- within Corporate/Commercial Law topic(s)

- in United Kingdom

- within Law Department Performance, Strategy and Tax topic(s)

The Investment Limited Partnership ("ILP") is an Irish regulated partnership structure that offers a structuring solution for private equity, private credit, real asset, infrastructure, venture capital and other private fund strategies.

The ILP can accommodate all the typical features of a private fund partnership structure and is a comparable vehicle to the Luxembourg SCSp.

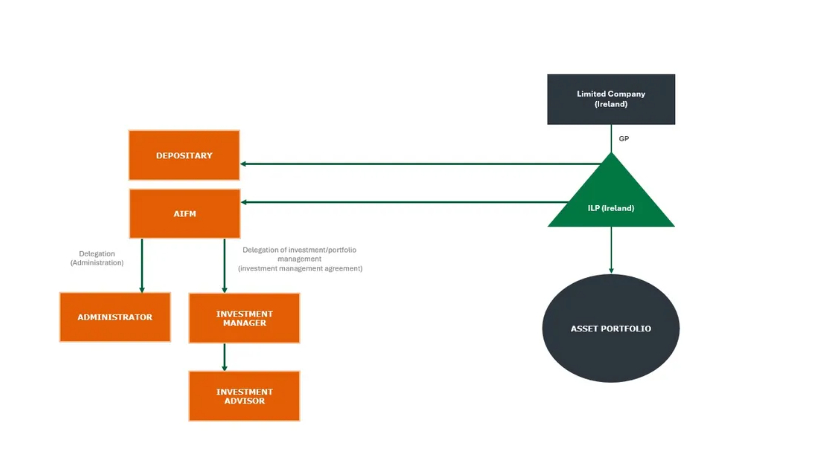

Typical Structure Diagram

What is an Investment Limited Partnership?

An investment limited partnership ("ILP") is a partnership structure established under the Investment Limited Partnerships Act 1994 (as amended) and regulated by the Central Bank of Ireland. An ILP is typically established as a Qualifying Investor AIF ("QIAIF") which is a flexible regulatory regime with limited investment restrictions. ILPs are particularly suited for use in private equity, private credit, real estate and infrastructure, venture capital and other private fund structures as they can accommodate all the typical features of a private fund partnership structure.

ILP structure:

Key Features

Key features of an Investment Limited Partnership

FLEXIBLE STRUCTURE

The ILP incorporates standard private fund features including but not limited to: the ability to have a closed-ended structure; excuse and exclude provisions; capital accounts; commitments, capital contributions and drawdowns; defaulting investor provisions; distribution waterfalls and carried interest mechanisms and advisory committees. There are no investment or borrowing restrictions applicable to an ILP structured as a QIAIF (except for loan origination funds and funds that invest in crypto and Irish real estate).

EU MARKETING PASSPORT

Where an ILP has appointed an authorised EEA alternative investment fund manager (AIFM), it can avail of the AIFMD marketing passport to market to professional investors throughout the EEA.

An ILP may also appoint a non-EEA AIFM or an Irish registered AIFM, in which case it may be sold in relevant EEA member states under applicable national private placement regimes, if applicable.

LP LIMITED LIABILITY

In general, a limited partner's liability will not exceed the amount of its capital contribution or commitment to the ILP unless the limited partner participates in the conduct of the business or management of an ILP. The ILP Act specifies certain activities (safe harbours) which are deemed not to constitute participation by a limited partner in the management of the ILP. This allows limited partners to sit on advisory committees, approve changes to the limited partnership agreement and consult with and advise the GP with respect to the business of the ILP, for example.

SPEED TO MARKET

ILPs structured as QIAIFs[1] can avail of the Central Bank's 24-hour approval process. The fund documents are submitted to the Central Bank but are not reviewed. Instead of undertaking a detailed review, the Central Bank relies on confirmations provided by the directors/manager and legal advisers of the ILP to ensure compliance with applicable Irish regulations. In general, the establishment of an ILP takes 8 to 12 weeks (including drafting the fund documents, negotiation of service provider contracts and completion of KYC).

