- with readers working within the Securities & Investment industries

80% of alternative asset fund managers that responded to Ocorian's survey on the provision of third-party fund services in 2023 said that their company uses third-party fund administration. There's a good reason for that.

In our increasingly complex industry – with a growing regulatory burden – it makes sense for fund managers to allocate fund administration to expert external providers.

What also makes sense is to question regularly whether your external fund administrator is helping or hindering your business – and to think about switching if your answer is the latter. Over 13% of fund managers said that they were expecting to switch to an alternative fund administration provider over the next 18 months.

However, fund managers often fear that switching fund administrators will be time-consuming and complex. The reality is that not switching when a provider no longer meets your needs can be more disruptive than staying put.

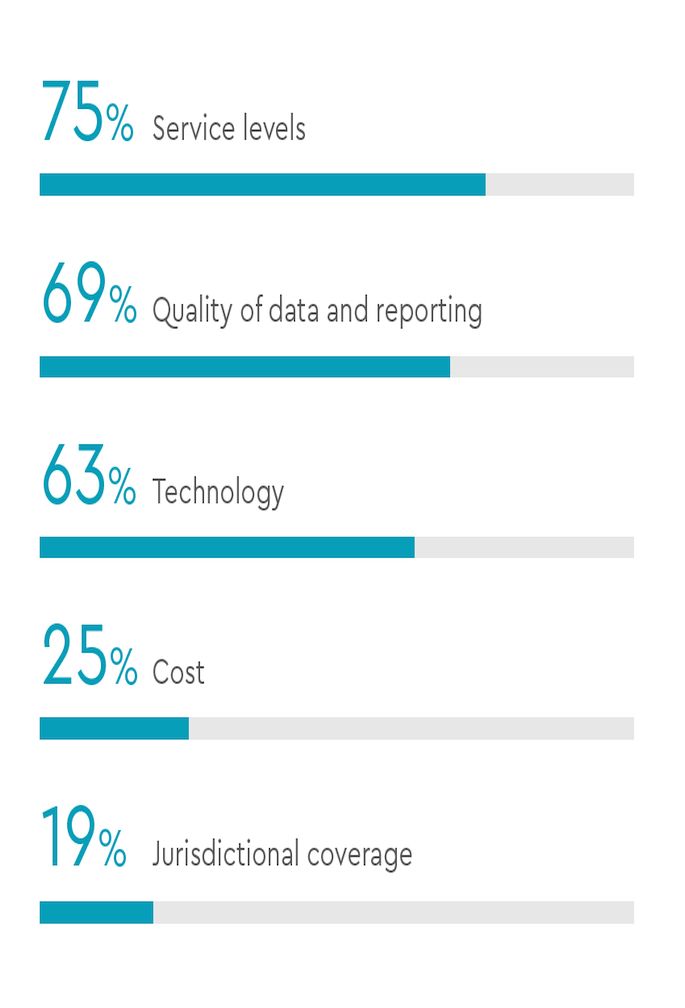

The latest Ocorian research data reveals the four main areas where a breakdown of trust prompts fund managers to switch fund administration services.

What are the four main reasons why fund managers want to switch fund administrator?

1. Service levels

Poor service delivery models and lack of delivery against service level agreements (SLAs) combined with offshoring can lead to missed deadlines and poor response rates.

2. Quality of data and reporting

Disparate systems for different jurisdictions and functions, an over-reliance on excel spreadsheets, along with teams that are located in low-cost centres that do not specialise in fund accounting, can lead to data errors and inconsistencies.

3. Technology

Outmoded technology, a lack of automation, reliance on excel spreadsheets and errors therein, over-engineered systems that cannot be easily updated, and multiple systems can make data harder to monitor, interrogate and check.

4. Streamlining complexity

The Ocorian survey shows that a clear majority of fund managers prefer to use one provider for all services, including AIFM, depositary, administration, SPV and corporate services. Increasingly, funds are running across several domiciles and fund managers may not want to work with different teams in different domiciles, so may seek a fund administrator with cross-jurisdictional coverage.

Other reasons fund managers are switching fund administrators include cost (25%) and jurisdictional coverage (19%).

All of these issues can negatively impact investors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.