- within Transport topic(s)

- in United States

- within Litigation, Mediation & Arbitration and Employment and HR topic(s)

Executive Summary

Having taken effect on 1 January 2025, the FuelEU Maritime Regulation is poised to reshape shipping operations, prompting vessel owners and stakeholders to adapt their business models in anticipation of its implementation. In addition to imposing strict limits on the greenhouse gas (GHG) intensity of fuels, the regulation requires a shift to low-intensity fuels and mandates that ships connect to onshore power supplies at designated ports to further reduce emissions.

This article provides an overview of the regulation's scope, outlining key obligations and explaining the compliance process. While it explores the potential pitfalls and economic implications for non-compliant companies, it also includes a brief overview of the flexibility mechanisms available. This in-depth exploration of the FuelEU Maritime Regulation serves as a valuable resource for industry professionals looking to refine their commercial strategies in line with the new regulatory framework.

Introduction

As the shipping industry grapples with the complexities of the EU's Emissions Trading System ('EU ETS'), another significant component of the EU's Fit for 55 agenda looms on the horizon: the FuelEU Maritime Regulation1 (Regulation (EU) 2023/1805). Adopted by the Parliament and Council on 13 September 2023, and having taken effect on January 1, 2025, the EU frames this Regulation as an attempt to accelerate the adoption of renewable and low-carbon fuels and green technologies in shipping. It targets a reduction in the carbon intensity of fuels used by ships by at least 55% by 2030 with 1990 as a baseline. While the FuelEU Regulation does not specify the low-carbon fuels required, it imposes strict limits on the permissible annual greenhouse gas ('GHG') intensity of the energy consumed onboard ships, thereby restricting the use of fossil fuel-derived energy.