[1] ILPs investing in Irish property are subject to a pre-submission process.

UMBRELLA FUND

An ILP may be established as a single fund or as an umbrella fund with segregated liability between sub-funds. Each sub-fund may be structured as an open-ended, closed-ended or open-ended with limited liquidity fund and have different investment strategies and terms.

EXCUSE AND EXCLUDE PROVISIONS

It is possible to provide for excuse (where an investor can be excused from an investment) and exclude (where the ILP can exclude an investor from an investment) provisions in a closed-ended ILP. Excuse and exclude provisions are permitted subject to the following conditions:

- the excuse and/or exclude provisions are predetermined and documented by the fund (in respect of excuse provisions by way of a written document between the ILP and the investor prior to an investment being made in the ILP and, in respect of exclude provisions, by providing for the circumstances in which this may occur in the prospectus and/or limited partnership agreement (LPA));

- a formal legal opinion (opinions of internal counsel are accepted) must be provided by the investor or the ILP (depending on the party invoking the provision) outlining the basis on which the excuse or exclude provision is being invoked; and

- the board of the GP and AIFM must document (i) whether or not it accepts the formal legal opinion so provided, and (ii) the consequences of accepting or disagreeing with such opinion.

STAGED CLOSING

Limited partners may invest in an ILP at staged closings. The terms of the ILP can provide that limited partnerss admitted at later closings may participate in existing and future investments of the ILP or in future investments only. In order to facilitate equalisation, the limited partners admitted at a later closing are typically placed in a new class of interests and an equalisation factor is applied.

MANAGEMENT PARTICIPATION AND CARRIED INTEREST

Members of the investment management team may participate in an ILP on the basis of terms that differ from other LPs. This is typically facilitated by placing investment management members in a separate class from other classes. The terms and conditions applicable to the management class must be described in the LPA.

Carried interest mechanisms can generally be facilitated within an ILP in the same manner as in other partnership and corporate structures.

ISSUE OF INTERESTS AT A PRICE OTHER THAN NET ASSET VALUE

An ILP is permitted to issue interests at a price other than net asset value without prior Central Bank approval.

SIDE LETTERS

Side letters may be agreed with limited partners in the same way as other alternative investment funds in Europe. It is not necessary to disclose specific details of preferential treatment agreed with LPs, provided the types of preferential treatment that may be agreed with LPs are generally disclosed.

AMENDMENTS TO THE LIMITED PARTNERSHIP AGREEMENT

The limited partnership agreement of an ILP may be amended by a majority of LPs and GPs. The LPA can define what constitutes a major of LPs (e.g. by commitment, number, contributions). The LPA may be amended without LP consent if the depositary certifies that the alteration does not prejudice the interests of the LPs.

FUND DOCUMENTS AND DISCLOSURE

AIFMD and the Central Bank rules require that certain disclosures are made to investors in relation to the ILP and its terms. An ILP will require a limited partnership agreement and a prospectus or offering document. The prospectus is required to include information on the ILP's investment objective and policy and investment restrictions, the use of leverage (including the types permitted and maximum leverage permitted), valuation provisions, information on the services providers, conflicts of interest and fees and expenses associated with the ILP.

TAXATION OF ILP

The ILP structure is tax transparent for Irish tax purposes and therefore the tax analysis will depend on the domicile of the investor and tax advice will be required on a case-by-case basis. No Irish stamp duty applies to the transfer, exchange or redemption of interests in ILPs.

