- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

ESG has been around for many years, but only given this three-letter label in recent times. With the increasing focus on environmental and ethical issues, though, its impact and influence has boomed: it is predicted that ESG investments will reach over $50 trillion by 2025, according to Bloomberg Intelligence1.

PE firms are increasingly factoring Environmental principles into their investment decisions and portfolio management strategies at all stages of the deal lifecycle. Analyzing the data from the UN Principles for Responsible Investment (UN PRI), we can see over time an increase in the number of volunteer investor signatories committed to the UN PRI, growing from just 63 in 2006 to 3,800 in 2021 (17% higher than 2020), with Assets Under Management valued at greater than $120 trillion.

Why now? The regulatory environment for carbon disclosure is heating up worldwide and corporations are experiencing the benefits of good environmental stewardship.

Currently, in the European "for-profit" corporate world, sustainability reports are required by law to be submitted only by publicly traded companies and large companies belonging to the insurance / banking sector2. However, over the years, regulation is becoming stricter, broadening the scope of entities that will be required to report.

Typically, companies follow the GHG Protocol3 to calculate environmental impact, in particular related to their carbon footprint. GHG Protocol supplies the world's most widely used greenhouse gas accounting standards, with carbon emissions categorization into Scopes 1 through 3, depending on whether they are direct or indirect. Scope 1 occurs from sources that are controlled or owned by an organization, referring to the direct emissions generally associated with fuel combustion in boilers, furnaces, vehicles. Scope 2 results from indirect emissions from purchased energy, heat, steam, and cooling. Scope 3 includes indirect emissions, referring to the upstream and downstream emissions across the company's value chain.

According to NIR data (United Nations Climate Change), "eating" is the second most important human activity in terms of carbon emissions, after "moving" (respectively 1.32 and 1.40 ton of CO2eq per capita. If you were to include imported deforestation, "eating" would likely leap into first position, reaching 1.61 ton of CO2eq per capita).

Food & Beverage companies can therefore clearly make a huge difference. Acting on Scope 1 and 2 emissions can be a quick fix for them; this would entail internal willingness and, potentially, some minor investments, but it is also generally associated with quick economic rewards.

Indeed, acting on Scope 1 generally requires some interventions on companies' internal industrial processes. Instead, Scope 2 emissions are generally addressed by either re-sourcing utilities with suppliers or directly by companies on their own. Actions include, for example:

- Switching to the purchase of 100% renewable electricity, as provided by some utilities through contracts that are now common in the market;

- As F&B companies increase in scale, they can also take into consideration the subscription of PPA – Power Purchase Agreements used as bankable contracts for utilities to invest in new renewable energy generators;

- Some F&B companies may also consider the possibility of investing directly in renewable energy generators, generally photovoltaic panels directly installed on the rooftop of companies' industrial premises.

However, what you may not expect is that in the F&B industry, Scope 3 emissions may cover up to 90% of a company's total4. For food companies, Scope 3 emissions, i.e. those that take into consideration their full value chains, upstream and downstream of their industrial processes, include both the carbon footprint of purchased raw materials, semi-finished products and packaging, as well as their supply chains from their industrial premises to the customers' tables (including the related "End of Life" of the product, which is clearly much less impactful for F&B companies compared to industrial products).

On the one hand, Scope 3 emissions are not directly controlled by the F&B companies, but they may depend, for example, on farming choices. On the other hand, though, Scope 3 is the sweet spot for F&B companies to take more action and make a real difference.

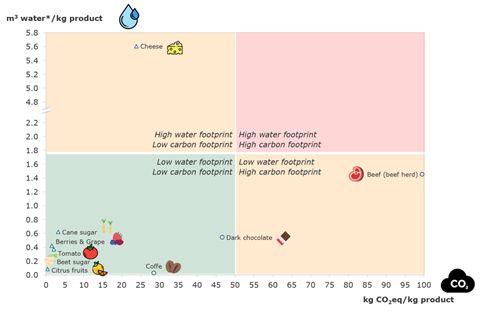

As shown below, based on analyses of public data5, we compared food types considering both carbon emissions (kg of CO2eq per kg of finished product) and water use (m3 of water use per kg of finished product). Meat, chocolate, and coffee, for example, present a high carbon footprint but low water use, while cheese showed the opposite characteristics.

