- in United States

- within Criminal Law topic(s)

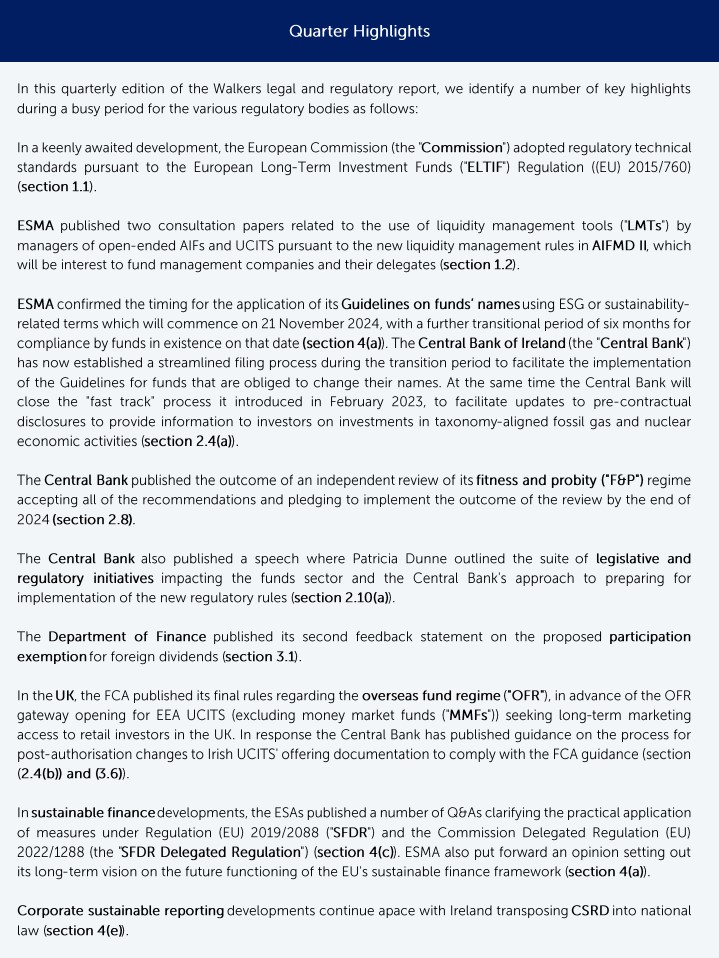

1. AIFMD & UCITS DEVELOPMENTS

1.1 Commission adopts delegated regulation on the ELTIF Regulation (This is a further update to section 4.3(a) of the quarterly report covering the second quarter of 2024)

On 19 July 2024, the European Commission (the "Commission") adopted a delegated regulation and accompanying annexes containing its regulatory technical standards ("RTS") supplementing Regulation EU 2015/760, as amended by Regulation 2023/606/EU (the "ELTIF Regulation").

The RTS specify detail on a number of features mandated under the ELTIF Regulation, in particular:

- the circumstances in which the life of an ELTIF is considered compatible with the life cycles of each of the individual assets, as well as different features of the redemption policy of the ELTIF (including the minimum holding period, choice of liquidity management tools ("LMTs"), notice periods and maximum percentage of liquid assets that can be redeemed);

- the circumstances for the use of a liquidity matching mechanism, i.e. the possibility of full or partial matching (before the end of the life of the ELTIF) of transfer requests of units or shares of the ELTIF by exiting ELTIF investors with transfer requests by potential investors;

- the criteria for establishing the circumstances in which the use of financial derivative instruments solely serves the purpose of hedging risks inherent in certain investments; and

- the ELTIF costs disclosure.

The key features of the adopted RTS include, but are not limited to, provisions on the following:

Notice periods and redemption frequency (open-ended ELTIFs)

The Commission's re-working of ESMA's original proposals constitutes its proportional approach to calculating allowable redemptions from an open-ended ELTIF. Discretion is provided in the RTS for ELTIF managers to calibrate the gating of redemptions either on the basis of:

(i) the redemption frequency and the maximum length of the notice period, which represents the notice period (per the tables in annex I) or, alternatively,

(ii) on the basis of the redemption frequency and the minimum percentage of liquid assets (per the table in annex II).