Service providers to an Investment Limited Partnership

Service Providers to an ILP

|

GENERAL PARTNER |

The GP of an ILP is responsible for the management of the ILP. The GP has unlimited liability and is responsible for the debts and liabilities of the ILP. The GP of an ILP may be a corporate entity, a natural person or a partnership. The GP can be based in any jurisdiction. The board of directors of a corporate GP based in Ireland must include at least two Irish resident directors and one independent director (which may be one of the Irish directors). The GP is not regulated by the Central Bank but the directors of the GP are subject to the Central Bank's fitness and probity regime and must be approved by the Central Bank to perform a pre-approval controlled function. Information in respect of all directors (including personal details, qualifications and experience, other business interests, and any shareholdings held by them in the proposing entity) must be submitted to the Central Bank by the directors themselves via the Central Bank's portal. A change of the GP is subject to CBI approval. |

|

AIFM |

An ILP is required, pursuant to AIFMD, to appoint an AIFM. The AIFM is responsible for risk management, portfolio management, and also generally, administration and marketing. An AIFM may delegate risk management or portfolio management but not both. |

|

INVESTMENT MANAGER |

The AIFM may perform the investment management role but in many cases an investment manager is appointed by the AIFM. The investment manager has discretionary authority to invest and manage the assets of the ILP in accordance with the investment objective and policy of the ILP. If an investment manager proposes to manage an Irish collective investment scheme, such as an ILP, for the first time, the investment manager will need to be cleared by the Central Bank. For a non-EEA investment manager, it must submit a short application to the Central Bank and must satisfy the Central Bank of its experience and expertise and provide certain information including financial statements and proof of existing regulatory licenses. This process typically takes 4-8 weeks. |

|

ADMINISTRATOR |

The administrator is responsible for maintaining the books and records of the ILP, calculating the net asset value of the ILP and maintaining the limited partner register. |

|

DEPOSITARY |

The depositary provides custodial services and is responsible for "safekeeping" the assets of the ILP. A depositary also has certain oversight responsibilities with respect to the ILP. |

|

INVESTMENT ADVISER |

An investment adviser appointed by the investment manager provides non-discretionary investment advice in respect of the ILP. |

|

AUDITOR |

An ILP must appoint an auditor to audit the financial statements of the ILP. |

|

MLRO |

An ILP must appoint a money-laundering reporting officer. |

|

COMPANY SECRETARY |

If the GP is a corporate entity domiciled in Ireland, it will need a company secretary to maintain the books and records of the GP. |

The Formation of an Investment Limited Partnership and Life Cycle – How Arthur Cox can help

Our fund establishment team advises on all types of funds including private equity, private credit, real estate, infrastructure, venture capital and many more. The team is fully equipped to advise clients throughout the entire life cycle of a fund from establishment to liquidation and everything in between.

|

STEPS |

|

|---|---|

|

1. STRUCTURING |

|

|

2. DOCUMENTS/NEGOTIATION |

|

|

3. OBTAINING AUTHORISATION |

|

|

4. LAUNCH |

|

|

5. DAY-TO-DAY OPERATIONS |

|

|

6. WINDING UP/LIQUIDATION |

|

Comparison Table

|

ITEM |

IRISH INVESTMENT LIMITED PARTNERSHIP |

LUXEMBOURG SCSp |

|---|---|---|

|

Legal Structure |

Partnership - at least one general partner and one limited partner |

Partnership - at least one GP & one LP |

|

Separate Legal Personality |

No |

No |

|

Regulatory Status |

Regulated |

Unregulated or Regulated |

|

Legal Framework |

Common law |

Civil law |

|

Applicable Legislation |

European Union (Alternative Investment Fund Managers) Regulations, 2013, Investment Limited Partnerships Act 1994, Central Bank AIF Rulebook |

Law of 12 July 2013 on alternative investment fund managers, Law of 10 August 1915 on commercial companies |

|

Umbrella Fund/Protected Cell Structure Possible |

Yes |

No |

|

Governance Structure |

Unregulated general partner. Directors of general partner subject to Central Bank of Ireland fitness & probity regime |

Unregulated |

|

Irish Resident Directors Required |

Only required if the general partner is Irish. Two Irish resident directors and One independent (which can be one of the Irish directors) |

