- within Compliance, Media, Telecoms, IT, Entertainment, Food, Drugs, Healthcare and Life Sciences topic(s)

Introduction

In this Tax Controversy and Dispute Resolution Report, we look back on the recent trends and developments in domestic and international tax controversy matters and provide insights on the key developments during recent periods. We have also included some horizon scanning to flag key Irish legislative and case law developments that are expected to have an impact on the Irish tax controversy landscape over the course of 2025 and beyond.

Our report demonstrates a continued increase in activity across the full range of tax controversy matters. This reflects our experience in practice as we assist clients with an increasing volume of complex tax compliance interventions and disputes. This trend is also consistent with the practice in other treaty partner jurisdictions, which is evident from the continued increase in Irish competent authority matters.

It is important for taxpayers that are in the process of compliance interventions or audits to be aware of key legal considerations which may be relevant to their case; most notably legal privilege, judicial review and administrative law remedies, overlapping Irish constitutional and EU law issues, as well as practice and procedure and the laws of evidence.

Matheson has the largest tax practice in the Irish legal market and, together with our market-leading commercial litigation practice and specialists in other key areas such as Constitutional, EU and Administrative law, this positions us uniquely in the Irish tax controversy market. The depth and breadth of our expertise across the full spectrum of legal and tax issues which may be relevant in tax disputes means that we are ideally placed to assist with managing and defending taxpayer's interests to achieve successful outcomes.

If helpful to discuss any aspect of this report, or Matheson's Tax Controversy and Dispute Resolution offering more generally, please contact a member of the Matheson Tax Team (with key contact details included at the end of this report).

1. Insights & Trends

Revenue: Monitoring Compliance

Use of Data and Analytics

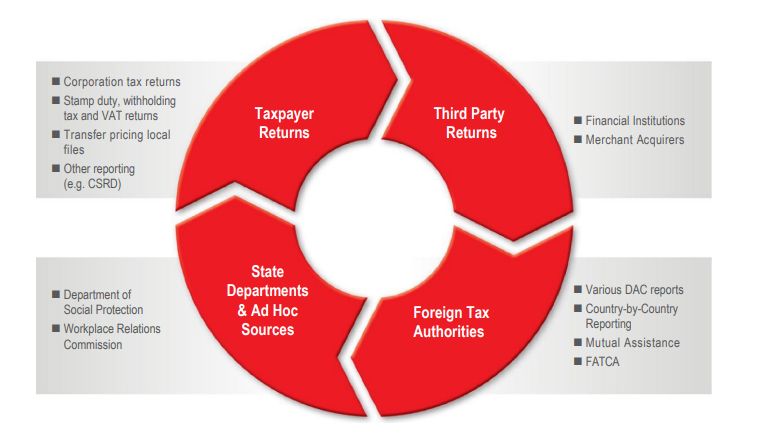

Revenue have noted in their latest annual report that they continue to use "a range of risk identification, assessment and evaluation programmes, together with real-time data analytics and interrogation, to monitor compliance". The sources of data and information available to Revenue to inform their analytics and approach to compliance interventions are summarised in the diagram below.

Revenue: Monitoring Compliance

International Collaboration

Revenue continue to collaborate with their counterparts in tax authorities throughout the world in relation to potential and live compliance interventions. For example, Revenue have noted in their annual report that they collaborate with HMRC, they are active members of the OECD's Joint International Taskforce on Shared Intelligence and Collaboration, they engage with the OECD Forum on Taxation Administration (which includes engagement on analytics to improve compliance / detect non-compliance), and they collaborate with EU colleagues through the FISCALIS programme (which most recently led to multi-jurisdictional engagement on cum / cum and other tax driven dividend arbitrage schemes).

Co-Operative Compliance Framework (CCF)

Revenue promote the CCF as a key initiative for supporting compliance among large corporate groups. Revenue's 2023 Annual Report notes that risk reviews and other engagements under CCF resulted in disclosures of €26 million in 2023.

During 2023 Revenue changed their approach to risk review meetings under the CCF. Such meetings previously took place on an annual basis but can now take place on a less frequent basis, e.g. every 18 months or two years, where Revenue considers the group's tax affairs and returns to be relatively low risk.

