- within Tax topic(s)

- in United States

- with readers working within the Law Firm industries

- within Law Department Performance and Employment and HR topic(s)

Cross-border Mergers and Acquisitions (M&A) demand planning and structuring across multiple dimensions, with tax being a crucial element. While India may seem small in the grand scheme, its tax landscape is as intricate as a game of chess, with numerous considerations that can significantly impact both buy-side and sell-side strategies.

The nuances of Indian tax implications and documentation requirements can significantly influence the overall structure of a transaction, even in cases where there's no direct transfer of Indian entities or assets. Much like China and Australia, India imposes capital gains tax and withholding tax obligations even on indirect transfer of Indian assets, adding another layer of complexity to the process.

If these Indian tax aspects and documentation needs are not factored at an early stage of structuring, they can lead to significant delays and unexpected tax costs, ultimately undermining the strategic goals of the M&A. It's therefore essential for stakeholders to adopt a proactive approach to these Indian tax issues from the very beginning.

This article delves into the critical tax considerations involved in an Indian M&A, particularly focusing on withholding tax implications, tax clearance certificates, valuation, and the essential registrations and filing obligations that parties must navigate.

1. WITHHOLDING TAX IMPLICATIONS: A DOUBLE-EDGED SWORD

Direct Transfer

Direct transfer refers to a straightforward sale of Indian shares or assets. While the seller usually bears the capital gains tax burden, the buyer steps into a pivotal role as the withholding agent, required to deduct tax at source (TDS) before parting with any payment to the seller.

- For Resident Sellers: The TDS obligation is relatively straightforward. A withholding tax @ 0.1% is required to be deducted if the consideration exceeds INR 5mn (USD 60k approx.). If the Buying shareholders are not engaged in any business activity in India, it could be argued that these withholding tax provisions should not apply and, in such scenario, the resident sellers can manage their capital gains tax through their annual income tax filings.

- For Non-Resident Sellers: This is where the plot thickens! The withholding tax rate for non-residents can range from 12.50% to 39% (plus applicable surcharge and cess), depending on whether the gains from the sale of the asset qualifies as a long-term or short-term capital gain. It's also crucial for buyers to obtain various tax declarations and examine applicable Double Taxation Avoidance Agreement (DTAA) that might lower this burden.