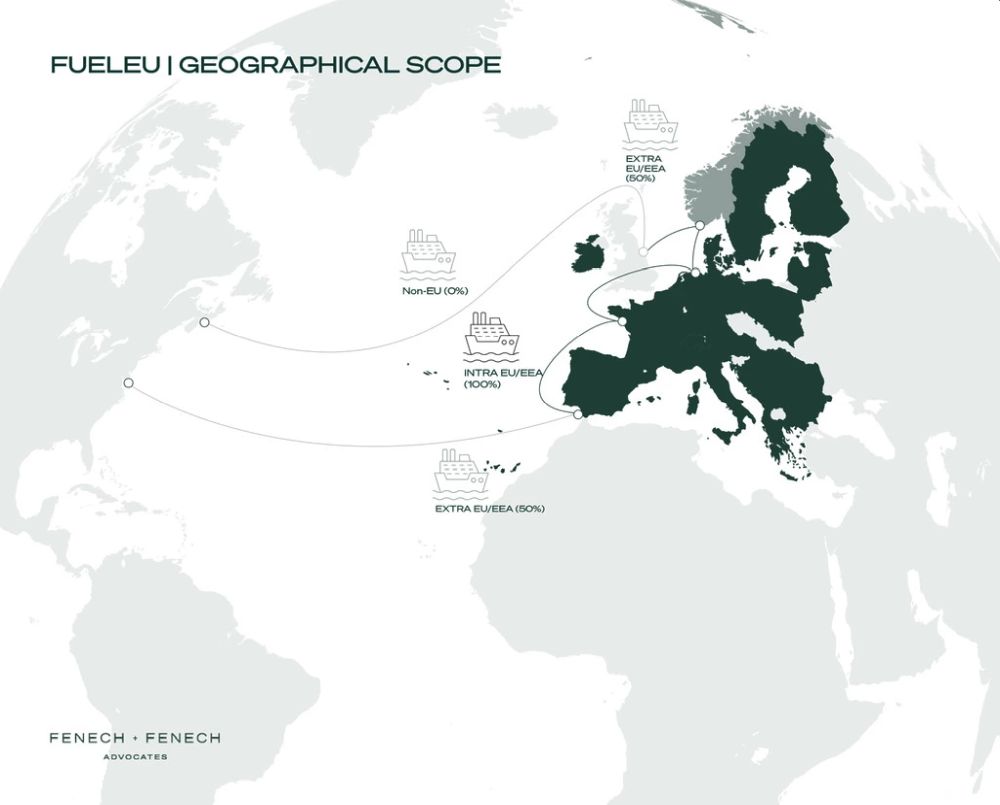

FuelEU Regulation: Scope, Compliance, and Port Definition

The FuelEU Regulation is being presented as a major initiative targeting all cargo and passenger ships over 5,000 Gross Tonnes ('GT'), regardless of their flag. It requires these ships to comply with the obligations set forth by the FuelEU Regulation when calling at ports within the jurisdiction of EU Member States. The geographical scope of this Regulation extends to 100% of intra-EU and EEA voyages, as well as 50% of voyages between EU/EEA and non-EU/EEA ports. FuelEU specifically targets the release of greenhouse gas (GHG) emissions, particularly carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O), into the atmosphere.

The FuelEU Regulation defines a port of call as a port where vessels stop to load or unload cargo or to embark or disembark passengers. This excludes stops solely for refuelling, obtaining supplies, crew repatriation, drydocking, or transshipment stops in designated neighbouring container transhipments ports through the Commission's implementing act. Similarly to the EU ETS the Commission shall designate neighbouring container transhipment ports to reduce the risk of non-conformity with the Regulation by container ships relocating their transshipment activities outside of the European Economic Area. To this end, the ports of Tanger-Med and East Port Said are expected to be designated as Neighbouring Container Transhipment Ports once again.

Core Obligations under The FuelEU Regulation

- GHG Intensity Reduction Targets

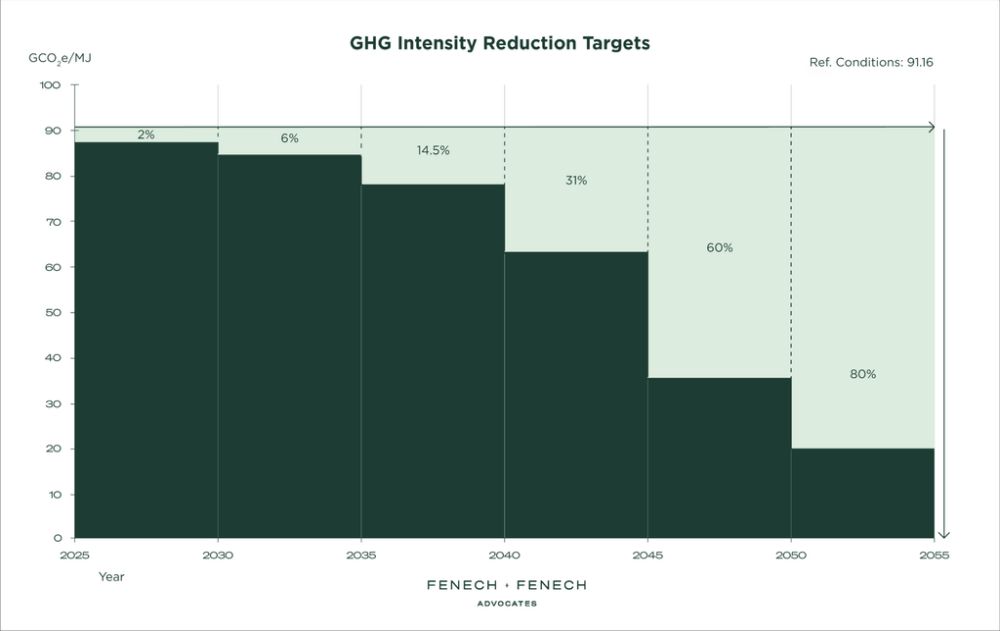

The Fuel EU Regulation adopts a "well-to-wake" approach, accounting for the entire life cycle of fuel emissions; from extraction and processing to transportation and combustion onboard. As from January 2025, shipping companies are required to reduce the GHG intensity of their ships' energy consumption at a staggered rate. This will be implemented by ensuring that the average amount of GHG produced per unit of energy used annually on board a vessel does not exceed a specific limit set by the Fuel EU Regulation. Technically, this limit is determined by reducing a reference value of 91.16 grams of CO2-equivalent per megajoule by an increasing and variable percentage over several years. The infographic below provides further clarification on this.

