Introduction: Meaning and purpose of the Refund process under the GST

The Goods and Services Tax ('GST') regime in India represents a unified tax structure that replaced multiple indirect taxes to simplify tax compliance and promote ease of doing business. Introduced under the Goods and Services Tax Act of 2017 ('Act'), this framework consolidates various state and central taxes into a single tax applicable to the supply of goods and services. The refund mechanism is central to the GST regime and critical in ensuring taxpayers do not suffer from excess tax payments.

The refund process under GST plays a vital role in maintaining the liquidity of businesses and preventing the cascading effect of taxes. Situations such as the export of goods or services, inverted duty structures, or the accumulation of input tax credits often result in excess tax payment, necessitating a refund. An efficient refund mechanism is essential for businesses to avoid capital blockage and ensure a smooth cash flow. Thus, understanding the nuances of the refund process under GST is crucial for businesses to operate without unnecessary financial burdens while complying with statutory obligations. The Act lays down specific provisions for claiming refunds, and the government's focus on streamlining this process reflects its commitment to enhancing taxpayer convenience under the GST framework.

In this insight, the author discusses the refund process comprehensively as outlined under the Act, which covers the provisions referring to the refund process that needs to be followed mandatorily to claim the refunds. Additionally, the insight touches upon the case laws, which have provided valuable discernment regarding the refund process under the GST.

Overview of Relevant Sections of the Act

Relevant Laws Governing Refunds Under the Act

- S.54 of the Act: S. 54 outlines the conditions and procedures for claiming refunds under the Act framework. Taxpayers can claim refunds in various scenarios, including exports (both with and without tax payment), situations involving an inverted duty structure where input tax rates exceed output tax rates, excess tax paid due to errors, deemed exports, and other specified circumstances. Importantly, the time limit for filing a refund claim is generally two years from the relevant date.

- S. 5 of the IGST Act, 2017: S. 5 of the Integrated Goods and Services TaxAct, 2017 ('IGST') deals with the refund on the supply of goods or services to a Special Economic Zone ('SEZ') or for exports. This section allows for the refund of the IGST paid on the export of goods and services, ensuring that the tax burden does not adversely impact exporters. It specifies that the refund shall be granted in accordance with the provisions prescribed under the Act, thereby linking the refund process for IGST to the existing refund mechanisms established under the CGST framework.

- R. 89 of the Central Goods and Service Tax Rules, 2017 ('Rules'): R. 89 of the Rules details the procedural aspects for claiming refunds under s. 54 of the Act. It mandates filing Form GST RFD-01 along with the necessary supporting documentation. The processing of refund claims is time-bound, requiring an acknowledgement within 15 days of submission and a final decision within 60 days. Additionally, a provision for provisional refunds allows taxpayers to receive 90% of the claimed amount for exports within 7 days of acknowledgement.

- R. 96 of the Rules: R. 96 of the Rules governs the refunds of IGST paid on exports. Refunds under this rule are processed automatically based on shipping bills filed with customs authorities. The refunds are verified and credited within 15 days of submission of export documentation. It is crucial for exporters to file their GSTR-1 and GSTR-3B returns timely to maintain eligibility for these refunds.

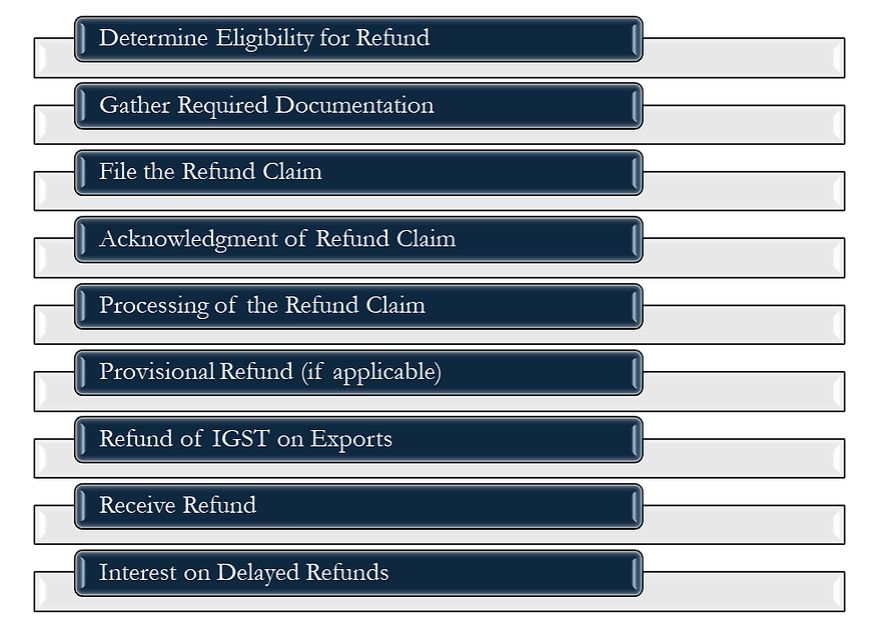

Step-by-Step Process to File a Refund Claim

- Determine Eligibility for Refund: Before initiating a refund claim, it is crucial to ascertain your eligibility under the provisions of the GST law. According to s. 54 of the Act, you may be eligible for a refund in scenarios such as exports of goods or services (with or without tax payment), inverted duty structure where input tax exceeds the output tax, excess tax paid due to errors, or deemed exports. Ensure that your situation aligns with these criteria.