Under both methodologies the manager of the ELTIF may consider introducing a minimum notice period as part of the redemption policy without the mandating of a minimum notice period under the RTS. Significantly, in determining the maximum redemption gate ELTIF managers may apply the sum of UCITS eligible assets at the redemption date, as well as the expected cash flow forecasted on a prudent basis over 12 months. ELTIF managers may only take into account those expected positive cash flows for which the ELTIF manager can demonstrate that there is a high degree of certainty that they will materialise and shall not consider as expected positive cash flows the possibility that the ELTIF can raise capital through new subscriptions.

Minimum holding period (open-ended ELTIFs)

While a minimum holding period can enable managers of ELTIFs which offer redemption facilities to complete the investments of its capital contributions, the RTS do not prescribe the duration of the minimum holding period. Instead, the manager of an ELTIF in considering the circumstances of the ELTIF should determine the requirement for any minimum holding period based on a set of certain criteria.

LMTs (open-ended ELTIFs)

The RTS clarify that the manager of an open-ended ELTIF is not required to, but may at its discretion and in accordance with the redemption policy, select and implement 4321from among any of the following anti-dilution LMTs:

(a) anti-dilution levies;

(b) swing pricing; and

(c) redemption fees.

The manager of the ELTIF may also additionally select and implement other LMTs. The manager of a retail investor ELTIF should provide the competent authority of the ELTIF, upon request of that authority, with the information on the choice of such other LMTs and their appropriateness in the context of the ELTIF.

Costs

The RTS also provides for common definitions, calculation methodologies and presentation formats to ensure a common approach in relation to the disclosure of the costs (borne directly or indirectly) by investors in an ELTIF.

Next steps

Following adoption by the Commission, a three-month scrutiny period by the co-legislators has been triggered following which the RTS may be published and enter into force the day after its publication. The adoption of the RTS has been keenly awaited and the approach taken by the Commission demonstrates a recognition of those concerns expressed by stakeholders as well as an effort to mitigate these concerns while also maintaining the protection of retail investors, ensuring the fulfilment of financial stability-related objectives of the capital markets union as well as maintaining the initial momentum behind the ELTIF 2.0 regime.

Walkers' Asset Management & Investment Funds team have published a recent advisory assessing the RTS, as well as its implications and next steps.

1.2 Corrigendum to the ELTIF Regulation

On 17 September 2024, a Corrigendum to the ELTIF Regulation (EU) 2023/606 was published in the official journal of the EU (the "OJ").

The text corrects a typographical error in Article 19 of the consolidated ELTIF Regulation entitled 'Secondary Market' (replacing a number of references to 'existing... investors' with 'exiting... investors').

1.3 ESMA consultations on AIFMD II LMTs (This is a further update to section 1.1 of the quarterly report covering the first quarter of 2024)

On 8 July 2024, ESMA published the following consultations on LMTs for funds pursuant to mandates in Directive (EU) 2024/927 of the European Parliament and of the Council of 13 March 2024 amending AIFMD (2011/61/EU) and the UCITS Directive (2009/65/EC) relating to delegation arrangements, liquidity risk management, supervisory reporting, provision of depositary and custody services, and loan origination by alternative investment funds ("AIFs") ("AIFMD II").

- Guidelines on Liquidity Management Tools of UCITS and open-ended AIFs (the "Draft Guidelines"). The Draft Guidelines provide guidance on how managers should select and calibrate LMTs in the light of their investment strategy, their liquidity profile and the redemption policy of the fund. The draft guidelines are set out in Annex IV to the consultation paper.

- Draft Regulatory Technical Standards on Liquidity Management Tools under the AIFMD and UCITS Directive (the "Draft RTS"). The draft RTS, among other things, define the constituting elements of each LMT, such as calculation methodologies and activation mechanisms. The Draft RTS are set out in Annex IV and Annex V to the consultation paper.

