech hub in Africa in 2025 and beyond.

In addition to these reforms, the CBN Governor also emphasised the need for banks to fulfil their intermediation and market-making roles, which will be critical to the banking sector's overall success in 2025. The CBN expects banks to rise to the challenge of providing tailored financial solutions that address the diverse needs of businesses, especially small and medium-sized enterprises, which are the backbone of Nigeria's economy. We expect that financial institutions will take up this challenge in 2025 to deliver bespoke financial products to their customers and expand their operations. Flowing from the above CBN's 2025 strategy, as highlighted by the CBN Governor in the keynote address, and some of the recent regulations and policies that have been implemented by the CBN, we anticipate several key developments in the following areas in 2025:

- Increased Activities for Banks regarding Capital

As the deadline for banks to meet the new capital requirements draws near, we expect increased activities by banks to raise capital through various means. There could be some mergers and acquisitions by and among some banks in 2025. This is because the expectation is that it is not all licensed banks that will be able to meet the new capital requirements on a standalone basis. The recapitalisation strategy that is adopted by banks will not only strengthen financial institutions but also enhance their competitiveness in both local and international markets.

- Economic Growth and Monetary Policies

Over the past two years, the Nigerian government has implemented critical reforms to promote macroeconomic stability, improve fiscal stability, incentivise investments, and slow down inflation. Some of these reforms include the removal of fuel subsidies, depreciation of the Naira and unification of the foreign exchange rates. While these measures have resulted in short-term pressures on businesses and consumers, they are expected to lay the foundation for future economic resilience. As projected by the World Bank, Nigeria's economic growth will strengthen to an average of 3.6% annually in 2025 and 2026.

Looking at macroeconomic factors, the CBN's efforts to stabilise the Naira and control inflation will remain central to the banking sector's performance in 2025. The CBN's monetary policy and fiscal interventions will be key in ensuring that inflation is kept within manageable levels, thus supporting the purchasing power of consumers and the profitability of businesses. The government has stated its intention to reduce inflation to about 15% in 2025.

The government's commitment to diversifying the economy away from oil will likely generate significant opportunities in non-oil sectors such as agriculture, manufacturing, mining, and technology. This economic diversification strategy is expected to create fresh opportunities for the banking sector to provide financial services to emerging industries, further driving economic growth and financial inclusion. In particular, the agriculture and technology sectors stand out as areas where financial institutions can play a key role in providing tailored financing solutions to foster growth and development.

Also, as the digital transformation of Nigeria's economy continues to unfold, the role of digital banking and fintech solutions will become increasingly important in 2025 and beyond. More Nigerians are expected to adopt mobile banking, digital wallets, and other fintech innovations, which will drive deeper financial inclusion across the country.

- Credit Access Expansion in Nigeria

One significant development for 2025 is the establishment of the National Credit Guarantee Company (the "Company"), as announced by President Bola Ahmed Tinubu in his New Year address. Set to begin operations by Q2 2025, the Company will be saddled with the mission of expanding credit access to consumers, strengthening the confidence of the financial system and providing support to underserved groups. The aim of the Company is to bolster credit availability, boost investor confidence, and support Nigeria's re-industrialisation efforts, which could significantly improve living standards and foster economic development. When the Company becomes operational, it is expected to have a positive impact on the financial system in 2025.

- Domestic and Cross-border Expansion of Banking Operations

In recent years, some tier 1 Nigerian banks have increasingly sought opportunities outside the country to mitigate local risks, access global markets, and diversify their portfolios. Among the drivers of the expansion strategy of Indigenous banks include the exigent need to mitigate in-country-specific risks, capitalise on the opportunities in other African and global markets and diversify their portfolios. We expect that in the coming months, some banks will expand into new economies by either establishing their base or entering into strategic arrangements to unlock their presence and maintain their foothold in the global market.

- Payments Ecosystem in Nigeria

The CBN's launch of the Payments System Vision 2025 (PSV 2025) in November 2022 is setting the stage for a transformed payments landscape. The roadmap outlines key initiatives to enhance Nigeria's payment system, focusing on greater financial inclusion, digital payment adoption, and security improvements. Notable components of PSV 2025 include upgrading payment infrastructure, supporting the deployment of contactless solutions, developing an open banking framework, and exploring blockchain technologies like Central Bank Digital Currency. Additionally, the CBN has been pushing for greater interoperability in the payments ecosystem to ensure seamless transactions across various service providers. With these strategies in place, Nigeria aims to become a leading hub for digital payments in Africa, fostering increased economic activity and financial inclusion. We expect this initiative to start yield positive results in the Nigerian payment space in 2025. As a result, we expect to witness more stringent regulation in the coming months as the CBN aims to fast-track its strategy to meet the stated timeline.