In summary, the limit on GHG emission intensity for vessels calling at EU/EEA ports is as follows:

- 2% from 1 January 2025

- 6% from 1 January 2030

- 14.5% from 1 January 2035

- 31% from 1 January 2040

- 62% from 1 January 2045

- 80% from 1 January 2050

Broadly speaking, if a vessel's yearly average GHG intensity is below the applicable limit, it will achieve a positive compliance balance. Conversely, if a vessel's annual average GHG intensity exceeds the limit, it will have a negative compliance balance. Compliance is assessed individually for each ship; however, there are mechanisms for compensating imbalances with other vessels.

2. Connecting to Onshore Power Supply ('OPS')

The second obligation imposed by the Fuel EU Regulation is that vessels moored at TEN-T Ports2 for more than two hours, are required to connect to an onshore power supply ('OPS') or equivalent zero-emission technologies, such as energy storage or on-board power generation, to meet all their electrical power needs while at berth. By way of exemption, if the port does not have OPS installed at the quayside, this requirement will only take effect starting on 1 January 2035. It is essential to recognise that while ships will be required to connect to the OPS/alternative zero emission technology at berth, ports bear a corresponding duty to provide such infrastructure. This shared responsibility aligns with the EU's Fit for 55 agenda, promoting the effectiveness of these measures through coordinated development.

The Compliance Process

Who is responsible for compliance?

The entity responsible for ensuring compliance with the FuelEU Regulation is the company holding the Document of Compliance (DoC) under the International Safety Management (ISM) Code. Ship owners should carefully evaluate whether they have the necessary capacity and expertise to manage FuelEU compliance as the DoC holder or if it would be more prudent to appoint an ISM Company to handle this responsibility. Ultimately, the DoC holder remains liable for any penalties arising from non-compliance.

Accordingly, the company must use the amended Monitoring, Reporting, and Verification (MRV) Regulation3 to monitor, record, and report emissions according to an approved FuelEU Regulation monitoring plan.

Compliance Deadlines and Timeline

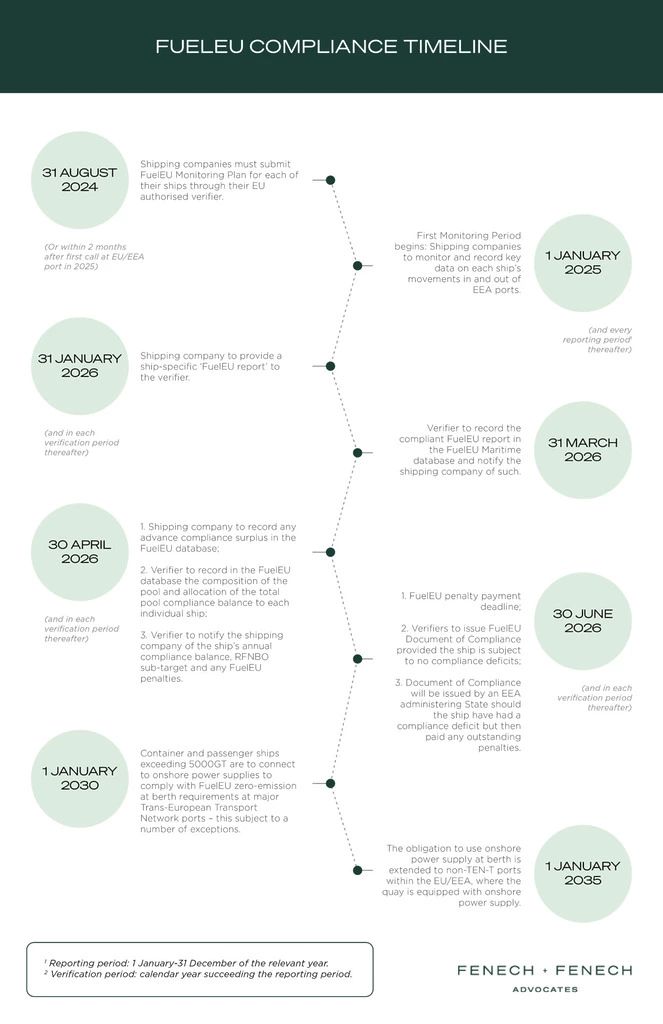

To ensure adherence to the FuelEU Regulation, the company must follow specific compliance steps as outlined in the infographic below.