The Draft Guidelines and Draft RTS will apply to alternative investment fund managers ("AIFMs") managing open-ended AIFs and UCITS and are to be read together. ESMA notes that the aim of the draft RTS and guidelines is to promote convergent application of the Directives for both UCITS and open-ended AIFs and make EU FMCs better equipped to manage the liquidity of their funds, in preparation for market stress situations. In addition, they clarify the functioning of specific LMTs, such as the use of side pockets, which is a practice that currently varies significantly across the EU.

AIFMD II requires FMCs of open-ended AIFs and UCITS to select at least two LMTs from those set out in points 2 to 8 of Annex V of the AIFMD and Annex IIA of the UCITS Directive (these lists are identical), having assessed that suitability of those LMTs in relation to the pursued investment strategy, the liquidity profile and the redemption policy of the fund. FMCs may also decide to use other tools (than the LMTs referred to in AIFMD II) to manage the liquidity of a fund. However, when doing so, these other tools shall not be considered as LMTs for the purpose of complying with AIFMD II. One example noted by ESMA of these other tools is "soft closure", where a fund is closed to new subscriptions when the size of the fund exceeds a pre-determined level, while still allowing investors to redeem. The Draft RTS do not mandate the conditions under which the LMTs selected shall be activated (except for side pockets), and ESMA identifies its expectations and instances that may lead to the activation of all LMTs.

The Draft LMT Guidelines outline how FMCs should select (selection relates to other LMTs only, as funds need to always be able to implement suspension of dealing procedures and side pockets without pre-selecting those) and calibrate LMTs, in light of their investment strategy, their liquidity profile and the redemption policy of the fund.

LMTs should be considered an essential (but not the sole) element of the fund's overall liquidity management framework, which should incorporate relevant provisions related to the fund's structure, investment strategy and operational processes and procedures to manage liquidity. The primary responsibility for liquidity risk management, including for the selection, calibration, activation and deactivation of LMTs remains with the AIFMs (acting on behalf of open-ended AIFs) or the UCITS respectively.

The Draft Guidelines also recommend that, in the selection of the two minimum mandatory LMTs, FMCs should consider, where appropriate, the merit of selecting at least one quantitative-based LMT (i.e, redemption gates and extension of notice period) and at least one anti-dilution (or price-based tool ("ADT") (i.e. redemption fees, swing pricing, dual pricing, anti-dilution levies)), taking into consideration the investment strategy, redemption policy and liquidity profile of the fund and the market conditions under which the LMT could be activated. In this context, FMCs may consider whether to select one LMT to use under normal market conditions and one LMT to be used under stressed market conditions (for instance, one ADT to use for normal market conditions and one quantitative LMT to be used under stressed market conditions).

Investor disclosure

The Draft Guidelines emphasise appropriate disclosure of available LMTs in the fund documentation, and/or periodic reports (e.g. a periodic report would provide an ex-post overview of activation whereas fund rules and prospectuses would state the conditions for activating am LMT). The implications of LMTs in terms of liquidity costs or access to their capital should also be disclosed. ESMA has noted that such disclosures should help to normalise the use of LMTs and increase the understanding of their functioning by investors, while the timing and detail of disclosure should balance any unintended consequences such as preventing any first mover advantage. ESMA also suggests that it may be helpful for funds to disclose periodic ex-post information on the historical use of LMT to investors via the fund's financial statements or via a website.

Governance

AIFMD II requires that detailed policies and procedures for the activation and deactivation of any of the selected LMTs and the operational and administrative arrangements for the use of such LMT must be implemented. The selected LMTs and the detailed policies and procedures must be communicated to the national competent authority ("NCA") of the UCITS or AIFM. AIFMD II requires that an AIFM or UCITS must notify its home state NCA, without delay, where it activates or deactivates suspension of subscriptions, repurchases and redemptions or any of the 'selected' LMTs in a manner that is not in the ordinary course of business as envisaged in the AIF/UCITS rules or instruments of incorporation.

In respect of governance principles and following IOSCO recommendations for liquidity risk management for collective investment schemes the Draft Guideline

(i) objective criteria (e.g. activation thresholds) for the application of LMTs;

(ii) methodology, including calibration;

(iii) parties involved (e.g. senior management, risk management, etc);

(iv) source of information and data used;

(v) controls;

(vi) documentation of decisions made;

(vii) escalation processes; and

(viii) oversight by the governing body.