- Increased FX Market reforms to spur liquidity and stability

In line with its ongoing efforts to stabilise the FX Market, the CBN introduced two new account types for Non-Resident Nigerians (NRNs): the Non-Resident Nigerian Ordinary Account (NRNOA) and the Non-Resident Nigerian Investment Account (NRNIA). These accounts are aimed towards facilitating foreign currency remittances, enable investments in Nigeria's financial markets and reduce reliance on intermediaries by Nigerian 'disaporans'. The accounts, which became effective on 1st January, 2025, allow for the full repatriation of funds, both foreign and local currency, and the conversion of foreign currency into naira at prevailing exchange rates. To enhance the seamless implementation of its policy changes regarding diasporans' remittances, the CBN Governor announced the launch of a Bank Verification Number (BVN) platform for diaspora Nigerians to ease KYC compliance and facilitate easier participation in the Nigerian economy. By enhancing the participation of Nigerians abroad in the domestic economy, the CBN hopes to strengthen foreign exchange reserves and support the broader financial system which, if adopted, would enhance liquidity in the NFEM in 2025.

To ensure that exporters repatriate all their export proceeds to Nigeria and boost liquidity in the FX market, the CBN has announced an immediate suspension of all requests for extensions on the repatriation of export proceeds for both oil and non-oil exports. This directive is part of the CBN's ongoing efforts to enforce stricter adherence to foreign exchange regulations and ensure the timely repatriation of export proceeds to the country. In this regard, Authorised Dealers are no longer permitted to request extensions for the repatriation of export proceeds on behalf of exporters. Consequently, non-oil export proceeds must be repatriated within 180 (one hundred and eighty) days, and oil and gas export proceeds must be repatriated within 90 (ninety) days, both from the bill of lading date.

This policy reflects the CBN's commitment to improving foreign exchange management by enhancing liquidity and preventing delays in the inflow of export proceeds thereby enhancing the stability of the Naira. By enforcing stricter timelines for repatriation, the CBN aims to stabilise the country's foreign exchange reserves, promote more liquidity in the market, and support the broader financial system.

- Enforcement of Existing Regulations

The CBN is increasingly enforcing its regulations against defaulting financial institutions for regulatory infractions and imposing applicable penalties. This is part of its broader strategy to ensure public trust and confidence in the financial system. As 2025 unfolds, banks and other financial institutions can expect tighter monitoring and further regulatory scrutiny regarding their operations. They should, therefore, ensure that the carry out their operations within the bounds of applicable laws and regulations to mitigate against the risk of financial penalties for infractions.

- Potential Amendment of the BOFIA

The Nigerian government is leveraging the Business Facilitation (Miscellaneous Provisions) Act ("BFA"), an omnibus act, to drive amendments to critical laws, including the BOFIA. This initiative, spearheaded by the Presidential Enabling Business Environment Council, is aimed at improving the ease of doing business and attracting investments across sectors, particularly within the banking and finance industry. The Business Facilitation (Miscellaneous Provisions) Act, 2022 was used to amend about 21 business-related laws. The BFA serves as a legislative tool to address gaps and inefficiencies in existing laws, ensuring they align with global standards and reflect current market realities. For the BOFIA, the proposed amendments aim to establish a more flexible and investment-friendly regulatory framework, address ambiguities, and remove provisions that hinder financial sector growth and foreign participation. Stakeholder consultations have identified key areas for reform, including overly restrictive provisions, inconsistencies with international best practices, and the need for greater clarity in financial regulations. The proposed amendments aim to enhance the operational environment for banks and other financial institutions while fostering investor confidence in the Nigerian financial system. We expect that the proposed changes will happen in 2025 which will lead to an amendment of the BOFIA. Should that happen, there is likely to be increased activities in the financial sector of the Nigerian economy.

CONCLUSION

Nigeria's banking and finance sector has grown and shown resilience amid challenging macroeconomic conditions characterised by rising inflation and currency volatility. The outlook for 2025, however, remains cautiously optimistic, with expected growth fueled by strategic reforms and innovations in the financial services sector. The various initiatives, being spearheaded by the CBN, including enhanced payment systems, credit access programmes, and foreign exchange market reforms, will play a pivotal role in shaping the future of the financial sector of the Nigerian economy which will result in positive growth in the overall economy. While external challenges like global inflation and oil price fluctuations could remain, the government's ongoing efforts to diversify the economy and implement sound fiscal and monetary policy reforms will provide a strong foundation for sustained growth and stability in the long term. Overall, we expect a more resilient and stable financial sector in 2025 and beyond.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.