Among the food types with a low carbon footprint we find sugar and fruits, but there are differences within the same categories: for example, cane sugar is more pollutant than beet sugar (c. +180%) and berries have a higher carbon footprint than citrus fruits (c. +400%).

How can F&B companies tackle their "Scope 3" climate emissions?

Focusing on raw materials, over the short-term, some quick-wins may exist, but they are not always available to all, and should also take into consideration potential impacts on product recipes and overall procurement costs. For example, F&B companies may evaluate switching some selected raw materials to less environmentally-impactful substitutes (e.g. beet vs. cane sugar). Companies may also evaluate locally-sourced alternatives to significantly reduce transportation pollution (accounting on average for up to 20-30% of a raw material's overall carbon footprint6), or replacing traditional farming products with organic ones (cutting up to 20% of the environmental impact7).

Over the medium- to long-term, F&B companies should deep-dive into their recipes as well as on understand how R&D and broader trends in the market may support their decarbonization path, or sometimes even challenge their entire business models. As an example, look at recent developments in plant-based alternatives for dairy (e.g. Oatly, Perfect Day Foods, Real Vegan Cheese, ...), meat (e.g. Beyond Meat, Impossible Foods, Gardein, Quorn, ...), and even chocolate (WNWN Foods Labs, Charm School Chocolate, Go Max Go Foods, ...).

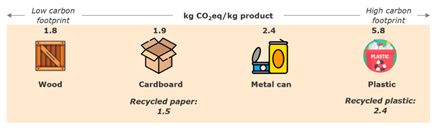

Packaging also represents an important share of Scope 3 emissions in F&B companies (up to 5-10% of their overall Scope 3 emissions8). As shown below, again based on analyses of public data9, plastics has the highest level of carbon emissions per kg of products compared to other types of packaging, followed by metal cans, carboard and wood (these last two showing a similar carbon footprint).

Moving from plastic to cardboard can reduce carbon intensity by two thirds. Even introducing recycled materials can have significant positive impacts:

- Carbon intensity can more than halve when moving from plastic to recycled plastic;

- Switching from carboard to recycled cardboard is less impactful, but still valuable with a 20% reduction.

Although replacing one type of packaging for another is nowhere near as simple to execute as it is to write it, a lot of market effort is under way in this space, and tailored solutions are increasingly available when pairing the efforts with packaging suppliers.

How can Private Equity funds push corporations to pass from a mere reporting of their sustainability footprints to real actions that can make the difference?

The best strategy is the one that PE has always proven to be best-in-class in applying: track, set targets, prioritize, and incentivize.

Moving from theory to practice, we recently performed a very detailed carbon footprint study for a PE's portfolio company operating as a pastry manufacturer, assessing its overall carbon footprint and identifying specific initiatives to reduce it.

Taking as an example some of the most carbon-intensive SKU, our study focused on:

- The significant use of sugar (>50% of the recipe), predominantly based on glucose

- Ingredients generally acquired from abroad, mainly transported by trucks

- Packaging made of plastic

- An energy-intensive production process

For this SKU, we proposed four initiatives aimed at reducing its overall carbon footprint:

- A switch from glucose to sucrose, resulting in c. 10% reduction potential of total carbon emissions

- The gradual introduction of some local suppliers to shorten the supply chain and, for the rest of suppliers, preference to use inter-modal transportation (significantly increasing the use of trains), resulting in c. 15% reduction potential

- A target to replace plastic with more sustainable packaging: recycled plastic as a first step, paper-based packaging as a second step, resulting in c. 3% reduction potential

- The switch to 100% electricity produced from renewable energy sources, resulting in c. 3% reduction potential

The combination of these four initiatives aim to reduce the overall carbon emissions of the company by c. 30%-35% in 3-5 years, in line with the ambitious expectations of some of the largest Food & Beverage companies worldwide.

Footnotes

1. Bloomberg Intelligence Research, Bloomberg Professional Services

2. Directive No. 95 of 2014 (2014/95/EU)

3. https://ghgprotocol.org/

4. Global Landscape Forum

5. Our World in Data

6. AlixPartners analysis

7. Natural Resources Defense Council

8. AlixPartners analysis

9. Our World in data

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.