The Draft Guidelines also note that depositaries should set up appropriate verification procedures on the FMC documented procedures for LMTs. The consultations seek feedback

from stakeholders before 8 October 2024. ESMA will deliver final reports outlining the final RTS and LMT Guidelines to the Commission by 16 April 2025. ESMA will also consult on draft RTS to determine the requirements that loan-originating AIFs must comply with to maintain an open-ended structure pursuant to AIFMD II at a later stage.

The Walkers' Asset Management & Investment Funds 101 advisory series considers a number of key changes for the asset management industry under AIFMD II. In the first advisory of the series our Irish Asset Management and Investment Funds team explain the new harmonised framework for loan originating activities across the EU and in the second instalment of the series, we focus on the new legal framework provided under AIFMD II in relation to the use of LMTs.

1.4 ESMA updated Q&As

On 12 July 2024, ESMA has published the following updated Q&As, including on AIFMD and the UCITS Directive:

AIFMD Q&A

Initial capital and additional own funds

Q&A 2227 notes that internally managed AIFs and self-managed UCITS investment companies should adopt procedures and systems to ensure compliance at all times with the requirements related to own funds per Article 9 of AIFMD and Articles 7 and 29 of the UCITS Directive.

The Q&A clarifies the initial capital and the additional own funds should not be included in the fund's net asset value ("NAV"), i.e. kept separate from the collective investment undertaking's assets. As a result, an investment company's own funds should be neither invested in accordance with the funds' investment strategy nor distributed to the redeeming investors, but instead they should be preserved to cover exposures from the investment company's professional liability and they should always remain within the limits of the minimum capital requirements.

Notification upon establishment of a branch

Q&A 711 notes that when an AIFM intends to carry out in another member state solely the functions referred to in point 2(c) of Annex I to AIFMD, such as real estate administration activities either directly or through establishing a branch, a notification to the competent authorities of its home member state under Article 33(2) and (3) AIFMD is not required in such instances.

The functions listed in point 2 of Annex I AIFMD are ancillary to the activities referred to in point 1 of Annex I to AIFMD and cannot be exercised independently from those. However, the AIFM may still need to provide information to the competent authorities of its home member state under different legal bases (e.g. Article 7(2)(c) on the requirement to provide upon authorisation a program of activity setting out the organisational structure of the AIFM).

Q&A on the UCITS Directive

Derogation for newly authorised UCITS

Q&A 601 confirms that under Article 57(1) of the UCITS Directive the six-month period member states may allow recently authorised UCITS to derogate from Articles 52 to 55 runs from the date of authorisation of the UCITS, regardless of whether the UCITS launches immediately after authorisation or at a later stage.

2. CENTRAL BANK UPDATES

2.1 Cross-border passporting process update

On 20 August 2024, the Central Bank communicated to Irish Funds that the following cross-border passporting submissions are with effect from 11 September 2024, required to be submitted via the Central Bank's online portal (the "Portal") (instead of via email):

- UCITS outward marketing submissions - notifications and de-notifications;

- Article 32 AIFMD outward marketing submissions, i.e., Irish AIFMs marketing EU AIFs in EU member states (excluding Ireland) – notifications and de-notifications; and

- Article 31 AIFMD inward marketing submissions, i.e., Irish AIFMs marketing EU AIFs in Ireland - notifications and de-notifications.

Note that any passporting submissions not listed above will continue using the relevant email mailbox submission process.

Third party entities appointed to make passporting notifications/de-notifications must have relevant Portal permissions assigned to them by the relevant Portal Administrator for UCITS and AIFMs. To this end the Central Bank notes that Irish AIFMs which intend to passport EU AIFs, as well as any legal advisors and/or other filing representatives to which the Portal tasks will be delegated, should complete the Portal registration process where they are not already registered. The nominated Portal Administrator for each EU AIF should complete the link on the Portal to the relevant EU AIF.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.