- in India

- with readers working within the Advertising & Public Relations and Retail & Leisure industries

- within Family and Matrimonial, International Law and Employment and HR topic(s)

Estate and succession planning aids in establishing an orderly process of transferring a person's wealth and assets. As the catastrophic outbreak of COVID-19 continues to wreck a global havoc, it is imperative for the families to secure their hard- earned wealth and assets through estate planning. A well-defined estate and succession plan can prevent future legal squabbles and family feud between the members of a family.

In this post, we will evaluate various instruments of succession and estate planning under the Indian law. Furthermore, we aim to assess the implications of transferability of Will, Gifts and Relinquishment Deed vis-à-vis explain the fundamental distinction between the three.

Wills

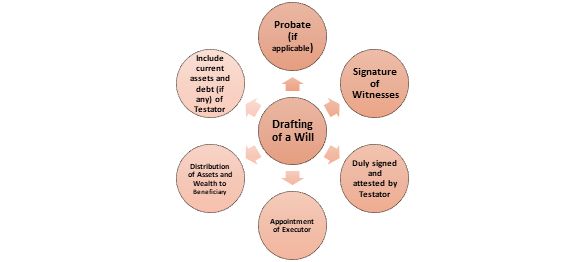

Will is the most popular instrument for estate and succession planning in India. It is a legal document wherein a person i.e., a testator declares his/her intention with respect to ownership and transferability of assets and wealth upon his/her demise. Unlike any other document, a Will comes into effect only upon the death of the testator.

In India, Wills are governed by the Indian Succession Act, 1925 ("Succession Act"). As per Section 2(h) of the Succession Act, a "Will" is defined as "the legal declaration of the intention of a testator with respect to his property which he desires to be carried into effect after his death".The essentials of a valid Will include testator's capacity to execute a Will, clear intention in relation to inheritance under the Will and signature of witnesses to the Will.

Under a Will, a testator can bequeath both movable and immovable properties in which he/she exercises complete ownership. Further, the testator may specify the manner of distribution of properties upon his/her demise. As the Will shall come into effect only upon death, the testator retains control over the assets and may at any time alter the manner and devolution of assets under the Will through a codicil (a document amending the Will). While a Will can be registered to minimize a potential dispute, an unregistered Will is also enforceable. As per the Succession Act, a Will can only be revoked by the testator in the event of - (i) execution of a subsequent Will, (ii) declaration of an intention in writing by the testator to revoke the Will; or (iii) burning, tearing or destruction of the Will.1

It is imperative to mention that upon the demise of the testator, a Will is enforced by the executors after filing an application before the court for obtaining a probate or a letter of administration. A probate is a certificate issued by the court to the executor upholding the validity of a Will. The executor must pay the requisite court fees on probate petitions. The court fees is computed on ad valorem basis i.e. a certain percentage of value of estate inherited under the Will must be probated. Once a probate is issued, the beneficiary shall be entitled to inherit the assets of the testator as specified in the Will.

Moreover, obtaining a probate of Will is mandatory only in Mumbai, Chennai and Kolkata wherein the Will is executed in either of the three cities or the immovable property bequeathed under the Will is situated in any of these cities.

| Applicable Court Fees on Probate | ||

| Mumbai | Chennai | Kolkata |

| INR 75,000/- | INR 25,000/- | 5.5% of value of property |

While the court fees in Mumbai and Chennai is capped to a certain

limit irrespective of the value of property, the court fees in

Kolkata appears to be as high as 5.5% of the value of property

bequeathed in the Will. On the contrary, the stamp duty on a gift

deed transferring immovable property within Kolkata is 0.5%.

Therefore, executing a gift deed will be a cost-effective option in

Kolkata rather than bequeathing property under a Will. However, one

must be mindful about the fact that once a gift deed is registered,

it cannot be revoked unless there is a specific clause carved out

in the deed.

In other jurisdictions, where probate is not compulsory, one must carefully assess the quantum of stamp duty and court fees payable over a Will. In the event, a Will appears to be a costly affair, one may consider making testamentary gifts.

Gifts

A Gift deed is another widely used instrument for estate and succession planning. According to Section 122 of the Transfer of Property Act, 1882 ("TP Act"), a gift is defined as - "the transfer of certain existing moveable or immoveable property made voluntarily and without consideration, by one person, called the donor, to another, called the donee, and accepted by or on behalf of the donee" ("Gift"). In simpler words, a Gift is a gratuitous transfer of ownership of a moveable or an immoveable property between the transferor ("Donor") and the transferee ("Donee"). It must be transferred voluntarily and accepted by Donee during his/her lifetime. As per Section 124 of TP Act, only an existing property can be transferred vide a Gift deed. Moreover, it is noteworthy to mention that a Gift deed cannot be revoked or cancelled by the Donor once it is accepted by the Donee and is registered in accordance with the due process of law.