Indirect Transfer

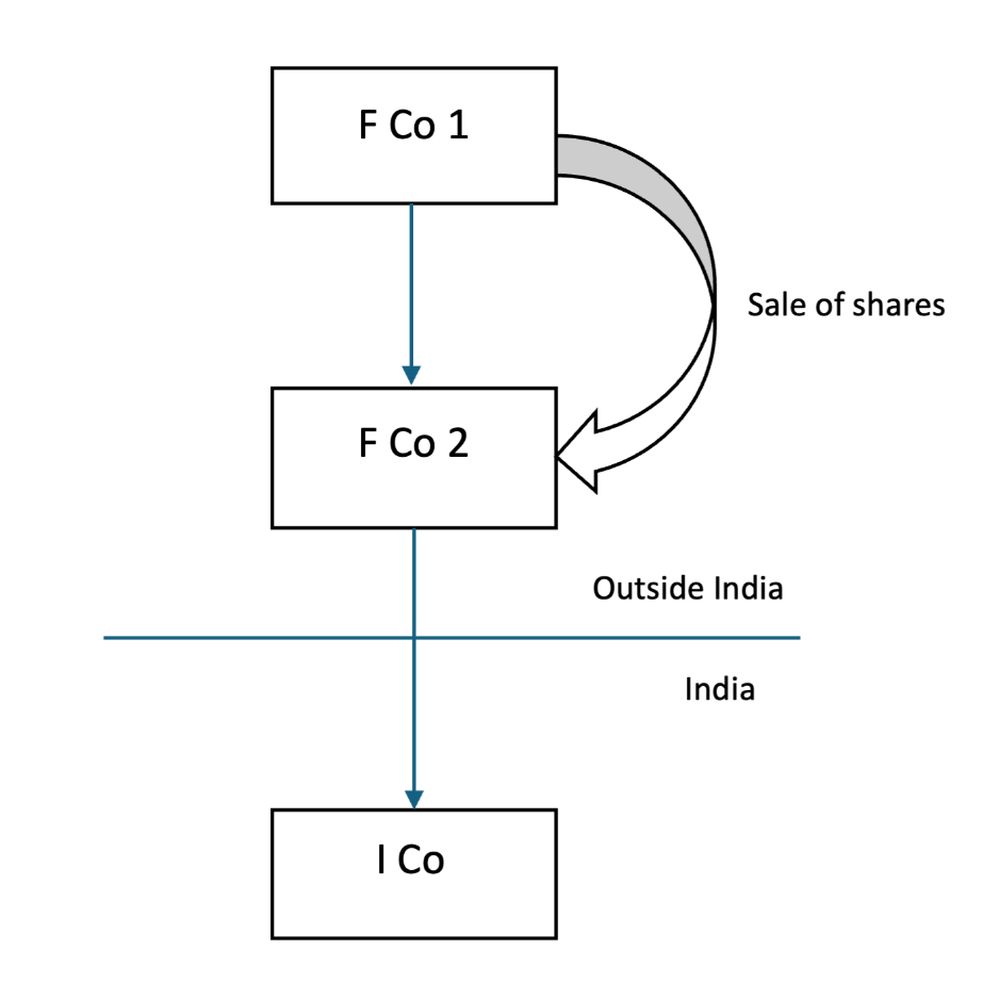

Indirect transfer involves sale or transfer of shares of a foreign company that holds assets in India.

The landmark Finance Act of 2012 clarified that such transactions are taxable in India under Section 9(1)(i) of the Income Tax Act, 1961, bringing indirect transfers into the purview of Indian tax regulations.

Primarily, it means that even if a foreign company sells its shares in another foreign company, Indian tax authorities can deem that as a transfer of assets situated in India, triggering capital gains tax obligation for the selling shareholders and withholding tax obligation for the buying shareholders. Failing to examine these provisions could lead to unexpected tax liabilities, interest, and penalties, making this aspect vital during the planning stages. Therefore, understanding this legal framework is crucial for any business contemplating cross-border transactions involving Indian assets.

Here's a summary of the conditions that must be met for indirect transfer provisions to apply, along with valuation requirements and exemptions outlined in the law:

Exemptions:

- Small shareholders exemption: Shareholders holding directly or indirectly less than 5% in F Co 2/ the transferring entity are exempt from indirect transfer provisions.

- Tax treaty exemption: Certain tax treaties allow gains from the sale of shares of a company which is a resident of a Contracting state to be taxed in that state, thereby exempting indirect transfers from Indian taxation.

- Foreign Portfolio Investors (FPIs): FPIs holding shares in F Co 2/ the transferring entity are exempt from indirect transfer provisions.

2. THE IMPORTANCE OF TAX CLEARANCE CERTIFICATES

Indian tax law (direct and indirect) requires prior permission or clearance from the tax authorities for sale or disposal of specified assets (including shares) if there are any ongoing tax proceedings or pending claims/demands against the seller ("Tax Clearance Certificate" or "TCC").

Failure to obtain the TCC can render the transaction "void" as regards any claim that the tax authorities may have against the seller. Therefore, ensuring a Tax Clearance Certificate is in place in accordance with Section 281 of the Income tax Act, 1961 and Section 85 of the Central Goods and Services Tax Act, 2017 is pivotal for the buying shareholders.

Practically, procuring a Tax Clearance Certificate can be time consuming (may involve several months) and is issued only after the taxpayer settles the tax demands/provides suitable collateral (bank guarantee) for the same.