- Gather Required Documentation: Once eligibility is confirmed, the next step is to collect all necessary documentation to support the refund claim. This may include invoices, shipping bills (for exports), payment receipts, and GSTR returns (GSTR-1 and GSTR-3B). R. 89 of the Rules emphasizes the importance of having adequate supporting documentation for the refund process.

- File the Refund Claim: To initiate the refund process, the assessee needs to fill out Form GST RFD-01. This form should be submitted through the GST portal along with all the supporting documents gathered by the assessee. R. 89 of the Rules outlines the procedure for filing the refund claim, ensuring that all details are accurately provided.

- Acknowledgement of Refund Claim: After submitting the refund claim, the GST officer must acknowledge it within 15 days of receipt. This acknowledgement is essential as it marks the commencement of the processing period for your claim, as stipulated in r. 89 of the Rules

- Processing of the Refund Claim: The refund claim must be processed within 60 days from the date of acknowledgement. This time frame is governed by s. 54 of the Act, which mandates timely processing to ensure taxpayers receive their refunds without unnecessary delays.

- Provisional Refund (if applicable): If the assessee's claim is eligible, a provisional refund of 90% of the claimed amount can be issued within 7 days of acknowledgement. This provision, included in r. 89 of the Rules allow quicker access to funds while the full claim is processed.

- Refund of IGST on Exports: The refund process for exporters is slightly different and is governed by s. 5 of IGST and r. 96 of the Rules. Refunds are processed based on shipping bills filed with customs and verified accordingly. Exporters can expect refunds to be credited within 15 days of their claim being acknowledged.

- Receive Refund: Once the refund claim is approved, the refund amount will be credited to your bank account per the details in your application. This step finalizes the refund process, providing the taxpayer with their entitled amount.

- Interest on Delayed Refunds: In case of delay in processing the refund, s. 54(6) of the Act stipulates that interest is payable at 6% per annum from the 61st day after the claim submission. This provision ensures taxpayers are compensated for any undue delay in receiving their refunds.

Eligibility for Claiming GST Refund

Refunds under the Act can be claimed by various categories of taxpayers, including:

- Exporters of goods and services.

- Persons who have paid excess tax.

- Suppliers affected by the inverted duty structure.

- Persons who have made an advance tax payment but have not made the supply.

- Taxpayers who have accumulated excess balance in their electronic cash ledger.

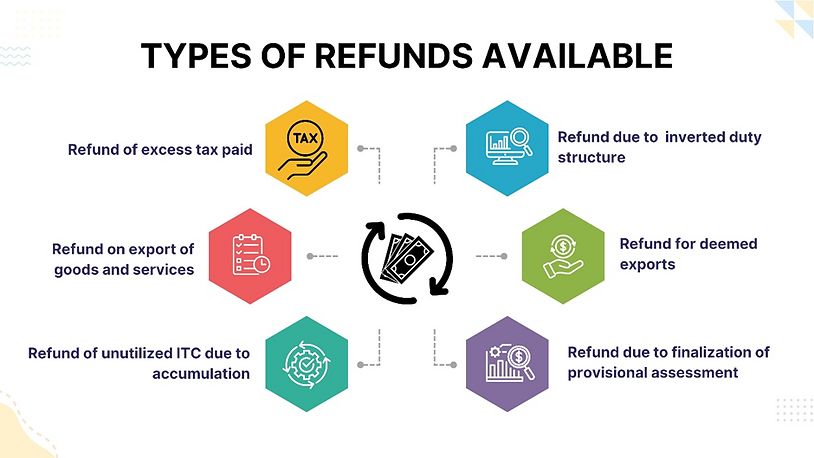

Types of Refunds

Limitations of GST Refund

The process of claiming refunds under GST is subject to various limitations and prerequisites, which have been shaped over time by statutory provisions and judicial rulings. One of the key limitations is the two-year time limit for filing refund applications under s. 54 of the GST Act, with the 'relevant date' differing based on the type of claim. For example, exports and excess tax payments have distinct relevant dates, which can lead to disputes. Courts have often intervened to clarify the interpretation of these time limits, ensuring that businesses adhere to timely submissions to avoid claim rejection.