By August 31, 2024, shipping companies should have submitted a monitoring plan to their independent approved verifier, typically a classification society. This plan should detail how the companies will monitor and report energy consumption and other relevant factors in accordance with the FuelEU Regulation and its associated implementing acts. The Commission is expected to publish a standard monitoring plan later this year to guide preparations. The monitoring plan must be continuously updated to reflect accurate data and to record any significant operational changes, such as a change in the Document of Compliance (DoC).

Starting January 1, 2025, companies are required to collect detailed fuel and energy consumption data for each intra-EU voyage. This data must be compiled annually into a 'FuelEU report' and submitted for verification and review by the authorities.

Following each reporting period, beginning in 2025, the verification phase will commence. During this phase, data collected throughout the preceding reporting period will be analysed, the compliance balance will be assessed, and both the data and results will be entered into the FuelEU database. This verification process will align with the existing MRV reporting framework and involve the shipping company (as the DoC holder), an independent verifier, and the relevant administrative authority.

The key steps within the Verification Phase are as follows:

By 31 January 2026 (and for each subsequent period): The shipping company is required to submit its FuelEU report to the verifier. The verifier will assess the data and determine the vessel's compliance balance. Should any non-conformities or discrepancies be identified, the shipping company must address these issues immediately.

By 31 March 2026 (and for each subsequent period): The verifier will record the FuelEU report and compliance balance in the FuelEU database and notify the shipping company.

By 30 April 2026 (and for each subsequent period): The shipping company needs to update the FuelEU database to specify if it plans to borrow an advance compliance surplus or pool with other vessels. If the shipping company chooses to make use of the pooling mechanism, a verifier appointed by the participating shipping companies will assess the total compliance surplus, document the pool's structure, and allocate the compliance balance to each vessel.

In essence, the Verification Phase provides the maritime industry only the month of April to finalise its compliance strategy based on its compliance balance. Therefore, it is advantageous for parties to establish contractual arrangements before the reporting period begins, enabling them to make well-considered decisions about their compliance strategy when the time comes to adopt the best approach.

By 1 June 2026 (and for each subsequent period): the designated administrative authority for each relevant Company will inform the Company if any vessel has a compliance deficit and is liable for a FuelEU penalty.

By 30 June (and for each subsequent period): The verifier will issue a "FuelEU Document of Compliance" for vessels which either carry no compliance deficits, or for vessels who have settled any outstanding FuelEU penalty.

Penalties and Enforcement: The 'Polluter Pays' Principle in Action

Integral to the FuelEU Regulation is the 'Polluter Pays' principle, which holds the DoC holder responsible for any penalties incurred. Nevertheless, such liability may be shared with fuel suppliers where contractual arrangements are made in this regard. Article 10 of the Fuel EU Regulation establishes the standards for bunker fuel quality required to maintain compliance with the Regulation. If green fuels are not provided as agreed upon or if such fuels fail to meet the agreed GHG intensity standards, such suppliers may be held accountable for penalties typically assigned to the Shipping company.

The FuelEU Regulation enforces a vessel-based compliance framework, thus enforcement action will fall upon the vessel should the DoC holder fail to make the necessary payments for penalties for two consecutive years or where the set-out regulatory requirements are not met. Such enforcement may even include the vessel's potential detention. These stringent compliance measures underscore the critical importance of selecting a reliable and diligent ISM Company.

Flexibility Mechanisms

The FuelEU Regulation introduces flexibility mechanisms that provide Shipping companies with options to manage their compliance and derive value from exceeding GHG intensity reduction targets:

- Banking – If a vessel surpasses its GHG intensity reduction target in any given year, the company can "bank" the surplus reductions and carry them forward to offset future deficits. Since there is no expiration date on these banked surpluses, they can be stored indefinitely and used whenever a vessel is at risk of falling short of its reduction targets in subsequent years.