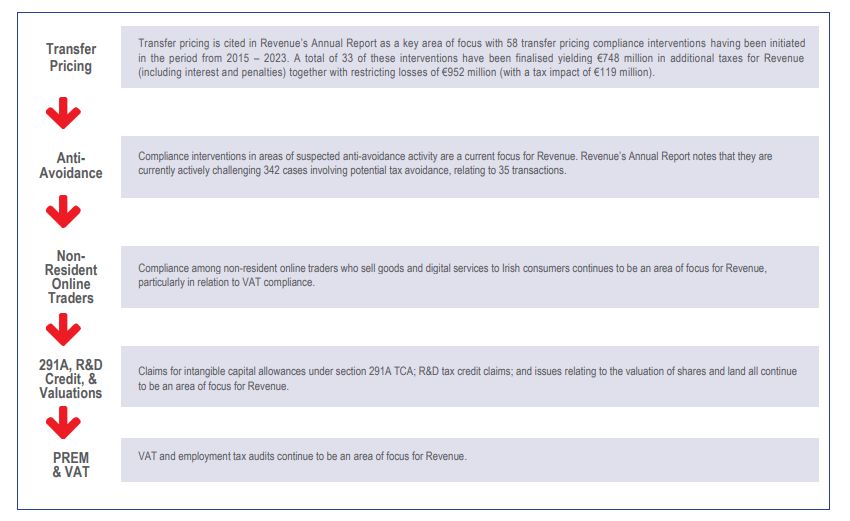

Revenue: Compliance Interventions

Tax Appeals Commission: Data on Appeals Received and Determinations Issued

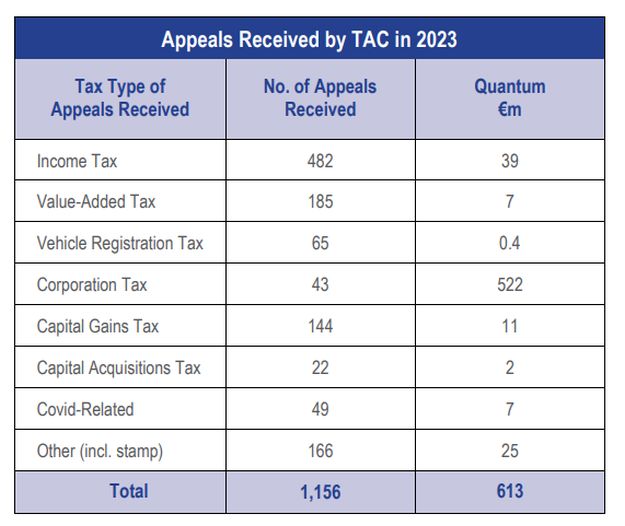

Appeals Received by TAC

TAC's annual report reveals that 1,156 Notices of Appeal were lodged with the TAC in 2023 with the total quantum of assessments being appealed totaling €613 million. It is notable that of the 1,156 Notices of Appeal lodged with TAC only 43 of these related to corporation tax but still represented €522 million or 85% of the total quantum of €613 million appealed to the TAC.

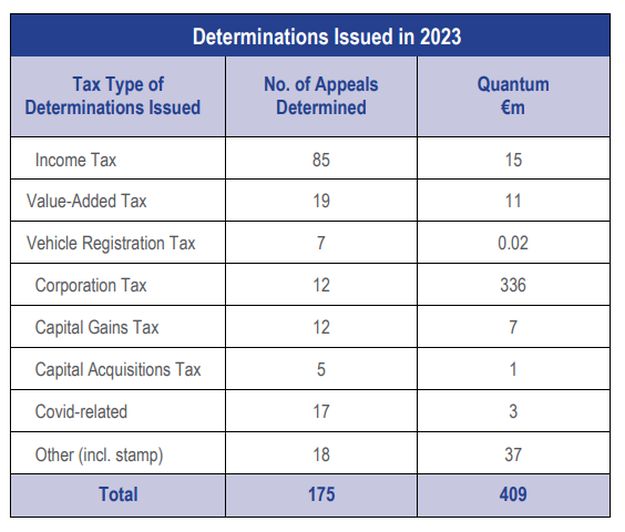

Determinations Issued by TAC

The TAC issued 175 determinations which dealt with a quantum of tax in dispute of €409 million. Again it is notable that while only 12 of the determinations related to corporation tax they accounted for €336 million or 82% of the tax at issue in the determinations.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.