In recent trends, the time limit for filing refund applications under s. 54 of the Act is generally regarded as a mandatory two-year period from the 'relevant date', which varies based on the nature of the refund claim. The relevant date for exports is the date on which goods were exported or services provided, while for excess tax paid, it is the date of payment. Refunds due to an inverted duty structure are claimed based on the end of the financial year in which the refund is sought. This understanding aligns with prior Supreme Court rulings, where strict adherence to this timeline has often resulted in rejecting refund claims submitted beyond the prescribed period.

However, a notable shift occurred in the rulings of the Madras High Court in Lenovo (India) (P) Ltd. v. Commissioner of GST (Appeals-I)1 and ARS Energy (P) Ltd. v. Commissioner (Appeals)2, where the court interpreted the word 'may' in the provision to mean that the two-year limit is directory rather than mandatory. The aforementioned judgment affirmed that legitimate refund claims could be made beyond this period in appropriate cases, offering significant relief to assessees who had previously faced rejections based on time constraints. Although such High Court rulings are not binding on other High Courts, they have opened avenues for leniency in interpreting the provisions, benefiting taxpayers significantly.

Documentation is another critical requirement for successful refund claims. Taxpayers must provide tax invoices, shipping bills (for exports), and proof of tax payments, among other necessary documents. Failure to furnish complete and accurate documentation can delay or lead to the denial of refunds. Judicial pronouncements have reinforced the importance of proper record-keeping, emphasizing that taxpayers must be meticulous in maintaining and submitting these documents.

Compliance with GST return filing requirements is also a prerequisite for claiming refunds. Taxpayers need to ensure that returns such as GSTR-1 and GSTR-3B are accurately filed and that there are no outstanding liabilities. Mismatches between return filings and shipping details can cause significant delays, particularly in export-related refunds. Courts have clarified the need for stringent compliance to ensure smooth refund processing, aligning with the statutory framework.

Additionally, refund claims for unutilized input tax credit ('ITC') due to an inverted duty structure face certain limitations. S. 54(3) allows refunds of unutilized ITC on inputs (goods) but excludes input services, a restriction that has sparked legal challenges. Courts have issued varying rulings on this issue, thus contributing to the evolving jurisprudence. While courts have taken a taxpayer-friendly stance in some cases, strict adherence to legal prerequisites remains essential to avoid disputes and successfully claim refunds under GST.

Recent Changes and Notifications Impacting the GST Refund Process

Continuing from above, it is important to examine recent changes to facilitate the refund process. As per the Act, the refund process in India has undergone significant changes since its implementation in 2017, whereby issues pertaining to simplifying procedures, reducing delays, and addressing excessive documentation have been adequately addressed. The introduction of streamlined processes has enhanced transparency, ensuring quicker disbursements that are critical for maintaining cash flow, especially for exporters and small businesses.

One major improvement has been the simplification of documentation requirements under r. 89, which has significantly reduced the extensive paperwork previously needed for refund applications. Circular No. 125/44/2019-GST notably streamlined the refund application process and introduced a 'single disbursement window' for central and state GST portions. A clear processing timeline has been established to minimize delays. Notification No. 39/2018 – Central Tax specifies that delays beyond 60 days would attract interest while ensuring a provisional refund of 90% for exporters. Additionally, Notification No. 14/2022 – Central Tax allowed small taxpayers to file refund claims on a quarterly basis, easing their administrative burden.

The GST system has also enhanced security and efficiency by introducing Aadhaar authentication through Notification No. 40/2021 – Central Tax for newly registered businesses. Furthermore, Circular No. 37/11/2018-GST clarified the process for claiming refunds on ITC due to inverted duty structures. Automation also plays a crucial role, introducing fast-track refund processing through Circular No. 135/05/2020-GST, which utilizes advanced analytics to expedite claims, particularly for exporters. Together, these changes have created a more efficient and reliable refund system under the Act, improving the overall experience for taxpayers.

These recent changes to the GST refund process are crucial for enhancing business efficiency and cash flow management, especially for exporters and small enterprises. These reforms foster a more conducive business environment by streamlining documentation and ensuring timely processing. Ultimately, they contribute to a robust and resilient economy, boosting stakeholder confidence.

Role of the GST Network ('GSTN') and Online Processing

The GSTN serves as the IT backbone of the GST system in India, facilitating key processes such as registration, return filing, and refund claims. Established as a non-profit entity, GSTN ensures the smooth functioning of GST operations through its digital platform. For businesses, especially exporters, the GSTN plays a critical role in processing refunds, enabling timely cash flow and seamless tax administration. Its role is vital in today's economic landscape, where quick and accurate processing of tax refunds can make a significant difference to business operations.