As an alternative, if there are no material tax demands or proceedings against the selling shareholders, stakeholders may consider obtaining:

- A comfort letter from an independent and reputed accounting firm confirming that there are no tax proceedings or pending claims/demands; and / or

- Screen-prints from the tax portal of the respective selling shareholders that confirm that there are no tax proceedings or pending claims/demands.

3. TAX VALUATION: NAVIGATING SECTION 50CA AND 56(2)(X)

Tax valuation of Indian entities is another critical aspect influencing both the purchase price and the timelines in a transaction.

In addition to the valuation requirements for indirect transfer, the Indian Income Tax Act (Section 50CA and Section 56(2)(x)) prescribes the minimum price at which the shares of a closely held unlisted entity should be transferred.

If the shares are transferred at less than the prescribed minimum price and the difference exceeds INR 50,000 (USD 600 approx.), there may be tax implications for both the buying shareholders and the selling shareholders:

- For Buying Shareholders: The difference between the actual price and the minimum price would be taxable as Income from Other Sources.

- For Selling Shareholders: The prescribed minimum price will be imputed as the sale price for the shares and capital gains will be computed accordingly.

4. TAX COLLECTION AT SOURCE - AN ADDED COST

Tax Collection at Source (TCS) is another critical factor in M&A transactions that can potentially add extra tax costs for the buying shareholders.

When tax withholding doesn't apply, selling shareholders may impose a TCS of 0.1% on top of the purchase price. The applicability of TCS depends on fulfilment of specific conditions. If it does apply, the selling shareholders must collect the 0.1% tax in addition to the sale proceeds, remit it to the Indian government, and handle all related compliance obligations. For buying shareholders, TCS could represent an additional cost unless they secure a Tax ID (Permanent Account Number) and file an income tax return to claim a refund.

5. TAX REGISTRATIONS AND RETURN FILING OBLIGATIONS

Both buying and selling shareholders may be required to obtain Indian tax ID / registrations. This process can involve apostille of several documents, a process that often drags on and demands considerable time. Moreover, failing to obtain these registrations could result in higher tax rates. Therefore, to sidestep delays and extra tax costs, it's wise to analyse the requirements and kick off this process early in the transaction.

Buying shareholder compliances

To comply with tax withholding, buying shareholders need to obtain a Permanent Account Number (or PAN) and a Tax Collection and Deduction Account Number or (TAN).

They may also need to secure tax declarations from the selling shareholders, file Form 15CA and 15CB (the latter being a Chartered Accountant certificate), deposit the withholding tax amount with the Indian Government treasury, file a withholding tax return / statement, and provide a withholding tax certificate to the selling shareholders.

Selling shareholders compliances

If the buying shareholders adhere to the appropriate tax withholding and compliance measures, selling shareholders may not be required to make any additional tax payments. However, they are required to file a return of income disclosing the share sale transaction and the corresponding capital gains or losses. Also, to file the return of income, they must obtain a PAN in India.

Moreover, if indirect transfer provisions are triggered, additional tax compliances and filing obligations may arise for the buying shareholders, selling shareholders and the Indian entity involved.

6. CONCLUSION: MASTERING THE M&A TAX LANDSCAPE

Often, it is observed that the scale of Indian operations or the perception that the Indian entity primarily serves as a captive support unit for its parent company leads to the assumption that these operations hold little intrinsic value. Consequently, the tax implications, documentation, valuation and registration requirements associated with the Indian entity are overlooked during the initial planning stages of the transaction.

As a result, these Indian tax considerations tend to surface only at a much later stage, disrupting the entire transaction timeline. This oversight not only generates anxiety among stakeholders but can also lead to substantial tax costs that could have been avoided with earlier intervention. Moreover, there are instances where a different transaction structure could have been more advantageous in light of Indian tax implications, but by the time this realization dawns, it's often too late to make necessary adjustments.

To effectively navigate the complex and intricate Indian tax environment, stakeholders must adopt a proactive approach to these Indian tax implications and documentation requirements right from the start.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.