- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy industries

Fact not myths

The global tax environment has never seen such fundamental change at such a rapid pace. As a result, funds, their managers, investors and advisers may be uncertain of the impact on their current and future structures.

These changes, however, have not altered Jersey's position as a leading, forward-thinking centre for the domiciliation, management and servicing of funds.

In particular, while the Organisation for Economic Co-operation and Development (OECD) Base Erosion and Profit Shifting (BEPS) project1 has resulted in the introduction of new international tax treaties and legislative change in some jurisdictions, Jersey has remained focussed on supporting managers and investors by providing a clear, stable and certain environment in line with the action points stipulated by the BEPS project.

BEPS objectives

The OECD's Action Plan on BEPS was published in July 2013

with a view to addressing perceived flaws in international tax

rules and

their inefficacy in detecting and preventing unwarranted

tax-motivated cross-border activities.

These perceived flaws include, for instance, deficiencies in

certain domestic anti-tax avoidance provisions and differences in

the thousands of bilateral tax treaties that are currently in

force. The OECD also identified issues in relation to the lack of

information sharing between some national tax authorities.

Addressing these issues, the OECD's work contains 15

'actions'2, some of which are further split into specific

workstreams or outputs.

The BEPS project's ultimate goal is to resolve the problems

that arise - including double non-taxation (or less than single

taxation)

of income - as a result of 'cracks' in the interaction

between domestic tax systems, which may be exposed when profits are

geographically divorced from activities.

BEPS and Jersey funds

Whilst BEPS was never intended to impact the global funds

industry, the reality is that funds and fund managers are caught by

a number of its actions.

Consistent with its leading position on compliance with the highest

standards of international regulation, Jersey's government,

regulator and industry have worked together to ensure it is

'BEPS-ready' and able to provide a stable and certain

environment for funds business.

Jersey became a BEPS Associate and Member of the BEPS Inclusive

Framework at the OECD's inaugural BEPS discussions in June

20163. It has consistently been fully supportive of the BEPS

project and is actively implementing BEPS standards, being among

the first to introduce country-by-county reporting legislation and

standards in accordance with BEPS Action 13 ('Transfer Pricing

Documentation').

Moreover, in December 2017, Jersey became only the third jurisdiction in the world to have completed domestic ratification of the OECD's Multilateral Instrument (MLI) in accordance with Action 154 ('Multilateral Instrument').

This type of action demonstrates Jersey's full commitment towards, and active participation in, the development of international tax standards.

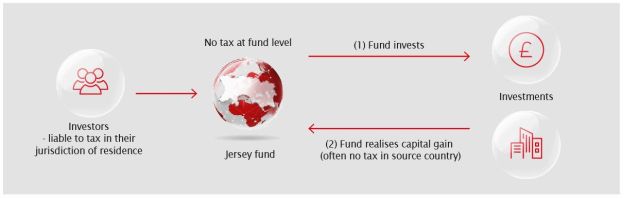

BEPS, transparency and tax neutrality

Many of the changes proposed under BEPS will inevitably affect funds and the way they operate and are administered. However, these changes are in large part location agnostic and their impact will be felt in the same way, regardless of jurisdiction.

Transparency and achieving tax neutrality remain key cornerstones under BEPS, and the OECD has provided a number of examples that illustrate a range of valid purposes for establishing holding platforms for collective investments, which may help funds achieve a tax-neutral outcome for investors by pooling capital and providing investment management and advisory services in tax-benign locations such as Jersey.

These examples will look familiar to many Jersey funds that own investments through holding companies established outside the jurisdiction.

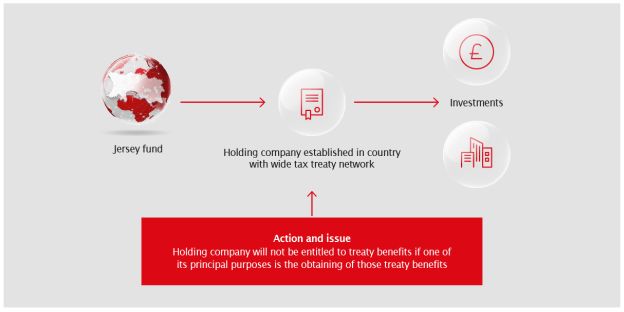

One particular aspect of the BEPS agenda that is causing uncertainty for some is Action 6, which relates to the effectiveness of double tax treaties. To be clear, Action 6 does not necessarily raise difficulties for funds in Jersey.

For many Jersey funds, much consideration around Action 6 will depend on specific investments and repatriation models, and the outcome of many assessments will be that relocation to another jurisdiction is unlikely to result in a better outcome, whether tax, regulatory, or operational, than would be found in Jersey.

In addition, the requirements of BEPS have led to an increased focus on demonstrating substance from a governance perspective, which has tended to mean a more granular analysis on process and function. This has typically focussed on the quality of skills and experience on the board of the fund or its general partner (GP) and is further bolstered by internal recruitment and systems, as well as access to expertise in such areas as governance, risk and portfolio management.

A link between governance activities and the creation of profit and value sits naturally with elements that have long been a leading feature of Jersey fund structures.

Detailed analysis of the effectiveness of structuring or restructuring funds in 'treaty access' jurisdictions is vital, given the clear focus of BEPS on treaty abuse. Not only might it be ineffective to move a structure to a tax-treaty jurisdiction to seek to avoid the impact of BEPS but doing so might in fact lead to unforeseen consequences, such as a requirement for full AIFMD compliance or other regulatory oversight e.g. the Capital Requirements Directive.

Meanwhile, Jersey remains an effective, flexible and tax-benign jurisdiction that is widely recognised as highly compliant by the OECD5, MONEYVAL6 and the EU Code of Conduct group7. The straight-forward tax neutrality offered by Jersey, together with its commitment to transparency can be a very appealing proposition, being fully in line with the OECD's objectives and providing funds with a positive outcome.

Jersey: ready for BEPS

By working with key stakeholders and retaining a keen focus on the international transparency landscape, Jersey is ready for BEPS and is in a better place to respond to it than many other jurisdictions.

As a result of the limited impact of BEPS on Jersey, funds and their managers, investors and advisers can be certain that Jersey remains a future-proof solution.

Case study 1

Case study 2

2 www.oecd.org/tax/beps/beps-actions.htm

3 www.gov.je/News/2017/Pages/JerseySignsOECDConvention.aspx

4 www.gov.je/News/2017/Pages/BEPSRatification.aspx

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.