GSTN offers several important functions in the GST refund process. Taxpayers submit their refund applications online through the GST portal, where the system automatically verifies data against other returns, like GSTR-1 and GSTR-3B, minimizing manual errors. This digitized process speeds up refund approvals and ensures accuracy. For exporters, integrating GSTN with Indian Customs Electronic Gateways (ICEGATE) and banking systems facilitates streamlined refunds for IGST paid on exported goods and services. With real-time tracking, businesses can follow their refund status and receive timely updates, adding transparency to the process.

When refund claims are rejected due to errors or mismatches, GSTN simplifies the resubmission process. Taxpayers are notified about the reasons for rejection, and they can correct errors or submit missing documents via the portal. The resubmission or appeal process is digitized, reducing the risk of further delays. Despite challenges such as documentation requirements or delays in some cases, GSTN continues to improve with ongoing enhancements, making the refund process more efficient, transparent, and reliable for taxpayers.

Noteworthy Judicial Observations

This section aims to apprise the reader of certain noteworthy judicial observations, discussed herein below, which have been made in regard to the refund filing process under GST:

In Union of India v. Bharti Airtel ltd.3, the Supreme Court of India held that Bharti Airtel, having self-assessed its GST liability based on its own records and paid the tax in cash, could not later amend its manually submitted GST returns to claim a refund for the excess tax paid. The Court set aside the Delhi High Court's decision allowing the amendment, reasoning that such unilateral changes would impact recipients and suppliers and create uncertainty in tax administration. However, the Court noted that Bharti Airtel could adjust the excess input tax credit against future liabilities.

In Raghav Ventures v. Commissioner of Delhi4, the Delhi High Court held that the payment of interest under s. 56 of the CGST Act is statutory and automatically payable if the GST refund is not made within 60 days of receipt of the refund application, regardless of whether the taxpayer has claimed the interest. The Court rejected the argument that interest could be denied based on the absence of a claim in the refund application. It directed the tax authorities to pay interest at the rate of 6% from the expiry of 60 days until the refund amount was credited to the taxpayer's account.

In Aluminum Corporation Ltd. v. Union of India5, the Supreme Court emphasized that good governance requires not only the diligent collection of taxes but also the prompt refund of excess levies. The Court stressed that rules and notifications should be drafted in clear and simple language, and their interpretation should be fair and consistent rather than skewed against taxpayers.

In Jian International v. Commissioner of Delhi Goods and Service Tax6, the Delhi High Court held that since the respondent failed to acknowledge the petitioner's refund application or point out deficiencies within the stipulated 15-day period as required under r. 90 of the GST Rules, the application is presumed to be complete. Allowing the respondent to raise deficiencies after the statutory timeline would unjustly delay the petitioner's refund and impair their right to claim interest from the original filing date. The Court directed the respondent to process the refund along with applicable interest within two weeks.

Further, in Parsvnath Traders v. Principal Commissioner, CGST7, the High Court decided that a deposit made by a taxpayer during a GST search could only be retained without formal proceedings or a show cause notice under s. 74(1) of the GST Act, requiring a refund with 6% interest. In Indian Oil Corporation Ltd. v. Commissioner of Central Goods & Services Tax8, the court allowed a refund of accumulated ITC even when the principal input and output had the same GST rate, directing GST authorities to process the refund with interest. Lastly, in Tata Steel Ltd. v. Union of India9, the High Court ruled that the amendment to r. 89(4) of the CGST Rules, 2017, for export refund claims, was substantive and applied prospectively, leading to the quashing of a refund rejection order for a period prior to the amendment.

Conclusion

While critical for maintaining business liquidity, the GST refund process is fraught with challenges that necessitate continuous attention and improvement. To mitigate these issues, taxpayers should ensure the timely filing of claims, maintain proper documentation, and regularly reconcile their returns to avoid discrepancies.

Judicial decisions and government initiatives have paved the way for a more streamlined process. However, further simplification and taxpayer-friendly measures are essential. A robust and efficient refund mechanism is crucial for enhancing business operations, preventing capital blockage, and fostering a conducive environment for economic growth in India. To achieve this, taxpayers and tax authorities must collaborate to streamline processes, enhance transparency, and ensure the timely disbursement of refunds.

Footnotes

1. [2023] 156 taxmann.com 467 (Madras)

2. [2023] 157 taxmann.com 610 (Madras)

3. (2022) 4 SCC 328.

4. 2024 SCC Online Del 1398.

5. (1975) 2 SCC 472.

6. (2020) 83 GSTR 341.

7. [2023] 153 taxmann.com 361 (Punjab & Haryana).

8. [2023] 157 taxmann.com 431 (Delhi).

9. [2023] 154 taxmann.com 76 (Jharkhand).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.