The Irish government recently enacted the implementing regulations for CSRD a lot of the focus has been on large corporates and listed SME's. Attention will now turn to their value chain, largely made up of SME's and it will become increasingly important for SMEs to review how they approach sustainability in their businesses.

In Part 1 of our Guide to SME Sustainability Reporting we provided an overview of the drivers of sustainability reporting for SME's, CSRD, value chain reporting by large corporates, the cascade effects for SME's and the practical implications CSRD will have for accessing finance and investment.

But if you are an SME, where do you start with sustainability reporting or formulating a sustainability strategy? What are the key issues to consider in formulating a coherent approach?

EFRAG (European Financial Reporting Advisory Group) have developed guidance for SMEs on sustainability reporting which will aid SME's address value chain sustainability, standardisation of SME sustainability disclosures to be made to large corporates and also support the development of voluntary sustainability reporting.

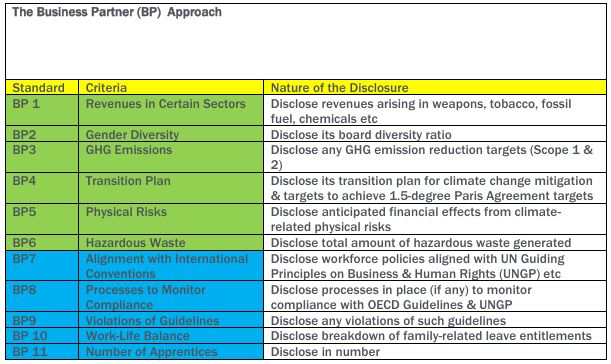

In Part 1 our "CSRD Where to Start" flowchart addressed in simple terms a series of steps for an SME's thought process. Once you have considered what your sustainability strategy is and what you are seeking to achieve, the next step is to address how to approach reporting on your sustainability strategy. EFRAG have devised a three-tier approach to sustainability reporting for SME's:

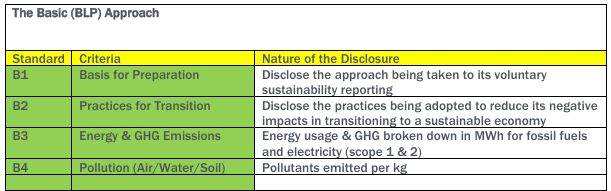

- Basic Approach– ideally suited to micro-undertakings (<€350k Balance Sheet Total; <€700k turnover and <10 employees). This is the baseline minimum reporting requirement with simple basic level disclosures. No materiality analysis is required to be undertaken under this approach.

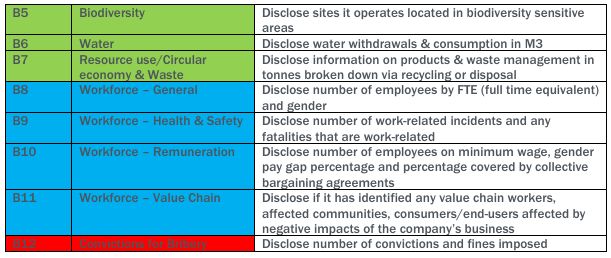

- Narrative Approach– comprising a narrative of the policies, actions and targets (PAT) set by an undertaking. Materiality analysis is required to be included to explain the relevance of the sustainability disclosures being made by the entity.

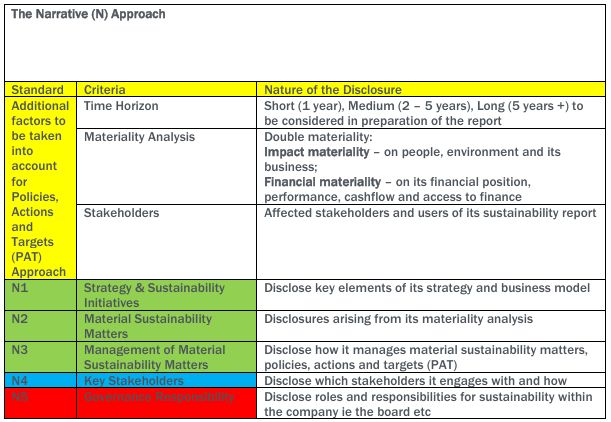

- Business Partner Approach– appropriate for lenders, investors or business partners of an undertaking to disclose the sustainability matters relevant to its business and organisation. This is a baseline value chain sustainability approach which can be referenced in assessing sustainability enquiries received from customers or suppliers that are requirements subject to CSRD.

SME Voluntary Sustainability Reporting Approaches - Overview

By reviewing the core components of the basic sustainability reporting an SME can begin to establish the basic elements of its sustainability strategy, establishing policies and early internal governance measures, setting a baseline for its primary impacts which will inform the setting of targets as time evolves and the steps to be taken to mitigate its primary impacts and GHG emission reductions.

The Business Approach will guide large corporates, banks and insurance companies in setting a baseline expectation for sustainability reporting from their value chain, borrowers/policy holders and SME's.

SME sustainability reporting whilst voluntary under CSRD for SME's other than listed SME's, value chain reporting will increasingly make the deployment of by SMEs of sustainability reporting the norm. Whether seeking to access finance or refinance from a bank, to securing the next customer opportunity or sales contract, SME's will find they are being asked to provide increasing levels of sustainability information. Those that are prepared and are able to demonstrate a clear sustainability strategy and the mitigation of harmful impacts will gain a competitive commercial advantage. Added to this that adopting sustainability reporting offers a framework to undertake a 360-degree review of a business's operations and policies and to publicise and demonstrate the efforts it may have already taken (and future plans) in relation to sustainability, such as installing solar panels, adopting green electricity supply, reducing GHG emissions or retrofitting premises SME's can maximise the commercial in a coherent and consolidated form.

Talk to us if you are considering your sustainability ambitions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.