- within Criminal Law and Corporate/Commercial Law topic(s)

We have heard a lot about Jersey's MONEYVAL preparations, which has of course been useful given the impact the result can have on the island, our businesses and our economy.

However, your focus is likely to be more on what your part in this process may be and how best you can prepare for it.

Recap

- The MONEYVAL mutual evaluation will test Jersey's compliance with international standards for anti-money laundering, countering of terrorist financing and countering of proliferation financing (AML/CFT/CPF)

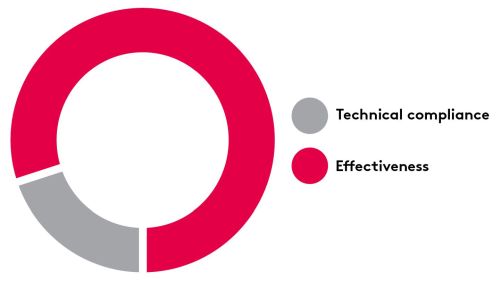

- The evaluation is made up of two parts: Technical compliance and effectiveness

- In March and May, information is submitted by Jersey in response to mutual evaluation questionnaires

- In July, the MONEYVAL assessment team (AT) produce a scoping note setting the priorities and focus of the evaluation

- In September/October, the AT will visit for two weeks, focusing on effectiveness and the priorities in the scoping note

- During the visit, the AT will meet with the public and private sector. Therefore, if you are supervised by the Jersey Financial Services Commission (JFSC), you may be invited to meet with the AT

Evaluation methodology

Jersey's last MONEYVAL evaluation took place in 2015 and focused on technical compliance. This time round the evaluation will place much more focus on the effectiveness of the framework in place, as per the chart below.

Technical compliance: Does Jersey have the

right building blocks in place? Think laws, regulations and legal

instruments, for example.

Effectiveness: Can Jersey demonstrate that the

measures in place are working to get the right results and protect

the financial system from abuse?

Your part in the process

What is selection based on?

Selection will be based on the AT's review of the information provided and what they have determined to be the areas of focus. Considerations will include the perceived threats, vulnerabilities and risks present in Jersey, and the materiality of the sectors/businesses in the context of our island. It is likely that any business which has been subject to sanctions or adverse media will be of interest.

The JFSC and Government of Jersey (GOJ) have put together a list of those that the AT will probably want to see, but the final decision rests with the AT. Those on the list have already been contacted.

When will we know if we have been selected?

The process states that the schedule should be provided at least three weeks prior to the visit, however it is hoped that it will be received earlier (ie June) to ensure that the businesses/individuals can be available. It is possible that additional meetings may also be requested nearer the time of, and during, the visit.

Who will be expected to meet with them?

You will need to get the right people in the room. Appropriate individuals may include board/senior management members, compliance managers/officers and potentially front-line/operational staff members (such as those from your onboarding team) or subject matter expects in specific products/services of interest.

It will not be one-to-one meetings with the AT, you will either be with the rest of your colleagues or potentially with representatives of other businesses and associations.

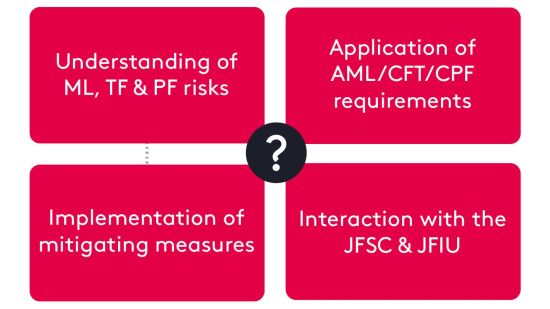

What might they ask us about?

The AT will not be conducting an in-depth review of your operations, as they will simply not have the time.

There will be specific areas of focus in the scoping note, details of which we are not yet aware, however the four general areas that will be discussed are detailed below.

What documentation might they request?

The AT will have limited time to review documentation, however, the type of documentation they may request includes:

- Business profile (to provide a clear and succinct summary of your business)

- AML/CFT/CPF business risk assessment (BRA), risk appetite and strategy

- AML/CFT/CPF policies and procedures

- Internal/external audit reports and remediation plans

- JFSC examinations reports and remediation plans

What happens with the information we provide?

All information will be treated confidentially and no conclusions or references will feature in report regarding individual businesses.

What can we do now?

Some tips on how you can prepare are detailed below (please note that these should be undertaken anyway, regardless of the MONEYVAL evaluation).

- Understand Jersey's view of risks and document considerations against your own risks - see Financial crime strategy, appetite and national risk assessments (gov.je).

- Have in place clear and up to date risk

documentation – appetite, exposure

assessment (BRA) and strategy to mitigate. You should:

- Separate money laundering (ML), terrorist financing (TF) and proliferation financing (PF) risks

- Know your top ML, TF and PF risks

- Include targeted financial sanctions (TFS)

- Check consistency – is your actual risk exposure in line with your appetite?

- Show how you have mitigated the risks in practice

- Share – all employees should be living and breathing these documents

- Consider your connections to jurisdictions which the Financial Action Task Force (FATF) has identified as having strategic ML/TF deficiencies – see Appendix D2 (source 1 and 2) of the AML/CFT/CPF Handbook for those which feature on the FATF black and grey lists. However, it can take time for jurisdictions to be added to the lists following an evaluation, therefore you should also monitor the FATF website, where you can find mutual evaluations reports and progress updates.

- Ensure you have a good understanding of regulatory

requirements and check your compliance:

- Conduct a gap analysis of policies and procedures against requirements and guidance

- Review your breaches/findings – remediate and put in place measures to avoid reoccurrence

- Analyse your SAR data – what is it telling you? For example, do you have a low number of SARs in consideration of your business/its risks? Are there any potential barriers to employees reporting?

- Identify and plug any knowledge gaps – examples may be TF, PF, TFS, international standards and national risk context.

- Consider relevant publications, such as those from the JFSC, Joint Financial Crimes Unit, Jersey Financial Intelligence Unit (JFIU), GOJ and FATF.

- Foster an open and cooperative relationship with the JFSC – make sure that they are fully aware of any issues you have and what you are doing about them.

- Remember, we are all in this evaluation together.

What support will there be?

The GOJ and JFSC will be providing further support to the selected businesses once they, and the areas of focus, are known.

In the meantime, we can provide expert regulatory advice, AML/CFT/CPF health checks, remediation assistance and training, to ensure you can feel as prepared as you can be for the upcoming MONEYVAL evaluation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.