- with Senior Company Executives, HR and Finance and Tax Executives

Welcome to the May 2025 edition of our Asset Management & Investment Funds Update.

In this month's edition we look at:

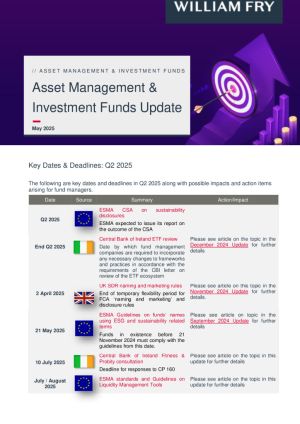

- Dates & Deadlines: Q2 2025

Stay ahead of upcoming deadlines and key dates with our legal & regulatory tracker.

- Central Bank of Ireland permits semi-transparent ETFs

The Central Bank of Ireland (CBI) has amended its rule requiring full daily public portfolio disclosure by UCITS ETFs by allowing UCITS ETFs to opt to disclose portfolio information to the public on a quarterly basis.

- Liquidity Management Tools – ESMA technical standards and final report

On 15 April 2025, ESMA published draft Regulatory Technical Standards and a final report on the Guidelines on Liquidity Management Tools for UCITS and AIFs.

- CSRD: Stop-the-clock Directive fully approved at EU level

The Council of the EU gave the green light to one of the European Commission's proposals to simplify EU rules and boost EU competitiveness. The proposal postpones the dates of application of certain corporate sustainability reporting and due diligence requirements as well as the transposition deadline of the due diligence provisions.

- EFAMA paper on SFDR fund market trends

EFAMA has published the 21st issue of its Markets Insights series which focuses on the Sustainable Finance Disclosure Regulation (SFDR) Article 8 and 9 fund markets and upcoming review.

- Central Bank of Ireland authorisations workshop – SFDR templates

The CBI announced at a recent authorisations workshop that its Advisory Unit will accept submissions to review templates for methodologies agreed at group level in respect of sustainable investment methodologies, policy to assess good governance practice and PAI consideration.

- ESMA report – ESG name changes

In April 2025, ESMA released a report and held a webinar on Fund names: ESG-related changes and their impact on investment flows.

- ESMA report on risks posed by leverage in UCITS and AIFs

ESMA has published its annual risk assessment of leveraged AIFs. It also presented its first analysis on risks in UCITS using the absolute Value-at-Risk (VaR) approach. Both papers represent ESMA's work to identify highly leveraged funds in the EU investment sector and assess their potential systemic relevance.

Click the image below to download our full update.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.