N/A |

|

Location of General Partner |

Possible to establish general partner outside of Ireland (e.g. US) |

The partnership manager (gérant) (which is typically also the GP) must be in Luxembourg |

|

Open/Closed-Ended |

Both possible |

Both possible |

|

Maximum Number of Investors |

Unlimited |

Unlimited |

|

Ability to Offer Preferential Terms to Certain Investors |

Yes |

Yes |

|

Possible to Structure as a "non-AIF" |

No |

Yes |

|

Required Service Providers |

General Partner, AIFM, Depositary & Auditor |

General Partner, AIFM, depositary & auditor |

|

Speed to Market |

24 hour regulatory approval by Central Bank Passports: One month (if Irish AIFM) two months (if no Irish AIFM) |

No regulatory approval. Formed as soon as the LPA is finalised and entered into Passports: One month (if Lux AIFM) two months (if no Lux AIFM) |

|

EEA Marketing Passport |

Yes |

Yes |

|

Investor Eligibility |

Qualifying Investors (i.e. professional investors, certain types of semi-professional/retail investors) & employees. €100,000 minimum commitment |

Unrestricted[3] |

|

Method of Investment |

Capital commitments & capital contributions |

Capital commitments & capital contributions |

|

Investment Restrictions |

Unrestricted (except for direct exposure to crypto assets and certain loan origination fund restrictions) |

Unrestricted (except for certain loan origination fund restrictions) |

|

Loan Origination Fund Requirements |

Pre-2026: Certain Irish domestic rules 2026 onwards: Harmonised across all EU countries |

Pre-2026: None |

|

Borrowing/Leverage Limits |

None (except for loan origination funds – currently 200% gross assets but to be harmonised across the EU from April 2026 (1) closed-ended 300% net ass value ("NAV"), (2) open-ended: 175% NAV) |

None (except for loan origination funds – to be harmonised across the EU from April 2026 (1) closed-ended 300% NAV, (2) open-ended: 175% NAV) |

|

Diversification Requirements |

None (except for loan origination funds) |

None (except for loan origination funds) |

|

Tax – Fund/Entity Level |

|

|

|

Tax – Investor Level |

|

|

[1] A professional client within the meaning of Annex II of Directive 2014/65/EC (Markets in Financial Instruments Directive)

[2] A knowledgeable investor/employee means (a) a company appointed to provide investment management or investment advisory services to the ILP; (b) a director of the GP or a director of a company appointed to provide investment management or investment advisory services to the ILP; or (c) an employee of a company appointed to provide investment management or investment advisory services to the ILP and is directly involved in the investment activities of the ILP or is a senior employee of the company and has experience in the provision of investment management services; and, in each case, the LP must certify that they are availing of the relevant exemption and that they are aware that the ILP is normally marketed to qualifying investors who are subject to a minimum commitment of €100,000 and they are aware of the risks involved in the investment.

[3] Marketing to professional investors is by way of the AIFMD marketing passport. Marketing to any investor other than a professional investor (e.g. semi-professional or retail investors) is via private placement

Why Ireland

Ireland is a highly attractive leading global fund domicile. Since the establishment of the funds and asset management industry in Ireland over 30 years ago, the industry has grown exponentially. Ireland is a renowned fund jurisdiction due to its:

Regulatory Environment: Ireland has a robust regulatory environment

Tax Benefits: internationally recognised, open and tax-efficient jurisdiction. Regulated Irish funds are generally exempt from tax on their profits. Favourable tax status for debt issuers/minimal corporate tax leakage. No withholding tax and limited VAT leakage

Skilled Workforce: extensive and skilled fund service provider industry and well-established financial services infrastructure

Strategic position within the European Union

Distribution: the EEA marketing passport facilitates cross-border distribution

International recognition: Irish funds can be sold in countries across Europe, the Americas, Asia and the Pacific, the Middle East and Africa

Easy to do business in

Common law legal system, similar to the US and UK

Sophisticated legal market

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.