- within Insurance topic(s)

- with readers working within the Banking & Credit and Insurance industries

After a tumultuous early start in life, the finalised draft technical standards amending granular rules currently applicable to PRIIPS KIDs (Level 2 Measures)11 were finally adopted by the European Commission last month and are currently subject to scrutiny by the European Parliament and the Council of Europe.

The European Commission proposes the revised Level 2 Measures will apply to all PRIIPS KIDs from 1 July 2022. So why is this development causing UCITS management companies throughout the EU to sit up and take note?

In a "quick-fix" amendment being made to the PRIIPS Regulation itself2, the European Commission has also proposed that a PRIIPS KID be prepared in relation to UCITS which are marketed to retail investors in the EEA from 1 July 2022.

If implemented as proposed by the European Commission, this would require all in-scope UCITS management companies to provide EEA retail investors with a PRIIPS KID from 1 July 2022 onwards, a task which should not be underestimated given the significant differences between the PRIIPS KID and the UCITS KIID which is currently produced.

In a separate quick-fix amendment proposed by the European Commission to the UCITS Directive, the obligation to produce a UCITS KIID under that directive will be deemed satisfied where the UCITS provides a PRIIPS KID which complies with the PRIIPS Regulation. This is in order to avoid a scenario where a UCITS is required to produce both a UCITS KIID and a PRIIPS KID. In this briefing, we analyse the scope of this obligation, provide an overview of the key features of the PRIIPS KID, highlighting where it differs and where it aligns with the UCITS KIID and outline next steps which should be taken by in-scope UCITS management companies as they implement their transition plans over the coming months.

Is this timeframe of 1 July 2022 set in stone?

No. As noted above, the European Commission has proposed that UCITS management companies managing UCITS that are marketed to EEA retail investors be required to prepare a PRIIPS KID from 1 July 2022.

However, the Economic and Monetary Affairs Committee of the European Parliament (ECON) has, in considering the quick-fix amendments to both the PRIIPS Regulation and the UCITS Directive, proposed amendments to both pieces of legislation3 which would delay the relevant provisions from taking effect until 1 January 2023 in order to give stakeholders sufficient time to prepare for the obligation to produce a PRIIPS KID. The revised time-frame proposed by the ECON must now be considered by the Council of Europe. For the purposes of this briefing, we refer to the relevant application date as being 1 July 2022 although if the revised timeframe as proposed by ECON is approved by the Council of Europe, readers should be aware that the application date will be pushed out to 1 January 2023 (Application Date). We will keep readers updated as and when any further clarity on this emerges.

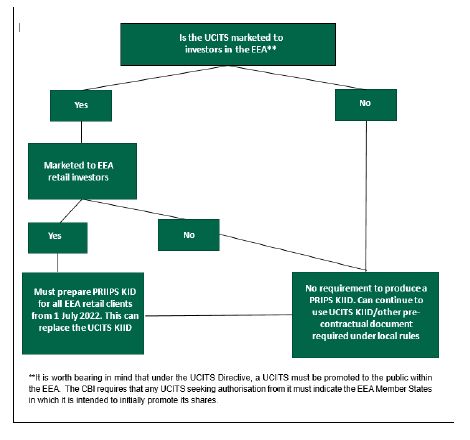

In what circumstances will a UCITS management company be required to produce a PRIIPS KID?

Pursuant to Article 5 of the PRIIPS Regulation4, a PRIIP manufacturer5 will be required to draw up a PRIIPS KID in respect of the UCITS and to publish it on its website, before making that UCITS available to retail investors in the EEA.

The decision tree on the next page should help UCITS management companies in establishing whether or not they will be required to produce a PRIIPS KID from the Application Date.

To view the full article please click here.

Footnotes

1 The revised technical standards amend Commission Delegated Regulation (EU) 2017/653

2 Regulation 1286/2014/EU

3 https://www.europarl.europa.eu/doceo/document/ECON-PR-697633_EN.pdf and https://www.europarl.europa.eu/doceo/document/ECON-PR-697630_EN.pdf

4 Regulation (EU) No 1286/2014 on key information documents for packaged retail and insurance-based investment products (PRIIPs)

5 Although the definition of "PRIIPS manufacturer" under the PRIIPS Regulation does not expressly refer to a UCITS management company, Recital 5 of the PRIIPS Regulation suggests that a UCITS management company is the entity to be considered a PRIIP manufacturer of a UCITS product for the purposes of the legislation. Recital 5 states "PRIIP manufacturers - fund managers, insurance undertakings, credit institutions or investment firms - should draw up the key information document for the PRIIPs that they manufacture, as they are in the best position to know the product" References to "PRIIPS manufacturer" throughout this briefing should be read accordingly

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.