- within Finance and Banking topic(s)

- with readers working within the Consumer Industries industries

- within Media, Telecoms, IT, Entertainment, Antitrust/Competition Law, Food, Drugs, Healthcare and Life Sciences topic(s)

The European Securities and Markets Authority ("ESMA") has issued consultations on draft guidelines and technical standards under the revised Alternative Investment Fund Managers Directive ("AIFMD") and the Undertakings Collective Investment in Transferable Securities ("UCITS") Directive. Recent amendments to these directives aim, inter alia, to mitigate potential financial stability risks and promote harmonisation in liquidity risk management in the investment funds sector. The revised provisions are due to apply from 16 April 2026.

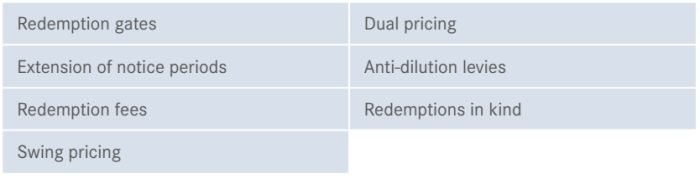

The amended AIFMD and UCITS Directive require AIFMs of open-endes AIFs and UCITS to select at least two1 appropriate liquidity management tools ("LMTs") from those set out in points 2 to 8 of Annex V of the AIFMD and Annex IIA of the UCITS Directive, having assessed that suitability of those tools in relation to the pursued investment strategy, the liquidity profile and the redemption policy of the fund. These LMTs are as follows:

The LMTs are defined in the AIFMD and the UCITS Directive. The potential to use these LMTs must be disclosed in the fund documentation. It is not possible to select only dual pricing and swing pricing. It is provided that suspensions of subscriptions, repurchases and redemptions and side pockets may always be activated in exceptional circumstances and where justified having regards to the interests of investors, without the need for the AIFM / UCITS to "pre-select" these tools.

AIFMs and UCITS must implement detailed policies and procedures for the activation and deactivation of any selected LMT and the operational and administrative arrangements for the use of such tool. These policies, procedures and arrangements must be communicated to the home state regulator of the AIFM / UCITS.

In the draft regulatory technical standards ("RTS") on the characteristics of LMTs, ESMA defines the constituting elements of each LMT, such as calculation methodologies and activation mechanisms. The draft guidelines provide guidance on how managers should select and calibrate LMTs, in light of their investment strategy, their liquidity profile and the redemption policy of the fund. The Commission's mandate requires the guidelines to recognise that the primary responsibility for liquidity risk management remains with the UCITS and AIFM. They must also include indications as to the circumstances in which side pockets can be activated and allow adequate time for adaptation before they apply, in particular in existing UCITS and open-ended AIFs.

While the mandate to ESMA in respect of the guidelines refers to the activation of side pockets only, ESMA has deemed it important to set minimum expectations, as well as examples, in order to identify instances that may lead to the activation of all LMTs.

ESMA also emphasises that managers should not solely rely on LMTs to manage a funds' liquidity risk. LMTs should be considered an essential element of the fund's overall liquidity management framework, which should incorporate relevant provisions related to the fund's structure, investment strategy and operational processes and procedures to manage liquidity.

Responses to the consultations are welcomed by 8 October 2024. ESMA expects to publish the final RTS and guidelines by 16 April 2025.

Footnote

1. Money market funds may decide to select only one LMT.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]