- within Finance and Banking topic(s)

- within Law Department Performance, Strategy, Litigation and Mediation & Arbitration topic(s)

GENERAL POSITION

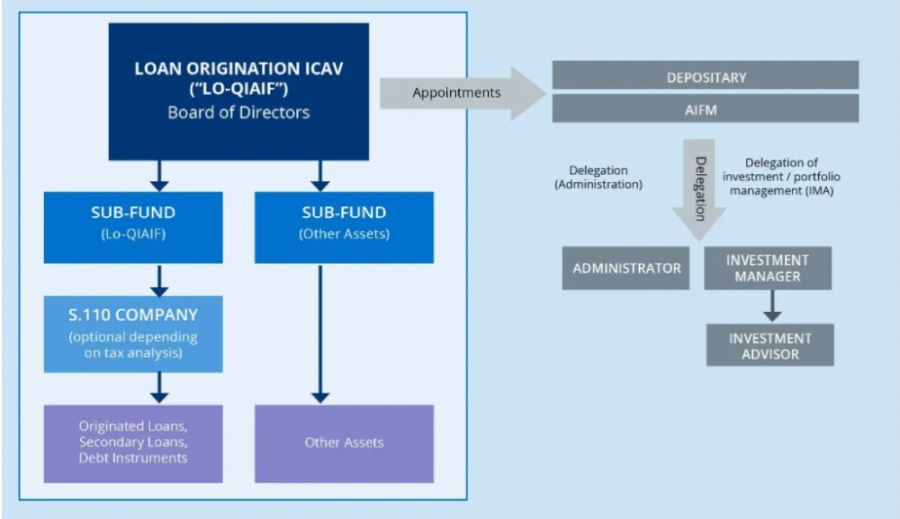

- Facilitates direct lending / loan origination

- LO-QIAIFs can issue loans, participate in loans, invest in debt / credit instruments and participate in lending and operations relating thereto, including investing in debt and equity securities of entities or groups to which the LO-QIAIF lends or which are held for treasury, cash management or hedging purposes

- Lending can be structured as a bilateral loan, an investment in debt securities or as a participation in a syndicated lending arrangement

Regulatory requirements for LO-QIAIFS:

- persification: maximum exposure of 25% of NAV per borrower group (can be achieved over a ramp-up period disclosed in PPM)

- Leverage: must not have gross assets of more than 200% of NAV

- Certain prohibited borrowers (e.g., other investment funds, financial institutions or related companies of these, persons intending to invest in equities / other traded investments / commodities)

TAX

Fund level: Exempt from tax on income or gains; VAT exemptions available for provision of management services to Funds

Investor level: No Irish WHT on payments by a Fund to non-Irish resident investors and exempt Irish resident investors; No stamp duty on the issue or transfer of units in a Fund; No Irish tax on income or gains made by non-Irish resident / ordinarily resident investor

Treaty Access: Available in many cases, further facilitated by the use of a p 110 company subsidiary where required. ICAV is specifically treated as an Irish resident under Ireland/US Tax Treaty and (subject to satisfying ownership requirements of limitation on benefits provisions) is a very efficient vehicle for US source interest income.

* Assumes the ICAV does not hold assets related to Irish land

CHANGES TO AIFMD

Draft legislative proposals amending AIFMD ("AIFMD II") include a proposal to introduce a harmonised framework for loan origination alternative investment funds across the EU. The current Irish LO-QIAIF regime requirements are similar to those proposed for AIFMD II.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.