- Borrowing – If a vessel incurs a deficit, the company can borrow a surplus from the next reporting period to address the shortfall. This borrowing is subject to a 10% penalty and cannot be utilised in consecutive reporting periods. Additionally, the borrowing is capped at 2% of the reduction target.

- Pooling – This mechanism allows companies to monetise any excess compliance by sharing or trading surplus reductions even with third party vessels. By virtue of this, not only can companies pool surpluses among their own fleet, but they can also sell or trade these surpluses to other companies seeking to cover their compliance shortfalls.

Potential Pitfalls and Economic Implications

Notwithstanding the FuelEU Regulation's intention to apply non-discriminately to ships, and despite the same Regulation's recital justifying the exclusion of vessels below 5,000 GT to ensure coherence with Union and international rules and to limit administrative burdens, this approach, may overlook the broader implications.

Another possible area of concern is the exemption of stops by containerships at neighbouring container transhipment ports (NCTPs) from the definition of a "Port of Call." Although the European Commission has yet to adopt implementing acts to establish the list of these ports—and has until 31 December 2025 to do so—it is highly probable that the list will mirror those already designated for the EU ETS. As a result, vessels may reroute to NCTPs specifically to circumvent the regulation. This outcome would directly undermine the regulation's primary objective, as such rerouting would paradoxically result in longer voyages and an increased carbon footprint.

Furthermore, this creates a worrisome situation for EU Member States, particularly those whose economies rely heavily on maritime activities. For instance, countries like Malta—whose GDP is significantly dependent on maritime trade, including operations at the Malta Freeport and related services—face severe economic disruption. The combination of exempting vessels below 5,000 GT and designating certain ports as NCTPs risks incentivising shipping operators to bypass EU ports altogether. Instead, operators could call at these NCTPs and subsequently deploy smaller feeder vessels under 5,000 GT to access the EU market.

Such a scenario risks creating the perfect storm: a mechanism for circumventing the FuelEU Regulation while simultaneously jeopardising the economies of Member States that depend on maritime trade.

Malta's Shore Power Initiatives: Supporting FuelEU Regulation Compliance

Malta's commitment to the decarbonisation of the maritime industry is evident through its substantial investment in its shore-to-ship infrastructure. In July 2024, the stupendous LNG Fuelled, MSC World Europa cruise ship inaugurated Malta's shore power facility in the Grand Harbour, Valletta; pioneering as the first operational facility in the Mediterranean. This landmark achievement is the fruit of a transformative project, co-financed by the European Union, expecting to reduce 90% of air pollution in the Grand Harbour area. This sustainability rationale also extends to the Malta Freeport were works on an OPS facility commenced in October 2023, with completion anticipated for 2025. With connection to the local electricity grid, the environmental impact on the surrounding area will be considerably reduced.

Malta's proactive efforts in advancing more sustainable maritime operations not only position the jurisdiction at the forefront of the industry but also facilitate vessels' compliance with their FuelEU obligations.

Looking Ahead: Adopting a Proactive Approach

As the maritime industry approaches the FuelEU Regulation's implementation, stakeholders must navigate a complex regulatory environment. While the EU is presenting this policy as an innovatively green measure, the FuelEU Regulation falls short from prescribing the alternative fuels which the maritime industry must use to ensure compliance. Instead, it seems to adopt a laissez-faire approach, merely requiring that the annual average intensity of the energy used on board vessels does not exceed a specified GHG intensity limit.

Along with valuable support from Member States like Malta, which invests in shore-to-ship infrastructure to aid shipping companies in enhancing compliance, achieving compliance with the FuelEU Regulation requires more than just infrastructure. Ship owners must also develop a comprehensive compliance strategy and align their contractual agreements with this new Regulation. Additionally, leveraging flexibility mechanisms and investing in decarbonisation technologies should be strongly considered to ensure effective compliance.

Footnotes

1.Regulation (EU) 2023/1805 of the European Parliament and of the Council of 13 September 2023 on the use of renewable and low-carbon fuels in maritime transport and amending Directive 2009/16/EC

2. List of TEN-T Ports

3. Regulation (EU) 2015/757 of the European Parliament and of the Council of 29 April 2015 on the monitoring, reporting and verification of greenhouse gas emissions from maritime transport, and amending Directive 2009/16/EC

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]