- within Wealth Management topic(s)

Warranty & Indemnity(W&I)insurance has increased in popularity in recent years, especially in private merger and acquisition(M&A)transactions. In the past five to ten years, W&I insurance has become a mainstream and widely applied M&A solution for larger and smaller M&A transactions. Both private equity and strategic parties have come to realise that W&I insurance not only facilitates clean exits for sellers by replacing escrows or contractual claims under an SPA with an insurance policy, but also provides buyers with extended warranty coverage (in terms of scope and time periods) as well as a solid and professional counterparty in case of a warranty claim.

The standard W&I insurance policy is an attempt to reach a compromise between the commercial advantage and overall appeal of using a W&I insurance on the one hand and the requirement by underwriters that the insured and their advisors still conduct comprehensive due diligence to confirm the accuracy of the representations and warranties on the other hand.

W&I insurance policies offer protection in the event of unknown breaches of representations and warranties but they are not meant to cover blanket risks that could be identified during the course of standard due diligence. In addition to adequate diligence, insurers expect to see a healthy negotiation of representations and warranties in the underlying agreement and a proper disclosure letter listing all alarming or worrying facts. Both a comprehensive due diligence and disclosure process as well as a relatively balanced set of representations and warranties remain key for a smooth underwriting process and for the proper W&I insurance policy to be obtained.

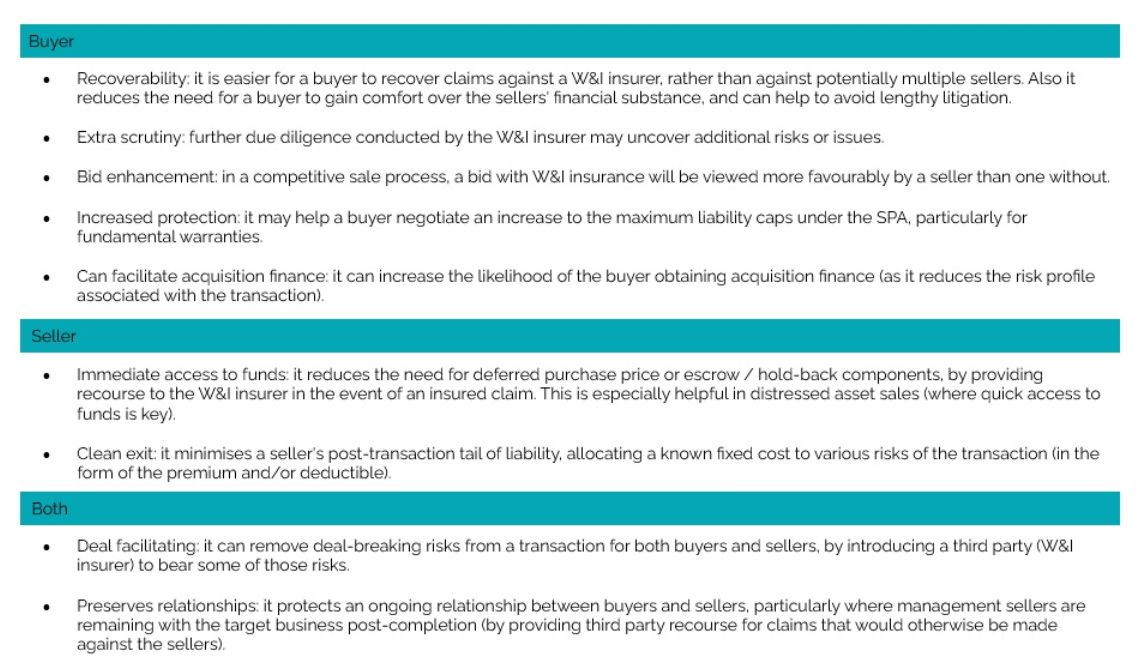

Benefits of W&I insurance

There are a range of benefits to W&I insurance for both buyers and sellers as detailed below.

How can Woźniak Legal help?

Woźniak Legal can help:

- draft and /or review your M&A transactions and advise whether you may benefit from W&I insurance;

- undertake legal due diligence;

- coordinate the acquisition process;

- liaise with the right insurance company who may provide W&I insurance; and

- review terms and conditions of W&I insurance.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]