- within Tax topic(s)

- with Finance and Tax Executives

- with readers working within the Law Firm industries

In eBay Singapore Services Private Limited v. DCIT, [TS-1343-ITAT-2025(Mum)], the Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) ruled that capital gains arising to a Singapore tax resident from sale of shares of a Singapore company (which derives 'substantial value' from Indian assets) fall under the residual clause i.e. Article 13(5) of the India – Singapore tax treaty (Tax Treaty) and hence, the income from the sale of such shares is not taxable in India.

Background

Under the Income Tax Act, 1961 (IT Act), the income of a non-resident taxpayer from transfer of shares or interest in a foreign entity is deemed to be taxable in India if such foreign entity derives 'substantial value' from Indian assets (Indirect Transfer Provisions), unless the same is exempt under the applicable tax treaty. The Tax Treaty was amended in 2017 pursuant to which gains from sale of shares of an Indian company (acquired on or after 1 April 2017) by a Singapore resident were made taxable in India. With respect to indirect transfers, the tax authorities have time and again adopted a look- through approach to allege that even Indirect Transfer Provisions are covered by the above amendment since in substance, Indirect Transfer involves sale of shares of an Indian company.

Notably, Article 13 (Capital Gains) under the Tax Treaty inter alia covers the following clauses for sale of shares:

- Clause 4A deals with sale of shares acquired before 1 April 2017: Article 13(4A)

- Clause 4B deals with sale of shares acquired on or after 1 April 2017: Article 13(4B)

- Clause 5 is a residuary clause which is applicable to any other property not covered in any other clause: Article 13(5)*

*While some tax treaties such as India-Cyprus tax treaty include a specific clause providing that sale of shares of a company which principally consists of immovable property situated in the other country will be taxable in such other country (Immovable Property Clause), there is no such clause under the Tax Treaty.

Facts of the case

- eBay Singapore Services Private Limited (Taxpayer) is a Singapore company engaged in providing e-commerce-related services to its group companies, such as product management, business development, customer service support, legal, human resources and finance as well as providing an online platform to facilitate export sales from Indian sellers to overseas buyers.

- Taxpayer has always been a tax resident of Singapore and held tax residency certificate ('TRCs') for inter-alia calendar years 2018 and 2019.

- Taxpayer also holds investments in the Asia-Pacific region for eBay group and has made investments in various Indian entities over the years from 2014 to 2019, apart from some other global investments.

- In April 2017, Taxpayer sold shares of eBay India (i.e. Indian

e-commerce business) to Flipkart Singapore in lieu of shares of

Flipkart Singapore as consideration. Additionally, it acquired a

further minority stake in Flipkart Singapore through primary

subscription.

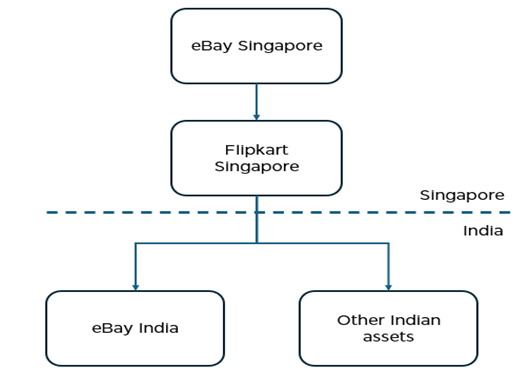

The structure of the Taxpayer was as follows:

- In August 2018, Taxpayer divested its stake in Flipkart Singapore and earned short-term capital gains which was claimed as exempt as per Article 13(5) of the Tax Treaty.

- The tax officer denied the claim of the Taxpayer which was further upheld by the Dispute Resolution Panel, against which the Taxpayer filed an appeal before the ITAT.

Tax department's key allegations

The Tax Department relied on the following to deny the claim of the Taxpayer:

- 'Control and management' not in

Singapore:

The ultimate beneficiary of the transaction is a US based company (eBay Inc) as the control and management of the Taxpayer was in US and thus, the Tax Treaty has no applicability in the present case.

- Article 13 vs Article 23:

Article 13 of India-Singapore Tax Treaty is inter-alia applicable only in case of sale of shares of an Indian company. Since the present case involves sale of shares of Flipkart Singapore, Article 13 is not applicable and the income is governed by Article 23, as per which gains would be taxable as per domestic laws of India i.e. the IT Act. - Applicability of Article 13(4B):

The tax department relied on the domestic Indirect Transfer Provisions to argue that the transaction involves an indirect transfer of Indian assets and thus, as per Article 13(4B) such income is taxable in India. Without prejudice, the tax authorities argued that the use of terms 'maybe' under Article 13(4B) provides such taxing rights to India as well.

ITAT ruling

The ITAT ruled in favour of the Taxpayer and allowed the capital gains tax exemption under Article 13(5) of the Tax Treaty for the following reasons:

- Control and management in

Singapore:

The documents furnished by the Taxpayer (such as board resolutions, details of directorship of Taxpayer as well as Ebay Inc) suggest that the control and management of the Taxpayer is with its board of directors based in Singapore and Hong Kong[1] and the tax department were not able to submit anything to support its assumption that the Taxpayer is controlled from the USA. - Indirect Transfer Provisions are governed by

Article 13(5):

The ITAT evaluated Article 13 and concluded that the Indirect Transfer Provisions shall be governed by Article 13(5) of the Tax Treaty. The ITAT particularly analysed the interplay of Article 13(4B) and Article 13(5) and held that Article 13(4B) would apply only when the seller and the target company (whose shares are sold) are of two different countries. In the present case, given that Taxpayer as well as Flipkart Singapore are residents of Singapore, Article 13(4B) is not applicable. - No 'look- through'

approach:

Regarding tax department's proposition on 'look through' approach, the ITAT relied on earlier precedents and reiterated the principle that Tax Treaty provisions over ride domestic provisions, and in absence of any specific provision under the Tax Treaty, the residuary clause (i.e. Article 13(5)) shall apply, which allocates taxing rights exclusively to Singapore.

Comments

In the context of indirect transfers and availability of tax treaty relief, this ruling clears the ambiguity arising from the interplay of Article 13(4B) vs Article 13(5) of the Tax Treaty and reiterates well-established principles that Indirect Transfer Provisions shall be governed by the residuary clause of the capital gains article of the respective tax treaty, except in cases where the applicable tax treaty has a 'look-through' clause (such as Immovable Property Clause).

Tax treaty relief eligibility has been a constant subject matter of dispute with the tax department. ITAT also placed emphasis on the documentation of the Taxpayer in demonstrating control and management. Accordingly, it is important for taxpayers to maintain adequate documentation around control and management / decision making / tax residency, commercial rationale for two-tier structures, adequate substance / business presence in the offshore jurisdiction, etc. as the tax authorities are increasingly making more in-depth inquiries around these aspects to challenge tax treaty relief claimed by taxpayer.

Footnote

1 One of the directors of the Taxpayer was a Hong Kong tax resident

The content of this document does not necessarily reflect the views / position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up, please contact Khaitan & Co at editors@khaitanco.com.