As per Section 17 of the Registration Act, 1908 a Gift deed must be compulsorily registered in order to be valid and legally effective. The stamp duty applicable on the registration of a Gift deed varies from one state to another. Few states also offer concessions in case property under Gift deed is being transferred to blood relatives.

| Applicable Stamp Duty on Gift deed | |

| Name of State | Stamp Duty |

| Maharashtra2 | 3% of market value of property; Rs. 200/- (if the Gift deed is for residential/ agricultural property passed onto to family members) |

| Andhra Pradesh & Telangana3 | 1% of market value of property (family members). In any other case 4% of the market value of property |

| Delhi4 | 3% of the market value of property; 2% in respect of individually/jointly held immovable property by woman (reduction only applicable to share of woman in property) |

| Madhya Pradesh (family members)5 | 2.5% of market value of property |

| Madhya Pradesh (non-family members) | 5% of market value of property |

| Karnataka (non-family member)6 | 5% of market value of property |

| Karnataka (family member)7 | Rs. 5000/- (property is situated within the limits of Bangalore); Rs. 3,000/- (property is situated within panchayat area); and Rs. 1,000/- (property is situated within the limits other than limit specified above) |

While transferring assets through a Gift deed, it is imperative to

understand the tax implications in respect of the same. The Income

Tax Act, 1961 ("ITA"), under

Section 56, imposes tax under various heads, one of which is

'income from other sources'. According to the ITA, the

value of all the Gifts received by a person during a year is fully

exempt, as long as the total value of Gifts does not exceed Rs.

50,000 in a year8. Therefore, in the event a person

receives Gifts exceeding Rs. 50,000 in value without any

consideration, the entire sum of money is liable to tax in the

hands of the Donee as income from other sources.

However, there are certain exceptions on tax liability in respect of Gifts. Money or property that is received from Donee's close relatives or during marriage shall not be taxed as income from other sources. Similarly, money or property that is received under a Will is exempt from tax. Therefore, one must carefully evaluate the local rules and regulations surrounding the transfer of property by way of a Gift deed.

Relinquishment Deed

In the event, a person dies intestate (without a will), his/her right in the properties will devolve upon the legal heirs as per the Succession Act. Accordingly, the legal heirs may decide to retain their shares in the property or relinquish their rights with or without any consideration. A relinquishment deed enables the co-owner to legally transfer their share in the property to another co-owner. It is noteworthy to mention that a relinquishment deed can be executed by the co-owners in favour of another co-owner only. A person cannot relinquish his/her share in a property in respect of a third party.

Moreover, according to Section 17(1)(b) of the Registration Act 1908, any instrument using which a right is created or transferred in respect of an immovable property must be compulsorily registered. Therefore, a relinquishment deed must be registered in order to be legally binding.

Generally, people confuse relinquishment deed with a Gift deed. In order to address the issue, the Delhi High Court in the case of Tripta Kaushik v. Sub Registrar VI-A, Delhi & Anr.9 carved out a test to determine whether an instrument can be considered to be a relinquishment deed or a Gift deed. The court upheld that the language or nomenclature which the party may chose while drafting a document is irrelevant, rather the decisive factor shall be the actual character of the transaction intended by the executors. Furthermore, the court has expressly clarified that if the relinquishment is in favour of one of the co-owners and not against all, the document would then be a Gift deed and not a relinquishment deed. The test laid down by the court is a guiding factor to understand the difference between a Gift deed and a relinquishment deed. Additionally, stamp duly charges on registering a relinquishment deed is lower as compared to a Gift deed, thereby rendering it as a cost-effective alternative.

Key Differences between Will, Gift and Relinquishment Deed

| Parameters of Comparison | Will | Gift | Relinquishment Deed |

| Execution | Upon the death of the testator. | During the lifetime of Donor and Donee. | During the lifetime of the co-owner towards another co-owner. |

| Registration | Registration is not mandatory. | Registration is mandatory u/s 17 of Registration Act 1908. | Registration is mandatory u/s 17 of Registration Act, 1908. |

| Consideration | A Will is made without any consideration. | A Gift deed is made without any consideration. | A Relinquishment Deed may or may not have an element of consideration. |

| Tax Implications | There are no tax implications on the beneficiary. | A Gift with a value exceeding Rs. 50,000/- is taxable at the hands of Donee. However, a Gift received from close relatives or during marriage is exempt from tax liability. | There are no tax benefits for a 'transfer' under Relinquishment Deed. Therefore, relinquishing a right in property against monetary consideration will attract capital gains for the transferor. Further, tax will be levied only upon the portion of property in which the right is relinquished. |

| Revocation | A Will can only be revoked in accordance with Section 70 of the Succession Act. | A Gift deed cannot be revoked; however, it can be challenged in a court of law on the grounds of fraud or coercion. | A Relinquishment Deed is irrevocable even if it is without any consideration. It can be only challenged in a court of law on the grounds of fraud or coercion. |

Conclusion

Estate and succession planning requires a careful consideration before finalizing the mode of transfer of interest in properties. As discussed above, a Will, Gift and Relinquishment Deed are the most common instruments of estate planning. Nonetheless, each serve a different purpose of its own. A Will may be the best option to avoid potential family disputes over inheritance rights in a property after the death of the testator whereas a Gift deed enables the Donor to bequeath the interest in property immediately during his/her lifetime.

In light of the discussions in this post, one must carefully assess the objective, tax implications and costs related to transfer of property in respective jurisdictions. Therefore, it is important to seek legal and tax advice before undertaking estate and succession planning.

Footnotes

1. Section 70, Indian Succession Act, 1925

2. Article 34 of Schedule I, Maharashtra Stamp Act, 1958

3. Article 29 of Schedule IA, Indian Stamp (Andhra Pradesh Amendment) Act, 1922

4. Article 33 of Schedule IA, Indian Stamp Act, 1899 (As applicable to National Capital Territory of Delhi)

5. Article 36 of Schedule IA, Indian Stamp Act, 1899 (Madhya Pradesh)

6. Article 20 of Schedule, Karnataka Stamp Act, 1957

7. Article 28 of Schedule, Karnataka Stamp Act, 1957

8. Section 56(2)(vi), Income Tax Act, 1961

9. 270 (2020) DLT36

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.